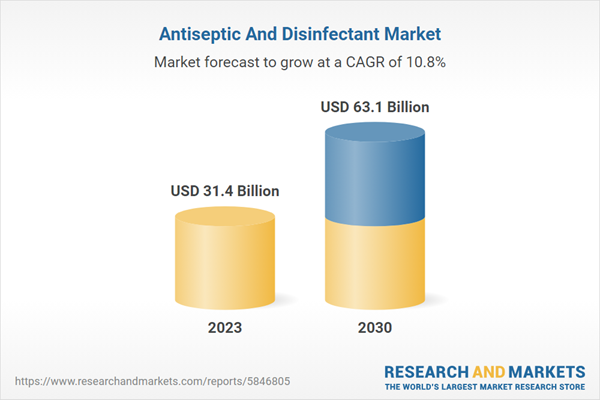

The global antiseptic and disinfectant market size is anticipated to reach USD 63.1 billion by 2030, according to a new report. The market is expected to expand at a CAGR of 10.8% from 2024 to 2030. Key factors driving the market expansion include technological advancements in antiseptics and disinfectants along with increasing use of endoscope reprocessors and surgical units. The current COVID-19 outbreak is expected to have a substantial impact on the market. The pandemic has resulted in a significant surge in demand for emergency supplies, hospital equipment, medicines, and medical disposables. According to Eurostat in 2020, extra-EU exports and imports of COVID-19 related products increased by 5.5 % and 10.4 % respectively, compared to 2019.

Additionally, EU extra- imports of protective oxygen and garments equipment recorded the highest increase (respectively by 38.7% and 40.3 % compared with 2019) amongst COVID-19 related products, followed by sterilization products (19.1 %) and. diagnostic equipment (19.2 %). However, the highest increases for EU- extra- exports were recorded for diagnostic testing equipment (14.9%), and sterilization products (16.0 %). As a result, market growth is expected to accelerate in the near future. Furthermore, the global market for antiseptics and disinfectants is consolidating due to the rising popularity of medical equipment along with the increased research collaboration and agreements between diverse manufacturers. For instance, in June 2021, Bactiguard and Schülke & Mayr GmbH, a German company, agreed to distribute Bactiguard's wound care solutions exclusively to German hospitals. The agreement allows schülke to add Bactiguard's hypochlorous acid-based portfolio to its existing antiseptic and wound-care product line which will, in turn, push the market scale during the study period.

This product will be delivered within 2 business days.

Additionally, EU extra- imports of protective oxygen and garments equipment recorded the highest increase (respectively by 38.7% and 40.3 % compared with 2019) amongst COVID-19 related products, followed by sterilization products (19.1 %) and. diagnostic equipment (19.2 %). However, the highest increases for EU- extra- exports were recorded for diagnostic testing equipment (14.9%), and sterilization products (16.0 %). As a result, market growth is expected to accelerate in the near future. Furthermore, the global market for antiseptics and disinfectants is consolidating due to the rising popularity of medical equipment along with the increased research collaboration and agreements between diverse manufacturers. For instance, in June 2021, Bactiguard and Schülke & Mayr GmbH, a German company, agreed to distribute Bactiguard's wound care solutions exclusively to German hospitals. The agreement allows schülke to add Bactiguard's hypochlorous acid-based portfolio to its existing antiseptic and wound-care product line which will, in turn, push the market scale during the study period.

Antiseptic And Disinfectant Market Report Highlights

- In terms of revenue, the quaternary ammonium compounds held the largest share of around 31.4% in 2023, owing to the rising incidence of healthcare-associated infections and the increasing number of hospitals across the globe

- The enzymatic cleaners segment is expected to witness the fastest CAGR of 10.5% over the forecast period. The growth of this segment can be attributed to the increasing number of hospitals in developing countries

- The hospital segment is expected to witness the fastest growth rate of 10.6% over the forecast period. The increasing number of hospitals in developing countries is expected to propel segment growth

- In terms of revenue, the B2B segment held the largest share owing to the rising end-users opting for this sales channel across the globe

- In Asia Pacific, the market is expected to witness the fastest CAGR of 11.5% over the forecast period, owing to the rising prevalence of cardiovascular, neurology, and urology disorders

This product will be delivered within 2 business days.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Segment Definitions

1.2.1. Type

1.2.2. Product

1.2.3. Sales

1.2.4. End-use

1.2.5. Regional scope

1.2.6. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. Internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.4.5.1. Data for primary interviews in North America

1.4.5.2. Data for primary interviews in Europe

1.4.5.3. Data for primary interviews in Asia Pacific

1.4.5.4. Data for primary interviews in Latin America

1.4.5.5. Data for Primary interviews in MEA

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

1.2. Segment Definitions

1.2.1. Type

1.2.2. Product

1.2.3. Sales

1.2.4. End-use

1.2.5. Regional scope

1.2.6. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. Internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.4.5.1. Data for primary interviews in North America

