Perfume is a fragrant liquid typically manufactured from essential oils extracted from flowers, herbs, spices, and other natural sources. It is often mixed with alcohol or other solvents to create a pleasing scent that can linger on the skin or clothing. The art of making perfumes, or perfumery, has a rich history dating back thousands of years. It is used for various purposes including personal grooming, enhancing attractiveness, and evoking memories or emotions. The complexity and depth of a perfume come from the combination of different notes, which unfold over time, creating a unique olfactory experience. It can be found in various concentrations, with eau de parfum and eau de toilette being the most common types, differing in the percentage of essential oils they contain.

Perfumes hold significant cultural importance in Kuwait, where they have been traditionally used in various social and religious ceremonies. The usage of fragrances such as Oud and Bakhoor is deeply ingrained in Kuwaiti culture, reflecting prestige and hospitality. This connection with cultural identity and traditions continues to foster a strong market for perfumes in Kuwait. Along with this, the rise in female participation in the workforce and their growing economic independence has led to increased spending on personal care products, including perfumes. Women in Kuwait are becoming key consumers, and their evolving preferences and spending patterns are impacting the market dynamics. In addition, the Kuwaiti government's support for local industries, including regulations that encourage domestic production of perfumes, also contributes to market growth. Encouraging local manufacturing through incentives and fostering a favorable business environment helps in the development of local brands, adding diversity and competitiveness to the market. Apart from this, the presence of influencers and brand ambassadors promoting specific brands or products creates aspirational appeal is contributing to the market. Moreover, the emergence of specialized perfume retail stores, along with the strong presence of international and local brands in shopping malls is creating a positive market outlook.

Kuwait Perfume Market Trends/Drivers

Growing Consumer Preference for Luxury Brands

In Kuwait, there has been a significant rise in the consumer's inclination towards luxury and premium branded perfumes. This trend is driven by the country's robust economy, high GDP per capita, and affluent consumer base, which have collectively contributed to the demand for high-end products. Along with this, the emergence of luxury shopping malls and the increased presence of international brands have further facilitated this growth. Cultural factors also play a role in this trend, as perfumes are often considered a status symbol in Kuwaiti society. In addition, international tourism and exposure to global fashion trends have influenced local preferences, further enhancing the appetite for luxury perfumes. Market players operating in Kuwait are capitalizing on this trend by offering a wide range of luxury fragrances, collaborations with international designers, and personalized services, which altogether contribute to the buoyant market of luxury perfumes in the region.Rising Importance of Personal Grooming and Fragrance Customization

Personal grooming has become increasingly important in Kuwait, and the perfume industry is an integral part of this trend. The country's young and fashion-conscious population is investing more in personal care products, including fragrances. In confluence with this, the demand for personalized and unique scents is also rising, leading to the growth of niche and boutique perfume brands offering customized fragrance experiences. This trend is supported by technological advancements in fragrance customization and increased consumer engagement through interactive experiences. There is also a growing appreciation for traditional Arabic fragrances such as Oud, Musk, and Amber, tailored to individual preferences. This combination of personal grooming trends, technological innovation, and cultural appreciation is creating a dynamic and evolving perfume market in Kuwait, attracting both international and local players.Kuwait Perfume Industry Segmentation

This report provides an analysis of the key trends in each segment of the Kuwait perfume market report, along with forecasts at the country levels from 2025-2033. The report has categorized the market based on premium and mass products, gender and perfume type.Breakup by Premium and Mass Products

- Premium Products

- Mass Products

The report has provided a detailed breakup and analysis of the market based on the premium and mass products. This includes premium products and mass products. According to the report, premium products represented the largest segment.

In the context of the Kuwaiti perfume industry, the emergence of market drivers for premium products can be attributed to a convergence of factors that shape consumer preferences and industry dynamics. The discerning Kuwaiti clientele, characterized by a high disposable income and a strong cultural affinity for luxury, propels the demand for premium fragrances. Moreover, the prevalence of social media and digital platforms has amplified aspirations for luxury, fostering a desire for exclusive and prestigious fragrances. Additionally, the strategic positioning of Kuwait as a shopping destination and its regional influence further amplifies the demand for premium products within the perfume industry. Concurrently, the industry's emphasis on craftsmanship, unique blends, and premium packaging aligns with the inherent value Kuwaiti consumers place on quality and distinction. Furthermore, the interplay of an affluent consumer base, digital exposure, regional stature, and a penchant for excellence collectively underpin the ascendant market drivers for premium products in the Kuwaiti perfume industry.

Breakup by Gender

- Male

- Female

- Unisex

A detailed breakup and analysis of the market based on the gender have also been provided in the report. This includes male, female, and unisex. According to the report, male represented the largest segment.

The male demographic is gaining prominence due to the preferences and sensibilities of male consumers. The evolving perceptions of masculinity, characterized by a heightened emphasis on personal grooming and self-expression, have propelled the demand for male-oriented fragrances. Kuwait's sociocultural landscape, where traditional values harmonize with modern aspirations, creates a dynamic backdrop for the growth of this market segment. In confluence with this, the rise of e-commerce platforms and digital marketing enables wider accessibility and exposure to diverse fragrance offerings, appealing to the tech-savvy male audience. The industry's innovative approach to crafting scents that cater specifically to male tastes further augments this demand. Moreover, the interplay of changing gender norms, cultural adaptability, digital outreach, and tailored product innovation collectively fuel the market drivers targeting the male gender within the Kuwait perfume industry.

Breakup by Perfume Type

- Arabic

- French

- Others

The report has provided a detailed breakup and analysis of the market based on the perfume type. This includes Arabic, French, and others. According to the report, Arabic type represented the largest segment.

In the context of the Kuwaiti perfume industry, the ascendancy of market drivers associated with Arabic perfume types can be attributed to a synergy of factors that resonate deeply with local preferences and cultural heritage. Along with this, the rich tradition of perfumery in Kuwait and the wider Arabian region underscores the intrinsic value placed on fragrances deeply rooted in local customs and aesthetics. The resurgence of interest in traditional practices and a growing sense of cultural pride has led to heightened demand for Arabic perfume types. Furthermore, the industry's adeptness at adapting these scents to contemporary sensibilities, often through modern packaging and marketing strategies, bridges the gap between tradition and modernity. The industry's strategic alignment with cultural events and celebrations further amplifies the allure of Arabic perfumes. Thus, the harmonious blend of cultural legacy, innovative adaptation, and contextual marketing converge to propel the market drivers associated with Arabic perfume types within the Kuwaiti perfume industry.

Competitive Landscape

Key players recognize the profound cultural significance attached to fragrances in the region. Perfumes are not merely products but essential elements of personal grooming and cultural expression. This deep-rooted connection drives consistent demand for an array of scents that resonate with Kuwaiti heritage and individual preferences. Also, leading players emphasizes the Kuwaiti consumer's inclination towards luxury and prestige. Perfumes are considered status symbols and markers of sophistication. They respond to this driver by curating exclusive, high-end fragrances that reflect opulence and cater to the discerning tastes of customers. Moreover, top companies focus on niche and artisanal fragrances that set them apart. The Kuwaiti market appreciates limited-edition scents and handcrafted blends that offer a sense of exclusivity. This driver allows leading players to tap into a segment that seeks unconventional and bespoke fragrance experiences.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Key Questions Answered in This Report

How has the Kuwait perfume market performed so far, and how will it perform in the coming years?What are the drivers, restraints, and opportunities in the Kuwait perfume market?

What is the impact of each driver, restraint, and opportunity on the Kuwait perfume market?

What is the breakup of the market based on the premium and mass products?

Which is the most attractive premium and mass products in the Kuwait perfume market?

What is the breakup of the market based on the gender?

Which is the most attractive gender in the Kuwait perfume market?

What is the breakup of the market based on the perfume type?

Which is the most attractive perfume type in the Kuwait perfume market?

What is the breakup of the market based on imports and domestic manufacturing?

What is the competitive structure of the Kuwait perfume market?

Who are the key players/companies in the Kuwait perfume market?

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 136 |

| Published | February 2025 |

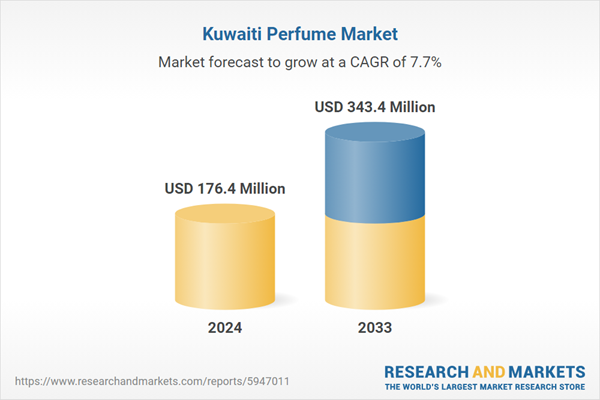

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 176.4 Million |

| Forecasted Market Value ( USD | $ 343.4 Million |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Kuwait |