Key Highlights

- The COVID-19 pandemic had a significant impact on the South American automotive market. The region experienced a sharp decline in automotive sales and production due to various factors. Government-imposed lockdowns and restrictions on movement led to a decrease in consumer demand and disrupted supply chains, resulting in reduced manufacturing output.

- However, the South American automotive market has shown resilience, with a gradual recovery observed as restrictions were lifted and economic activities resumed. Government stimulus measures, including tax incentives and subsidies, have been implemented to encourage automotive sales and production. The market is expected to continue its recovery, driven by pent-up demand, digital transformation, and the introduction of new electric and hybrid vehicle models.

- The prime factors driving the growth in the sales and demand for passenger cars were lower interest rates and improving consumer confidence. For instance, the export and sales of passenger cars in 2022, compared to 2021, witnessed an increase of about 50% and 6%, respectively.

- However, the automotive market in South America is highly vulnerable to the instability of social and political policies, as countries like Venezuela are experiencing a slowdown in their economic growth, drastically impacting the country's automotive industry growth.

- In Brazil, with the improvement in the economy (directly influencing consumer confidence) and rise in credit availability to support the country's light-vehicle market, growing investment in the country, and strong export demand, the country has been witnessing positive growth in the demand and sales of vehicles.

- Hence, with the situation easing and investments in the industry, the market is expected to grow in the upcoming years.

South America Automotive Market Trends

Brazil, Argentina, and Chile, to Drive the Market

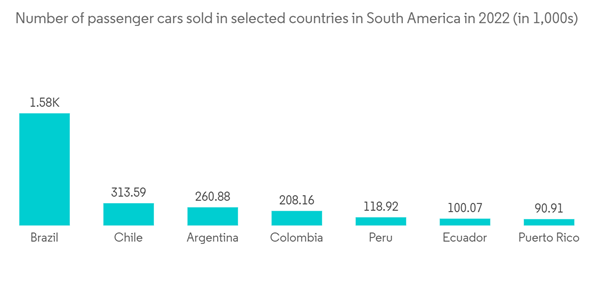

- The passenger car market in South America witnessed considerable numbers in 2021 despite the pandemic. Although the numbers indicate a dip of more than 100% in the sales of all types of vehicles in all the countries of the region combined in 2021, considering the pandemic and the pace at which the economy is set to bounce back, the region being a hotspot for potential investors from all over the world, the industry is expected to recover with good numbers in the coming quarters. For instance,

- In September 2022, Argentine drafted a new law, which was enacted which aims to promote new investments in the automotive industry and its supply chain. It also aims to strengthen the industry's export orientation, promote the development of new clean engine technologies, and foster technology transfer and innovation.

- The automotive industry grew steadily, with total sales reaching 1.39 million units throughout the region's nine main markets.

- The Brazilian automotive industry's output fell consistently following the economic recession that affected production and sales. However, the industry is now gathering momentum due to the improvement of the economic indexes directly influencing consumer confidence and increased credit availability to support the country's light-vehicle market and strong export demand from South American countries.

- Brazil saw a significant drop in yearly car production for FY 2021. Furthermore, sales were down 26.6 % and 28.2 % during the same period, respectively. Lockdowns and other preventative measures imposed by the government have had a significant impact on the passenger automobile industry in Latin America. However, the market has rebounded significantly following the relaxing of government sanctions and the reopening of production houses in Q2 FY21. The market has re-entered a growth phase and appears promising for the projection term. In 2021, about 1.97 million light vehicles were sold in the country, which is about 2% more than in 2020. Owing to the slow rise in demand, the number of vehicles sold is expected to increase in the upcoming years.

- Similarly, in Argentina, more than 350,000 vehicles were sold in 2021, up by 10% compared to 2020 figures. Comparing the number of light vehicles sold in Chile in June 2021, there is an increase of more than 70%. In June 2020, more than 8,000 vehicles were sold in the country, increasing to over 35,000 units.

- With the industry moving toward a more sustainable production, the research being carried into the electrification of automotive looks promising because the region is a hot investment zone, owing to the growing nature of the market, which can bring in a lot of money and improve the market conditions.

Electric Vehicles are Expected to Witness Significant Growth

- Electric vehicles (EVs) have grown in popularity in the South American region over the last few years due to the necessity to meet future energy and emission demands. The need for environmentally friendly transportation is a major driver of the electric vehicle segment of the market studies. The electric vehicle market is growing as an important part of the South American automotive industry, and it promises a path to increased energy efficiency while lowering pollution and other greenhouse gas emissions.

- Owing to the stringent exhaust emission norms imposed and the incentives provided by several governments in the region are the prime drivers of sales in the countries in South America. Because of Brazil's growing demand for electric vehicles, several players are investing in starting a manufacturing plant there.

- For instance, in July 2023, BYD, the Chinese electric vehicle giant, invested USD 624 million to build its first plant outside of Asia in Brazil. This is part of the company's plan to expand its global reach amid a surge in sales. Similarly, the demand for low-emission vehicles, such as battery electric automobiles and hybrid electric vehicles, is constantly increasing in Argentina. In 2021, for instance, the country sold 5,871 low-emission vehicles, representing a 148% increase from the 3,488 electric vehicles sold in 2020. So, in March 2022, Shell exclaimed to install its first charging station network in the county to cater to the demand for electric vehicles.

- Governments of many countries in the region are also pushing incentives to boost the sales of electric vehicles. For instance, in March 2022, Chile published its national electric mobility strategy to transform the transportation sector over the next decade. One of these incentives offers tax discounts on annual car usage on electric vehicles. For the first two years, the tax is completely waived off, after which, for the next 3-4 years, the government will offer a discount of 75%, a 50% discount for the next 5-6 years, and a 25% reduction on following 7-8 years.

- With the increase in government awareness of converting to sustainable energy and many electric vehicle manufacturers expanding their business in the country, the electric vehicle segment of the South America Automotive Market is expected to witness growth in the following years.

South America Automotive Industry Overview

A few major manufacturers in the South American automotive market include Stallantis, General Motors, Toyota Motor Corporation, Nissan Group, and Volkswagen AG. Between 2021 and 2022, Toyota led the market with more than 73,000 units of new registrations, followed by Volkswagen with 55,000.For instance, in July 2023, Volkswagen is planning a major product offensive in South America, with the goal of increasing its market share in Brazil by 40% by 2027. The company will launch 15 new electric and flex-fuel vehicle models by 2025 and will follow up with hybrid vehicles in the medium term. The first fully electric models, the Volkswagen ID.4 and ID. Buzz, will be available in Brazil before the end of 2023.

In July 2023, Stellantis launched it is New Citroën C3 for the South American Market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- General Motors

- Toyota Motor Corp.

- Stallantis NV

- Volkswagen AG

- Ford Motor Company

- Honda Motor Company Ltd

- Hyundai Motor Company

- Nissan Motor Company Ltd

- Daimler AG

- Groupe Renault

- Kia Motor Corporation