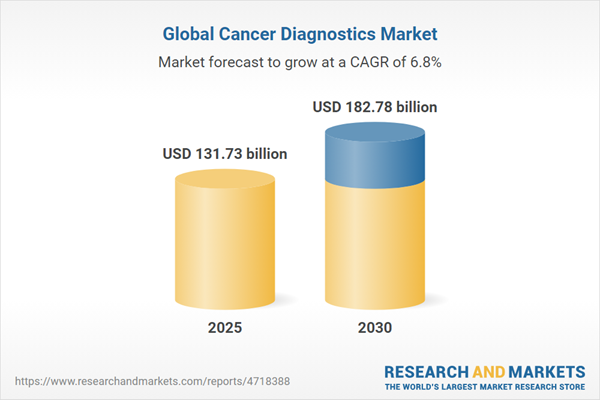

The cancer diagnostics market encompasses the development, production, and commercialization of tools and technologies critical for detecting cancer, including imaging tests (e.g., X-rays, CT scans, MRI), blood tests, biopsies, and molecular diagnostics such as genetic and tumor marker tests. This market is vital to the healthcare industry, as early and accurate diagnosis significantly improves patient outcomes by enabling timely treatment. The market is projected to experience robust growth from 2025 to 2030, driven by rising cancer incidence and technological advancements. However, challenges such as high costs and limited access in developing regions may hinder progress.

Market Drivers

The primary driver of the cancer diagnostics market is the escalating global incidence of cancer, which increases the demand for effective diagnostic tools. The growing burden of cancer, particularly breast cancer, underscores the need for early detection to enhance treatment success rates. Government support is another key factor, with initiatives like expedited regulatory approvals for innovative diagnostics boosting market growth. For instance, regulatory bodies are increasingly recognizing the potential of advanced diagnostic technologies, such as liquid biopsies, to improve early detection and patient outcomes. Additionally, heightened investment in research and development by industry players is fostering innovation in diagnostic solutions, further propelling the market.Market Restraints

The cancer diagnostics market faces challenges, including the high cost of advanced diagnostic technologies, which can limit accessibility, particularly in low-resource settings. Additionally, disparities in healthcare infrastructure across regions hinder the widespread adoption of sophisticated diagnostics. Limited awareness and access to screening programs in developing countries also pose barriers, potentially delaying diagnoses and impacting market growth. Addressing these challenges through cost-effective solutions and expanded healthcare access will be critical for sustained market expansion.Market Segmentation

By Diagnostic Procedures

The cancer diagnostics market is segmented into laboratory tests, imaging procedures, and biopsies. Laboratory tests, including blood, urine, and genetic tests, are expected to hold a significant market share due to their versatility and increasing use in early detection. Imaging procedures, such as CT scans and MRIs, remain essential for visualizing tumors, while biopsies provide definitive diagnoses. The laboratory test segment is anticipated to grow steadily, driven by advancements in molecular diagnostics and tumor marker tests.By Cancer Type

Breast cancer diagnostics represent a substantial market segment, driven by the disease's high prevalence among women globally. The surge in investment in breast cancer diagnostic tools, including advanced imaging and molecular tests, is expected to fuel growth in this segment. Other cancer types, such as lung and colorectal, also contribute to market demand, with diagnostics tailored to specific genetic and biomarker profiles gaining traction.By Geography

The global cancer diagnostics market is segmented into North America, South America, Europe, Asia-Pacific, and the Middle East and Africa. Asia-Pacific leads in cancer incidence due to its large population, driving significant demand for diagnostics. North America and Europe follow, with advanced healthcare systems and high adoption of cutting-edge technologies. In the United States, factors such as rising alcohol and tobacco consumption, sedentary lifestyles, and genetic predispositions contribute to market growth, with increasing cancer cases necessitating enhanced diagnostic and screening efforts. Emerging regions like South America and the Middle East and Africa are expected to grow as healthcare infrastructure improves.Key Industry Players

Major players in the cancer diagnostics market include bioMérieux SA, F. Hoffmann-La Roche Ltd, Sienna Cancer Diagnostics, and Insight Medical Genetics. These companies are heavily investing in research and development to advance diagnostic technologies, such as next-generation sequencing and liquid biopsies, to meet growing demand and improve diagnostic accuracy.The cancer diagnostics market is set for significant growth from 2025 to 2030, driven by rising cancer incidence, government support, and technological innovations. Despite challenges like high costs and limited access, the market's outlook remains positive, particularly in high-incidence regions like Asia-Pacific and advanced markets like North America. Industry players must focus on affordability and accessibility to fully capitalize on the growing demand for early and accurate cancer diagnostics.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data from 2020 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling: Strategies, Products, Financial Information, and Key Developments among others

Global Critical Care Diagnostics Market Segmentation

By Diagnostic Procedure

- Laboratory Test

- Imaging Procedures

- Biopsy

By Cancer Type

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Skin Cancer

- Stomach Cancer

- Others

By End-User

- Hospitals

- Clinics

- Diagnostics Centers

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- South Korea

- Taiwan

- Indonesia

- Japan

- Others

Table of Contents

Companies Mentioned

- bioMérieux SA

- Roche Diagnostics

- MetaCell

- Breath Diagnostics, Inc

- Metabiomics

- Castle Biosciences, Inc.

- Exact Sciences Corporation

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- GE Healthcare

- Siemens Healthineers (Siemens AG)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 151 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 131.73 billion |

| Forecasted Market Value ( USD | $ 182.78 billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |