The healthcare system in South Korea has experienced enormous challenges as a result of the COVID-19 pandemic. All outpatient treatments were postponed or restricted during the COVID-19 pandemic to reduce the risk of viral transmission as most chronic therapies were regarded as non-urgent. For instance, according to the study published in the Archives of Craniofacial Surgery, titled "Effects of COVID-2019 on plastic surgery emergencies in Korea" in April 2021, between March and June 2020, there were 800 emergency plastic surgery patients, down from 981 during the same time period in 2019. Patients presenting with face trauma dropped in 2020 due to fewer injuries occurring on the streets. Slipping and sports injuries decreased in 2020. This has led to a decrease in medical aesthetic procedures during the pandemic, thereby impacting market growth. However, with the advent of the COVID-19 infection, large-scale vaccinations were performed across the country, which helped the aesthetic devices market to gain traction. The major factors for the growth of the South Korean aesthetic devices market include the rise in medical tourism in South Korea, technological advancements in devices, and an increasingly obese population.

Furthermore, the lower cost of treatment for medical aesthetic services compared to countries like the United States, Japan, and China is one of the key factors responsible for the growth of this market. Korea's tourism organization also reported that there has been an increase in medical tourists pursuing plastic surgeries like breast augmentation surgery, liposuction, facelifts, and others. Furthermore, according to the study published in BMC Public Health titled "A Bilingual Systematic Review of South Korean Medical Tourism: A Need to Rethink Policy and Priorities for Public Health?" in April 2021, medical tourism proponents continue to lobby the government for more deregulation and investment in the industry. This has led to increased investments in medical tourism in South Korea, which will further lead to increased aesthetic procedures in this region due to decreased prices. In addition, according to the study published in the International Journal of Environmental Research and Public Health, titled "A Look at Collaborative Service Provision: Case for Cosmetic Surgery Medical Tourism at Korea for Chinese Patients" in December 2021, customers' attitudes toward medical tourism for cosmetic surgery are influenced by a hospital's service quality in terms of tangibles, certainty, and empathy, which in turn influences satisfaction with medical tourism. The rising customer satisfaction for patients from the medical tourism services in Korea will lead to a rise in the inclination of patients for aesthetic procedures in this region, which is thereby expected to drive the growth of this market in South Korea.

Also, the increasing obese population in the nation seeking aesthetic devices to improve their appearance is propelling the market's growth. For instance, an article titled "Obesity Fact Sheet in Korea, 2020" published in the Journal of Obesity and Metabolic Syndrome in June 2021 indicated that there was a dramatic increase in the prevalence of class II and III obesity among young adults, as well as the population as a whole. There has been a rapid rise in the number of obesity cases in South Korea. The increasing awareness about body image perception among people and the side effects associated with obesity are expected to add to the growth of the studied market over the forecast period.

The key market players, with their technological innovations in the aesthetics sector, are playing a major role in the market's growth. For instance, in August 2021, Sofwave Medical received approval from the Korean Ministry of Foods and Drug Safety (MFDS) to market Sofwave, its proprietary next-generation Synchronous Ultrasound Parallel Beam technology, SUPERB, for reducing the appearance of fine lines and wrinkles while also revitalizing the skin. Such product approvals across the nation are expected to boost the growth of the market over the forecast period. Also, in May 2022, South Korea-based Daewoong Pharmaceutical Co. registered for the application of its botulinum toxin product Nabota beyond cosmetic indications to speed up its global outreach. The company filed a new drug application (NDA) for its use in the treatment of benign masseteric hypertrophy (square jaw) with the Ministry of Food and Drug Safety. Such activities are likely to add to the growth of the market.

Thus, owing to the aforementioned factors, the South Korea aesthetic devices market is expected to grow over the forecast period. However, the social stigma concerns and the poor reimbursement scenarios in the nation are likely to hinder the market's growth.

South Korea Aesthetic Devices Market Trends

Skin Resurfacing & Tightening is the Segment under Application and is Expected to Account for Largest Market Share during the Forecast Period

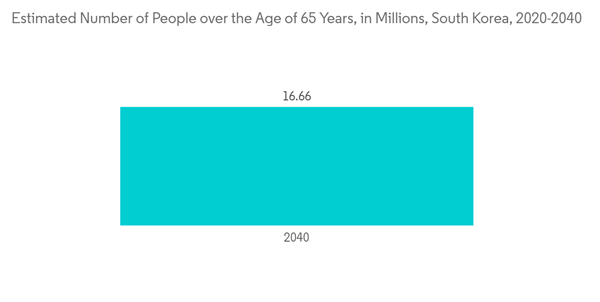

The skin resurfacing and tightening segment is expected to have significant growth over the forecast period due to the rising geriatric population and increasing awareness about the aesthetic devices used for skin tightening. Older women opt for various types of cosmetic enhancement procedures, including skin resurfacing and tightening, to enhance their looks. Facelifts, eyelid enhancements, face fat repositioning, jawbone reductions, skin resurfacing, and tightening, among others, are the most common facial feature enhancements performed in South Korea.An article titled "Customized Treatment Using Microfocused Ultrasound with Visualization for Optimized Patient Outcomes: A Review of Skin-tightening Energy Technologies and a Pan-Asian Adaptation of the Expert Panel's Gold Standard Consensus" published in the Journal of Clinical Aesthetic Dermatology in May 2021 discussed the various non-invasive facial-rejuvenation devices, such as non-ablative radiofrequency (RF) and laser-assisted technology, used in the Korean population. The article indicated that micro-focused ultrasound with visualization was the gold standard for nonsurgical lifting and skin tightening in Asian countries.

Rising product launches by the key players for the launch of their skin resurfacing and tightening products in South Korea are expected to drive the growth of this market. For instance, in June 2021, HELIOS IV 785, the world's first high-powered Q-switched laser with a 785nm picosecond pulse setting, was approved in South Korea. The launch of advanced devices for skin resurfacing and tightening will lead to increased adoption of skin resurfacing procedures in South Korea, thereby driving the growth of this segment.

South Korea Aesthetic Devices Industry Overview

The South Korea aesthetic devices market is fragmented and competitive and consists of both major and small companies. Most of the global market players are expanding their presence in South Korea through distributorship and partnership. Some of the players in the market are AbbiVe (Allergan Inc.), Alma Lasers, Bausch & Lomb Incorporated, Hologic Inc., Lumenis Inc., Sanuwave Health Inc., Sciton Inc., and Syneron Medical Ltd.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AbbVie Inc (Allergan)

- Alma Lasers

- Bausch & Lomb Incorporated

- Galderma S.A. (Nestle)

- Cynosure

- Johnson & Johnson

- Lumenis Inc.

- Sanuwave Health Inc.

- Sciton Inc.

- Candela Medical