The sonar systems market is driven by the adoption of active sonar systems by the naval forces to enhance anti-submarine warfare capabilities as well as the growth in the usage of sonobuoys in tactical defense programs is anticipated to bolster the growth of the market during the forecast period.

Furthermore, growth for high-resolution imaging for mapping of the seabed coupled with procurement of new ships and submarines equipped with advanced sonar technology as well as the upgradation of existing vessels with next-generation sonar capabilities will also lead to driving the market growth in the future.

On the other hand, factors such as expensive installation as well as maintenance costs of new sonar technologies might subdue the growth of the market.

Furthermore, the growing usage of 3D printing technology to build a 3D-printed sonar system will open up new opportunities for the market players as this would enable rapid prototyping and manufacturing of sophisticated sonar systems within a shorter timeframe.

Sonar Systems and Technology Market Trends

The Defense Segment to Witness Highest Growth During the Forecast Period

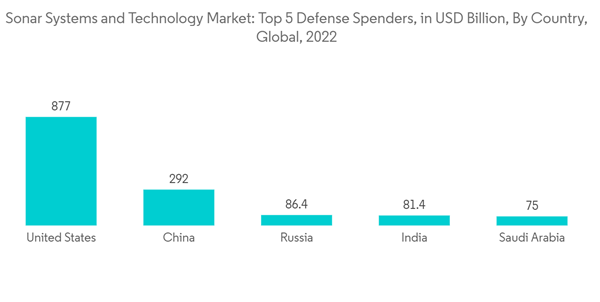

The growing defense expenditure worldwide to acquire new and advanced sonar systems to increase the capabilities of naval vessels coupled with growing military procurement programs to acquire new ships and submarines are some of the factors that will drive the market growth during the forecast period.The growth in military expenditure globally has led to various defense personnel worldwide retrofitting naval vessels with a new generation of sonar systems to increase their capabilities and gain a competitive edge during modern warfare operations. As per the Stockholm International Peace Research Institute (SIPRI), in 2022, the US defense expenditure of USD 877 billion accounted for nearly 40% of the global defense expenditure (USD 2.2 trillion).

On the other hand, there has been significant development in terms of procurement programs by the global defense industry to acquire new ships and submarines that have been equipped with advanced sonar systems. For instance, in September 2023, Taiwan announced that they had launched their first home-developed submarine prototype known as Hai Kun, as part of their multibillion Indigenous Defense Submarine (IDS) program. Furthermore, the newly launched submarine is expected to be priced at USD 1.54 billion and will be delivered to the Taiwan navy by the end of 2024. The submarine is expected to be armed with new generation of sonar systems developed by the US.

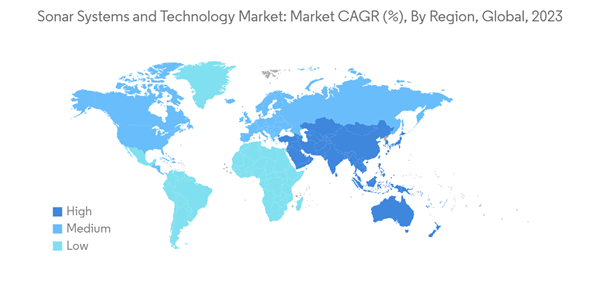

Asia-Pacific to Dominate the Market During the Forecast Period

The geo-political scenario of the Asia-Pacific region has made it a hotspot for unprecedented skirmishes and armed standoffs, and this has led to various countries within the region witnessing growth in terms of defense spending as well as the significant development in terms of acquisition of advanced sonar technologies to increase the defense capabilities of the naval forces.For instance, in June 2023, Kraken Robotics announced that they are in the process of supplying their high-resolution seabed mapping sonar equipment called Katfish together with sustainment options such as training, spares, and operational support to an undisclosed defense naval force based in the Asia-Pacific region under a contract valued at USD 9.5 million. Moreover, the delivery of the equipment will also include towed synthetic aperture sonar and autonomous launch and recovery systems and is expected to be completed by 2023. Furthermore, the KATFISH sonar system will be integrated onboard the vessel, as decided upon by the undisclosed defense naval force.

On the other hand, there has been significant development in terms of new sonar technologies by various countries in the Asia-Pacific region. For instance, in March 2023, China announced that they have developed a new tile shaped device which can analyze the sonar frequency of the enemy and can generate opposing sound waves which leads to the enemy sonar operator mistaking the submarine sound for water sounds thereby hampering the ability of the enemy submarine operators to detect and locate submarines belonging to opposing troops.

Sonar Systems and Technology Industry Overview

The sonar systems and technology market is fragmented with various players dominating the market. Some of the major players in the sonar systems and technology market are Northrop Grumman Corporation, THALES, ThyssenKrupp AG, Lockheed Martin Corporation, and General Dynamics Corporation amongst others.Various players in the market are investing significantly in research and development of advanced sonar technologies which will help to enhance the capabilities of naval vessels. Furthermore, various players are also collaborating with defense forces worldwide to understand the military requirements and develop cutting-edge technologies such as retractable sonar systems for vessels operating in shallow waters while also working towards business expansion. In addition, the growing global presence of international companies coupled with increasing investments in new technologies by such companies as compared to their regional counterparts is anticipated to lead to the international companies increasing their market share significantly in the years to come within the global market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Nautel

- Mistral Solutions Pvt. Ltd

- Sonardyne International Ltd

- Northrop Grumman Corporation

- Thales Group

- Ultra Electronics Holdings

- ThyssenKrupp AG

- Western Marine Electronics Inc.

- GeoSpectrum Technologies Inc.

- Aselsan AS

- Lockheed Martin Corporation

- Kongsberg Gruppen ASA

- Koc Bilgi ve Savunma Teknolojileri AS

- SonarTech Underwater Systems LLC

- Meteksan Defense Industry Inc.

- General Dynamics Corporation

- Raytheon Technologies Corporation

- L3Harris Technologies Inc.

- Teledyne Technologies Incorporated