This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Questions Answered in this Report:

- What are the enabling technologies within the UAS traffic management (UTM) system market?

- What is the demand for commercial drones for various applications?

- What are the driving and challenging factors for the growth of the UTM system market?

- Which are the various trials and demonstrations that have been conducted from 2018 till date?

- What are the various regulations in countries, such as the U.S., Canada, U.K., France, China, and India?

- How is the industry expected to evolve during the forecast period, 2021-2031?

- What are the key developmental strategies that are implemented by the key players to sustain the competitive market?

- What are the different UTM concepts in each country?

- What is the competitive scenario and who are the stakeholders in the UTM value chain?

- Which are the different companies involve in the UTM market?

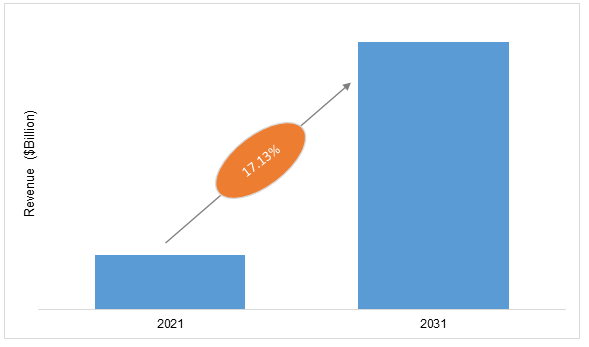

Global UAS Traffic Management (UTM) System Market Forecast, 2021-2031

The UAS traffic management (UTM) system industry analysis projects the market to grow at a significant CAGR of 17.13% on the basis of value during the forecast period from 2021 to 2031. North America and Europe and the two major regions in the UAS traffic management (UTM) system market, wherein these regions have carried out trials and demonstrations of UTM capabilities.

The demand for UTM services has been increasing in the past five years and this is due to the growing drone operations. There are several factors that are contributing to the significant growth of UAS traffic management (UTM) system market. Some of these factors include focus on BVLOS operations and potential opportunities for key stakeholders.

Scope of the Global UAS Traffic Management (UTM) System Market

The UAS traffic management (UTM) system market research provides detailed market information for segmentation such as potential application areas and region. The purpose of this market analysis is to examine the UAS traffic management (UTM) system market outlook in terms of factors driving the market, trends, technological developments, and competitive benchmarking, among others.

The report further takes into consideration the market dynamics and the competitive landscape, along with the detailed financial and product contribution of the key players operating in the market.

Global UAS Traffic Management (UTM) System Segmentation

While highlighting the key driving and restraining forces for this market, the report also provides a detailed study of the potential application areas for UAS Traffic Management. These potential application areas include precision agriculture, package delivery, critical infrastructure inspection, mapping, disaster management, law enforcement, and construction.

The UAS traffic management (UTM) system market is segregated by region under four major regions, namely North America, Europe, Asia-Pacific, and Rest-of-the-World. Information for each of these regions (by country) has been provided in the market study.

Key Companies in the Global UAS Traffic Management (UTM) System Industry

The key market players in the UAS traffic management (UTM) system market include Unifly, Altitude Angel, Skyward.io, OneSky, DeDrone, DJI Innovation, Kitty Hawk, Precision Hawk, vHive, Airbus, Thales, Leonardo Company, SRC Inc., and AirMap, among others.

Table of Contents

1 Industry Outlook

1.1 Overview of UAS Traffic Management System (UTM)

1.2 UAS Traffic Management (UTM) Evolution

1.2.1 UAS Traffic Management System Architecture

1.2.1.1 List of UTM Services

1.2.1.2 Operational Scenarios of UTM

1.2.1.3 UAS Traffic Management (UTM) System Stakeholders

1.2.1.3.1 Air Navigation Service Providers (ANSPs)

1.2.1.3.2 UAS Service Suppliers (USS)

1.2.1.3.3 Drone Operators

1.2.1.3.4 Communication Service Providers

1.2.1.3.5 Data Service Providers

1.2.1.3.6 Law Enforcement

1.2.1.3.7 Other Stakeholders

1.2.2 Funding Scenario in UTM Space

1.2.3 Regulatory Framework on UTM

1.2.4 Ongoing and Upcoming UTM Systems

1.2.5 Current and Emerging Technologies

1.2.5.1 Geofencing

1.2.5.2 Detect-and-Avoid (DAA)

1.2.5.3 Blockchain

1.2.5.4 LAANC for Airspace Data Sharing

1.2.5.5 Remote Identification

1.2.5.6 5G and LTE Communication Technologies

1.2.5.7 Surveillance, Identification and Tracking

1.2.5.8 Parachute Systems

1.2.6 UTM: An Enabler for Urban Air Mobility

1.2.6.1 Current Developments in UAM

1.2.6.2 Use Cases of Urban Air Mobility

1.2.6.3 Futuristic Scenario of UAM

1.3 Market Dynamics

1.3.1 Business Drivers

1.3.1.1 Increasing Deployment of Drones for Commercial and Civil Applications

1.3.1.2 Focus of the Unmanned Industry on BVLOS Operations

1.3.2 Business Challenges

1.3.2.1 UTM Separation Management Challenges

1.3.2.2 Rising Concerns on Security, Safety, and Privacy

1.3.3 Business Strategies

1.3.3.1 New Launches and Development

1.3.3.2 Market Developments

1.3.3.2.1 Funding

1.3.3.2.2 Trials and Demonstrations

1.3.4 Corporate Strategies

1.3.4.1 Contracts, Agreements, Partnerships, and Collaborations

1.3.5 Business Opportunities

1.3.5.1 Potential Growth Opportunities for Key Stakeholders

1.3.5.2 Changing Regulatory Framework for Drone Operations

2 Market Overview

2.1 Global UAS Traffic Management System Market, 2021-2031

2.1.1 Assumptions

2.1.2 Market Overview

3 Potential Application Areas for UAS Traffic Management (UTM)

3.1 Introduction

3.1.1 Precision Agriculture

3.1.2 Package Delivery

3.1.3 Critical Infrastructure Inspection

3.1.3.1 Rail Inspection

3.1.3.2 Oil & Gas Pipeline Inspection

3.1.3.3 Powerline Inspection

3.1.3.4 Windmill Inspection

3.1.4 Mapping

3.1.5 Disaster Management

3.1.6 Law Enforcement

3.1.7 Construction

4 Regions

4.1 North America

4.1.1 Market

4.1.1.1 Key Players in North America

4.1.1.2 Business Drivers

4.1.1.3 Business Challenges

4.1.2 Overview of UAS Traffic Management in North America

4.1.2.1 NASA's UTM System

4.1.3 North America (by Country)

4.1.3.1 U.S.

4.1.3.1.1 Markets

4.1.3.1.1.1 Key Players in the U.S.

4.1.3.1.1.2 Business Drivers

4.1.3.1.1.3 Business Challenges

4.1.3.1.2 Regulatory Scenario

4.1.3.1.2.1 14 CFR Part 107 Small Unmanned System Aircraft

4.1.3.1.2.2 49 U.S. Code 44809 – Exception for Limited Recreational Operations of Unmanned Aircraft

4.1.3.1.3 Trials and Demonstrations

4.1.3.2 Canada

4.1.3.2.1 Market

4.1.3.2.1.1 Key Players in Canada

4.1.3.2.1.2 Business Drivers

4.1.3.2.1.3 Business Challenges

4.1.3.2.1.4 Regulatory Scenario

4.1.3.2.2 Trials and Demonstrations

4.2 Europe

4.2.1 Market

4.2.1.1 Key Players in Europe

4.2.1.2 Business Drivers

4.2.2 Overview of UAS Traffic Management in Europe

4.2.2.1 European Union's U-Space Project

4.2.3 Europe (by Country)

4.2.3.1 U.K.

4.2.3.1.1 Market

4.2.3.1.1.1 Key Players in the U.K.

4.2.3.1.1.2 Business Drivers

4.2.3.1.1.3 Business Challenges

4.2.3.1.2 U.K.'s Civil Aviation Authority Perspective on UTM

4.2.3.1.3 Regulatory Scenario

4.2.3.1.4 Trials and Demonstrations

4.2.3.2 Italy

4.2.3.2.1 Market

4.2.3.2.1.1 Key Players in Italy

4.2.3.2.2 Regulatory Scenario

4.2.3.3 France

4.2.3.3.1 Market

4.2.3.3.1.1 Key Players in France

4.2.3.3.1.2 ONERA's Low Level RPAS Traffic Management System (LLRTM)

4.2.3.3.1.3 Regulatory Scenario

4.3 Asia-Pacific

4.3.1 Market

4.3.1.1 Key Players in Asia-Pacific

4.3.2 Overview of UAS Traffic Management in Asia-Pacific

4.3.3 Asia-Pacific (by Country)

4.3.3.1 China

4.3.3.1.1 China's UAS Operation Management System (UOMS)

4.3.3.1.2 Market

4.3.3.1.2.1 Key Players in China

4.3.3.1.2.2 Business Drivers

4.3.3.1.2.3 Business Challenges

4.3.3.1.3 Regulatory Scenario

4.3.3.2 Japan

4.3.3.2.1 Japan's Ministry of Economy, Trade, and Industry's (METI) Aerial Industrial Revolution

4.3.3.2.2 Market

4.3.3.2.2.1 Key companies in Japan

4.3.3.2.2.2 Business Drivers

4.3.3.2.2.3 Business Challenges

4.3.3.2.3 Regulatory Scenario

4.3.3.3 India

4.3.3.3.1 India's National UAS Traffic Management Policy

4.3.3.3.2 Market

4.3.3.3.2.1 Key Players in India

4.3.3.3.2.2 Business Drivers

4.3.3.3.2.3 Business Challenges

4.3.3.3.3 Regulatory Scenario

4.3.3.4 Rest-of-Asia-Pacific

4.3.3.4.1 Singapore’s Concept of UTM

4.3.3.4.2 South Korea’s UTM

4.4 Rest-of-the-World

4.4.1 Latin America

4.4.1.1 Market

4.4.1.1.1 Key Players in Latin America

4.4.1.1.1.1 Business Drivers

4.4.1.1.1.2 Business Challenges

4.4.2 Middle East

4.4.2.1 Markets

4.4.2.1.1 Key Players in the Middle East

4.4.2.1.1.1 Business Drivers

4.4.2.1.1.2 Business Challenges

4.4.3 Africa

4.4.3.1 Market

4.4.3.1.1 Key Players in Africa

4.4.3.1.1.1 Business Drivers

4.4.3.1.1.2 Business Challenges

5 Markets - Competitive Benchmarking & Company Profiles

5.1 Competitive Benchmarking

5.1.1 Competitive Landscape

5.1.2 Value Chain Analysis

5.2 Altitude Angel

5.2.1 Company Overview

5.2.1.1 Role of Altitude Angel in UAS Traffic Management System Market

5.2.1.2 Product Portfolio

5.2.2 Corporate Strategies

5.2.2.1 Partnership and Collaboration

5.2.3 Strength and Weakness of Altitude Angel

5.3 AirMap

5.3.1 Company Overview

5.3.1.1 Role of AirMap in UAS Traffic Management System Market

5.3.1.2 Product Portfolio

5.3.2 Corporate Strategies

5.3.2.1 Partnership and Collaboration

5.3.2.2 Contract and Agreement

5.3.2.3 Acquisition

5.3.3 Strength and Weakness of AirMap

5.4 Airbus

5.4.1 Company Overview

5.4.1.1 Role of Airbus in UAS Traffic Management System Market

5.4.1.2 Product Portfolio

5.4.2 Corporate Strategies

5.4.2.1 Partnership and Collaboration

5.4.3 Strength and Weakness of Airbus

5.4.4 R&D Analysis

5.5 Dedrone

5.5.1 Company Overview

5.5.1.1 Role of Dedrone in UAS Traffic Management System Market

5.5.1.2 Product Portfolio

5.5.2 Strength and Weakness of Dedrone

5.6 DJI Innovations

5.6.1 Company Overview

5.6.1.1 Role of DJI Innovations in UAS Traffic Management System Market

5.6.2 Strength and Weakness of DJI Innovations

5.7 Kitty Hawk

5.7.1 Company Overview

5.7.1.1 Role of Kittyhawk in UAS Traffic Management System Market

5.7.1.2 Product Portfolio

5.7.2 Corporate Strategies

5.7.2.1 Partnership

5.7.3 Strength and Weakness of Kittyhawk

5.8 Leonardo Company

5.8.1 Company Overview

5.8.1.1 Role of Leonardo in UAS Traffic Management System Market

5.8.1.2 Product Portfolio

5.8.2 Corporate Strategies

5.8.2.1 Partnership and Joint Venture

5.8.3 Strength and Weakness of Leonardo Company

5.9 OneSky

5.9.1 Company Overview

5.9.1.1 Role of OneSky in UAS Traffic Management System Market

5.9.1.2 Product Portfolio

5.9.2 Corporate Strategies

5.9.2.1 Partnership and Collaboration

5.9.3 Strength and Weakness of OneSky

5.1 Precision Hawk

5.10.1 Company Overview

5.10.1.1 Role of Precision Hawk in UAS Traffic Management System Market

5.10.1.2 Product Portfolio

5.10.2 Strength and Weakness of Precision Hawk

5.11 SRC Inc.

5.11.1 Company Overview

5.11.1.1 Role of SRC Inc. in UAS Traffic Management System Market

5.11.1.2 Product Portfolio

5.11.2 Strength and Weakness of SRC Inc.

5.12 Skyward

5.12.1 Company Overview

5.12.1.1 Role of Skyward in UAS Traffic Management System Market

5.12.1.2 Product Portfolio

5.12.2 Corporate Strategies

5.12.2.1 Partnership

5.12.3 Strength and Weakness of Skyward

5.13 Thales Group

5.13.1 Company Overview

5.13.1.1 Role of Thales Group UAS Traffic Management System Market

5.13.1.2 Product Portfolio

5.13.2 Corporate Strategies

5.13.2.1 Partnership and Collaboration

5.13.3 Strength and Weakness of DJI Innovations

5.13.4 R&D Analysis

5.14 The Boeing Company

5.14.1 Company Overview

5.14.1.1 Role of The Boeing Company in UAS Traffic Management System Market

5.14.1.2 Product Portfolio

5.14.2 Strength and Weakness of The Boeing Company

5.14.3 R&D Analysis

5.15 Unifly

5.15.1 Company Overview

5.15.1.1 Role of Unifly in UAS Traffic Management System Market

5.15.1.2 Product Portfolio

5.15.2 Corporate Strategies

5.15.2.1 Partnership and Collaboration

5.15.2.2 Agreements

5.15.3 Strength and Weakness of Unifly

5.16 vHive

5.16.1 Company Overview

5.16.1.1 Role of vHive in UAS Traffic Management System Market

5.16.2 Strength and Weakness of vHive

5.17 Other Players

5.17.1 Exponent Technology Services

5.17.2 Indra

5.17.3 Intel

5.17.4 NTT Data

5.17.5 RakutenAirMap Inc.

5.17.6 Terra Drone

5.17.7 X Development LLC

5.17.8 ANRA Technologies

5.17.9 List of Emerging Companies

6 Research Methodology

List of Figures

Figure 1: Operating Range for VLOS and BVLOS

Figure 2: Global Commercial UAV and eVTOL Market, 2021-2031

Figure 3: Stakeholders Role in UTM

Figure 4: UAS Traffic Management (UTM) System Market Coverage

Figure 5: Operations (by Altitude)

Figure 6: UTM Operations in Context of Airspace Classes

Figure 7: FAA’s Notional UTM architecture

Figure 8: Primary Insights

Figure 9: Primary Insights

Figure 10: Flow of Information in a Notional UVR

Figure 11: Responsibilities of ANSP

Figure 12: Market Progressiveness in Forecast Period, 2020-2034

Figure 13: Roles and Responsibilities of Commercial Drone Operators

Figure 14: Type of Communication Technologies Used in UAS Traffic Management System

Figure 15: Information Provided by Data Service Providers

Figure 16: Data Service Providers in UAS Traffic Management System

Figure 17: Law Enforcement Agencies Use of Drones

Figure 18: Primary Insights

Figure 19: Primary Insights

Figure 20: LAANC Process

Figure 21: Primary Insights

Figure 22: UAS Model in the 3GPP Ecosystem

Figure 23: Primary Insights

Figure 24: Primary Insights

Figure 25: On-going Projects for eVTOLs

Figure 26: Global UAS Traffic Management (UTM) System Market, Business Dynamics

Figure 27: Application Areas of BVLOS

Figure 28: Share of Key Market Strategies and Developments, 2017-2020

Figure 29: New Product Development (by Company), 2017-2020

Figure 30: Funding (by Company), 2017-2020

Figure 31: Trials and Demonstrations (by Company), 2017-2020

Figure 32: Contracts, Agreements, Partnerships, Collaborations, and Acquisitions (by Company), 2017-2020

Figure 33: Primary Insights

Figure 34: Global Commercial UAV and eVTOL Market, 2021-2031

Figure 35: Potential Application Areas for UAS Traffic Management

Figure 36: Global Commercial Drone for Precision Agriculture, Units, 2020-2031

Figure 37: Global Commercial Drones for Package Delivery, Units, 2020-2031

Figure 38: Global Commercial Drones for Critical Infrastructure Inspection, Units, 2020-2031

Figure 39: Global Commercial Drones for Mapping, Units, 2020-2031

Figure 40: Global Commercial Drones for Disaster Management, Units, 2020-2031

Figure 41: Global Commercial Drones for Law Enforcement, Units, 2020-2031

Figure 42: Global Commercial Drones for Construction, Units, 2020-2031

Figure 43: Model Fleet of sUAS, 2019-2024

Figure 44: Non-Model Fleet of sUAS, 2019-2024

Figure 45: NASA’s UTM Vision

Figure 46: Set of Services Offered by U-Space

Figure 47: Different Phases of U-Space

Figure 48: Business Opportunities with the Implementation of U-Space

Figure 49: Airspace Modernization Strategy

Figure 50: Low-Level RPAS Traffic Management System (LLRTM)

Figure 51: Structure of UOMS

Figure 52: Key Companies Involved in J-UTM

Figure 53: Layered Approach of the Indian UTM Ecosystem

Figure 54: UTM Stakeholders

Figure 55: DigitalSky Platform

Figure 56: Competitive Landscape

Figure 57: UTM Value Chain

Figure 58: Airbus R&D (2017-2019)

Figure 59: Thales Group R&D (2017-2019)

Figure 60: The Boeing Company, R&D (2017-2019)

Figure 61: Research Methodology

Figure 62: UAS Traffic Management (UTM) System Market Influencing Factors

Figure 63: Assumptions and Limitations

List of Tables

Table 1: Key Technologies Enabling UTM

Table 2: Summary of Operational Scenarios of UTM

Table 3: Analysis for USS

Table 4: Analysis of Drone Operators

Table 5: Analysis for Communication Service Providers

Table 6: Funding Scenario in UTM Space, 2016-2020

Table 7: FAA Vs. EASA

Table 8: Ongoing and Upcoming UTM Systems

Table 9: List of Countries with UAM

Table 10: List of the Top Seven Commercial Drones in the Market:

Table 11: FAA Drone Forecast, 2019-2024

Table 12: Opportunities for Different Key Stakeholders

Table 13: Drone Related Regulations

Table 14: List of Companies Partnering with NASA

Table 15: UTM Services

Table 16: Lead Participants of the BEYOND Program

Table 17: FAA’s UPP Phase One

Table 18: UPP Capabilities, Use Case Elements, and Related Interactions

Table 19: Trials and Demonstrations in the U.S.

Table 20: Trials and Demonstrations in Canada

Table 21: European UTM Roadmap

Table 22: Trials and Demonstrations in the U.K.

Table 23: UTM Key Developments in APAC

Table 24: Category of System Integrators

Table 25: System Integrators Developments

Table 26: Category of Connectivity Providers

Table 27: System Integrators Developments

Table 28: Category of UTM Service Providers

Table 29: Altitude Angel: Product Portfolio

Table 30: Partnership and Collaboration

Table 31: AirMap: Product Portfolio

Table 32: Partnership and Collaboration

Table 33: Partnership and Collaboration

Table 34: Acquisition

Table 35: Airbus: Product Portfolio

Table 36: Partnership and Collaboration

Table 37: Dedrone: Product Portfolio

Table 38: Kittyhawk: Product Portfolio

Table 39: Partnership

Table 40: Leonardo Company: Product Portfolio

Table 41: Partnership and Joint Venture

Table 42: OneSky: Product Portfolio

Table 43: Partnership and Collaboration

Table 44: Precision Hawk: Product Portfolio

Table 45: SRC Inc.: Product Portfolio

Table 46: Skyward: Product Portfolio

Table 47: Partnership

Table 48: Thales Group: Product Portfolio

Table 49: Partnership and Collaboration

Table 50: The Boeing Company: Product Portfolio

Table 51: Unifly: Product Portfolio

Table 52: Partnership and Collaboration

Table 53: Agreements

Table 54: List of Emerging Companies

Samples

LOADING...

Companies Mentioned

- Airbus

- AirMap

- Altitude Angel

- Dedrone

- DJI Innovations

- Kitty Hawk

- Leonardo Company

- OneSky

- Precision Hawk

- Skyward

- SRC Inc.

- Thales Group

- The Boeing Company

- Unifly

- vHive