Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The United States electric vehicle market has been gaining traction due to government incentives and the availability of improved battery technology. This has led to the increased adoption of EVs in the United States. Furthermore, technological advancements such as moving from lead acid batteries to lithium-ion batteries have reduced weight, improved performance, and extended the range. This has attracted customers toward EVs and consequently, increased the demand for lithium-ion batteries. The United States government has also been promoting the use of lithium-ion batteries through various policies and initiatives. The Energy Storage Tax Credit program was introduced in 2016 with the aim of boosting the demand for lithium-ion battery storage. The US Trade and Development Agency (USTDA) has also launched several initiatives such as Roadmap for Energy Storage and Battery Solutions, which aims to promote the development and adoption of lithium-ion-based solutions and technologies. The increased demand for energy storage solutions and EVs has resulted in the establishment of companies such as Tesla Inc. and Boeing. These companies are engaged in the manufacturing of advanced batteries and fuel cell technologies. The United States government has also announced the American Innovation and Manufacturing Act of 2021, which will provide incentives for companies engaged in the manufacturing of lithium-ion batteries. This act will provide tax credits for investments in clean energy technology and will aim to create jobs in the energy sector.

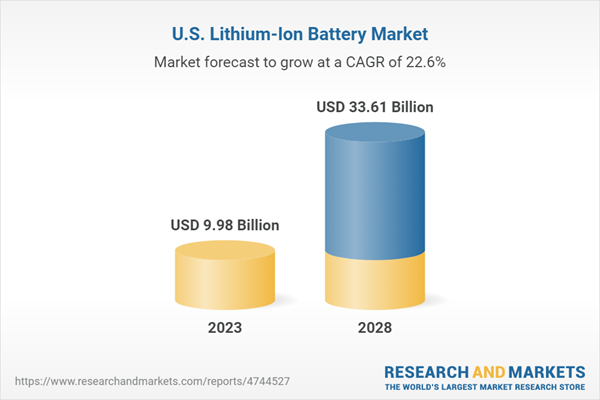

In conclusion, the United States lithium-ion battery market is expected to witness significant growth in the coming years due to the increasing demand for consumer electronics and EVs, the availability of improved battery technology, the introduction of government incentives, and the establishment of companies engaged in the manufacturing of batteries.

Increasing usage of lithium batteries in consumer electronics

The use of lithium-ion batteries in consumer electronics serves as an important driver for the growth of the market. The growing demand for consumer electronics and the increasing popularity toward a greener lifestyle is driving the demand for lithium-ion batteries. Moreover, technological advancements in the field of lithium-ion batteries have made them lighter and more efficient, further fuelling their demand in the consumer electronics sector.The United States lithium-ion battery market is well-equipped to meet the increased demand for lithium-ion batteries. The presence of major players such as Panasonic Corporation, BYD Company Limited, and LG Chem Ltd has made the supply chain for these batteries stronger and more efficient. The penetration of e-commerce is also helping to enhance sales and distribution of lithium-ion batteries across the country. The demand for consumer electronics such as smartphones, laptops, tablets, and wearable devices has been consistently increasing over the years. These devices rely heavily on lithium-ion batteries due to their high energy density, long cycle life, and light weight. As the demand for consumer electronics continues to rise, the need for lithium-ion batteries will also increase, thereby boosting the growth of the market. The United States government has recognized the importance of lithium-ion batteries in various sectors and has implemented policies and incentives to support their development and adoption. These include tax credits, grants, and research initiatives aimed at advancing battery technology. Such government support creates a favorable environment for the United States lithium-ion battery market, encouraging further growth and innovation. It is evident that the increasing usage of lithium batteries in consumer electronics will positively impact the United States lithium-ion battery market. The demand from consumer electronics, the transition to EVs, the need for energy storage systems, technological advancements, and government support collectively contribute to the growth and expansion of the market. Thus, the growing use of lithium-ion batteries in consumer electronics is expected to have a positive impact on the United States Lithium-ion Battery Market during the forecast period.

Increasing demand for energy storage

The United States lithium-ion battery market is currently driven by the increasing demand for energy storage. This is due to the growing adoption of renewable energy sources such as solar and wind power and the deployment of energy storage systems to improve grid stability and resilience. Additionally, the need for energy storage is being fuelled by the rapid adoption of EVs, the enhanced demand for consumer electronics, and the expanding off-grid applications. The ongoing trend of increased need for energy storage is influencing market growth and futuristic innovation within the United States lithium-ion battery industry. Lithium-ion batteries have emerged as a well-suited option for energy storage, capable of storing excess energy generated during periods of high production and releasing it during times of low production or increased demand. The rising demand for renewable energy integration consequently fuels the need for large-scale energy storage solutions, thereby driving the demand for lithium-ion batteries in the United States.Increasing demand from the automotive sector

The United States lithium-ion battery market is seeing a surge of growth due to the increasing demand for energy storage in the automotive space. Driven by a keen focus on reducing carbon emissions and achieving sustainable transport, the industry's adoption of EVs is fuelling the need for lithium-ion batteries. With these vehicles relying heavily on lithium-ion batteries for their primary energy storage solution, the market for the technology is steadily rising. In addition to the consumer-facing element, commercial EV applications such as passenger cars, buses, and trucks are also contributing to the increased demand for lithium-ion batteries. Automakers are looking to meet consumers' needs by providing advanced batteries capable of delivering enhanced performance and driving range. Governmental initiatives and regulations are working to stimulate the energy storage needs of the automotive sector. Federal and state-led credits, subsidies, grants, and emission standards have been integral in encouraging the adoption of EVs. This, in turn, has greatly stimulated the demand for lithium-ion batteries in the automobile industry. In conclusion, the automotive sector's shift to EVs is a defining trend in the US lithium-ion battery market.Market Segments

The United States lithium-ion battery market is segmented into type, application, battery, and region. Based on type, the market is segmented into lithium cobalt oxide, lithium nickel manganese cobalt oxide and others. Based on application, the market is divided into consumer electronics, industrial, automotive, and others. Based on battery capacity, the market is segmented into up to 4000 mAh, 4001-15000 mAh, 15001-50000 mAh and above 50000 mAh. The market analysis also studies the regional segmentation to devise regional market segmentation, divided among North East Region, South East Region, North Region, Mid-West region, and South Region

Market Players

Major market players of the United States lithium-ion battery market are Tesla, Inc, LG Chem Ltd, Samsung SDI, BYD Company Limited, A123 SYSTEMS, LLC, Enphase Energy, Inc, Panasonic Corporation of North America, Boston-Power, Inc, Johnson Controls, and Samsung SDI Co. Ltd. To achieve good market growth, businesses that are active in the market employ organic tactics such as product launches, mergers, and partnerships.Report Scope:

In this report, United States lithium-ion battery market has been segmented into following categories, in addition to the industry trends which have also been detailed below:United States Lithium-Ion Battery Market, By Type

- Lithium Cobalt Oxide

- Lithium Nickel Manganese Cobalt Oxide

- Others

United States Lithium-Ion Battery Market, By Application

- Consumer Electronics

- Industrial

- Automotive

- Others

United States Lithium-Ion Battery Market, By Battery Capacity

- Up to 4000 mAh

- 4001-15000 mAh

- 15001-50000 mAh

- Above 50000 mAh

United States Lithium-Ion Battery Market, By Region:

- North East Region

- South East Region

- North Region

- Mid-West region

- South Region

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United States lithium-ion battery market

Available Customizations:

United States lithium-ion battery market with the given market data, the publisher offers customizations according to a company’s specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Tesla, Inc

- LG Chem Ltd

- Panasonic Corporation

- Enphase Energy, Inc

- Boston-Power, Inc

- Samsung SDI

- BYD Company Limited

- Johnson Controls

- A123 SYSTEMS, LLC

- Samsung SDI Co. Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 78 |

| Published | October 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 9.98 Billion |

| Forecasted Market Value ( USD | $ 33.61 Billion |

| Compound Annual Growth Rate | 22.5% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |