Key Highlights

- COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- Increasing demand for perlite from the agricultural and construction industries is expected to drive the market during the forecast period. The availability of substitutes, such as Diatomite, Pumice, Slag, Vermiculite, and Coco-coir, will likely hinder the market’s growth.

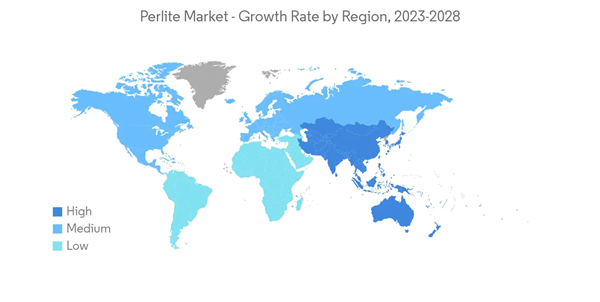

- Increasing new application bases of perlite like eco-roofs, soil conditioning, and wastewater filtration and government certifications for its consumption may act as an opportunity for the market in the future. The Asia-Pacific region dominates the market worldwide, with countries like China, India, and Japan being the biggest consumers.

Perlite Market Trends

Increasing Demand from Construction Sector

- The majority of perlite market consumption is by the construction industry. Perlite demand in the construction industry is attributed to its durable, lightweight, and efficient properties, which is anticipated to drive market expansion over the forecast period.

- Further, due to perlite's density and low cost, it is used in various construction and building products, such as insulation, ceiling tiles, concrete, mortar, and lightweight plasters. The building construction sector is expanding rapidly across the globe.

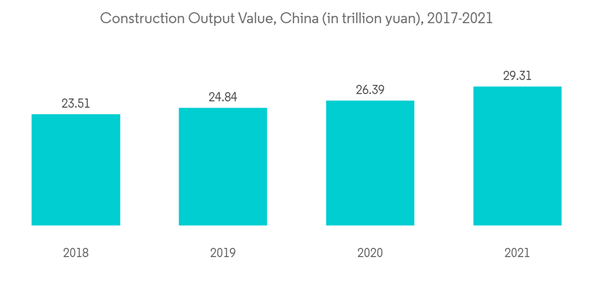

- For example, China's growth is fueled mainly by rapid residential and commercial building expansion. China is encouraging and enduring a continuous urbanization process, with a projected rate of 70% by 2030. Also, China's construction output peaked in 2021 at a value of about USD 4.21 trillion. As a result, these factors tend to increase the demand for perlite across the globe.

- India is expanding its commercial construction sector. For instance, the CommerzIII Commercial Office Complex construction worth USD 900 million started in Q1 2022. The project involves the construction of a 43-story commercial office complex and is expected to be completed in Q4 2027. The increasing commercial construction is expected to increase the demand for perlite during the forecast period.

- Therefore, the aforementioned factors, the demand for perlite is expected to increase during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominated the global market share. With the growing application of perlite in horticulture, agricultural production has shown an outstanding yield. The use of a hydroponic system can also boost the yield, which in turn, drives the consumption of perlite.

- Perlite is also used as a filler in the construction industry for ceiling tiles, floor heating insulations, highway sound-absorbing walls, etc. With growing construction activities, perlite consumption is expected to grow during the forecast period.

- China experienced a significant increase in construction activities, resulting in a surge in demand for perlite in construction applications. For example, China is one of the leading countries with respect to the construction of shopping centers. China has almost 4,000 shopping centers, while 7,000 more are estimated to be open by 2025.

- Moreover, in India, under Pradhan Mantri Awaas Yojana Gramin (PMAY-G), the scheme of “Housing for All” by 2024 has been set at 2.95 crore houses. Out of which, 2,17,54,812 houses have been sanctioned to the beneficiaries, and 1,71,34,737 houses have been completed as of 2nd February 2022. Thus, the increasing housing construction is expected to support market growth.

- Thus, such factors may contribute to the increasing demand for perlite in the region during the forecast period.

Perlite Industry Overview

The perlite market is highly consolidated in nature. Some of the major players in the market include Carolina Perlite Co., Inc., Imerys, Bergama Madencilik İnşaat Makine Perlit Sanayi ve Ticaret A.Ş., Cornerstone Industrial Minerals Corporation, and Saudi Perlite Industries, among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Drivers

4.1.1 Surge in Demand in the Agricultural and Construction Industries

4.1.2 Increasing Usage in the Metallurgical Industry

4.1.3 Other Drivers

4.2 Restraints

4.2.1 Availability of Substitutes

4.2.2 Health Problems Due to Prolonged Exposure

4.2.3 Other Restraints

4.3 Value Chain/Supply Chain Analysis

4.4 Porter's Five Forces Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Power of Consumers

4.4.3 Threat of New Entrants

4.4.4 Threat of Substitute Products and Services

4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

5.1 Product Type

5.1.1 Expanded Perlite

5.1.2 Agro-perlite

5.1.3 Vapex

5.1.4 Other Product Types

5.2 Application

5.2.1 Fillers

5.2.2 Fire-proofing

5.2.3 Insulation

5.2.4 Filtration

5.2.5 Abrasives

5.2.6 Other Applications

5.3 Geography

5.3.1 Asia Pacific

5.3.1.1 China

5.3.1.2 India

5.3.1.3 Japan

5.3.1.4 South Korea

5.3.1.5 Rest of Asia-Pacific

5.3.2 North America

5.3.2.1 United States

5.3.2.2 Canada

5.3.2.3 Mexico

5.3.2.4 Rest of North America

5.3.3 Europe

5.3.3.1 Germany

5.3.3.2 United Kingdom

5.3.3.3 France

5.3.3.4 Italy

5.3.3.5 Russia

5.3.3.6 Rest of Europe

5.3.4 South America

5.3.4.1 Brazil

5.3.4.2 Argentina

5.3.4.3 Rest of South America

5.3.5 Middle-East and Africa

5.3.5.1 Saudi Arabia

5.3.5.2 South Africa

5.3.5.3 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share (%)**/Ranking Analysis

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 Ausperl Pty Ltd

6.4.2 Azer Perlite Corporation

6.4.3 Bergama Mining Perlite

6.4.4 Blue Pacific Minerals

6.4.5 Cornerstone Industrial Minerals Corporation USA

6.4.6 Amol Minechem Ltd.

6.4.7 Imerys

6.4.8 Mianeh Prlite Expanding Co. Ltd

6.4.9 Omya AG

6.4.10 Profiltra BV

6.4.11 Saudi Perlite Industries

6.4.12 Supreme Perlite Company

6.4.13 Termolita

6.4.14 Carolina Perlite Co., Inc.

6.4.15 Midwest Perlite

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Government Certification for its Consumption

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ausperl Pty Ltd

- Azer Perlite Corporation

- Bergama Mining Perlite

- Blue Pacific Minerals

- Cornerstone Industrial Minerals Corporation USA

- Amol Minechem Ltd.

- Imerys

- Mianeh Prlite Expanding Co. Ltd

- Omya AG

- Profiltra BV

- Saudi Perlite Industries

- Supreme Perlite Company

- Termolita

- Carolina Perlite Co., Inc.

- Midwest Perlite