1.4.5.2. Data for primary interviews in Europe

1.4.5.3. Data for primary interviews in Asia Pacific

1.4.5.4. Data for primary interviews in Latin America

1.4.5.5. Data for Primary interviews in MEA

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Type outlook

2.2.2. Product outlook

2.2.3. Sales outlook

2.2.4. End-use outlook

2.3. Regional outlook

2.4. Competitive Insights

2.2. Segment Outlook

2.2.1. Type outlook

2.2.2. Product outlook

2.2.3. Sales outlook

2.2.4. End-use outlook

2.3. Regional outlook

2.4. Competitive Insights

Chapter 3. Antiseptic and Disinfectant Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Increasing Prevalence of Hospital-acquired Infections

3.2.1.2. Growing Awareness About Home Cleanliness

3.2.1.3. Increasing Use of Endoscope Reprocessors and Surgical Units

3.2.1.4. Impact Of COVID-19

3.2.2. Market Restraint Analysis

3.2.2.1. Stringent Regulations Pertaining to Usage of Antiseptics & Disinfectants

3.3. Antiseptic and Disinfectant Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.2. Bargaining power of suppliers

3.3.3. Bargaining power of buyers

3.3.4. Threat of substitutes

3.3.5. Threat of new entrants

3.3.6. Competitive rivalry

3.3.7. PESTEL Analysis

3.3.7.1. Political landscape

3.3.7.2. Economic landscape

3.3.7.3. Social landscape

3.3.7.4. Technological landscape

3.3.7.5. Environmental landscape

3.3.7.6. Legal landscape

3.1.1. Parent Market Outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Increasing Prevalence of Hospital-acquired Infections

3.2.1.2. Growing Awareness About Home Cleanliness

3.2.1.3. Increasing Use of Endoscope Reprocessors and Surgical Units

3.2.1.4. Impact Of COVID-19

3.2.2. Market Restraint Analysis

3.2.2.1. Stringent Regulations Pertaining to Usage of Antiseptics & Disinfectants

3.3. Antiseptic and Disinfectant Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.2. Bargaining power of suppliers

3.3.3. Bargaining power of buyers

3.3.4. Threat of substitutes

3.3.5. Threat of new entrants

3.3.6. Competitive rivalry

3.3.7. PESTEL Analysis

3.3.7.1. Political landscape

3.3.7.2. Economic landscape

3.3.7.3. Social landscape

3.3.7.4. Technological landscape

3.3.7.5. Environmental landscape

3.3.7.6. Legal landscape

Chapter 4. Antiseptic and Disinfectant Market: Type Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Antiseptic and Disinfectant Market: Type Movement Analysis

4.3. Antiseptic and Disinfectant Market by Type Outlook (USD Million)

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.5. Quaternary Ammonium Compounds

4.5.1. Quaternary Ammonium Compounds Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6. Chlorine Compounds

4.6.1. Chlorine Compounds Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.7. Alcohols & Aldehyde Products

4.7.1. Alcohols & Aldehyde Products Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.8. Enzyme

4.8.1. Enzyme Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.9. Others

4.9.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.2. Antiseptic and Disinfectant Market: Type Movement Analysis

4.3. Antiseptic and Disinfectant Market by Type Outlook (USD Million)

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.5. Quaternary Ammonium Compounds

4.5.1. Quaternary Ammonium Compounds Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6. Chlorine Compounds

4.6.1. Chlorine Compounds Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.7. Alcohols & Aldehyde Products

4.7.1. Alcohols & Aldehyde Products Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.8. Enzyme

4.8.1. Enzyme Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.9. Others

4.9.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Antiseptic and Disinfectant Market: Product Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Antiseptic and Disinfectant Market: Product Movement Analysis

5.3. Antiseptic and Disinfectant Market by Product Outlook (USD Million)

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.5. Enzymatic Cleaners

5.5.1. Enzymatic Cleaners Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.6. Medical Device Disinfectants

5.6.1. Medical Device Disinfectants Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.7. Surface Disinfectants

5.7.1. Surface Disinfectants Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.2. Antiseptic and Disinfectant Market: Product Movement Analysis

5.3. Antiseptic and Disinfectant Market by Product Outlook (USD Million)

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.5. Enzymatic Cleaners

5.5.1. Enzymatic Cleaners Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.6. Medical Device Disinfectants

5.6.1. Medical Device Disinfectants Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.7. Surface Disinfectants

5.7.1. Surface Disinfectants Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Antiseptic and Disinfectant Market: Sales Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Antiseptic and Disinfectant Market: Sales Movement Analysis

6.3. Antiseptic and Disinfectant Market by Sales Outlook (USD Million)

6.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

6.5. B2B

6.5.1. B2B Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6. FMCG

6.6.1. FMCG Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.7. Others

6.7.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.2. Antiseptic and Disinfectant Market: Sales Movement Analysis

