Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Their compact form factor, adaptability, and optimized cargo capacity make them ideal for navigating congested cityscapes while maintaining delivery efficiency. Technological innovations in vehicle architecture - ranging from modular interiors to fuel-efficient powertrains - are enhancing van utility and expanding their appeal among fleet operators and personal users alike. As companies seek flexible mobility solutions, vans are bridging the gap between light and heavy commercial vehicles, further propelling their global adoption.

Key Market Drivers

Surge in E-Commerce and Last-Mile Delivery Demand

The rapid expansion of e-commerce has created an urgent requirement for agile and cost-effective last-mile delivery vehicles. Vans have emerged as a key solution for logistics providers due to their maneuverability in urban environments, moderate cargo capacity, and ability to handle frequent stops efficiently. Their versatility allows businesses to meet delivery timelines without the operational drawbacks associated with larger vehicles. Fleet operators are increasingly relying on vans to manage diverse delivery needs, including temperature-sensitive shipments and high-frequency route logistics. Real-time route optimization enabled by telematics is further enhancing operational performance. This surge in demand is prompting fleet expansion and vehicle upgrades across various delivery-based industries.Key Market Challenges

High Upfront Investment for Advanced and Electric Vans

A major barrier in the adoption of advanced and electric vans is the high initial cost. Vehicles equipped with sophisticated technology, telematics, and low-emission systems often command premium pricing, making them less accessible to small and medium-sized enterprises. Electric vans, in particular, involve additional costs related to battery systems and infrastructure requirements. While these models offer long-term savings in operational costs and emissions compliance, the upfront investment remains a critical concern. For businesses operating on limited budgets, especially those managing multi-vehicle fleets, the financial hurdle slows down transition efforts and affects market penetration of sustainable alternatives.Key Market Trends

Expansion of Subscription and Leasing Models

Subscription and leasing models are reshaping van ownership dynamics, offering users access to vehicles without the liabilities of full ownership. These models provide operational flexibility, fixed monthly costs, and bundled services such as insurance, maintenance, and telematics. Businesses with seasonal demands or limited capital are especially benefiting from this trend, enabling them to scale transportation resources according to fluctuating needs. Additionally, modern leasing agreements often include integrated fleet management tools, improving cost-efficiency and vehicle utilization. The shift toward these asset-light models is promoting van usage across startups, SMEs, and service-based industries, reinforcing long-term growth in the segment.Key Market Players

- Ford Motor Company

- MERCEDES-BENZ GROUP AG

- Volkswagen Group

- Renault Group

- TOYOTA MOTOR CORPORATION

- Nissan Motor Co., Ltd.

- Hyundai Motor Company

- MITSUBISHI MOTORS CORPORATION

- ISUZU MOTORS LIMITED

- Stellantis NV

Report Scope:

In this report, the Global Van Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Van Market, By Tonnage Capacity:

- Up to 2 Tons

- 2 Tons - 3 Tons

- 3 Tons - 5.5 Tons

Van Market, By Propulsion Type:

- ICE

- Electric

Van Market, By End Use:

- Commercial

- Personal

Van Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe & CIS

- Germany

- France

- U.K.

- Spain

- Italy

- Asia-Pacific

- China

- Japan

- Australia

- India

- South Korea

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- South America

- Brazil

- Argentina

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Van Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Ford Motor Company

- Mercedes-Benz Group AG

- Volkswagen Group

- Renault Group

- TOYOTA MOTOR CORPORATION

- Nissan Motor Co., Ltd.

- Hyundai Motor Company

- MITSUBISHI MOTORS CORPORATION

- ISUZU MOTORS LIMITED

- Stellantis NV

Table Information

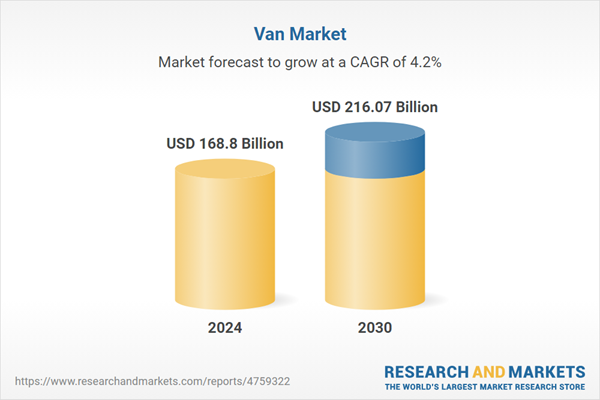

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 168.8 Billion |

| Forecasted Market Value ( USD | $ 216.07 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |