Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Urbanization and Changing Lifestyles

Urbanization is one of the primary drivers behind the growth of the furniture market in India. The rapid migration of people from rural to urban areas in search of better job opportunities, education, and living standards has led to a surge in demand for residential and office furniture. For instance, In 2023, India's urban population was recorded at 36.36%, as per the World Bank's development indicators. This growing urbanization is a key factor driving the demand for modern and functional furniture solutions across residential and office spaces.In urban environments, compact living spaces and apartments are becoming more common, creating a demand for modular and multi-functional furniture. Consumers are increasingly looking for furniture that fits their living spaces while also offering convenience and comfort. This shift in lifestyle is encouraging the growth of customizable and modular furniture, which offers flexibility for different needs, such as convertible sofas, storage beds, and foldable tables.

Rising Disposable Incomes and Middle-Class Growth

The rise in disposable incomes, particularly among the growing middle class, is another key factor driving the India furniture market. As more people move into the middle-income bracket, they are becoming increasingly willing to spend on home decor and furnishings to enhance their living spaces. This new wave of consumers is seeking a blend of comfort, style, and affordability, creating opportunities for furniture manufacturers to cater to diverse customer preferences. With a population of 1.4 billion, the country has a large consumer base and a rising middle class with increasing disposable incomes. As reported by the Trade Promotion Council of India (TPCI), India is anticipated to become the world's fifth-largest furniture manufacturer and the fourth-largest consumer by 2022.With improved economic conditions, more individuals and families are opting for higher-quality furniture that lasts longer and offers greater value for money. This trend is especially evident in Tier 1 and Tier 2 cities, where rising urban incomes are creating a higher demand for premium and luxury furniture. Additionally, the younger generation's preference for contemporary and aesthetically pleasing designs is driving the demand for innovative, trendy, and modern furniture solutions.

Sustainability and Eco-friendly Trends

Sustainability has emerged as an important driver in the Indian furniture market, with a growing number of consumers becoming environmentally conscious. This shift in consumer preferences is pushing furniture manufacturers to adopt eco-friendly materials and sustainable manufacturing practices. Products made from recyclable, biodegradable, and renewable materials are gaining popularity, as consumers are increasingly looking for eco-conscious alternatives to traditional furniture options.Wooden furniture, in particular, is seeing a revival, especially when made from sustainably sourced or reclaimed wood. The use of non-toxic paints, water-based finishes, and low-VOC adhesives is also becoming a common trend in the industry. Furniture brands that promote sustainability and transparency in their production processes are attracting environmentally aware consumers, particularly in the urban markets.

Key Market Challenges

Supply Chain Disruptions and Raw Material Shortages

One of the major challenges in the India furniture market is the disruption in supply chains and the shortage of raw materials. India heavily depends on imported raw materials, including wood, metal, and plastic, to manufacture furniture. Fluctuating prices and import restrictions, particularly on wood, have caused price volatility and limited availability, which in turn affects the pricing and production timelines for furniture brands.Additionally, the furniture industry in India relies on labor-intensive manufacturing processes, which have been significantly impacted by supply chain inefficiencies, labor shortages, and transportation delays. The COVID-19 pandemic, for example, highlighted vulnerabilities in the supply chain, leading to delayed deliveries and inventory shortages. As the global market faces rising freight costs and challenges related to international trade, the Indian furniture industry must address these issues by exploring alternative sourcing strategies, improving logistics infrastructure, and focusing on local manufacturing to reduce dependency on imports.

Intense Competition and Price Sensitivity

The Indian furniture market is highly fragmented and competitive, with both domestic and international players vying for market share. Local and global brands, ranging from budget-friendly options to premium luxury offerings, make it difficult for businesses to differentiate themselves. The market is home to a wide range of furniture styles, from traditional to contemporary, catering to varying tastes and preferences, making competition even more intense.The rise of e-commerce has further intensified the competition, with online platforms offering a broad range of products at competitive prices. E-commerce giants like Amazon, Flipkart, and specialized platforms like Urban Ladder and Pepperfry have disrupted traditional brick-and-mortar retail models by providing a convenient shopping experience. These platforms often offer aggressive pricing strategies, discounts, and free delivery services, which pressure local furniture manufacturers to reduce costs or offer similar deals to remain competitive.

Key Market Trends

Preference for Modular and Multi-functional Furniture

Another key trend in the India furniture market is the increasing demand for modular and multi-functional furniture. As urbanization accelerates, living spaces in cities are becoming smaller, particularly in metropolitan areas where apartments and flats are the norm. This has led consumers to seek furniture that maximizes the use of available space while maintaining functionality and style.Modular furniture, which offers flexibility and adaptability, is gaining popularity as it allows consumers to create customized setups that fit their specific needs. Multi-functional furniture pieces that can serve more than one purpose, such as sofa beds, extendable dining tables, and storage ottomans, are in high demand. These versatile products cater to consumers who need to make the most of their space, particularly in smaller homes or apartments.

Customization and Personalization of Furniture

The demand for customized and personalized furniture is another growing trend in the Indian market. With an increasing focus on individual tastes and preferences, consumers are looking for furniture pieces that reflect their unique style and cater to their specific needs. The desire for personalized designs is prevalent in both residential and commercial spaces, where the furniture plays a significant role in creating the desired aesthetic and functional atmosphere.Furniture brands are increasingly offering customization options, allowing consumers to choose the materials, colors, sizes, and finishes of their furniture pieces. This trend is particularly evident in high-end furniture segments where customers are willing to pay a premium for personalized designs. Custom-made furniture allows consumers to add a personal touch to their living or working spaces, whether it’s a sofa with a particular fabric or a dining table with a specific wood finish.

Segmental Insights

Type Insights

Home furniture was the dominating segment in the India furniture market, driven by increasing urbanization, rising disposable incomes, and changing lifestyles. The growing demand for aesthetically appealing and functional furniture for residential spaces, such as living rooms, bedrooms, and dining areas, has significantly boosted this segment. With the rise of nuclear families, smaller apartments, and an emphasis on home décor, consumers are seeking personalized and multi-functional furniture options. Additionally, the popularity of online shopping platforms and easy access to diverse furniture styles has further fueled the demand for home furniture. This segment continues to dominate, reflecting evolving consumer preferences.Regional Insights

The North region was the dominating segment in the India furniture market, driven by its robust urbanization and growing disposable incomes. Major cities like Delhi, Chandigarh, and Jaipur contribute significantly to this trend, with a high demand for both traditional and modern furniture. The region's well-established retail infrastructure, coupled with the rising number of residential and commercial developments, fuels the market's growth. Additionally, the increasing preference for e-commerce platforms and online furniture shopping has strengthened the North's market dominance, as consumers seek convenience and variety in their purchases. The North continues to lead with a strong consumer base and higher purchasing power.Key Market Players

- Nilkamal Limited

- IKEA India Private Limited

- Godrej and Boyce Manufacturing Company Limited

- Durian Industries Limited

- Forte Furniture Products India Private Limited

- Damro Furniture Pvt Ltd

- Usha Shriram Private Limited

- Featherlite Private Limited

- Haworth India Pvt Ltd

- Dynasty Modular Furniture's Private Limited

Report Scope:

In this report, the India Furniture Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Furniture Market, By Supply:

- Domestic

- Imported

India Furniture Market, By Organized Vs. Unorganized:

- Organized

- Unorganized

India Furniture Market, By Type:

- Home Furniture

- Office Furniture

- Institutional Furniture

India Furniture Market, By Product Type:

- Bed

- Sofa

- Wardrobe

- Dining Set

- Others

India Furniture Market, By Point of Sale:

- Offline

- Online

India Furniture Market, By Raw Material:

- Wood

- Metal

- Plastic

India Furniture Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Furniture Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Nilkamal Limited

- IKEA India Private Limited

- Godrej and Boyce Manufacturing Company Limited

- Durian Industries Limited

- Forte Furniture Products India Private Limited

- Damro Furniture Pvt Ltd

- Usha Shriram Private Limited

- Featherlite Private Limited

- Haworth India Pvt Ltd

- Dynasty Modular Furniture's Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | February 2025 |

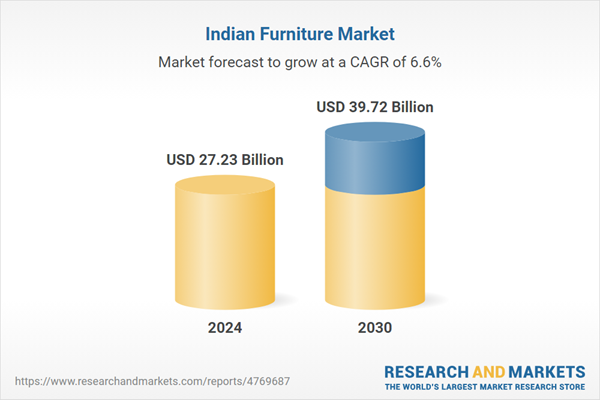

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 27.23 Billion |

| Forecasted Market Value ( USD | $ 39.72 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |