Advancements in industrial absorbent development are vital to meet changing industry demands and address environmental concerns. Ongoing research focuses on novel materials like superabsorbent polymers and nanomaterials, enhancing liquid absorption. There's a shift towards eco-friendly, biodegradable options from renewable sources, reducing environmental impact. Smart materials, changing color upon contact with specific liquids, aid quick spill identification, improving response times. Innovations in packaging ensure easy transport and deployment, featuring compact, lightweight designs. These developments prioritize performance, sustainability, cost-efficiency, and compliance, driving the global industrial absorbents market to adapt to various spill scenarios in industrial settings.

The synthetic segment is expected to hold the largest share of the industrial absorbent market during the forecast period

The synthetic segment accounted for the largest share of the industrial absorbent industry in 2022 due to their remarkable fluid absorption capacity, capable of absorbing up to 70 times their weight. These materials, derived from polypropylene, polyurethane, polyester, and polyethylene, are extensively adopted in industrial applications for spill control. Their non-flammable nature and excellent water repellency specifically cater to oil-only and HAZMAT/chemical absorbent needs, ensuring effective containment. Despite being relatively expensive compared to natural absorbents, their superior performance across various industries positions synthetic absorbents as the preferred choice, driving their dominance in the market.Pads product segment is expected to be the largest segment of the industrial absorbent market during the forecast period

Pads hold the largest share in the product type segment of the industrial absorbents market due to their versatile and widespread applications. These thin spill response products are extensively utilized for cleanup across various spill scenarios involving liquids like oil, water-based fluids, and mild chemicals. Available in diverse sizes tailored to specific industry needs, these pads, primarily made from polypropylene, cater to industries such as oil & gas, chemicals, and food processing. Additionally, cellulose-based pads find specialized use, such as blood spill cleanup in healthcare settings. Their wide-ranging applicability and effectiveness in different industries establish pads as the primary spill control solution in the industrial absorbents market.Oil-only segment is expected to lead the industrial absorbents market during the forecast period

Based on type, the oil-only segment is estimated to account for the largest share of the industrial absorbents market in 2022 due to their specialized functionality. These products are engineered to exclusively absorb petroleum hydrocarbons and oil-based liquids while repelling water-based fluids. Their selective absorption nature finds widespread use in environmental cleanups, ranging from major oil spill incidents to everyday smaller oil leaks. They are particularly crucial in scenarios involving crude oil leakage from tankers, offshore platforms, drilling rigs, wells, or refined petroleum products like gasoline and diesel.Oil spills pose significant threats to both human health and the environment, leading to substantial economic losses. Especially in marine environments, these spills can severely impact birds and mammals by infiltrating their plumage or fur, diminishing their insulation and buoyancy capacities. To combat such crises, oil-only absorbent products play a pivotal role as they are tailored to efficiently absorb oil-based liquids, aiding in spill control and environmental protection.

The oil & gas segment is estimated to account for the largest share during the forecast period

The oil & gas industry commands the largest share in the end-use industry segment of the industrial absorbents market due to inherent spill risks in its operations. Manufacturers across downstream, midstream, and upstream sectors within this industry require spill control products to mitigate these risks effectively. Oil & gas spills encompass the release of liquid hydrocarbons, oil-based liquids, or liquid gases into the environment. These spills arise from various sources such as crude oil leakage from tankers, offshore platforms, drilling rigs, wells, or the seepage of refined petroleum products like gasoline, diesel, bunker fuel from large ships, and waste oil.Given the potential environmental and economic repercussions, oil & gas producers utilize industrial absorbents to address spill consequences, facilitating the recovery and disposal of spilled liquids. The necessity to manage and contain these spills propels the oil & gas industry as the primary consumer of industrial absorbents.

Asia Pacific is projected to grow at the highest CAGR of the industrial absorbents market during the forecast period

The Asia Pacific industrial absorbents market is poised for the highest CAGR during the forecast period due to several key factors. The region, led by countries like China, Japan, South Korea, and India, thrives on robust demand fueled by rapid industrialization. The evolving industrial landscape, particularly in emerging economies such as China and India, is a significant driver propelling the global industrial absorbents market. Industrial absorbents play a pivotal role across diverse industries in controlling, containing, and remediating spills, contributing to the region's growing demand. While environmental regulations regarding spill response and pollution in Asia Pacific are relatively lenient, there's an escalating emphasis on reinforcing stringent environmental standards, particularly in economies like India and China. This growing awareness and pressure to enforce stricter regulations are anticipated to drive market growth in the region.Moreover, the Asia Pacific market is characterized by heightened dynamism and competitiveness compared to the western region, further fueling demand for industrial absorbents. China led the consumption of industrial absorbents within the region, yet India is expected to witness the highest CAGR during the forecast period in terms of value. Overall, these factors position Asia Pacific, driven by these influential economies, for substantial growth in the industrial absorbents market.

Breakdown of primary interviews for the report on the industrial absorbents market

- By Company Type - Tier 1 - 25%, Tier 2 - 25%, and Tier 3 - 50%

- By Designation - C-Level - 25%, D-Level Executives - 30%, and Others - 45%

- By Region - North America - 15%, Europe - 27%, Asia Pacific - 45%, South America - 6%

Some of the leading manufacturers of industrial absorbents profiled in this report include 3M Company (US), Brady Corporation (US), Decorus Europe Ltd. (UK), Johnson Matthey Plc (UK), Kimberly-Clark Professional (US), Meltblown Technologies Inc. (US), Monarch Green, Inc. (US), New Pig Corporation (US), and Oil-Dri Corporation of America (US).

Research Coverage

This report covers the industrial absorbents market by material type, product, type, end-use industry, and region. It aims to estimate the market’s size and future growth potential across various segments. The report also includes an in-depth competitive analysis of the key market players, their profiles, and key growth strategies.Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the industrial absorbents market and its segments. This report is also expected to help stakeholders understand the market’s competitive landscape better, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It also enables stakeholders to understand the market’s pulse and provides information on key market drivers, restraints, challenges, and opportunities.The report provides insights on the following pointers:

- Analysis of critical drivers (Rise in global healthcare expenditure), restraints (Fluctuations in raw material prices), opportunities (Rise in demand for sustainable packaging solutions in healthcare), and challenges (Stringent rules & regulations) influencing the growth of the industrial absorbents market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research &

- Market Development: Comprehensive information about lucrative markets - the report analyses

- Market Diversification: Exhaustive information about new products & services, untapped

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service

Table of Contents

Companies Profiled

- New Pig Corporation

- Decorus Europe

- Meltblown Technologies Inc.

- Denios

- 3M

- Johnson Matthey

- Oil-Dri Corporation of America

- Brady Corporation

- Ansell Ltd.

- Goltens

- Asa Environmental Products

- Chemtex Industries

- Drizit Environmental

- Enretech

- Ep Minerals

- Fentex

- Gei Works

- Kimberly-Clark Professional

- Share Corporation

- Sysbel

- Tolsa

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | January 2024 |

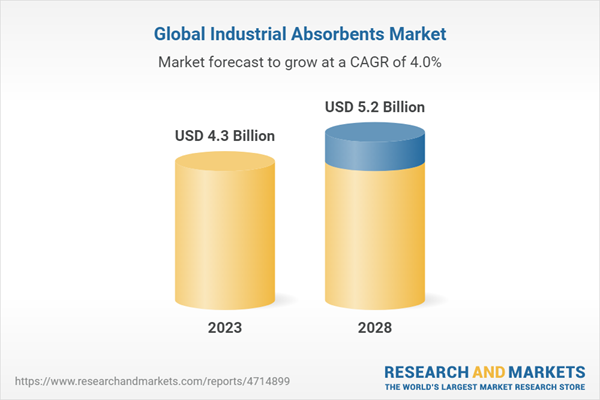

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 4.3 Billion |

| Forecasted Market Value ( USD | $ 5.2 Billion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |