The Indonesia Health and Medical Insurance Market is expected to deliver strong growth for the forecasted period. The Indonesians covered by the National Health Insurance Scheme (JKN) are managed by the Social Insurance Administration Organization (BPJS). It includes some medical and non-medical benefits but excludes orthodontics, infertility treatments, and drug rehabilitation. While the BPJS can be commended for offering a measure of healthcare coverage, issues with the quality of service, financing, and participation currently undermine confidence in the system.

As health insurance premium rises, the expectation of quality care is likely to rise in tandem, providing the opportunity for foreign investors to bridge the gap. However, some restrictions remain on international investment in hospitals. Private health insurers are also improving customer experience by offering cashless payments and broadening their offering to include advice on health and wellness.

Indonesians have become more interested in insurance to mitigate uncertainty regarding their health and personal finances brought about by the pandemic. Personal accident and health insurance (PA&H), which accounts for 8% of general insurance premiums, is forecasted to grow in 2023 backed by an increase in awareness for health insurance products.

The market was initially affected due to COVID-19 as people cannot take up insurance due to lockdowns, and travel-out restrictions. But later the growth of online platforms has brought some profits to the market. Post-COVID due to an increase in health consciousness among people the market is experiencing significant growth rates.

Health and Medical Insurance Market Trends

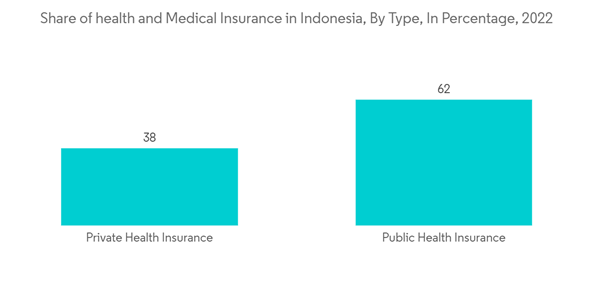

Public Health Insurance is Dominating the Market

Public insurance is highly opted by Indonesians over private insurance. Healthcare is a priority on Indonesia's national agenda, and the central and regional governments continue to build and upgrade healthcare facilities. An increase in public awareness about the importance of healthcare, the expansion of public and private hospitals, and the increased demand for modern medical devices have led to the growth of public insurance in Indonesia. The country launched a mandatory health insurance program called Jaminan Kesehatan Nasional. It's designed to make basic medical care and facilities available to all citizens. As BPJS Kesehatan provides essential coverage, many individuals and families choose this as their insurance over private health insurance.Universal Health Coverage in Indonesia is Driving the Market

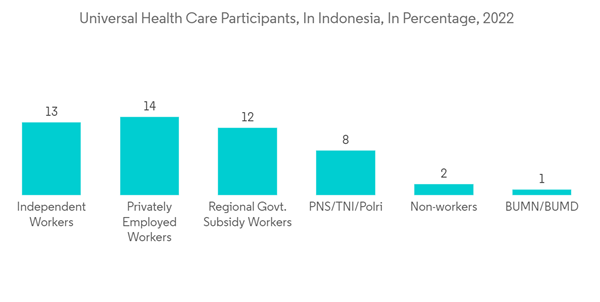

The healthcare system in Indonesia is evolving rapidly to meet the varied health needs of its vast population. It is the fourth most populous country and is facing the challenges of the growing healthcare costs to implement the UHC initiative.This initiative ensures that more than 40% of the country's residents are covered by government-sponsored subsidies, to address their health concerns. Indonesia's quick transition from official development assistance for health and a budget deficit facing the country's social insurance administration organization, which administers the national health insurance program, has made health technology assessment (HTA) a critically important tool.

Health and Medical Insurance Industry Overview

The report covers the major players operating in the Indonesia health and medical insurance market. In terms of market share, a few of the major players currently dominate the market studied. In fact, the market is predominantly controlled by the top 10 participants that cover 75% of the market. However, with technological advancements and better schemes, mid to small-size companies can experience growth. Some of the major players currently dominating the market include Allianz Care, AXA Indonesia, AIA Financial Indonesia, Prudential Indonesia, and Manu Life Indonesia.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allianz Care

- AXA Indonesia

- AIA Financial Indonesia

- Prudential Indonesia

- ManuLife Indonesia

- AVIVA

- BNI Life

- PT Sun Life Financial Indonesia

- PT Reasuransi Indonesia Utama (Persero)

- Cigna Insurance

- BCA Life

- PT Great Eastern Life Indonesia*