The increase in the number of young adults is one of the main reasons anticipated to propel the growth of the alcoholic beverage market in the region. The market for alcoholic beverages such as beer, wine, and spirits is also expected to develop due to the expanding demand for premium and super-premium products. The demand for alcoholic beverages is growing among American consumers due to rising disposable income and changing demographics.

Beer accounts for the prominent market of alcoholic beverages consumed worldwide and predominates in the United States. Due to the increasing popularity of craft beer, the beer market in the region has seen a heightened preference for flavored beers by consumers, especially millennials. The millennial population holds the largest share in the overall population of the United States, with about 22%, thus the breweries are consistently offering new innovative flavors targeted toward the millennial population to penetrate the highly potential segment and gain a competitive edge. For instance, Constellation Brands introduced passionfruit lime, guava lime, and coconut lime under the brand Corona Refresca, especially to target millennials in the United States.

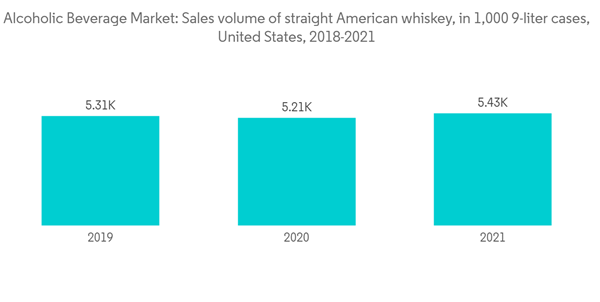

The premium liquor segment in the region is also growing, particularly in darker spirits, like whiskey. However, Mexico is North America's most rapidly growing alcoholic beverage market. Nevertheless, there is an evolving preference for craft beer and a variety of wines among young generations in the region, and the sales of low-alcohol beers and wines have been rising with the growing interest from health-conscious consumers, which is expected to boost the growth of the market.

North America Alcoholic Beverages Market Trends

Growing Preference for Low Alcohol By Volume

The North American alcoholic beverage market is witnessing an upsurge in demand for low-alcohol-by-volume beverages, specifically among millennials and baby boomers. The sales of low-alcohol beverages have been rising, with consumers' growing interest in health-consciousness and the availability of a wider product portfolio with improved taste, aiding consumers to select a product as per their preference easily. Moreover, the high consumption of alcoholic beverages among the Mexican population is also driving the market growth. For instance, Mexicans consumed 130.7 beer cans per capita in 2020 to 183.9 beer cans in 2021, with a 41% increase in beer consumption, according to the National Institute of Statistics and Geography (INEGI) data. Thus, the figures are a clear indication of the continuously inflating demand for craft beverages in the country, as well as the region.Moreover, North America is following a trend towards low-alcohol beers and ciders, which is attributed to a growing awareness of alcohol unit consumption and the customers' willingness to try new beverages with a huge diversity of product styles and taste profiles introduced by the manufacturers. For instance, in May 2021, Toronto’s Mill Street Brewery launched a new premier organic lager which is fully certified organic beer brewed in Toronto.

United States Holds a Major Share in the Market

The United States alcoholic market is mature in terms of demand, especially for spirits and beers. Based on the Brewery Association data, 202 new brewpubs were opened in the country in the year 2021. The increasing per capita consumption of beer associated with growing disposable income in the country is driving market growth. For example, according to the Statistics published by Beer Canada, Newfoundland and Labrador region had the highest per capita consumption at 90.6 liters of beer in 2021. American consumers are becoming more attracted to wines with descriptors 'no taste additives, gluten-free, low carb, vegan-friendly, sulfite-free, low calorie, low alcohol, light, lighter, organic wines as they are more conscious about their health and wellness. According to UN Comtrade, in 2021, imports of wine in Mexico exceeded their exports by 267 million U.S. dollars. The total value of wine imported reached 272 million U.S. dollars, whereas wine exports totaled 5.15 million dollars. That year, the North American country's wine industry revenue was estimated at 1.56 billion dollars.

North America Alcoholic Beverages Market Competitor Analysis

The North American Alcoholic Beverage market is highly fragmented with the presence of five major players such as Diageo PLC, Bacardi Limited, Pernod Ricard, Anheuser-Busch Companies, LLC, and Molson Coors Beverage Company, involved in the processing of beer and spirits.Key players have been investing in acquiring small players in the market, significantly to leverage the luxury spirits segment and to develop the product portfolio. They are also majorly focusing on product development and innovation to meet the consumer's needs by offering a variety of tastes and product quality to maintain premiumization.

Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Diageo PLC

- Bacardi Limited

- Suntory Holdings Limited

- Pernord Ricard

- Sazerac Company

- Heaven Hill Distilleries

- The Brown Forman Corporation

- Anheuser-Busch Companies, LLC.

- Molson Coors Beverage Company

- Halewood Wines & Spirits