The pandemic affected all the countries and business sectors with varying degrees of impact. The COVID-19 pandemic disrupted the working of several markets, including the sorghum forage seed market. The pandemic affected the manufacturing process and supply chain networks, thus, resulting in major losses for sorghum forage companies and farmers as well. It has affected the production, certification, distribution, and cost of seeds, which play an important role in the growing stages of the agricultural cycle. Adding to that, the restrictions by governments on movement to protect their people from COVID-19 have caused a major problem for all countries as they are hard hit by the economic downturn.

According to the FAO, sorghum is one of the lesser water-consuming crops, which requires an average of 550 ml of water for its total growing period. This peculiarity will reduce the cost of farming because it reduces the additional cost of investing in artificial water resources. This competitive edge of sorghum over other crops has attracted farmers to grow more sorghum, thereby impacting the long-term increase in demand for the forage sorghum seeds on a global scale. Forage sorghum seed has many exclusive nutritional advantages when fed to cattle, as it is naturally gluten-free. Gluten is a mixture of two proteins, termed prolamin and glutelin, that are present in cereal grains, especially wheat. This is responsible for the elastic texture of dough when churned during digestion making digestion difficult. This nutritional benefit and less water-consuming property will bolster the forage sorghum seed market during the forecast period for the long term.

Key Market Trends

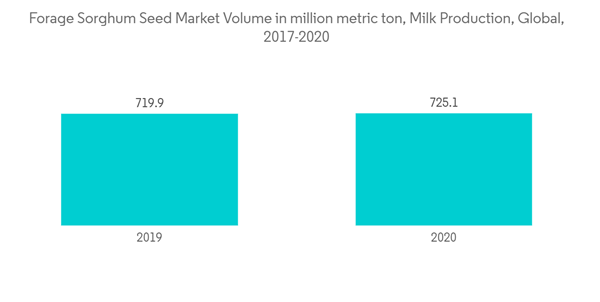

Increased Demand for Meat, Dairy, and Poultry Products

The main industries using sorghum seeds are animal feed manufacturers, alcohol distilleries, and starch industries. Only rainy-season sorghum is used for industrial purposes. The sorghum varieties available in the United States are completely tannin-free. As a result, sorghum can be used in poultry diets with only minor changes to the other dietary ingredients. In developing countries, such as India and Indonesia, sorghum is produced on a commercial basis and is used exclusively as an animal feed, either in the domestic market or in export destinations. According to the FAO, the annual growth of meat production and milk production in developing countries is projected at 2.1% and 2.3%, respectively, from 2017 to 2030. This factor is anticipated to bolster the developing countries' share in the global meat production to 66% (247 million metric ton) and milk production to 55% (484 million metric ton) by 2030.

Sorghum forage is mainly used for feeding livestock. The continuous increase in the production of animal products has resulted in the demand for more feed to rear them. The rising demand for animal products in the global commodity market and the higher prices in the international markets are encouraging farmers to take up sorghum forage cultivation.

The United States Dominates the Global Market

The US forage sorghum seed market is projected to witness a CAGR of 6.2% during the forecast period. The United States cornered the largest share, accounting for 84.8% of the total North American forage sorghum seed market in 2019. A steep fall in sorghum seed sales was observed, especially during the period 2016-17. This is primarily attributed to severe drought conditions, while the production ramped up in the latter part of 2016, and hence, the demand for forage sorghum seed increased drastically. According to statistics provided by the United States Department of Agriculture(USDA) over the period of 2017-20, the contribution of major sorghum-producing states in the United States, such as Kansas and Texas, accounted for nearly 58% of the sorghum seed sales in 2019. The United States is one of the major exporters of sorghum silage, and China, Japan, the UAE, Saudi Arabia, and South Korea are the top five export destinations for the product. Thus, the rising export demand for the seed sorghum, especially from the massive Chinese feed industry, is anticipated to boost forage seed sales from the commercially operated sorghum forage farms in the country. Allied Seed LLC, S&W Seed Co., and Legend Seeds are a few major market players offering a huge line-up of forage sorghum seeds in the United States market.

Competitive Landscape

The forage sorghum seed market is moderately fragmented, with a large number of regional and global players. In the forage sorghum seed market, companies are focusing on mergers and acquisitions, collaborations, joint ventures, and partnerships in order to increase their market share. For instance, in September 2018, S&W Seed Company created a joint venture with AGT Foods Africa (Pty) Ltd (“AGT Foods Africa”) to establish a new company, SeedVision SA (Pty.) Ltd, which is projected to boost the production and processing facilities to produce new forage sorghum varieties for sale in Africa, the Middle East countries, and Europe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allied Seed LLC

- BRETTYOUNG

- S&W Seed Company

- Nuseed

- AgReliant Genetics LLC

- Advanta Seeds