The COVID-19 pandemic caused severe issues with the provision of wound care. Due to several comorbidities, wound patients were more likely to experience COVID-19 effects; fewer hospital admissions and reduced diagnoses affected the biologics used in wound care. According to the International Journal of Medicine, published in July 2021, during the COVID-19 pandemic, patients who had recovered from an ulcer were switched to telephone consultations. The number of in-person visits for patients with an active DFU was decreased using a telephone consultation in between occasions of treatment. To reduce their exposure to COVID-19, some patients with active DFU preferred telephone consultations. Additionally, the risk of pressure ulcers is high in the COVID population. Thus, COVID-19 has significantly impacted the market studied.

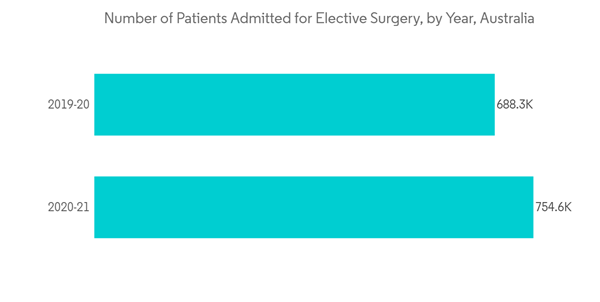

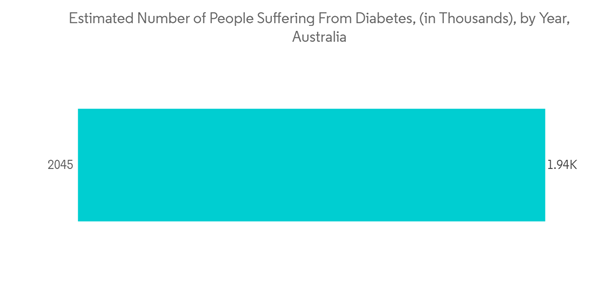

Certain factors driving the growth of the market include rising incidences of chronic wounds, including venous ulcers, arterial ulcers, diabetic ulcers, and pressure ulcers, growing demand for faster recovery of wounds, and an increase in surgeries.

According to the Journal of Foot and Ankle Research published in July 2022, up to 50,000 Australians have diabetes-related foot ulcers (DFU), and another 300,000 might be at risk for developing DFUs. Chronic wounds remain a largely hidden and poorly supported problem in the Australian community. However, the awareness regarding the condition and the demand for fast recovery of these wounds have been observing a significant rise over the past few years, thus generating a significant opportunity for the growth of the market in the country.

The growing desire for faster wound recovery forces market participants to implement technological advancements that enhance wound care management in Australia. For instance, in December 2021, Western NSW Primary Health Network, Australian Unity, the University of Technology Sydney, CSIRO, and Coviu, Australia's top telehealth solution, worked together to develop a comprehensive digital toolkit for telehealth wound care. Such initiatives support market expansion in the country.

Growing awareness among individuals about wound care management further supports the market's growth. For instance, in July 2021, the most significant annual campaign of Wounds Australia, Wound Awareness Week 2021 (WAW21), ran to increase public awareness about chronic wounds and change public policy on wound care.

All aforementioned factors are expected to drive the growth of the market over the forecast period. However, the high cost of the procedure and lack of reimbursement restrain the market growth.

Advanced Wound Therapy Devices Market Trends

Negative Pressure Wound Therapy (NPWT) System is Expected to Dominate the Market Over the Forecast Period

Negative-pressure wound therapy (NPWT) is a therapeutic technique using a suction dressing to remove excess exudation and promote healing in acute or chronic wounds and second-and third-degree burns. The segment is expanding as the prevalence of burns and chronic wounds both rise. According to Wound Australia Report in January 2022, over 420,000 Australians experience a persistent wound each year. The average patient with persistent wounds pays over USD 4,000 out of pocket. Hence, the high expenditure associated with chronic wounds is expected to propel the demand for cost-effective wound management devices in the coming years.NPWT applies sub-atmospheric pressure inside a closed dressing to create a positive pressure that draws fluid and infection from a burn wound's surface. The pediatric burn centers in Australia treat more than 4000 kids for acute burns each year. Compared to traditional silver dressings, NPWT for burns has demonstrated faster healing times, an average of 22%, 60% lower referral risk for long-term scar treatment, and lower costs per patient. Thus, the benefits of NPWT in the treatment of burns and chronic wounds are anticipated to drive the growth of the segment.

People over 65 are more susceptible to chronic wounds because of age-related problems; thus, with the growing aging population in the country, the burden of chronic wounds is expected to increase over the forecast period. For instance, according to the Australian Institutes of Health and Welfare, in November 2021, the percentage of people 65 and older in Australia was 16.2%. Australians over the age of 65 will make up a huge portion of the population by 2066, reaching a peak of about 20.7%. Hence, the increasing burden of chronic wounds and the growing adoption of these products are the major factors propelling the growth of the wound care market.

Foam Dressing is Expected to Witness Significant Growth During the Forecast Period

Foam dressing is used as a primary and secondary dressing for various types of wounds to provide absorption and insulation. The presence of various companies providing foam dressings in Australia and the rising burden of chronic wounds are some of the leading factors contributing to the segment's growth.Some of the key companies operating in the Australia foam dressing segment include Smith and Nephew, 3M, Hartman AG, inHealth Group, and Cardinal Health, among others. One of the leading suppliers of foam dressing in Australia includes Vital Medical Supplies. As per the data from the Journal of Foot and Ankle Research published in May 2022, the Australian guidelines on wound healing interventions include foam dressing as a crucial wound management tool in a heavily exuding neuropathic diabetic foot ulcer. The data also stated that foam dressing is widely used across Australian hospitals for the management of wounds with heavy drainage.

Per the Wounds Australia 2022 report, over USD 3 billion from the nation's aged care and healthcare budgets is spent on chronic wounds. Per the data from the Australian Institute of Health and Welfare updated in November 2022, there was around 33,600 hospitalization in Australia due to injuries. The data indicated that there is a growing burden of injuries in the country, accounting for around 8.4% of the total burden of diseases in Australia. Hence, considering the support and initiatives proposed by the government and the rising burden of injuries in the country, the demand for wound care products in Australia is likely to witness growth over the forecast period.

Advanced Wound Therapy Devices Industry Overview

The Australian market for wound care management devices is highly competitive and consists of several major players. Companies such as 3M Health Care Ltd, Coloplast AS, ConvaTec Inc., Covidien PLC, Hollister Incorporated, Johnson & Johnson, Medline Industries Inc., and Smith & Nephew PLC, among others, hold a substantial market share.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Health Care Ltd

- Coloplast AS

- ConvaTec Inc.

- Hollister Incorporated

- Johnson & Johnson

- Medline Industries Inc.

- Medtronic PLC

- Smith & Nephew PLC