Post Covid-19 as the worldwide restrictions imposed on functional cafes and pubs were lifted, the mass consumption segment of craft beers, i.e., on-trade channels, came back to normal and witnessed a steady recovery rate. The off-trade distribution segment witnessed remarkable growth as the store and online alcohol sales soared across the world. Hence, the overall sales of craft beers steamed up again after the pandemic.

In the past, low-ABV beers have been mostly considered tasteless, but they are now getting a reboot by craft brewers. The scenario is much more prominent in European countries like Sweden, where brewers are seeking to bring changes to the craft beer market. The craft beer industry is constantly changing, but with planning, breweries can prepare themselves for what the craft beer market demands.

The demand for low-alcoholic beverages has been rising with the growing interest of health-conscious consumers. Wider choices of the new product range by key players with improved taste and low alcoholic content in beer for those of 2.8% ABV and less are driving the market. However, the threat from other alcoholic beverages, like wine, is one of the major hindering factors to the craft beer market.

Craft Beer Market Trends

Rising Number of Microbreweries

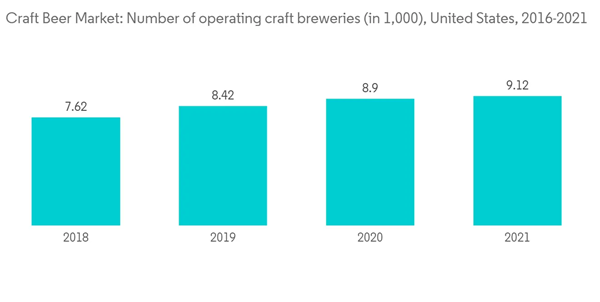

Craft beer has been increasingly gaining a strong foothold in the market, with a rising number of independent microbreweries coming up to provide numerous products. The growing popularity of craft beer among consumers, especially the younger generation, is considered the major growth factor. Factors affecting the shift toward craft beer consumption are the demand for variety, higher disposable income, taste for flavor, and beer quality. There is a growing trend for low-alcohol by-volume beverages. Sales of no-alcohol and low-alcohol beers have also increased due to increased interest from health-conscious customers and a better selection of new varieties with superior taste. The growth of the craft beer market is inherently associated with the growth in consumer desire for variety.Furthermore, shifting consumer demand toward variety and taste for flavor has led to the inclusion of microbreweries into the craft beer industry. By large, the active participation of macro-brewers is promoting the craft beer market. These new brewers have been driving the exports that first led to the stabilization and incremental growth in the craft beer industry. With more and more microbreweries participating, the market has been witnessing intense competition among these brewers in terms of product innovation and differentiation using flavors, packaging, price, and producing techniques. Thus, the rising number of microbreweries and small independent breweries has been a crucial factor driving the craft beer market growth globally.

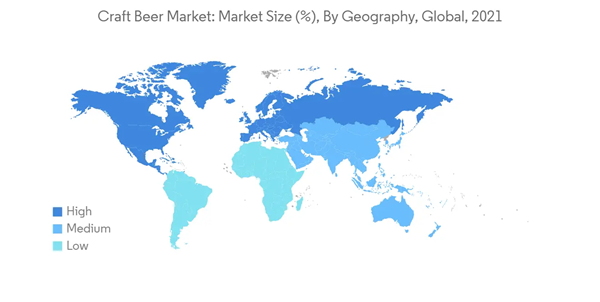

North America Dominates the Market

North America caters to a large share of the craft beer market. The rising number of microbreweries has surged the popularity of craft beer in the North American market. The increase in the number of breweries in the United States has increased the demand for craft beers exponentially. According to the Brewers Association, the number of craft breweries in the United States increased from 8391 in 2019 to 9118 in 2021. Social media and local events and promotions significantly drive the craft movement. Millennials in the region are more interested in craft beer than regular ones because of its rich and vibrant taste. Due to the rising demand for craft beers among the young population and the surging demand for low-alcohol craft beers in the region, the market players have come up with numerous product innovations. For instance, in 2021, Stella Artois, a brand under Anheuser-Busch, launched a non-alcoholic brew, Liberte, in the United States.Craft Beer Industry Overview

AB In Bev, Heineken NV, Constellation Brands, the Boston Beer Company, Molson Coors Beverage Company, and Sierra Nevada Brewing Co. are some of the key players in the market. The market is highly competitive, considering the presence of many global and regional players. The regional brewers cater to a large portion of the craft beer market. Both global and regional players have catered to the rising consumer demand for the product with their extensive product innovations in terms of flavors, packaging, and alcohol content.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Anheuser-Busch InBev

- Molson Coors Beverage Company

- Heineken NV

- The Boston Beer Company Inc.

- Constellation Brands

- D.G. Yuengling & Son Inc.

- New Belgium Brewing Company Inc.

- Bell's Brewery Inc.

- Stone and Wood Brewing Co.

- Sierra Nevada Brewing Co.