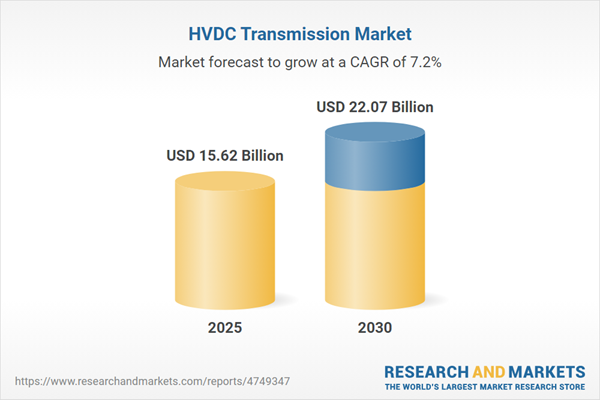

The global HVDC transmission market is estimated to be valued at USD 22.07 billion by 2030, up from USD 15.62 billion in 2025, at a CAGR of 7.2% during the forecast period. The HVDC transmission market is experiencing significant growth driven by the integration of VSC (voltage source converter) technology, rapid transition toward renewable energy, and strong government and utility focus on modernizing grids to improve power reliability. Additionally, government-led initiatives promoting HVDC transmission are further accelerating market adoption. However, the market faces challenges due to high initial investment requirements and the availability of substitute technologies such as distributed and off-grid power generation systems. Moreover, the complex lifecycles of HVDC projects can delay implementation and increase costs, slightly restraining overall market expansion.Strong Focus of Governments and Utilities on Grid Modernization to Improve Power Reliability

VSC technology is likely to register the fastest growth in the technology segment during the forecast period.

Voltage source converter (VSC) technology is expected to grow fastest in the HVDC transmission market during the forecast period. VSC offers key advantages over traditional Line Commutated Converter (LCC) systems, such as a smaller footprint, modular design, black start capability, and reactive power support. These features make VSC systems particularly suitable for integrating renewable energy sources like offshore wind farms, solar power plants, and distributed energy systems into the grid. Additionally, VSC technology allows for connection to weak or passive grids, which is essential for remote and island-based energy deployments.As countries expand their renewable capacity and move toward decentralized power generation, the demand for flexible, space-efficient transmission solutions is surging. VSC-based HVDC systems also enable underground and subsea cable transmission, making them ideal for urban centers and environmentally sensitive zones. Moreover, technological advancements in modular multilevel converters (MMC) are further enhancing the scalability, reliability, and cost-effectiveness of VSC systems. Governments across Europe, Asia Pacific, and North America increasingly favor VSC for new grid modernization projects and cross-border interconnections. With growing emphasis on energy transition, VSC is poised to play a pivotal role in the next generation of HVDC infrastructure, driving its rapid adoption globally.

Circuit breakers are expected to register the fastest growth rate in the converter station segment during the forecast period.

Circuit breakers are projected to witness the fastest growth within the converter station segment of the HVDC transmission component market during the forecast period. In HVDC systems, circuit breakers play a critical role in protecting equipment by interrupting fault currents and isolating faulty sections, thereby ensuring system stability and reliability. The rising demand for reliable and flexible power transmission, driven by the integration of renewable energy sources such as offshore wind and large scale solar, has significantly increased the need for advanced HVDC protection solutions.Recent technological advancements, including the development of hybrid HVDC circuit breakers, have addressed the challenges of interrupting direct current which is traditionally a more complex task compared to AC systems. These innovations enable faster fault clearance and minimize downtime, supporting the expansion of long distance high capacity HVDC projects. Furthermore, growing investments in intercontinental and cross border power links, as well as modernization of aging grid infrastructure, are boosting circuit breaker adoption. As utilities focus on operational safety and system efficiency, the circuit breaker segment is expected to maintain strong momentum, outpacing other converter station components in growth rate.

Asia Pacific is projected to expand at the fastest growth rate during the forecast period.

Asia Pacific is anticipated to register the fastest growth in the HVDC transmission market during the forecast period, driven by rapid industrialization, growing energy demand, and large-scale investments in renewable energy integration. Countries like China and India are leading the deployment of HVDC systems to address grid stability challenges, support long-distance electricity transmission, and connect remote renewable energy generation sites with consumption hubs. China, in particular, has become a global pioneer in ultra-high-voltage (UHV) DC transmission, with several cross-country projects that span thousands of kilometers and transport gigawatts of power.India also expands its HVDC infrastructure through green energy corridors and inter-regional power transfer initiatives. Southeast Asian nations such as Vietnam and Indonesia are gradually exploring HVDC to enhance grid reliability and meet rising energy needs in remote islands and rural areas. Government-led initiatives, favorable policy frameworks, and the involvement of regional players in HVDC component manufacturing are further accelerating adoption. Moreover, rising urbanization and electrification efforts, coupled with cross-border interconnection projects (e.g., China-Laos, India-Bangladesh), position the Asia Pacific as the fastest-growing market. The region’s focus on sustainable development and energy security makes HVDC a key enabler for its future power transmission landscape.

The break-up of the profile of primary participants in the HVDC transmission market:

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, Tier 3 - 20%

- By Designation Type: C Level - 35%, Director Level - 30%, Others - 35%

- By Region Type: Asia Pacific - 40%, Europe - 25%, North America - 20%, Rest of the World - 15%

The three tiers of the companies are based on their total revenues as of 2024: Tier 1: More than USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: USD 500 million.

The major players in the HVDC transmission market with a significant global presence include Hitachi, Ltd. (Japan), Siemens Energy (Germany), Mitsubishi Electric Corporation (Japan), GE Vernova (US), Prysmian Group (Italy), and others.

Research Coverage

The report segments the HVDC transmission market and forecasts its size by technology, component, project type, application, and region. It also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing market growth. The report covers qualitative aspects in addition to quantitative aspects of the market.Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall HVDC transmission market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.The report provides insights on the following pointers:

- Analysis of key drivers (integration of VSC technology into HVDC systems, rapid transition toward renewable energy, strong focus of governments and utilities on grid modernization to improve power reliability, and government-led policies and initiatives promoting HVDC transmission technology), restraints (high initial investment requirements, availability of substitute technologies such as distributed and off-grid power generation systems, and complex project lifecycles), opportunities (constant advances in power electronics and adoption of digital and automation technologies, electrification of transportation sector, growing demand for integrated networks across long distances, and energy transition strategies in oil-rich economies), and challenges (interoperability issues due to lack of standardization, stringent regulatory landscape and complexities associated with obtaining permit for HVDC projects)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the HVDC transmission market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the HVDC transmission market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the HVDC transmission market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, including include Hitachi, Ltd. (Japan), Siemens Energy (Germany), Mitsubishi Electric Corporation (Japan), GE Vernova (US), and Prysmian Group (Italy).

Table of Contents

Companies Mentioned

- Hitachi, Ltd.

- Siemens Energy

- Mitsubishi Electric Corporation

- GE Vernova

- Prysmian Group

- Toshiba Corporation

- Nkt A/S

- Nexans

- Ls Electric Co. Ltd.

- Nr Electric Co. Ltd.

- Sumitomo Electric Industries, Ltd.

- Zaporozhtransformator

- Trench Group

- Taihan Cable & Solution Co. Ltd.

- American Semiconductor, Inc.

- Ztt

- Tbea Co. Ltd.

- Efacec

- Sieyuan Electric Co. Ltd.

- Xj Electric Co. Ltd.

- Btw

- Cg Power & Industrial Solutions Ltd.

- Sgb Smit

- C-Epri Electric Power Engineering Co. Ltd.

- Hyosung Heavy Industries

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 265 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 15.62 Billion |

| Forecasted Market Value ( USD | $ 22.07 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |