Key Highlights

- Italy and Spain are major rice producers in the region, and the United Kingdom, France, and Germany are the most extensive rice importers. The Netherlands is an essential entry point for rice from many origins into Europe. Belgium and Italy are significant players in the milling industry, and the organic rice markets in Germany and France are the most developed.

- Italy and Spain account for 80% of the total EU rice production. Traditionally, rice consumed in countries such as Spain and Italy comprises native rice varietals. Consumers in European non-producing countries are less wedded to specific rice varieties and, thus, more open to new and specialty rice varieties. According to the Food and Agriculture Organization Statistics, rice is grown on about 637.9 thousand hectares in Europe European non-producing countries, with a production of 4.1 million tons in 2020.

- Other rice-growing areas are Greece, Portugal, France, Russia, Romania, Bulgaria, and Hungary. The Japonica variety accounts for approximately 75% of European production and is primarily produced and consumed in Southern Europe. Most European tensions depend on imports for specialty long-grain Indica rice, such as basmati and jasmine, from India and Pakistan, as the regions lack specialty and aromatic rice varieties.

Europe Rice Market Trends

Strong Demand in Northwestern Europe

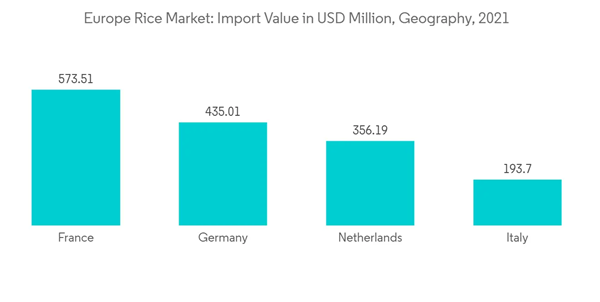

The majority of European rice imports are accounted for by Northwestern Europe, with the United Kingdom, France, and Germany being the largest importers. France and the Netherlands are the largest importers of rice from developing countries. The Netherlands's marine transportation system forms a critical entry point for rice from various developing countries into Europe. As per ITC trade, in 2021, the United Kingdom imported USD 574.7 million worth of rice.Important rice varieties imported by Europe are long-grain Indica rice and aromatic varieties (basmati, jasmine, etc.). Basmati rice is the most popular type of specialty rice. This aromatic or fragrant rice has grown in popularity among many Northwestern European customers. Aromatic and colored rice types are not commonly grown in Europe and are primarily imported from Asian countries. Imports from non-European vendors are increasing as demand for these rice varieties grows. The United Kingdom is the leading importer of basmati rice, primarily sourced from India. India, Pakistan, Thailand, and Cambodia are major European rice exporters.

Italy is the Largest Rice Producer and Significant Consumer

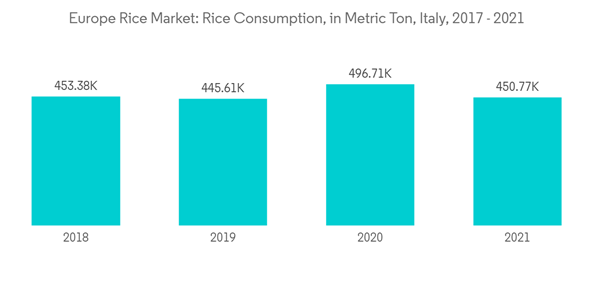

Italy is by far the largest producer of rice in the European region and accounted for about 50% of the total rice production in the region in 2021. The Lungo A and Medio kinds are used to cultivate up to 50% of Italian paddy fields. The Lungo A, like most risotto variations designated for national consumption, is often parboiled, as are the prized Carnaroli, Arborio, Baldo, and Roma variants, which command higher prices but are manufactured in more select, restricted amounts. 30% of Italy's rice fields are of the "common" or Tondo variety, while the remaining 20% are of the Lungo B variety, which includes the widely exported Indica variety. Tondo and Lungo rice, which have higher yields, typically have lower market pricing than Lungo A and Medio rice. Rice production in Italy has faced severe draught in 2022, and the production estimates declined by 20%, driving the prices higher in the domestic market.Risotto is one of the most representative and widely eaten Italian dishes, and its demand has been rising rapidly among domestic and international consumers. Italian consumers perceive rice and grains to be healthier than pasta. Owing to the growing health consciousness among Italian consumers, they are cutting back and limiting the amount of pasta in their diet and shifting toward consuming healthier grains, including rice. For instance, as per National Rice Organization, Italy rice consumption stood at 450.8 thousand metric ton in 2021.

With the changing consumer preferences and lifestyles, local companies in the country are consistently involved in innovation that constantly adapts to the needs of the modern consumer. For instance, Italian company Riso Bello introduced new ready-to-eat risottos in its product range to satisfy the market demand for high-quality, easy-to-cook products.

Europe Rice Industry Overview

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.