The white cement industry is influenced by rapid urbanization and the expansion of infrastructure, as visually appealing and long-lasting construction materials are in greater demand. The aesthetic value of white cement makes it a popular choice for decorative uses, such as facades, flooring, and ornamentation. Moreover, growing attention toward the application of sustainable building techniques has fostered growing interest in using white cement, based on its reflecting characteristics that support mitigating heat island conditions around cities. Apart from this, the development of modern manufacturing technologies enhanced the quality as well as competitiveness of white cement, opening ways for broader implementation across a multitude of building endeavors. All these factors are expected to spur the white cement market growth throughout the next few years.

The United States stands out as a key market disruptor, driven by its sophisticated building industry and robust focus on architectural beauty. Commercial and residential building demand for luxury finishes is also driving the adoption of white cement for its use in decorative concrete, precast panels, and interior design features. Moreover, the US market is extremely sensitive to innovation, prompting manufacturers to invest in new formulations and eco-friendly production methods that meet green building standards. The increasing trend of urban renewal and high-end housing projects in cities such as New York, Los Angeles, and Chicago are also driving white cement demand. In addition, the existence of several large players and technologically sophisticated plants in the US improves supply chain effectiveness and product quality, which makes the country a global leader in product innovation and customization.

White Cement Market Trends

The rapid urbanization and infrastructure development

Rapid urbanization is a major driver for the white cement market due to increasing infrastructure development in both developed and developing countries. In line with this, the expansion of urban areas leads to the construction of new residential, commercial, and public infrastructure, such as roads, bridges, buildings, hospitals, schools, malls, railway stations, airports, and other public spaces. By 2050, 68% of the world's population is expected to reside in cities, according to the UN. This tendency indicates a constant need for infrastructure and, by extension, white cement. White cement is extensively used in these structures due to its superior aesthetic appeal, strength, and durability. It is employed in aesthetic and decorative concrete, ornamental designs, and precast concrete units to enhance the visual appeal of the urban landscape. Furthermore, infrastructure refurbishment projects in mature and well-developed regions also demand white cement for repair and renovation purposes. As more people are shifting to urban settings, the prospects for sustained infrastructure development and consequent demand for white cement remain strong.The increasing product demand for decorative and premium quality applications

The rising demand for decorative and premium quality applications is a significant factor transforming the white cement market outlook. Consumer preferences are shifting toward aesthetically pleasing interiors and exteriors in residential and commercial spaces. As per the publisher, the India interior design market is expected to reach USD 71.0 Billion by 2033, exhibiting a growth rate (CAGR) of 8.50% during 2025-2033. White cement is extensively used in creating decorative tiles, designer flooring, terrazzo, and mosaics, due to its color and quality consistency. In addition, it is compatible with color pigments, which allow users to select a wide range of color options, further expanding its use in decorative applications. Besides this, the increasing number of high-end real estate projects, luxury hotels, and commercial spaces that prefer white cement for a premium look and high-quality finish is boosting the market growth. Moreover, improving living standards and increasing focus on interior and exterior aesthetics is anticipated to drive the market growth for decorative and premium applications.The rising adoption of sustainable construction practices

The growing focus on sustainable construction practices due to escalating environmental concerns is boosting the demand for sustainable materials, such as white cement. Its high reflectivity aids in reducing the heat island effect in urban areas, as it reflects more sunlight and absorbs less heat than darker materials. This can lead to energy savings in buildings because less cooling is required. According to the International Finance Corporation, buildings account for 19% of energy-related greenhouse gas emissions and utilize 40% of global electricity, with the built environment projected to increase by 2050. Additionally, the visibility of cracks in white cement structures allows early detection of potential structural issues, facilitating timely repairs and increasing building longevity. Furthermore, white cement's low iron content makes it more resistant to sulfate attack, enhancing the durability of structures and reducing the need for replacements. As a result, the ongoing global shift toward sustainability will continue to favor materials, such as white cement, that contribute to energy efficiency and durability in construction.White Cement Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global white cement market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.Analysis by Type:

- White Portland Cement

- White Masonry Cement

- Others

Analysis by Application:

- Residential

- Commercial

- Infrastructure

Regional Analysis:

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- North America

- United States

- Canada

- Latin America

- Brazil

- Mexico

- Others

- Middle East & Africa

Key Regional Takeaways:

United States White Cement Market Analysis

In 2024, the United States accounted for over 76.80% of the white cement market in North America. The United States white cement market is experiencing steady growth, driven primarily by the rising demand for architectural concrete with premium aesthetic appeal. Increasing investments in urban beautification projects, including parks, pedestrian zones, and decorative pavements, are fostering demand for white cement in structural applications. The growing inclination toward minimalist and modern construction styles that emphasize brightness and clean finishes is further accelerating product adoption. Additionally, the focus on energy-efficient buildings has led to the increased use of white cement in cool roofing systems, enhancing solar reflectivity. Technological advancements in surface finishing and pre-cast concrete applications are also expanding the usage of white cement across commercial and residential construction. Furthermore, the integration of white cement in sustainable infrastructure initiatives is being favored for its environmental compatibility in LEED-certified projects. Notably, a report states that the federal government's allocation of USD 62 Billion for infrastructure development in 2025 is a game-changer creating substantial opportunities for white cement demand in large-scale civic and urban renewal projects. The renovation of public spaces, particularly in urban areas, continues to provide momentum for the market. Consumer preference for durable, aesthetically pleasing exteriors and interiors is driving market expansion, while prefabricated and modular construction segments are bolstering white cement consumption in the US.Europe White Cement Market Analysis

The Europe white cement market is growing due to its focus on heritage preservation, artistic construction, and the integration of white cement into recycled materials. The region's circular economy principles and architectural innovation in public infrastructure, such as cultural centers and transportation hubs, have also boosted demand for white cement due to its visual purity and adaptability. The transition toward low-carbon building materials has made white cement a favorable choice in sustainable design frameworks. According to the U.S. Green Building Council (USGBC), Europe hosts over 6,000 LEED-certified projects spanning nearly 113 million gross square meters, highlighting the continent's accelerating commitment to green buildings, an environment where white cement plays a pivotal role. The rise of urban landscaping projects and vertical gardens in densely populated cities is also supporting market growth. With changing lifestyle preferences and increased attention to interior aesthetics, white cement continues to gain favor in high-end residential and commercial architecture throughout Europe.Asia Pacific White Cement Market Analysis

The Asia Pacific white cement market is expanding due to urban infrastructure development and evolving consumer design preferences. The region's middle-class population and disposable income have led to increased use of decorative building materials, with white cement playing a key role in interior and exterior finishing. Precast construction technology enhances the product's appeal due to consistent coloration and finish. Climate-conscious construction practices are also boosting demand for heat-reflective surfaces, where white cement finds application. In India, for example, the India Brand Equity Foundation emphasizes that the nation is dedicated to improving its infrastructure to achieve its 2025 economic growth goal of USD 5 Trillion, thereby boosting the demand for adaptable construction materials such as white cement. Moreover, the increased emphasis on individualized home design and premium flooring solutions has broadened the market's consumer base. As the pace of urbanization accelerates in emerging economies, the demand for aesthetically appealing and functional construction materials, such as white cement, is expected to maintain a strong upward trajectory across the Asia Pacific region.Latin America White Cement Market Analysis

The white cement market in Latin America is experiencing growth due to increased investment in cultural infrastructure projects and time-efficient construction trends. Additionally, its application in local artisan crafts and surface finishes in hospitality architecture has added a unique demand segment. Overall cement consumption is also on the rise, as a report states that the cement consumption in Brazil increased by 5.4% in January 2025, with SNIC noting domestic sales of 5.174Mt compared to 4.911Mt in January 2024. This uptick reflects a broader regional trend toward construction activity, which supports white cement demand. Growing awareness about light-reflective materials to reduce urban heat islands is further enhancing product relevance. White cement is gaining popularity in contemporary construction due to cleaner finishes and design-led development, gaining a niche in Latin America's exterior facades and interior designs.Middle East and Africa White Cement Market Analysis

The Middle East and Africa white cement market is growing due to luxury architecture, high-visibility projects, urban expansion, and tourism-centric zones, enhancing architectural contrasts and finishes. A report states that as property investment turnover is projected to rise by 27% to USD 952 Billion in 2025 and is expected to surpass USD 1 Trillion by 2026, the MENA region is primed to capitalize on this upward momentum. This surge in investment is likely to drive increased adoption of white cement in premium commercial and residential projects. White cement's heat-reflective properties align with regional building exterior requirements, and its popularity in custom moldings, facades, and decorative cladding in upscale commercial developments demands visual impact and material performance.Competitive Landscape:

The leading companies are investing in capacity expansion and technological upgrades in their production facilities to increase production output and meet the growing demand for white cement. Furthermore, several key players are also exploring mergers and acquisitions to increase their market share, access new markets, and diversify their product portfolios. Additionally, the increasing emphasis on research and development (R&D) efforts to introduce better-quality products and create more durable, weather-resistant, and environmentally friendly versions is positively influencing the market growth. Moreover, top companies are forming strategic partnerships with other stakeholders to leverage each other's strengths, capabilities, and networks. Apart from this, the increasing global focus on sustainability has prompted companies to adopt more environmentally friendly practices in their operations, including efforts to reduce carbon emissions and waste.The report provides a comprehensive analysis of the competitive landscape in the white cement market with detailed profiles of all major companies, including:

- Cementir Holding N.V.

- Aditya Birla (UltraTech Cement Limited)

- JK Cement Ltd

- CEMEX

- Sotacib

- Ras Al Khaimah Cement Company

- Federal White Cement

- Saveh Cement Company

Key Questions Answered in This Report

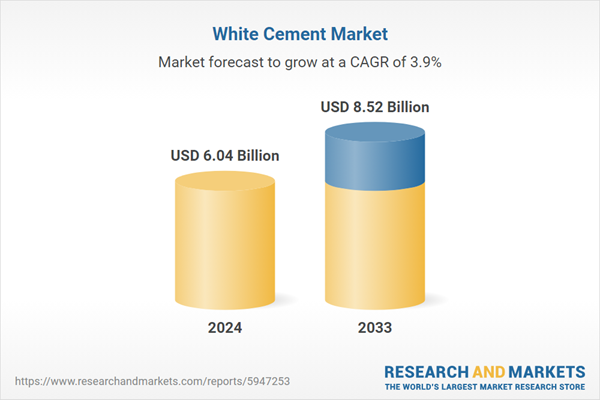

1. How big is the white cement market?2. What is the future outlook of white cement market?

3. What are the key factors driving the white cement market?

4. Which region accounts for the largest white cement market share?

5. Which are the leading companies in the global white cement market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Cement Industry

5.1 Market Overview

5.2 Market Performance

5.3 Market Breakup by Region

5.4 Market Breakup by Application

5.5 Market Forecast

6 Global White Cement Industry

6.1 Market Overview

6.2 Market Performance

6.2.1 Volume Trends

6.2.2 Value Trends

6.3 Impact of COVID-19

6.4 Price Analysis

6.4.1 Key Price Indicators

6.4.2 Price Structure

6.4.3 Price Trends

6.5 Market Breakup by Region

6.6 Market Breakup by Application

6.7 Market Breakup by Type

6.8 Market Forecast

6.9 SWOT Analysis

6.9.1 Overview

6.9.2 Strengths

6.9.3 Weaknesses

6.9.4 Opportunities

6.9.5 Threats

6.10 Value Chain Analysis

6.10.1 Raw Material Procurement

6.10.2 Manufacturing

6.10.3 Marketing

6.10.4 Distribution

6.10.5 End-Use

6.11 Porter’s Five Forces Analysis

6.11.1 Overview

6.11.2 Bargaining Power of Buyers

6.11.3 Bargaining Power of Suppliers

6.11.4 Degree of Competition

6.11.5 Threat of New Entrants

6.11.6 Threat of Substitutes

6.12 Key Market Drivers and Success Factors

7 White Cement Market: Performance of Key Regions

7.1 Asia-Pacific

7.1.1 China

7.1.1.1 Market Trends

7.1.1.2 Market Forecast

7.1.2 Japan

7.1.2.1 Market Trends

7.1.2.2 Market Forecast

7.1.3 India

7.1.3.1 Market Trends

7.1.3.2 Market Forecast

7.1.4 South Korea

7.1.4.1 Market Trends

7.1.4.2 Market Forecast

7.1.5 Australia

7.1.5.1 Market Trends

7.1.5.2 Market Forecast

7.1.6 Indonesia

7.1.6.1 Market Trends

7.1.6.2 Market Forecast

7.1.7 Others

7.1.7.1 Market Trends

7.1.7.2 Market Forecast

7.2 Europe

7.2.1 Germany

7.2.1.1 Market Trends

7.2.1.2 Market Forecast

7.2.2 France

7.2.2.1 Market Trends

7.2.2.2 Market Forecast

7.2.3 United Kingdom

7.2.3.1 Market Trends

7.2.3.2 Market Forecast

7.2.4 Italy

7.2.4.1 Market Trends

7.2.4.2 Market Forecast

7.2.5 Spain

7.2.5.1 Market Trends

7.2.5.2 Market Forecast

7.2.6 Russia

7.2.6.1 Market Trends

7.2.6.2 Market Forecast

7.2.7 Others

7.2.7.1 Market Trends

7.2.7.2 Market Forecast

7.3 North America

7.3.1 United States

7.3.1.1 Market Trends

7.3.1.2 Market Forecast

7.3.2 Canada

7.3.2.1 Market Trends

7.3.2.2 Market Forecast

7.4 Latin America

7.4.1 Brazil

7.4.1.1 Market Trends

7.4.1.2 Market Forecast

7.4.2 Mexico

7.4.2.1 Market Trends

7.4.2.2 Market Forecast

7.4.3 Others

7.4.3.1 Market Trends

7.4.3.2 Market Forecast

7.5 Middle East & Africa

7.5.1 Market Trends

7.5.2 Market Breakup by Country

7.5.3 Market Forecast

8 White Cement Market by Application

8.1 Residential

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Commercial

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Infrastructure

8.3.1 Market Trends

8.3.2 Market Forecast

9 White Cement Market by Type

9.1 White Portland Cement

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 White Masonry Cement

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Others

9.3.1 Market Trends

9.3.2 Market Forecast

10 Competitive Landscape

10.1 Market Structure

10.2 Market Breakup by Key Players

11 White Cement Manufacturing Process

11.1 Product Overview

11.2 Detailed Process Flow

11.3 Various Types of Unit Operations Involved

11.4 Mass Balance and Raw Material Requirements

12 Project Details, Requirements and Costs Involved

12.1 Land Requirements and Expenditures

12.2 Construction Requirements and Expenditures

12.3 Plant Machinery

12.4 Machinery Picture

12.5 Raw Material Requirements and Expenditures

12.6 Raw Material and Final Product Picture

12.7 Packaging Requirements and Expenditures

12.8 Transportation Requirements and Expenditures

12.9 Utility Requirements and Expenditures

12.10 Manpower Requirements and Expenditures

12.11 Other Capital Investments

13 Loans and Financial Assistance

14 Project Economics

14.1 Capital Cost of the Project

14.2 Techno-Economic Parameters

14.3 Product Pricing and Margins Across Various Levels of the Supply Chain

14.4 Taxation and Depreciation

14.5 Income Projections

14.6 Expenditure Projections

14.7 Financial Analysis

14.8 Profit Analysis

15 Key Player Profiles

15.1 Cementir Holding N.V.

15.2 Aditya Birla (UltraTech Cement Limited)

15.3 JK Cement Ltd

15.4 CEMEX

15.5 Sotacib

15.6 Ras Al Khaimah Cement Company

15.7 Federal White Cement

15.8 Saveh Cement Company

List of Figures

Figure 1: Global: White Cement Market: Major Drivers and Challenges

Figure 2: Global: Cement Market: Volume Trends (in Million Tons), 2019-2024

Figure 3: Global: Cement Market: Breakup by Region (in %), 2024

Figure 4: Global: Cement Market: Breakup by Application (in %), 2024

Figure 5: Global: Cement Market Forecast: Volume Trends (in Million Tons), 2025-2033

Figure 6: Global: White Cement Market: Consumption Volume (in Million Tons), 2019-2024

Figure 7: Global: White Cement Market: Consumption Value (in Million USD), 2019-2024

Figure 8: White Cement Market: Price Structure

Figure 9: Global: White Cement Market: Average Price Trends (in USD/Ton), 2019-2024

Figure 10: Global: White Cement Market Forecast: Average Price Trends (in USD/Ton), 2025-2033

Figure 11: Global: White Cement Market: Breakup by Region (in %), 2024

Figure 12: Global: White Cement Market: Breakup by Application (in %), 2024

Figure 13: Global: White Cement Market: Breakup by Type (in %), 2024

Figure 14: Global: White Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 15: Global: White Cement Market Forecast: Consumption Value (in Million USD), 2025-2033

Figure 16: Global: White Cement Industry: SWOT Analysis

Figure 17: Global: White Cement Industry: Value Chain Analysis

Figure 18: Global: White Cement Industry: Porter’s Five Forces Analysis

Figure 19: Asia-Pacific: White Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 20: Asia-Pacific: White Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 21: China: White Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 22: China: White Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 23: Japan: White Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 24: Japan: White Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 25: India: White Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 26: India: White Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 27: South Korea: White Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 28: South Korea: White Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 29: Australia: White Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 30: Australia: White Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 31: Indonesia: White Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 32: Indonesia: White Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 33: Others: White Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 34: Others: White Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 35: Europe: White Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 36: Europe: White Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 37: Germany: White Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 38: Germany: White Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 39: France: White Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 40: France: White Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 41: United Kingdom: White Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 42: United Kingdom: White Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 43: Italy: White Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 44: Italy: White Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 45: Spain: White Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 46: Spain: White Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 47: Russia: White Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 48: Russia: White Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 49: Others: White Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 50: Others: White Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 51: North America: White Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 52: North America: White Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 53: United States: White Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 54: United States: White Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 55: Canada: White Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 56: Canada: White Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 57: Latin America: White cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 58: Latin America: White cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 59: Brazil: White cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 60: Brazil: White cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 61: Mexico: White cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 62: Mexico: White cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 63: Others: White cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 64: Others: White cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 65: Middle East & Africa: White Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 66: Middle East & Africa: White Cement Market: Breakup by Country (in %), 2024

Figure 67: Middle East & Africa: White Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 68: Global: White Cement Market (Residential Applications): Consumption Volume (in Million Tons), 2019 & 2024

Figure 69: Global: White Cement Market Forecast (Residential Applications): Consumption Volume (in Million Tons), 2025-2033

Figure 70: Global: White Cement Market (Commercial Applications): Consumption Volume (in Million Tons), 2019 & 2024

Figure 71: Global: White Cement Market Forecast (Commercial Applications): Consumption Volume (in Million Tons), 2025-2033

Figure 72: Global: White Cement Market (Infrastructure Applications): Consumption Volume (in Million Tons), 2019 & 2024

Figure 73: Global: White Cement Market Forecast (Infrastructure Applications): Consumption Volume (in Million Tons), 2025-2033

Figure 74: Global: White Portland Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 75: Global: White Portland Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 76: Global: White Masonry Cement Market: Consumption Volume (in Million Tons), 2019 & 2024

Figure 77: Global: White Masonry Cement Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 78: Global: White Cement Market (Others): Consumption Volume (in Million Tons), 2019 & 2024

Figure 79: Global: White Cement Market Forecast (Others): Consumption Volume (in Million Tons), 2025-2033

Figure 80: Global: White Cement Market: Breakup by Key Players (in %), 2024

Figure 81: White Cement Manufacturing Plant: Detailed Process Flow

Figure 82: White Cement Manufacturing: Conversion Rate of Feedstocks

Figure 83: White Cement Manufacturing: Packaging Requirements

Figure 84: White Cement Manufacturing: Breakup of Capital Costs (in %)

Figure 85: White Cement: Profit Margins at Various Levels of the Supply Chain

Figure 86: White Cement Manufacturing Plant: Breakup of Total Production Cost (in %)

List of Tables

Table 1: Global: Cement Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: White Cement Market: Key Industry Highlights, 2024 and 2033

Table 3: Global: White Cement Market Forecast: Breakup by Region (in Million Tons), 2025-2033

Table 4: Global: White Cement Market Forecast: Breakup by Application (in Million Tons), 2025-2033

Table 5: Global: White Cement Market Forecast: Breakup by Type (in Million Tons), 2025-2033

Table 6: Global: White Cement Market: Competitive Structure

Table 7: Global: White Cement Market: Key Players

Table 8: White Cement Manufacturing Plant: Costs Related to Land and Site Development (in USD)

Table 9: White Cement Manufacturing Plant: Costs Related to Civil Works (in USD)

Table 10: White Cement Manufacturing Plant: Costs Related to Machinery (in USD)

Table 11: White Cement Manufacturing Plant: Raw Material Requirements (in Tons/USD) and Expenditures (in USD/Ton)

Table 12: White Cement Manufacturing Plant: Costs Related to Salaries and Wages (in USD)

Table 13: White Cement Manufacturing Plant: Costs Related to Other Capital Investments (in USD)

Table 14: Details of Financial Assistance Offered by Financial Institutions

Table 15: White Cement Manufacturing Plant: Capital Costs (in USD)

Table 16: White Cement Manufacturing Plant: Techno-Economic Parameters

Table 17: White Cement Manufacturing Plant: Taxation and Depreciation (in USD)

Table 18: White Cement Manufacturing Plant: Income Projections (in USD)

Table 19: White Cement Manufacturing Plant: Expenditure Projections (in USD)

Table 20: White Cement Manufacturing Plant: Cash Flow Analysis Without Considering the Income Tax Liability (in USD)

Table 21: White Cement Manufacturing Plant: Cash Flow Analysis on Considering the Income Tax Liability (in USD)

Table 22: White Cement Manufacturing Plant: Profit and Loss Account (in USD)

Companies Mentioned

- Cementir Holding N.V.

- Aditya Birla (UltraTech Cement Limited)

- JK Cement Ltd

- CEMEX

- Sotacib

- Ras Al Khaimah Cement Company

- Federal White Cement

- Saveh Cement Company etc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 142 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 6.04 Billion |

| Forecasted Market Value ( USD | $ 8.52 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |