In 2021, China's cotton imports totaled 2.147 million tons, down 5.7% year-on-year, and the import value was US$4.11 billion, up 15.3% year-on-year. According to the publisher analysis, in the first three quarters of 2022, China's cotton imports totaled 1.458 million tons, down 21.2% year-on-year, and the import value was US$3.84 billion, up 11.1%.

The average price of China's cotton imports is more volatile in 2018-2022. According to the publisher's analysis, the average price of China's cotton imports fell continuously from 2018-2020, from US$2.0 per kg in 2018 to US$1.7 per kg in 2020. the average price of China's cotton imports reached US$1.9 per kg in 2021, up 16.0% y-o-y. in the first three quarters of 2022, the average price of China's cotton imports rose to US$2.6 per kg, up 41.0% year-on-year.

In 2021, China imports cotton from 36 countries, and the top five source countries by import volume are the U.S., Brazil, India, Burkina Faso and Benin. According to the publisher's analysis, China's cotton imports from the U.S., Brazil and India in 2021 will be 1.884 million tons, accounting for 87.7% of total imports, and $3.60 billion, or 87.5% of total imports, with the U.S. accounting for 38.6%, Brazil for 30.0% and India for 19.2%.

In the first three quarters of 2022, Sudan overtook Burkina Faso to return to the top five source countries of China's cotton imports, the United States, Brazil, India still firmly in the top three, the three accounted for 88.8% of total imports, of which the United States imports amounted to 95.0 million tons, an increase of 26.6% year-on-year. India's imports fell to 39,000 tons, down 90.4% year-on-year.

The types of cotton imported into China mainly include uncombed cotton and combed cotton, of which uncombed cotton is the main type of cotton imported into China. 2021, China imported 2.142 million tons of uncombed cotton, accounting for 99.8% of the total imports, and the import value of US$4.10 billion, accounting for 99.8%.

In the publisher's analysis, China is the world's largest cotton consumer, and domestic cotton production cannot meet the demand of the downstream industry chain, so the cotton market is in short supply, it is expected that the future demand gap of China's cotton will still rely mainly on imports to meet, China's cotton import market is dynamic.

Topics covered:

- China's Cotton Import Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on China's Cotton Import?

- Which Companies are the Major Players in China's Cotton Import Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in China's Cotton Import

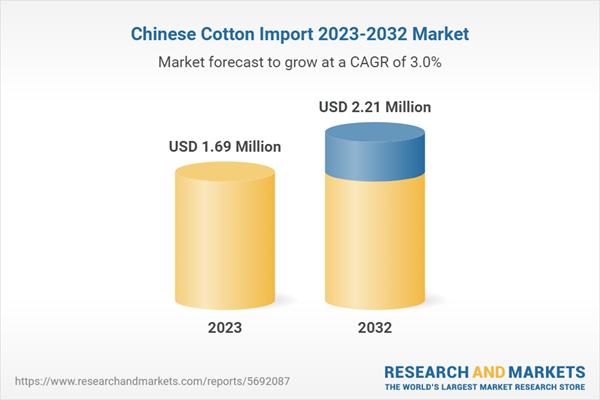

- What are the Key Drivers, Challenges, and Opportunities for China's Cotton Import during 2023-2032?

- What is the Expected Revenue of China's Cotton Import during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in China's Cotton Import Market?

- Which Segment of China's Cotton Import is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing China's Cotton Import?

Table of Contents

1. 2018-2022 China Cotton Import Analysis1.1. Scale of China's Cotton Import

1.1.1. China's Cotton Import Volume Analysis

1.1.2. China's Cotton Import Value Analysis

1.1.3. China's Cotton Import Price Analysis

1.1.4. China's Cotton Apparent Consumption Analysis

1.1.5. Analysis of China's Cotton Import Dependence

1.2. China's Cotton Main Import Sources

2. 2018-2022 China Cotton Import Type Analysis

2.1 Import Analysis of Uncombed Cotton

2.1.1 Import Volume Analysis of Uncombed Cotton

2.1.2 Import Value Analysis of Uncombed Cotton

2.1.3 Import Price Analysis of Uncombed Cotton

2.1.4 Import Dependence Analysis of Uncombed Cotton

2.1.5. Uncombed Cotton Import Source Country Analysis

2.2 Combed Cotton Import Analysis

2.2.1 Combed Cotton Import Volume Analysis

2.2.2 Combed Cotton Flower Import Volume Analysis

2.2.3 Combed Cotton Import Price Analysis

2.2.4 Import Dependence Analysis of Combed Cotton

2.2.5 Combed Cotton Main Import Source Countries Analysis

3. 2018-2022 China's Cotton Major Import Source Country Analysis

3.1 USA Cotton Import Analysis

3.2. Brazil Cotton Import Analysis

3.3. India Cotton Import Analysis

3.4 Other Cotton Import Analysis

4. 2023-2032 China's Import Cotton Outlook

4.1 Factors Affecting China's Cotton Imports

4.2. Drivers and Market Opportunities for China's Cotton Imports

4.3 Threats and Challenges to China's Cotton Imports

4.4. China's Cotton Import Demand Forecast, 2023-2032

List of Charts:

Chart 2018-2022 China's Cotton Imports

Chart Cotton Import Volume in China 2018-2022

Chart Average Price of Cotton Imports in China in 2018-2022

Chart China's Cotton Import Dependence in 2018-2022

Chart Quantity of US Cotton Imported by China in 2018-2022

Chart Quantity of Brazilian Cotton Imported by China in 2018-2022

Chart Quantity of Indian Cotton Imported by China in 2018-2022

Chart Forecast of China's Cotton Imports in 2023-2032

Methodology

Background research defines the range of products and industries, which proposes the key points of the research. Proper classification will help clients understand the industry and products in the report.

Secondhand material research is a necessary way to push the project into fast progress. The analyst always chooses the data source carefully. Most secondhand data they quote is sourced from an authority in a specific industry or public data source from governments, industrial associations, etc. For some new or niche fields, they also "double-check" data sources and logics before they show them to clients.

Primary research is the key to solve questions, which largely influence the research outputs. The analyst may use methods like mathematics, logical reasoning, scenario thinking, to confirm key data and make the data credible.

The data model is an important analysis method. Calculating through data models with different factors weights can guarantee the outputs objective.

The analyst optimizes the following methods and steps in executing research projects and also forms many special information gathering and processing methods.

1. Analyze the life cycle of the industry to understand the development phase and space.

2. Grasp the key indexes evaluating the market to position clients in the market and formulate development plans

3. Economic, political, social and cultural factors

4. Competitors like a mirror that reflects the overall market and also market differences.

5. Inside and outside the industry, upstream and downstream of the industry chain, show inner competitions

6. Proper estimation of the future is good guidance for strategic planning.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 50 |

| Published | November 2022 |

| Forecast Period | 2023 - 2032 |

| Estimated Market Value ( USD | $ 1.69 Million |

| Forecasted Market Value ( USD | $ 2.21 Million |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | China |