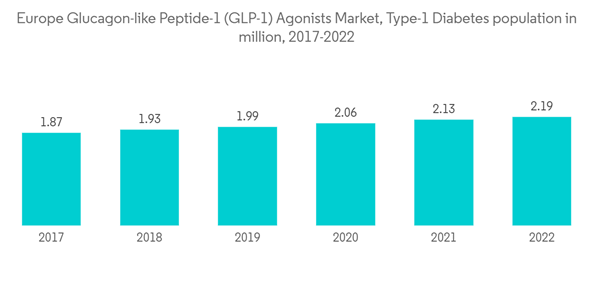

mainly as a result of new drug launches. Europe has approximately 57 million adults living with diabetes, and this number is expected to reach 75 million by 2026, which would represent around 10% of the total population of Europe. Europe's expenditure on diabetes is 9% of its total healthcare expenditure. Spending on diabetes largely varies among countries in Europe. It ranges from EUR 312 per capita in the Republic of Macedonia, to EUR 6,896 per capita in Norway. Similarly, the prevalence is also highly varied across Europe, ranging from 2.8% in Albania to 9.8% in Portugal. In high-income countries, diabetes is one of the leading causes of cardiovascular disease, blindness, kidney failure, and lower limb amputation.

Europe Glucagon-Like Peptide-1 (GLP-1) Agonists Market Trends

The dulaglutide segment occupies the highest market share in the Europe Glucagon-Like Peptide-1 (GLP-1) Agonists Market in the current year

The dulaglutide segment holds the highest share in the Europe Glucagon-Like Peptide-1 (GLP-1) Agonists Market in the current year and is expected to register a CAGR of about 8.3% over the forecast period.According to the IDF, the overall diabetes expenditure in Europe among the population aged 20-79 years was USD 156 billion, and it is expected to increase to USD 174 billion by 2040. These figures indicate that approximately 9% of the total healthcare expenditure is spent on diabetes in Europe. The rapidly increasing incidence and prevalence of diabetic patients and healthcare expenditure are indications of the increasing usage of diabetic drugs.

GLP1RAs have been available internationally and are recommended when treatment escalation for type 2 diabetes is required after metformin and lifestyle management. They can be safely used with all other glucose-lowering therapies except vildagliptin. Dulaglutide (Trulicity) is a weekly subcutaneous GLP1RA that reduces HbA1c with additional weight loss and cardiorenal protection benefits. Therapy with dulaglutide allows many patients to reach and maintain target HbA1c without insulin and sulfonylureas, eliminating the associated hypoglycemia risk. GLP1RAs elicit greater weight reduction and are recommended over SLGT2 inhibitors when cerebrovascular disease other than heart failure or renal disease predominates.

The government and the companies are working towards better diabetes management. For instance, the National Service Framework (NSF) program is improving services by setting national standards to drive up service quality and tackle variations in care. The Association of British HealthTech Industries (ABHI) launched a diabetes section, enabling diabetes technology companies to work together in the first forum of its kind. Such advantages have helped the rise in the market growth.

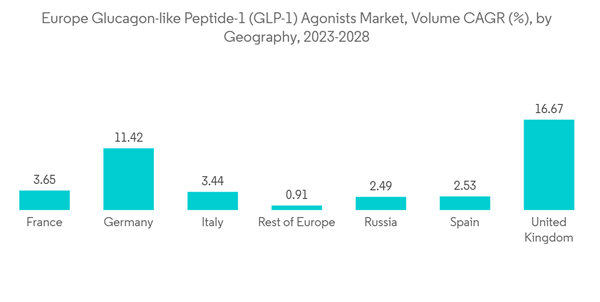

Germany is expected to register the highest CAGR in the Europe Glucagon-Like Peptide-1 (GLP-1) Agonists Market over the forecast period

Germany is expected to register the highest CAGR of about 7.8% in the Europe Glucagon-Like Peptide-1 (GLP-1) Agonists Market over the forecast period.According to the German Diabetes Centre (DDZ), about 8.5 million people in Germany are affected by diabetes. The number of people with type 2 diabetes in Germany will continue to increase over the next twenty years. Diabetes is a significant health problem and one of the astounding challenges for healthcare systems all over Germany. The prevalence of known type 1 & 2 diabetes in the German adult population is very high, along with many patients not yet diagnosed with the disease. Due to an aging population and unhealthy lifestyle, the prevalence of type 2 diabetes is expected to increase steadily over the next few years. High-quality care, including adequate monitoring, control of risk factors, and active self-management, are the key factors for preventing complications in German patients with type 2 diabetes.

The disease's growing incidence, prevalence, and progressive nature have encouraged the development of new drugs to provide additional treatment options for dietic patients. Non-insulin treatments, used as first-line therapies for patients who have diabetes, currently capture more than half the sales in the anti-diabetics market. German law requires public plans to cap out-of-pocket health care costs and to cover all medically necessary treatment, including insulin. Germany is one of the developed countries with advanced healthcare facilities. Moreover, reimbursement and pricing policies are highly regulated, which drives the market.

The roll-out of many new products, increasing international research collaborations in technology advancement, and increasing awareness about diabetes among people are some market opportunities for the players in the German diabetes drugs market.

Europe Glucagon-Like Peptide-1 (GLP-1) Agonists Industry Overview

The Europe GLP-1 market is consolidated, with major manufacturers, namely Eli Lilly, Sanofi, Novo Nordisk, AstraZeneca, etc., holding a presence in the region.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Novo Nordisk

- AstraZeneca

- Eli Lilly and Company

- Sanofi

- Biocon

- Novartis