6.3. Antiseptic and Disinfectant Market by Sales Outlook (USD Million)

6.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

6.5. B2B

6.5.1. B2B Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6. FMCG

6.6.1. FMCG Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.7. Others

6.7.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 7. Antiseptic and Disinfectant Market: End-use Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Antiseptic and Disinfectant Market: End-use Movement Analysis

7.3. Antiseptic and Disinfectant Market by End-use Outlook (USD Million)

7.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

7.5. Hospitals

7.5.1. Hospitals Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6. Clinics

7.6.1. Clinics Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.7. Others

7.7.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.2. Antiseptic and Disinfectant Market: End-use Movement Analysis

7.3. Antiseptic and Disinfectant Market by End-use Outlook (USD Million)

7.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

7.5. Hospitals

7.5.1. Hospitals Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6. Clinics

7.6.1. Clinics Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.7. Others

7.7.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 8. Antiseptic and Disinfectant Market: Regional Estimates & Trend Analysis

8.1. Regional Dashboard

8.2. Regional Antiseptic and Disinfectant Market movement analysis

8.3. Antiseptic and Disinfectant Market: Regional Estimates & Trend Analysis by Type, Product, Sales & End-use

8.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

8.5. North America

8.5.1. North America Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.2. U.S.

8.5.2.1. Key Country Dynamics

8.5.2.2. Competitive Scenario

8.5.2.3. Regulatory Framework

8.5.2.4. Reimbursement scenario

8.5.2.5. U.S. Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.3. Canada

8.5.3.1. Key Country Dynamics

8.5.3.2. Competitive Scenario

8.5.3.3. Regulatory Framework

8.5.3.4. Reimbursement scenario

8.5.3.5. Canada Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.4. Mexico

8.5.4.1. Key Country Dynamics

8.5.4.2. Competitive Scenario

8.5.4.3. Regulatory Framework

8.5.4.4. Reimbursement scenario

8.5.4.5. Mexico Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.5. Europe

8.5.6. Europe Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.7. UK

8.5.7.1. Key Country Dynamics

8.5.7.2. Competitive Scenario

8.5.7.3. Regulatory Framework

8.5.7.4. Reimbursement scenario

8.5.7.5. UK Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.8. Germany

8.5.8.1. Key Country Dynamics

8.5.8.2. Competitive Scenario

8.5.8.3. Regulatory Framework

8.5.8.4. Reimbursement scenario

8.5.8.5. Germany Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.9. France

8.5.9.1. Key Country Dynamics

8.5.9.2. Competitive Scenario

8.5.9.3. Regulatory Framework

8.5.9.4. Reimbursement scenario

8.5.9.5. France Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.10. Italy

8.5.10.1. Key Country Dynamics

8.5.10.2. Competitive Scenario

8.5.10.3. Regulatory Framework

8.5.10.4. Reimbursement scenario

8.5.10.5. Italy Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.11. Spain

8.5.11.1. Key Country Dynamics

8.5.11.2. Competitive Scenario

8.5.11.3. Regulatory Framework

8.5.11.4. Reimbursement scenario

8.5.11.5. Spain Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.12. Denmark

8.5.12.1. Key Country Dynamics

8.5.12.2. Competitive Scenario

8.5.12.3. Regulatory Framework

8.5.12.4. Reimbursement scenario

8.5.12.5. Denmark Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.13. Sweden

8.5.13.1. Key Country Dynamics

8.5.13.2. Competitive Scenario

8.5.13.3. Regulatory Framework

8.5.13.4. Reimbursement scenario

8.5.13.5. Sweden Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.14. Norway

8.5.14.1. Key Country Dynamics

8.5.14.2. Competitive Scenario

8.5.14.3. Regulatory Framework

8.5.14.4. Reimbursement scenario

8.5.14.5. Norway Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6. Asia Pacific

8.6.1. Asia Pacific Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.2. Japan

8.6.2.1. Key Country Dynamics

8.6.2.2. Competitive Scenario

8.6.2.3. Regulatory Framework

8.6.2.4. Reimbursement scenario

8.6.2.5. Japan Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.3. China

8.6.3.1. Key Country Dynamics

8.6.3.2. Competitive Scenario

8.6.3.3. Regulatory Framework

8.6.3.4. Reimbursement scenario

8.6.3.5. China Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.4. India

8.6.4.1. Key Country Dynamics

8.6.4.2. Competitive Scenario

8.6.4.3. Regulatory Framework

8.6.4.4. Reimbursement scenario

8.6.4.5. India Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.5. South Korea

8.6.5.1. Key Country Dynamics

8.6.5.2. Competitive Scenario

8.6.5.3. Regulatory Framework

8.6.5.4. Reimbursement scenario

8.6.5.5. South Korea Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.6. Australia

8.6.6.1. Key Country Dynamics

8.6.6.2. Competitive Scenario

8.6.6.3. Regulatory Framework

8.6.6.4. Reimbursement scenario

8.6.6.5. Australia Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.7. Thailand

8.6.7.1. Key Country Dynamics

8.6.7.2. Competitive Scenario

8.6.7.3. Regulatory Framework

8.6.7.4. Reimbursement scenario

8.6.7.5. Thailand Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.7. Latin America

8.7.1. Latin America Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.7.2. Brazil

8.7.2.1. Key Country Dynamics

8.7.2.2. Competitive Scenario

8.7.2.3. Regulatory Framework

8.7.2.4. Reimbursement scenario

8.7.2.5. Brazil Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.7.3. Argentina

8.7.3.1. Key Country Dynamics

8.7.3.2. Competitive Scenario

8.7.3.3. Regulatory Framework

8.7.3.4. Reimbursement scenario

8.7.3.5. Argentina Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.8. Middle East & Africa

8.8.1. Middle East & Africa Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.8.2. South Africa

8.8.2.1. Key Country Dynamics

8.8.2.2. Competitive Scenario

8.8.2.3. Regulatory Framework

8.8.2.4. Reimbursement scenario

8.8.2.5. South Africa Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.8.3. Saudi Arabia

8.8.3.1. Key Country Dynamics

8.8.3.2. Competitive Scenario

8.8.3.3. Regulatory Framework

8.8.3.4. Reimbursement scenario

8.8.3.5. Saudi Arabia Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.8.4. UAE

8.8.4.1. Key Country Dynamics

8.8.4.2. Competitive Scenario

8.8.4.3. Regulatory Framework

8.8.4.4. Reimbursement scenario

8.8.4.5. UAE Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.8.5. Kuwait

8.8.5.1. Key Country Dynamics

8.8.5.2. Competitive Scenario

8.8.5.3. Regulatory Framework

8.8.5.4. Reimbursement scenario

8.8.5.5. Kuwait Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.2. Regional Antiseptic and Disinfectant Market movement analysis

8.3. Antiseptic and Disinfectant Market: Regional Estimates & Trend Analysis by Type, Product, Sales & End-use

8.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

8.5. North America

8.5.1. North America Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.2. U.S.

8.5.2.1. Key Country Dynamics

8.5.2.2. Competitive Scenario

8.5.2.3. Regulatory Framework

8.5.2.4. Reimbursement scenario

8.5.2.5. U.S. Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.3. Canada

8.5.3.1. Key Country Dynamics

8.5.3.2. Competitive Scenario

8.5.3.3. Regulatory Framework

8.5.3.4. Reimbursement scenario

8.5.3.5. Canada Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.4. Mexico

8.5.4.1. Key Country Dynamics

8.5.4.2. Competitive Scenario

8.5.4.3. Regulatory Framework

8.5.4.4. Reimbursement scenario

8.5.4.5. Mexico Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.5. Europe

8.5.6. Europe Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.7. UK

8.5.7.1. Key Country Dynamics

8.5.7.2. Competitive Scenario

8.5.7.3. Regulatory Framework

8.5.7.4. Reimbursement scenario

8.5.7.5. UK Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.8. Germany

8.5.8.1. Key Country Dynamics

8.5.8.2. Competitive Scenario

8.5.8.3. Regulatory Framework

8.5.8.4. Reimbursement scenario

8.5.8.5. Germany Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.9. France

8.5.9.1. Key Country Dynamics

8.5.9.2. Competitive Scenario

8.5.9.3. Regulatory Framework

8.5.9.4. Reimbursement scenario

8.5.9.5. France Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.10. Italy

8.5.10.1. Key Country Dynamics

8.5.10.2. Competitive Scenario

8.5.10.3. Regulatory Framework

8.5.10.4. Reimbursement scenario

8.5.10.5. Italy Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.11. Spain

8.5.11.1. Key Country Dynamics

8.5.11.2. Competitive Scenario

8.5.11.3. Regulatory Framework

8.5.11.4. Reimbursement scenario

8.5.11.5. Spain Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.12. Denmark

8.5.12.1. Key Country Dynamics

8.5.12.2. Competitive Scenario

8.5.12.3. Regulatory Framework

8.5.12.4. Reimbursement scenario

8.5.12.5. Denmark Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.13. Sweden

8.5.13.1. Key Country Dynamics

8.5.13.2. Competitive Scenario

8.5.13.3. Regulatory Framework

8.5.13.4. Reimbursement scenario

8.5.13.5. Sweden Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.14. Norway

8.5.14.1. Key Country Dynamics

8.5.14.2. Competitive Scenario

8.5.14.3. Regulatory Framework

8.5.14.4. Reimbursement scenario

8.5.14.5. Norway Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6. Asia Pacific

8.6.1. Asia Pacific Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.2. Japan

8.6.2.1. Key Country Dynamics

8.6.2.2. Competitive Scenario

8.6.2.3. Regulatory Framework

8.6.2.4. Reimbursement scenario

8.6.2.5. Japan Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.3. China

8.6.3.1. Key Country Dynamics

8.6.3.2. Competitive Scenario

8.6.3.3. Regulatory Framework

8.6.3.4. Reimbursement scenario

8.6.3.5. China Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.4. India

8.6.4.1. Key Country Dynamics

8.6.4.2. Competitive Scenario

8.6.4.3. Regulatory Framework

8.6.4.4. Reimbursement scenario

8.6.4.5. India Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.5. South Korea

8.6.5.1. Key Country Dynamics

8.6.5.2. Competitive Scenario

8.6.5.3. Regulatory Framework

8.6.5.4. Reimbursement scenario

8.6.5.5. South Korea Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.6. Australia

8.6.6.1. Key Country Dynamics

8.6.6.2. Competitive Scenario

8.6.6.3. Regulatory Framework

8.6.6.4. Reimbursement scenario

8.6.6.5. Australia Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.7. Thailand

8.6.7.1. Key Country Dynamics

8.6.7.2. Competitive Scenario

8.6.7.3. Regulatory Framework

8.6.7.4. Reimbursement scenario

8.6.7.5. Thailand Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.7. Latin America

8.7.1. Latin America Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.7.2. Brazil

8.7.2.1. Key Country Dynamics

8.7.2.2. Competitive Scenario

8.7.2.3. Regulatory Framework

8.7.2.4. Reimbursement scenario

8.7.2.5. Brazil Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.7.3. Argentina

8.7.3.1. Key Country Dynamics

8.7.3.2. Competitive Scenario

8.7.3.3. Regulatory Framework

8.7.3.4. Reimbursement scenario

8.7.3.5. Argentina Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.8. Middle East & Africa

8.8.1. Middle East & Africa Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.8.2. South Africa

8.8.2.1. Key Country Dynamics

8.8.2.2. Competitive Scenario

8.8.2.3. Regulatory Framework

8.8.2.4. Reimbursement scenario

8.8.2.5. South Africa Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.8.3. Saudi Arabia

8.8.3.1. Key Country Dynamics

8.8.3.2. Competitive Scenario

8.8.3.3. Regulatory Framework

8.8.3.4. Reimbursement scenario

8.8.3.5. Saudi Arabia Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.8.4. UAE

8.8.4.1. Key Country Dynamics

8.8.4.2. Competitive Scenario

8.8.4.3. Regulatory Framework

8.8.4.4. Reimbursement scenario

8.8.4.5. UAE Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.8.5. Kuwait

8.8.5.1. Key Country Dynamics

8.8.5.2. Competitive Scenario

8.8.5.3. Regulatory Framework

8.8.5.4. Reimbursement scenario

8.8.5.5. Kuwait Antiseptic and Disinfectant Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 9. Antiseptic and Disinfectant Market: Regional Estimates & Trend Analysis

9.1. Recent Developments & Impact Analysis, By Key Market Participants

9.2. Company Categorization

9.2.1. Innovators

9.2.2. Market Leaders

9.3. Vendor Landscape

9.3.1. Key Company Market Share Analysis, 2023

9.3.2. Major Deals & Strategic Alliances

9.3.2.1. New Product Launch

9.3.2.2. Expansion

9.3.2.3. Acquisition

9.4. Company Profiles

9.4.1. 3M

9.4.1.1. Company Overview

9.4.1.2. Product Benchmarking

9.4.1.3. Financial Performance

9.4.1.4. Strategic Initiatives

9.4.2. Reckitt Benckiser

9.4.2.1. Company Overview

9.4.2.2. Product Benchmarking

9.4.2.3. Financial Performance

9.4.2.4. Strategic Initiatives

9.4.3. Steris Plc

9.4.3.1. Company Overview

9.4.3.2. Product Benchmarking

9.4.3.3. Financial Performance

9.4.3.4. Strategic Initiatives

9.4.4. KIMBERLY-CLARK CORPORATION

9.4.4.1. Company Overview

9.4.4.2. Product Benchmarking

9.4.4.3. Financial Performance

9.4.4.4. Strategic Initiatives

9.4.5. BIO-CIDE INTERNATIONAL

9.4.5.1. Company Overview

9.4.5.2. Product Benchmarking

9.4.5.3. Financial Performance

9.4.5.4. Strategic Initiatives

9.4.6. CARDINAL HEALTH

9.4.6.1. Company Overview

9.4.6.2. Product Benchmarking

9.4.6.3. Financial Performance

9.4.6.4. Strategic Initiatives

9.4.7. BD

9.4.7.1. Company Overview

9.4.7.2. Product Benchmarking

9.4.7.3. Financial Performance

9.4.7.4. Strategic Initiatives

9.4.8. Johnson & Johnson

9.4.8.1. Company Overview

9.4.8.2. Product Benchmarking

9.4.8.3. Financial Performance

9.4.8.4. Strategic Initiatives

9.2. Company Categorization

9.2.1. Innovators

9.2.2. Market Leaders

9.3. Vendor Landscape

9.3.1. Key Company Market Share Analysis, 2023

9.3.2. Major Deals & Strategic Alliances

9.3.2.1. New Product Launch

9.3.2.2. Expansion

9.3.2.3. Acquisition

9.4. Company Profiles

9.4.1. 3M

9.4.1.1. Company Overview

9.4.1.2. Product Benchmarking

9.4.1.3. Financial Performance

9.4.1.4. Strategic Initiatives

9.4.2. Reckitt Benckiser

9.4.2.1. Company Overview

9.4.2.2. Product Benchmarking

9.4.2.3. Financial Performance

9.4.2.4. Strategic Initiatives

9.4.3. Steris Plc

9.4.3.1. Company Overview

9.4.3.2. Product Benchmarking

9.4.3.3. Financial Performance

9.4.3.4. Strategic Initiatives

9.4.4. KIMBERLY-CLARK CORPORATION

9.4.4.1. Company Overview

9.4.4.2. Product Benchmarking

9.4.4.3. Financial Performance

9.4.4.4. Strategic Initiatives

9.4.5. BIO-CIDE INTERNATIONAL

9.4.5.1. Company Overview

9.4.5.2. Product Benchmarking

9.4.5.3. Financial Performance

9.4.5.4. Strategic Initiatives

9.4.6. CARDINAL HEALTH

9.4.6.1. Company Overview

9.4.6.2. Product Benchmarking

9.4.6.3. Financial Performance

9.4.6.4. Strategic Initiatives

9.4.7. BD

9.4.7.1. Company Overview

9.4.7.2. Product Benchmarking

9.4.7.3. Financial Performance

9.4.7.4. Strategic Initiatives

9.4.8. Johnson & Johnson

9.4.8.1. Company Overview

9.4.8.2. Product Benchmarking

9.4.8.3. Financial Performance

9.4.8.4. Strategic Initiatives

List of Tables

Table 1 List of Secondary Sources

Table 2 List of Abbreviations

Table 3 Global antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 4 Global antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 5 Global antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 6 Global antiseptic and disinfectant market, by end use, (USD million) 2018 - 2030

Table 7 North America antiseptic and disinfectant market, by region, 2018 - 2030 (USD Million)

Table 8 North America antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 9 North America antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 10 North America antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 11 North America antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 12 U.S antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 13 U.S antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 14 U.S antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 15 Canada antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 16 Canada antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 17 Canada antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 18 Canada antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 19 Mexico antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 20 Mexico antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 21 Mexico antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 22 Mexico antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 23 Europe antiseptic and disinfectant market, by country, 2018 - 2030 (USD Million)

Table 24 Europe antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 25 Europe antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 26 Europe antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 27 Europe antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 28 UK antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 29 UK antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 30 UK antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 31 UK antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 32 Germany antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 33 Germany antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 34 Germany antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 35 Germany antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 36 France antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 37 France antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 38 France antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 39 France antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 40 Italy antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 41 Italy antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 42 Italy antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 43 Italy antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 44 Spain antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 45 Spain antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 46 Spain antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 47 Spain antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 48 Norway antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 49 Norway antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 50 Norway antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 51 Norway antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 52 Sweden antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 53 Sweden antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 54 Sweden antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 55 Sweden antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 56 Denmark antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 57 Denmark antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 58 Denmark antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 59 Denmark antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 60 Asia Pacific antiseptic and disinfectant market, by country, 2018 - 2030 (USD Million)

Table 61 Asia Pacific antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 62 Asia Pacific antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 63 Asia antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 64 Asia Pacific antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 65 Japan antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 66 Japan antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 67 Japan antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 68 Japan antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 69 China antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 70 China antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 71 China antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 72 China antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 73 India antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 74 India antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 75 India antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 76 India antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 77 Australia antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 78 Australia antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 79 Australia antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 80 Australia antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 81 South Korea antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 82 South Korea antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 83 South Korea antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 84 South Korea antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 85 Thailand antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 86 Thailand antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 87 Thailand antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 88 Thailand antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 89 Latin America antiseptic and disinfectant market, by country, 2018 - 2030 (USD Million)

Table 90 Latin America antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 91 Latin America antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 92 Latin America antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 93 Latin America antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 94 Brazil antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 95 Brazil antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 96 Brazil antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 97 Brazil antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 98 Argentina antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 99 Argentina antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 100 Argentina antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 101 Argentina antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 102 Middle East & Africa antiseptic and disinfectant market, by country, 2018 - 2030 (USD Million)

Table 103 Middle East & Africa antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 104 Middle East & Africa antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 105 Middle East & Africa antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 106 Middle East & Africa antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 107 South Africa antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 108 South Africa antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 109 South Africa antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 110 South Africa antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 111 Saudi Arabia antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 112 Saudi Arabia antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 113 Saudi Arabia antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 114 Saudi Arabia antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 115 UAE antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 116 UAE antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 117 UAE antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 118 UAE antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 119 Kuwait antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 120 Kuwait antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 121 Kuwait antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 122 Kuwait antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 2 List of Abbreviations

Table 3 Global antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 4 Global antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 5 Global antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 6 Global antiseptic and disinfectant market, by end use, (USD million) 2018 - 2030

Table 7 North America antiseptic and disinfectant market, by region, 2018 - 2030 (USD Million)

Table 8 North America antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 9 North America antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 10 North America antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 11 North America antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 12 U.S antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 13 U.S antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 14 U.S antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 15 Canada antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 16 Canada antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 17 Canada antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 18 Canada antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 19 Mexico antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 20 Mexico antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 21 Mexico antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 22 Mexico antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 23 Europe antiseptic and disinfectant market, by country, 2018 - 2030 (USD Million)

Table 24 Europe antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 25 Europe antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 26 Europe antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 27 Europe antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 28 UK antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 29 UK antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 30 UK antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 31 UK antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 32 Germany antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 33 Germany antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 34 Germany antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 35 Germany antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 36 France antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 37 France antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 38 France antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 39 France antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 40 Italy antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 41 Italy antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 42 Italy antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 43 Italy antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 44 Spain antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 45 Spain antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 46 Spain antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 47 Spain antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 48 Norway antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 49 Norway antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 50 Norway antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 51 Norway antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 52 Sweden antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 53 Sweden antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 54 Sweden antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 55 Sweden antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 56 Denmark antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 57 Denmark antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 58 Denmark antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 59 Denmark antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 60 Asia Pacific antiseptic and disinfectant market, by country, 2018 - 2030 (USD Million)

Table 61 Asia Pacific antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 62 Asia Pacific antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 63 Asia antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 64 Asia Pacific antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 65 Japan antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 66 Japan antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 67 Japan antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 68 Japan antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 69 China antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 70 China antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 71 China antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 72 China antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 73 India antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 74 India antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 75 India antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 76 India antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 77 Australia antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 78 Australia antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 79 Australia antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 80 Australia antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 81 South Korea antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 82 South Korea antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 83 South Korea antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 84 South Korea antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 85 Thailand antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 86 Thailand antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 87 Thailand antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 88 Thailand antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 89 Latin America antiseptic and disinfectant market, by country, 2018 - 2030 (USD Million)

Table 90 Latin America antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 91 Latin America antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 92 Latin America antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 93 Latin America antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 94 Brazil antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 95 Brazil antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 96 Brazil antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 97 Brazil antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 98 Argentina antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 99 Argentina antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 100 Argentina antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 101 Argentina antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 102 Middle East & Africa antiseptic and disinfectant market, by country, 2018 - 2030 (USD Million)

Table 103 Middle East & Africa antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 104 Middle East & Africa antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 105 Middle East & Africa antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 106 Middle East & Africa antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 107 South Africa antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 108 South Africa antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 109 South Africa antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 110 South Africa antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 111 Saudi Arabia antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 112 Saudi Arabia antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 113 Saudi Arabia antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 114 Saudi Arabia antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 115 UAE antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 116 UAE antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 117 UAE antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 118 UAE antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

Table 119 Kuwait antiseptic and disinfectant market, by type, 2018 - 2030 (USD Million)

Table 120 Kuwait antiseptic and disinfectant market, by product, 2018 - 2030 (USD Million)

Table 121 Kuwait antiseptic and disinfectant market, by sales, 2018 - 2030 (USD Million)

Table 122 Kuwait antiseptic and disinfectant market, by end use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Information Procurement

Fig. 2 Primary Research Pattern

Fig. 3 Market Research Approaches

Fig. 4 Value Chain-Based Sizing & Forecasting

Fig. 5 Market Formulation & Validation

Fig. 6 Antiseptic and disinfectant market segmentation

Fig. 7 Market driver analysis (Current & future impact)

Fig. 8 Market restraint analysis (Current & future impact)

Fig. 9 SWOT Analysis, By Factor (Political & Legal, Economic and Technological)

Fig. 10 Porter’s Five Forces Analysis

Fig. 11 Antiseptic and disinfectant market, type outlook key takeaways (USD Million)

Fig. 12 Antiseptic and disinfectant market: type movement analysis 2023 & 2030 (USD Million)

Fig. 13 Quaternary ammonium compounds market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 14 Chlorine compounds market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 15 Alcohols & aldehyde products market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 16 Enzyme market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 17 Others market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 18 Antiseptic and disinfectant market, product outlook key takeaways (USD Million);

Fig. 19 Antiseptic and disinfectant market: product movement analysis 2023 & 2030 (USD Million)

Fig. 20 Enzymatic cleaners market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 21 Medical device disinfectants market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 22 Surface disinfectants market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 23 Antiseptic and disinfectant market, sales channel outlook key takeaways (USD Million)

Fig. 24 Antiseptic and disinfectant market sales channels movement analysis 2023 & 2030 (USD Million)

Fig. 25 B2B market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 26 FMCG market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 27 Antiseptic and disinfectant market, end use outlook key takeaways (USD Million)

Fig. 28 Antiseptic and disinfectant market: end use movement analysis 2023 & 2030 (USD Million)

Fig. 29 Hospitals market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 30 Clinics market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 31 Others market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 32 Antiseptic and disinfectant market: regional key takeaways (USD Million)

Fig. 33 Antiseptic and disinfectant market: regional outlook, 2023 & 2030, USD Million

Fig. 34 North America antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 35 U.S antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 36 Canada antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 37 Mexico antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 38 Europe antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 39 UK antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 40 Germany antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 41 France antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 42 Spain antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 43 Italy antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 44 Sweden antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 45 Norway antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 46 Denmark antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 47 Asia Pacific antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 48 China antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 49 Japan antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 50 India antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 51 South Korea antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 52 Australia antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 53 Thailand antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 54 Latin America antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 55 Brazil antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 56 Argentina antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 57 Middle East and Africa antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 58 South Africa antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 59 Saudi Arabia antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 60 UAE antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 61 Kuwait antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 62 List of key emerging company’s/technology disruptors/innovators

Fig. 2 Primary Research Pattern

Fig. 3 Market Research Approaches

Fig. 4 Value Chain-Based Sizing & Forecasting

Fig. 5 Market Formulation & Validation

Fig. 6 Antiseptic and disinfectant market segmentation

Fig. 7 Market driver analysis (Current & future impact)

Fig. 8 Market restraint analysis (Current & future impact)

Fig. 9 SWOT Analysis, By Factor (Political & Legal, Economic and Technological)

Fig. 10 Porter’s Five Forces Analysis

Fig. 11 Antiseptic and disinfectant market, type outlook key takeaways (USD Million)

Fig. 12 Antiseptic and disinfectant market: type movement analysis 2023 & 2030 (USD Million)

Fig. 13 Quaternary ammonium compounds market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 14 Chlorine compounds market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 15 Alcohols & aldehyde products market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 16 Enzyme market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 17 Others market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 18 Antiseptic and disinfectant market, product outlook key takeaways (USD Million);

Fig. 19 Antiseptic and disinfectant market: product movement analysis 2023 & 2030 (USD Million)

Fig. 20 Enzymatic cleaners market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 21 Medical device disinfectants market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 22 Surface disinfectants market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 23 Antiseptic and disinfectant market, sales channel outlook key takeaways (USD Million)

Fig. 24 Antiseptic and disinfectant market sales channels movement analysis 2023 & 2030 (USD Million)

Fig. 25 B2B market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 26 FMCG market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 27 Antiseptic and disinfectant market, end use outlook key takeaways (USD Million)

Fig. 28 Antiseptic and disinfectant market: end use movement analysis 2023 & 2030 (USD Million)

Fig. 29 Hospitals market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 30 Clinics market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 31 Others market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 32 Antiseptic and disinfectant market: regional key takeaways (USD Million)

Fig. 33 Antiseptic and disinfectant market: regional outlook, 2023 & 2030, USD Million

Fig. 34 North America antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 35 U.S antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 36 Canada antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 37 Mexico antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 38 Europe antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 39 UK antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 40 Germany antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 41 France antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 42 Spain antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 43 Italy antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 44 Sweden antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 45 Norway antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 46 Denmark antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 47 Asia Pacific antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 48 China antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 49 Japan antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 50 India antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 51 South Korea antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 52 Australia antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 53 Thailand antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 54 Latin America antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 55 Brazil antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 56 Argentina antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 57 Middle East and Africa antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 58 South Africa antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 59 Saudi Arabia antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 60 UAE antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 61 Kuwait antiseptic and disinfectant market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 62 List of key emerging company’s/technology disruptors/innovators

Companies Mentioned

- 3M

- Reckitt Benckiser

- Steris Plc

- Kimberly-Clark Corporation

- Bio-Cide International, Inc.

- Cardinal Health

- BD

- Johnson & Johnson

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | July 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 31.4 Billion |

| Forecasted Market Value ( USD | $ 63.1 Billion |

| Compound Annual Growth Rate | 10.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |