Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One of the primary driving forces behind the surge in demand for DAS in the Asia Pacific region is the relentless urbanization. Cities like Shanghai, Beijing, and Seoul are experiencing unprecedented population growth, accompanied by a surge in the number of mobile devices. This urban sprawl places immense pressure on existing cellular networks, often leading to congestion and coverage gaps, especially in densely populated areas. DAS systems have emerged as a critical solution, adept at extending coverage, boosting network capacity, and ensuring uniform signal distribution in high-density environments. These systems have become the lifeline of connectivity in crowded shopping malls, sports stadiums, airports, and public transportation hubs. Key players like Comba Telecom Systems Holdings Ltd and TE Connectivity Ltd have capitalized on this trend, offering innovative DAS solutions tailored to the unique challenges posed by Asia Pacific's megacities.

Moreover, as the rollout of 5G networks gains momentum across the region, DAS solutions have taken on even greater significance. 5G promises lightning-fast data speeds, ultra-low latency, and the ability to connect billions of devices seamlessly. To realize these benefits, it's imperative to have a robust and reliable DAS infrastructure. DAS systems are being deployed in various verticals, from manufacturing to healthcare, enabling the Internet of Things (IoT) and the development of smart cities. These systems act as the nervous system of the burgeoning IoT landscape, ensuring that data can flow seamlessly between devices and the cloud. Leading companies like Corning Incorporated and Zinwave (now part of McWane, Inc.) have been instrumental in advancing DAS technologies to meet the specific requirements of 5G networks.

The Asia Pacific DAS market extends its reach beyond urban areas, addressing connectivity gaps in rural and remote regions. In countries like India, Indonesia, and Australia, where vast expanses of land are sparsely populated, providing reliable wireless connectivity can be a formidable challenge. DAS systems are being deployed in remote areas to bridge these gaps, enabling rural communities to access essential communication services and participate in the digital economy. This inclusivity is crucial for promoting economic growth and reducing the digital divide in the region.

In addition to its role in commercial telecommunications, DAS is also playing a pivotal role in enhancing public safety. Governments and regulatory bodies across the Asia Pacific region are increasingly recognizing the importance of DAS systems in ensuring that emergency responders have robust communication tools at their disposal. DAS implementations in critical infrastructure, such as tunnels, underground transportation systems, and public buildings, have become standard practice to safeguard public safety. This is especially important in seismically active regions like Japan and New Zealand, where reliable communication during natural disasters can be a matter of life and death.

Furthermore, the Asia Pacific DAS market is characterized by a vibrant ecosystem of companies offering a wide range of solutions and services. While global giants like Boingo Wireless, Axell Wireless, and Kathrein have a significant presence in the region, local players have also risen to prominence, catering to specific market segments and niche applications. This diversity within the market fosters healthy competition and drives innovation, leading to the development of tailored DAS solutions that meet the region's unique needs.

In conclusion, the Asia Pacific distributed antenna system market is a dynamic and rapidly evolving sector that serves as the linchpin of the region's wireless infrastructure. It addresses the challenges posed by urbanization, facilitates the deployment of 5G networks, bridges connectivity gaps in remote areas, and enhances public safety. As the Asia Pacific region continues its relentless pursuit of connectivity and technological advancement, DAS systems are poised to play an increasingly pivotal role in shaping the future of telecommunications. With its ability to adapt and thrive in diverse environments, the Asia Pacific DAS market is a testament to the industry's resilience and commitment to ensuring that every corner of the region remains connected.

Key Market Drivers

Rapid Urbanization & Increased Mobile Device Penetration

The Asia Pacific Distributed Antenna System (DAS) market is experiencing significant growth due to the region's rapid urbanization and the increasing penetration of mobile devices. As urban areas expand, there is a higher demand for seamless and high-quality wireless connectivity. This demand is driven by the rising number of smartphone users, the proliferation of IoT devices, and the growing importance of reliable connectivity for businesses and consumers. With the Asia Pacific region being home to some of the world's most densely populated cities, the need for efficient DAS solutions becomes paramount. DAS helps distribute wireless signals effectively within urban environments, addressing the challenges posed by high-rise buildings, crowded public spaces, and complex network infrastructure. As a result, the market for DAS in Asia Pacific is set to grow significantly in the coming years to support the burgeoning urban population and their ever-increasing reliance on mobile devices.5G Network Deployment

The rollout of 5G networks is another major driver of the Asia Pacific DAS market. 5G technology promises faster data speeds, lower latency, and increased network capacity, making it a game-changer for various industries, including telecommunications, healthcare, transportation, and manufacturing. However, 5G networks require a dense network of small cells and improved indoor coverage, which DAS solutions are well-suited to provide. As Asia Pacific countries aggressively deploy 5G infrastructure, the demand for DAS to enhance indoor and outdoor coverage is growing rapidly. DAS helps optimize 5G connectivity, ensuring that users can experience the full benefits of this technology, even in challenging environments like high-density urban areas, stadiums, and transportation hubs. This synergy between 5G and DAS is expected to drive substantial growth in the DAS market across the region.Increasing Data Consumption and IoT Adoption

The Asia Pacific region is witnessing a surge in data consumption and the adoption of Internet of Things (IoT) devices across various industries. Consumers and businesses alike are generating and consuming vast amounts of data, placing additional strain on existing wireless networks. To support this growing data demand, telecom operators and enterprises are turning to DAS solutions to enhance network capacity and reliability.IoT devices, which are becoming increasingly prevalent in sectors such as smart cities, healthcare, and agriculture, rely on seamless connectivity to transmit data and receive commands. DAS plays a crucial role in providing the necessary network coverage and capacity for IoT applications to function effectively. As the Asia Pacific region continues to embrace IoT and data-intensive technologies, the DAS market is poised for substantial growth to cater to these evolving connectivity needs.

Government Initiatives and Regulations

Government initiatives and regulations play a pivotal role in propelling the growth of the Asia Pacific Distributed Antenna System (DAS) market. Across the region, governments are recognizing the critical importance of robust wireless connectivity for economic development, public safety, and enhancing the overall quality of life. To achieve these goals, many countries are implementing supportive policies and regulations that incentivize the deployment of advanced telecommunications infrastructure, including DAS. This often includes the allocation of specific frequency bands, financial incentives, and the streamlining of regulatory processes to facilitate the rapid expansion of DAS networks. Furthermore, some governments mandate improved indoor wireless coverage in critical locations such as airports, hospitals, and government buildings, which necessitates the adoption of DAS solutions. As a result, government initiatives and regulations are acting as catalysts, driving the adoption of DAS technology, and ensuring that the Asia Pacific region remains at the forefront of connectivity advancements.Key Market Challenges

Complex Regulatory Environment and Compliance

The Asia Pacific Distributed Antenna System (DAS) market faces significant challenges related to the complex regulatory environment and compliance requirements across the region. Each country within Asia Pacific has its own set of regulations and standards governing telecommunications and wireless infrastructure, which can vary widely in terms of technical specifications, frequency bands, and licensing procedures. Navigating this intricate regulatory landscape can be a daunting task for DAS providers and network operators seeking to deploy and expand their systems across multiple countries. One of the primary challenges is ensuring compliance with diverse and evolving regulatory frameworks. Companies must not only stay abreast of changes in regulations but also dedicate substantial resources to secure the necessary permits and approvals for DAS installations. In some cases, regulatory hurdles can result in delays and increased deployment costs, hampering the growth of the DAS market.Additionally, the Asia Pacific region is characterized by political and economic diversity, which can further complicate regulatory matters. Companies often find themselves dealing with different government agencies, authorities, and stakeholders, each with its own priorities and requirements. Harmonizing regulatory approaches and fostering cooperation among countries can be a daunting task, but it is essential for the sustainable growth of the Asia Pacific DAS market.

Competition from Alternative Connectivity Solutions

Another pressing challenge for the Asia Pacific DAS market is the competition from alternative connectivity solutions. While DAS technology offers significant advantages in terms of indoor coverage and capacity enhancement, it faces competition from emerging wireless technologies and infrastructure options that cater to specific use cases. One such challenge comes from the deployment of small cells and microcells, especially in densely populated urban areas. These compact cellular base stations can be strategically placed to provide targeted coverage in high-traffic locations. With the rollout of 5G networks, small cells have gained traction as an efficient means of delivering high-speed data services. This competition necessitates DAS providers to differentiate themselves by offering superior indoor coverage, reliability, and integration capabilities with small cell solutions.Moreover, satellite communication, Wi-Fi, and emerging technologies like Li-Fi (Light Fidelity) pose alternative connectivity options for specific applications. Wi-Fi networks have become ubiquitous in indoor environments, providing cost-effective and high-speed wireless connectivity. DAS providers must demonstrate the added value and reliability of their solutions to remain competitive in a landscape where alternative connectivity options are readily available. Furthermore, the Asia Pacific region is vast and diverse, encompassing developed urban centers and remote rural areas. In less urbanized regions, the cost-effectiveness of DAS solutions compared to alternative technologies may come into question. Therefore, addressing regional disparities and tailoring DAS offerings to meet the unique needs of different market segments is crucial to overcoming this challenge.

Key Market Trends

Increasing Demand for In-Building Wireless Solutions

One prominent market trend in the Asia Pacific Distributed Antenna System (DAS) market is the surging demand for in-building wireless solutions. As urbanization continues to accelerate across the region, there is a growing need to ensure seamless connectivity within large structures such as commercial buildings, shopping malls, airports, and hospitals. This trend is driven by the increasing reliance on mobile devices for both personal and professional purposes, as well as the rising adoption of IoT devices in various industries. In-building DAS solutions are specifically designed to enhance wireless coverage and capacity within these complex indoor environments. They address challenges posed by structural impediments and high user density, ensuring that occupants can enjoy high-speed data connectivity and reliable voice communication. Furthermore, the ongoing COVID-19 pandemic has heightened the importance of robust indoor wireless networks for remote work, telehealth, and contactless technologies. As a result, the Asia Pacific DAS market is witnessing a surge in demand for tailored in-building wireless solutions, a trend expected to continue its upward trajectory.Convergence of DAS and Small Cells for 5G Networks

Another noteworthy trend in the Asia Pacific DAS market is the convergence of DAS and small cell technologies to support the deployment of 5G networks. 5G promises unparalleled data speeds, ultra-low latency, and the ability to connect a vast number of IoT devices simultaneously. To deliver on these promises, telecommunications operators are increasingly turning to small cells, which are compact, low-power cellular base stations. DAS systems are being adapted to seamlessly integrate with small cells to provide enhanced 5G network coverage. This convergence allows for a more distributed and flexible network infrastructure, addressing 5G's unique requirements, such as higher frequency bands and denser network deployments. It also facilitates efficient network management and optimization, ensuring that users experience the full benefits of 5G, both indoors and outdoors. This trend is expected to gain momentum as 5G networks continue to expand across the Asia Pacific region, making DAS and small cell integration a critical strategy for network operators and infrastructure providers.Focus on Public Safety and Emergency Communications

A significant market trend in the Asia Pacific DAS sector is the increasing focus on public safety and emergency communications. Governments and regulatory bodies in the region are recognizing the vital role that DAS technology can play in ensuring effective emergency response and disaster management. This trend has been accelerated by natural disasters, such as earthquakes and typhoons, as well as the need to enhance public safety in densely populated urban areas. DAS systems are being deployed in critical locations like transportation hubs, stadiums, and government buildings to provide reliable communication during emergencies. They ensure that first responders, law enforcement, and the public can access essential communication services when they are needed most. Moreover, regulatory mandates are emerging that require the installation of public safety DAS networks in specific buildings and public spaces. As a result, the Asia Pacific DAS market is witnessing increased investment in public safety-focused solutions, making this a significant and enduring trend that aligns with the region's commitment to disaster resilience and public security. In conclusion, the Asia Pacific Distributed Antenna System (DAS) market is experiencing several notable trends. These include the growing demand for in-building wireless solutions to support the rise of mobile and IoT devices, the convergence of DAS and small cells for efficient 5G network deployment, and an increased focus on public safety and emergency communications. These trends reflect the dynamic nature of the DAS market in the Asia Pacific region, driven by evolving connectivity needs, technological advancements, and regulatory developments.Segmental Insights

Coverage Insights

Based on coverage, the indoor segment asserted its dominance in the Asia Pacific distributed antenna system (DAS) market, and this dominance is anticipated to endure throughout the forecast period. This robust presence of indoor DAS solutions can be attributed to several factors. First and foremost, the region's rapid urbanization has led to an increased reliance on indoor spaces, such as commercial buildings, shopping malls, and airports, where people work, shop, and travel. Consequently, the demand for seamless wireless connectivity within these indoor environments has surged, and DAS technology is the preferred solution to address this need. The advent of 5G networks has further accelerated the prominence of indoor DAS. 5G networks rely on higher frequency bands, which are more susceptible to signal degradation when traversing through buildings. Indoor DAS systems effectively mitigate this issue by distributing 5G signals evenly within structures, ensuring that users experience the full benefits of 5G connectivity indoors. Additionally, the ongoing COVID-19 pandemic has underscored the critical importance of indoor wireless coverage for remote work, telehealth, and online education. As a result, businesses, healthcare facilities, and educational institutions have intensified their focus on deploying robust indoor DAS solutions to support these evolving needs. Given these factors, the dominance of the indoor segment in the Asia Pacific DAS market is expected to persist, driven by the region's urbanization, 5G adoption, and the imperative for reliable indoor connectivity.End User Insights

Based on end user, the public venues & safety emerged as the dominant segment in the Asia Pacific distributed antenna system (DAS) market, and this dominance is projected to persist throughout the forecast period. This remarkable dominance can be attributed to the region's growing emphasis on enhancing public safety, disaster resilience, and ensuring seamless connectivity in critical locations. DAS systems are particularly vital in public venues like stadiums, airports, shopping malls, and transportation hubs, where large crowds congregate, and reliable wireless connectivity is paramount. The Asia Pacific region has been marked by increased urbanization and the development of mega-cities, leading to the construction of numerous large public venues. These venues recognize the necessity of providing robust wireless coverage for both everyday communication and emergency situations. Government mandates and regulations are also driving the adoption of DAS in public spaces to bolster public safety and ensure effective disaster management.Furthermore, the ongoing COVID-19 pandemic has highlighted the importance of reliable indoor wireless coverage for contactless technologies and remote communication. This has spurred increased investment in DAS solutions by public venues to accommodate evolving connectivity needs. As these trends persist and the demand for public safety and seamless connectivity in crowded areas continues to grow, the dominance of the public venues and safety segment in the Asia Pacific DAS market is expected to endure, further reinforcing its significance in the region's connectivity landscape.

Country Insights

China asserted its dominance in the Asia Pacific Distributed Antenna System (DAS) Market, and this dominance is anticipated to persist throughout the forecast period. Several factors contribute to China's dominance in this market. First and foremost, the country's vast and densely populated urban areas have created an immense demand for seamless wireless connectivity, both indoors and outdoors. The rapid urbanization in China has led to an increased reliance on mobile devices, IoT applications, and data-intensive technologies, all of which necessitate robust DAS solutions to ensure uninterrupted connectivity. China's commitment to 5G technology deployment has further solidified its dominance in the DAS market. The country is aggressively rolling out 5G networks, and DAS systems play a crucial role in optimizing and extending 5G coverage, especially in complex indoor environments. The convergence of DAS and 5G technology is a strategic priority for China, and this synergy is expected to fuel continued growth and dominance in the DAS market. Moreover, government initiatives and regulatory support for telecommunications infrastructure development in China have created a conducive environment for DAS deployment. Favorable policies, spectrum allocation, and financial incentives have encouraged investments in DAS technology, further reinforcing China's leading position in the Asia Pacific DAS market. As China continues to drive innovation and investments in wireless connectivity, its dominance in the DAS sector is poised to persist and shape the market's trajectory across the region.Report Scope:

In this report, the Asia Pacific Distributed Antenna System (DAS) Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Asia Pacific Distributed Antenna System (DAS) Market, By Coverage:

- Indoor

- Outdoor

Asia Pacific Distributed Antenna System (DAS) Market, By Solution:

- Career Wi-Fi

- Small Cells

- Self Organizing Network (SON)

Asia Pacific Distributed Antenna System (DAS) Market, By Ownership:

- Career Ownership

- Neutral Host Enterprise

- Ownership Enterprise

Asia Pacific Distributed Antenna System (DAS) Market, By End User:

- Airports & Transportation

- Public Venues & Safety

- Education Sector & Corporate Offices

- Hospitality

- Industrial

- Healthcare

- Others

Asia Pacific Distributed Antenna System (DAS) Market, By Country:

- India

- China

- Japan

- South Korea

- Australia

- Singapore

- Malaysia

- Indonesia

- Thailand

- Philippines

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Asia Pacific Distributed Antenna System (DAS) Market.Available Customizations:

Asia Pacific Distributed Antenna System (DAS) Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Comba Telecom Systems Holdings Limited

- Corning Incorporated

- TE Connectivity Asia Pacific Pte. Ltd.

- Huawei Technologies Co., Ltd.

- Nokia Asia Pacific Pte. Ltd.

- Raytheon Technologies Asia Pacific Pte. Ltd.

- CommScope Asia Pacific Pte. Ltd.

- American Tower Asia Pacific Pte. Ltd.

- AT&T Asia Pacific Pte. Ltd.

- Boingo Wireless Inc.

Table Information

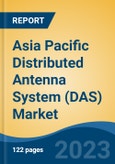

| Report Attribute | Details |

|---|---|

| No. of Pages | 122 |

| Published | October 2023 |

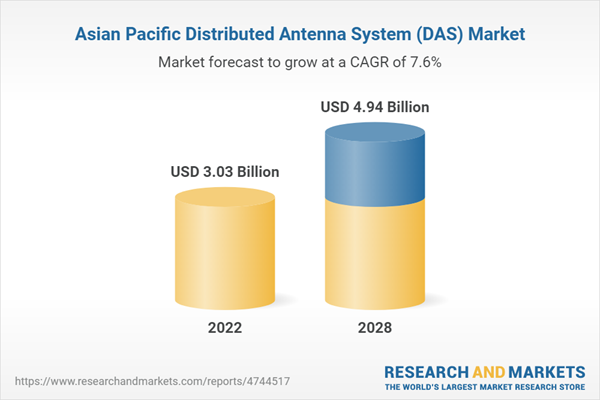

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 3.03 Billion |

| Forecasted Market Value ( USD | $ 4.94 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 10 |