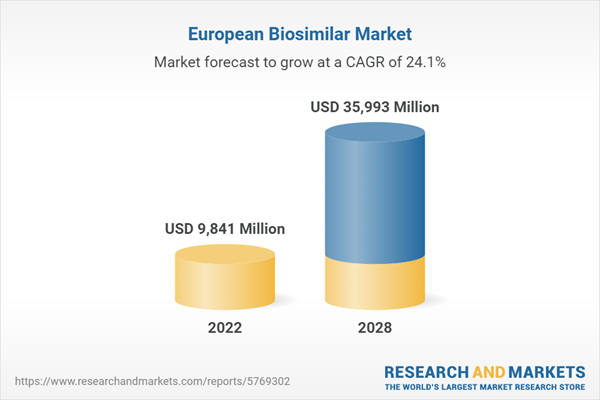

The European biosimilar market represents the most mature in the world and continues to rally momentum. This market is expected to grow robustly in the next five years, as a number blockbuster biologics are scheduled to lose patent protection in Europe.

Biosimilars are biotherapeutic products which are similar to already licensed reference biologics, in terms of quality, safety and efficiency. Biosimilar manufacturers wait till the patent of the reference product expires and then seek approval from the regulatory authorities in order to produce their biosimilar versions. These manufacturers use the state-of-the-art technology for comparing the characteristics, such as purity, chemical identity and bioactivity, of the proposed biosimilar to its reference product. In 2005, a science-based regulatory framework was established in the European Union (EU) for ensuring the production of high-quality biosimilars. Later in 2006, the European Medicines Agency (EMA) approved the first biosimilar medicine, Omnitrope. Since then, a number of biosimilars belonging to various therapeutic classes have been approved in Europe.

Biosimilars Market in Europe: Drivers

Biosimilars are less expensive than their branded counterparts as they do not require extensive research and testing which saves both money and time; thereby lowering the costs. Moreover, they also have short marketing times as launching a biosimilar does not require extensive marketing as the safety and efficacy profile of their branded counterparts have already been established.Several blockbuster biologics are expected to lose their patent protection over the next 5 to 10 years. This expiration of patents and other intellectual property rights is expected to create huge opportunities for biosimilar manufacturers.

The European population is ageing with around one fifth of the total EU population above 65 years of age. There has resulted in a significant increase in the burden of lifestyle diseases in the region. The prevalence of diseases such as diabetes, autoimmune diseases, oncology, etc. has been increasing rapidly in Europe. This is also expected to propel the market growth during the next few years.

As a result of rising healthcare costs, governments across a number of European countries have formulated policies incentivising physicians, pharmacists and patients in favour of biosimilars over branded biologics.

Key Market Segmentation:

The publisher provides an analysis of the key trends in each sub-segment of the biosimilar market in Europe report, along with forecasts at the regional and country level from 2023-2028. Our report has categorized the market based on molecule, indication and manufacturing type.Breakup by Country:

- Italy

- Germany

- United Kingdom

- France

- Spain

- Rest of Europe

Breakup by Molecule:

- Infliximab

- Insulin Glargine

- Epoetin Alfa

- Etanercept

- Filgrastim

- Somatropin

- Rituximab

- Follitropin Alfa

- Adalimumab

Breakup by Indication:

- Auto-Immune Diseases

- Blood Disorder

- Diabetes

- Oncology

- Growth Deficiency

- Female Infertility

Breakup by Manufacturing Type:

- In-house Manufacturing

- Contract Manufacturing

Some of the leading players operating in the European biosimilars market include:

- Novartis

- Pfizer

- Teva

- Celltrion

- Samsung Bioepis

- Amgen

- Apotex

- Ratiopharm

- Mylan

- Merck Sharp & Dohme

- Eli Lilly

- Accord Healthcare Ltd

- Boehringer Ingelheim

- Hexal Ag

- Stada Arzneimittel Ag

Key Questions Answered in This Report

1. What was the size of the biosimilar market in Europe in 2022?2. What is the expected growth rate of the biosimilar market in Europe during 2023-2028?

3. What are the key factors driving the biosimilar market in Europe?

4. What has been the impact of COVID-19 on the biosimilar market in Europe?

5. What is the breakup of biosimilar market in Europe breakup based on the molecule?

6. What is the breakup of biosimilar market in Europe based on the indication?

7. What is the breakup of biosimilar market in Europe based on the manufacturing type?

8. What are the key regions in the biosimilar market in Europe?

9. Who are the key players/companies in the biosimilar market in Europe?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Europe Biosimilars Market - Introduction

4.1 Overview

4.2 WHO and EMA Terminology on Biosimilars

4.3 Biosimilars and Generics

4.4 Biosimilars and Branded Biological Products

5 Europe Biosimilars Market

5.1 Market Overview

5.2 Historical and Current Market Trends

5.3 Impact of COVID-19

5.4 Market Breakup by Country

5.5 Market Breakup by Molecule

5.6 Market Breakup by Indication

5.7 Market Breakup by Manufacturing Type

5.8 Patent Landscape

5.9 Market Forecast

6 Market Breakup by Country

6.1 Italy

6.1.1 Market Performance

6.1.2 Key Players and Biosimilars

6.1.3 Market Forecast

6.2 Germany

6.2.1 Market Performance

6.2.2 Key Players and Biosimilars

6.2.3 Market Forecast

6.3 France

6.3.1 Market Performance

6.3.2 Key Players and Biosimilars

6.3.3 Market Forecast

6.4 United Kingdom

6.4.1 Market Performance

6.4.2 Key Players and Biosimilars

6.4.3 Market Forecast

6.5 Spain

6.5.1 Market Performance

6.5.2 Key Players and Biosimilars

6.5.3 Market Forecast

6.6 Rest of Europe

6.6.1 Market Performance

6.6.2 Market Forecast

7 Market Breakup by Molecule

7.1 Infliximab

7.2 Insulin Glargine

7.3 Epoetin Alfa

7.4 Etanercept

7.5 Filgrastim

7.6 Somatropin

7.7 Rituximab

7.8 Follitropin Alfa

7.9 Adalimumab

8 Market Breakup by Manufacturing Type

8.1 In-house Manufacturing

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Contract Manufacturing

8.2.1 Market Trends

8.2.2 Market Forecast

9 Market Breakup by Indication

9.1 Auto-Immune Diseases

9.2 Blood Disorder

9.3 Diabetes

9.4 Oncology

9.5 Growth Deficiency

9.6 Female Infertility

10 European Biosimilar Market: SWOT Analysis

10.1 Overview

10.2 Strengths

10.3 Weaknesses

10.4 Opportunities

10.5 Threats

11 European Biosimilar Market: Value Chain Analysis

11.1 Characterizing the Existing Innovator Drug

11.2 Research and Development

11.2.1 Characterization of Biosimilars

11.2.2 Developing a Unique Cell Line

11.3 Product Development

11.3.1 Pre-Testing

11.3.2 Intermediary Clinical Testing (PK/PD)

11.3.3 Confirmatory Clinical Phase-III

11.4 Final Product Formulation

11.5 Marketing and Distribution

12 Porter’s Five Forces Analysis

12.1 Overview

12.2 Bargaining Power of Buyers

12.3 Bargaining Power of Suppliers

12.4 Degree of Competition

12.5 Threat of New Entrants

12.6 Threat of Substitutes

13 Price Analysis

13.1 Key Price Indicators

13.2 Price Trends

14 Requirements for Setting Up a Generic Drug Manufacturing Plant

14.1 Manufacturing Process

14.2 Raw Material Requirements

14.3 Raw Material Pictures

14.4 Land and Construction Requirements

14.5 Machinery and Infrastructure Requirements

14.6 Machinery Pictures

14.7 Plant Layout

14.8 Packaging Requirements

14.9 Utility Requirements

14.10 Manpower Requirements

15 Competitive Landscape

15.1 Market Structure

15.2 Key Players

15.3 Profiles of Key Players

15.3.1 Novartis

15.3.2 Pfizer

15.3.3 Teva

15.3.4 Celltrion

15.3.5 Merck Sharp & Dohme

15.3.6 Samsung Bioepis

15.3.7 Eli Lilly

15.3.8 Accord Healthcare Ltd.

15.3.9 Amgen

15.3.10 Boehringer Ingelheim

15.3.11 Hexal Ag

15.3.12 Apotex

15.3.13 Stada Arzneimittel Ag

15.3.14 Ratiopharm

15.3.15 Mylan

List of Figures

Figure 1: Europe: Biosimilar Market: Sales Value (in Million US$), 2017-2022

Figure 2: Europe: Biosimilar Market: Breakup by Molecule (in %), 2022

Figure 3: Europe: Biosimilar Market: Breakup by Manufacturing Type (in %), 2022

Figure 4: Europe: Biosimilar Market: Breakup by Indication (in %), 2022

Figure 5: Europe: Biosimilar Market: Breakup by Country (in %), 2022

Figure 6: Europe: Biosimilar Market Forecast: Sales Value (in Million US$), 2023-2028

Figure 7: Italy: Biosimilar Market: Sales Value (in Million US$), 2017-2022

Figure 8: Italy: Biosimilar Market Forecast: Sales Value (in Million US$), 2023-2028

Figure 9: Germany: Biosimilar Market: Sales Value (in Million US$), 2017-2022

Figure 10: Germany: Biosimilar Market Forecast: Sales Value (in Million US$), 2023-2028

Figure 11: France: Biosimilar Market: Sales Value (in Million US$), 2017-2022

Figure 12: France: Biosimilar Market Forecast: Sales Value (in Million US$), 2023-2028

Figure 13: United Kingdom: Biosimilar Market: Sales Value (in Million US$), 2017-2022

Figure 14: United Kingdom: Biosimilar Market Forecast: Sales Value (in Million US$), 2023-2028

Figure 15: Spain: Biosimilar Market: Sales Value (in Million US$), 2017-2022

Figure 16: Spain: Biosimilar Market Forecast: Sales Value (in Million US$), 2023-2028

Figure 17: Rest of Europe: Biosimilar Market: Sales Value (in Million US$), 2017-2022

Figure 18: Rest of Europe: Biosimilar Market Forecast: Sales Value (in Million US$), 2023-2028

Figure 19: Europe: Rituximab Biosimilar Market: Sales Value (in Million US$), 2017

Figure 20: Europe: Infliximab Biosimilar Market: Sales Value (in Million US$), 2015 - 2017

Figure 21: Europe: Insulin Glargine Biosimilar Market: Sales Value (in Million US$), 2016 & 2017

Figure 22: Europe: Epoetin Alfa Biosimilar Market: Sales Value (in Million US$), 2014 - 2017

Figure 23: Europe: Filgrastim Biosimilar Market: Sales Value (in Million US$), 2014 - 2017

Figure 24: Europe: Somatropin Biosimilar Market: Sales Value (in Million US$), 2014 - 2017

Figure 25: Europe: Etanercept Biosimilar Market: Sales Value (in Million US$), 2016 & 2017

Figure 26: Europe: Follitropin Alfa Biosimilar Market: Sales Value (in Million US$), 2015 - 2017

Figure 27: Europe: Adalimumab Biosimilar Market: Sales Value (in Million US$), 2018

Figure 28: Europe: Biosimilar Market (In-House Manufacturing): Sales Value (in Million US$), 2017 & 2022

Figure 29: Europe: Biosimilar Market Forecast (In-House Manufacturing): Sales Value (in Million US$), 2023-2028

Figure 30: Europe: Biosimilar Market (Contract Manufacturing): Sales Value (in Million US$), 2017 & 2022

Figure 31: Europe: Biosimilar Market Forecast (Contract Manufacturing): Sales Value (in Million US$), 2023-2028

Figure 32: Europe: Biosimilar Market (Autoimmune Diseases): Sales Value (in Million US$), 2017 & 2022

Figure 33: Europe: Biosimilar Market Forecast (Autoimmune Diseases): Sales Value (in Million US$), 2023-2028

Figure 34: Europe: Biosimilar Market (Blood Disorders): Sales Value (in Million US$), 2017 & 2022

Figure 35: Europe: Biosimilar Market Forecast (Blood Disorders): Sales Value (in Million US$), 2023-2028

Figure 36: Europe: Biosimilar Market (Diabetes): Sales Value (in Million US$), 2017 & 2022

Figure 37: Europe: Biosimilar Market Forecast (Diabetes): Sales Value (in Million US$), 2023-2028

Figure 38: Europe: Biosimilar Market (Oncology): Sales Value (in Million US$), 2017 & 2022

Figure 39: Europe: Biosimilar Market Forecast (Oncology): Sales Value (in Million US$), 2023-2028

Figure 40: Europe: Biosimilar Market (Growth Deficiency): Sales Value (in Million US$), 2017 & 2022

Figure 41: Europe: Biosimilar Market Forecast (Growth Deficiency): Sales Value (in Million US$), 2023-2028

Figure 42: Europe: Biosimilar Market (Female Infertility): Sales Value (in Million US$), 2017 & 2022

Figure 43: Europe: Biosimilar Market Forecast (Female Infertility): Sales Value (in Million US$), 2023-2028

Figure 44: Europe: Biosimilar Industry: SWOT Analysis

Figure 45: Europe: Biosimilar Industry: Value Chain Analysis

Figure 46: Europe: Biosimilar Industry: Porter’s Five Forces Analysis

Figure 47: Biosimilar Manufacturing: Detailed Process Flow

List of Tables

Table 1: Europe: Sales and Patent Expiry of Blockbuster Biological Drugs (in Million US$)

Table 2: Biosimilar vs. Innovators Drug Development

Table 3: Biosimilar vs. Biologics Manufacturing

Table 4: Europe: Biosimilar Market: Key Industry Highlights, 2022 and 2028

Table 5: Europe: Biosimilar Market: Patent Landscape

Table 6: Europe: Biosimilar Market: Price Comparison Between Biosimilar and Originator Drugs

Table 7: Europe: Biosimilar Market Forecast: Breakup by Region (in Million US$), 2023-2028

Table 8: Europe: Biosimilar Market: Key Players and Biosimilars

Table 9: Italy: Biosimilar Market: Key Players and Biosimilars

Table 10: Germany: Biosimilar Market: Key Players and Biosimilars

Table 11: France: Biosimilar Market: Key Players and Biosimilars

Table 12: United Kingdom: Biosimilar Market: Key Players and Biosimilars

Table 13: Spain: Biosimilar Market: Key Players and Biosimilars

Table 14: Europe: Rituximab: Brand & Biosimilar Market Overview

Table 15: Europe: Infliximab: Brand & Biosimilar Market Overview

Table 16: Europe: Insulin Glargine: Brand & Biosimilar Market Overview

Table 17: Europe: Epoetin Alfa: Brand & Biosimilar Market Overview

Table 18: Europe: Filgrastim: Brand & Biosimilar Market Overview

Table 19: Europe: Somatropin: Brand & Biosimilar Market Overview

Table 20: Europe: Etanercept: Brand & Biosimilar Market Overview

Table 21: Europe: Follitropin Alfa: Brand & Biosimilar Market Overview

Table 22: Europe: Biosimilar Market Forecast: Breakup by Manufacturing Type (in Million US$), 2023-2028

Table 23: Europe: Biosimilar Market Forecast: Breakup by Indication (in Million US$), 2023-2028

Table 24: Biosimilar Manufacturing Plant: Raw Material Requirements

Table 25: Biosimilar Manufacturing Plant: Land and Construction Requirements

Table 26: Biosimilar Manufacturing Plant: Machinery Requirements

Table 27: Biosimilar Manufacturing Plant: Manpower Requirements

Table 28: Europe: Biosimilar Market: Competitive Structure

Table 29: Europe: Biosimilar Market: Key Players

Companies Mentioned

- Novartis

- Pfizer

- Teva

- Celltrion

- Samsung Bioepis

- Amgen

- Apotex ,Ratiopharm

- Mylan

- Merck Sharp & Dohme

- Eli Lilly

- Accord Healthcare Ltd

- Boehringer Ingelheim

- Hexal Ag

- Stada Arzneimittel Ag

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | March 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 9841 Million |

| Forecasted Market Value ( USD | $ 35993 Million |

| Compound Annual Growth Rate | 24.1% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 14 |