Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

A strong push towards sustainability and decarbonization is also prompting a shift toward electric and hybrid LCVs, supported by government incentives and low-emission zone regulations. Additionally, advancements in vehicle technology, such as telematics, driver-assistance systems, and connectivity features, are enhancing fleet management and safety. These factors collectively contribute to the evolving landscape of the UK’s LCV market.

Key Market Drivers

Government Policies and Incentives Supporting Low-Emission Vehicles

Environmental sustainability is becoming an increasingly important focus across the UK, both in public discourse and governmental policy. The UK government has set ambitious targets to reduce carbon emissions and achieve net-zero goals by 2050. In line with this, numerous policies have been implemented to encourage the adoption of electric and hybrid light commercial vehicles. Key initiatives include grants under the Plug-in Van Grant (PiVG) scheme, tax incentives, and exemptions from congestion charges and low-emission zone fees.Local councils, especially in cities like London, have introduced ultra-low emission zones (ULEZ) to discourage the use of polluting vehicles and promote cleaner alternatives. According to the UK Department for Transport, over 47,000 vans have been supported through the Plug-in Van Grant scheme as of early 2024. Such initiatives make the operational cost of electric LCVs more attractive, prompting businesses to upgrade or replace their older diesel-powered fleets. These supportive government policies are playing a crucial role in accelerating the transition towards a greener LCV market in the UK.

Key Market Challenges

High Upfront Costs of Electric Light Commercial Vehicles

One of the primary challenges confronting the UK LCV market is the high initial cost of electric light commercial vehicles (e-LCVs) compared to their diesel or petrol counterparts. Although the government provides grants and tax incentives, many small and medium-sized enterprises (SMEs) still find the upfront investment in e-LCVs prohibitive. For businesses operating with limited budgets or tight profit margins, switching to electric fleets can pose financial strain, especially when fleet sizes are large. Additionally, while electric vehicles offer savings in fuel and maintenance costs over time, the long payback period can deter companies focused on short-term returns. The cost of battery technology, although declining gradually, remains a significant factor contributing to the high prices of electric models. Without further price reductions or increased financial support, widespread adoption of e-LCVs could face delays, slowing the transition to low-emission fleets in the UK.Key Market Trends

Integration of Advanced Telematics and Fleet Management Solutions

The UK LCV market is experiencing rapid digital transformation, with telematics and smart fleet management systems becoming standard among fleet operators. These technologies enable real-time tracking of vehicles, route optimization, driver behavior monitoring, fuel consumption analysis, and predictive maintenance. Businesses are leveraging data insights to enhance operational efficiency, reduce downtime, and improve overall fleet performance. Advanced driver-assistance systems (ADAS), including lane-keeping assist, automatic emergency braking, and blind spot detection, are also becoming more common in newer LCV models, improving driver safety and reducing accident-related costs.Connectivity features such as integrated infotainment systems, remote diagnostics, and cloud-based fleet dashboards are enhancing the overall user experience. According to a 2023 Fleet News survey, over 68% of UK fleet managers reported improved operational efficiency after implementing telematics systems, while 54% noted a decrease in accident rates due to ADAS features. As the demand for automation, transparency, and accountability in fleet operations grows, telematics integration is emerging as a critical trend reshaping the future of light commercial transportation in the UK.

Key Market Players

- Volkswagen Group United Kingdom Limited

- Peugeot Motor Company PLC

- Mercedes-Benz UK Ltd

- Vauxhall Motors Limited

- Ford Motor Company Limited

- Citroën UK Limited

- Renault UK Ltd

- Isuzu (UK) Ltd Iveco Limited

- Iveco Limited

- Fiat Chrysler Automobiles N.V.

Report Scope:

In this report, the United Kingdom Light Commercial Vehicles Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:United Kingdom Light Commercial Vehicles Market, By Vehicle Type:

- Pickup truck

- Vans

United Kingdom Light Commercial Vehicles Market, By Tonnage Type:

- Less than 2 tons

- 2-2.5 Tons

- 2.5-3.5 tons

- 3.5-6 tons

United Kingdom Light Commercial Vehicles Market, By Fuel Type:

- Diesel

- Petrol

- Others

United Kingdom Light Commercial Vehicles Market, By Region:

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United Kingdom Light Commercial Vehicles Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Volkswagen Group United Kingdom Limited

- Peugeot Motor Company PLC

- Mercedes-Benz UK Ltd

- Vauxhall Motors Limited

- Ford Motor Company Limited

- Citroën UK Limited

- Renault UK Ltd

- Isuzu (UK) Ltd Iveco Limited

- Iveco Limited

- Fiat Chrysler Automobiles N.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 81 |

| Published | August 2025 |

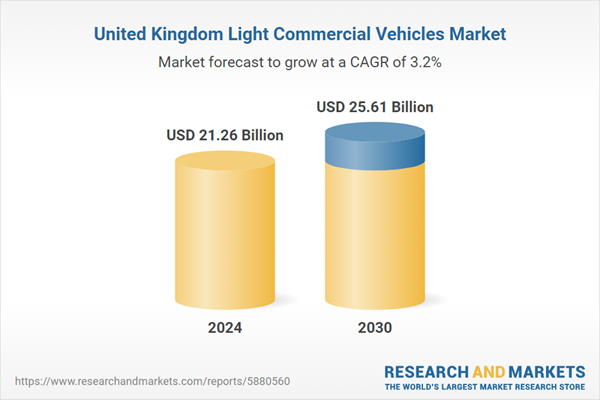

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 21.26 Billion |

| Forecasted Market Value ( USD | $ 25.61 Billion |

| Compound Annual Growth Rate | 3.2% |

| Regions Covered | United Kingdom |

| No. of Companies Mentioned | 10 |