The market is significantly influenced by the increasing adoption of xenon gas in semiconductor lithography processes, particularly for advanced chip manufacturing. Additionally, the growing research in quantum computing and atomic clocks, where xenon serves as a cooling medium, further supports the market demand. Also, the increasing usage of xenon gas for medical applications is a significant growth-inducing factor for the market. A recent study published on January 15, 2025, by scientists from Washington University School of Medicine and Mass General Brigham has enhanced xenon gas's potential for treating Alzheimer's. The study demonstrated that xenon gas reduces neuroinflammation and brain atrophy in mouse models by penetrating the blood-brain barrier and activating protective microglial responses, leading to improved cognitive functions. This breakthrough is driving interest in xenon-based therapeutics for neurodegenerative diseases. In line with this, expanding the use of high-speed photography and nuclear detection technologies also contributes to the xenon gas market growth.

The United States xenon gas market is witnessing significant growth driven by the rising demand for next-generation satellite propulsion systems, where xenon-ion thrusters offer efficiency for long-duration space missions. Furthermore, expanding semiconductor fabrication, driven by domestic investments in chip production, fuels the need for xenon in deep ultraviolet lithography. On August 8, 2024, EFC Gases and Advanced Materials announced a USD 210 Million investment to build a specialty gases and chemicals plant in McGregor, Texas, aiming to meet the growing demand from the global chip industry. The facility will produce fluorochemicals for semiconductor etching and deposition chamber cleaning, as well as fill cylinders with rare gases like krypton, xenon, and neon. Besides this, the increasing utilization of MRI spectroscopy and neuroimaging is fostering growth in the healthcare sector. Additionally, heightened investment in nuclear research and radiation detection technologies is accelerating consumption.

Xenon Gas Market Trends:

Technological Advancements and Increasing Applications

The continuous technological innovations increase the use of xenon gas in various industries, which is positively influencing the xenon gas market outlook. Originally confined to lighting solutions and aerospace, the applications extend to medical imaging, satellite communication, and semiconductor manufacturing due to its unique properties like high density, excellent insulating characteristics, and the ability to produce bright, flicker-free light. The development of advanced ion propulsion systems for spacecraft, which utilize this product as a propellant, exemplifies its critical role in enabling extended space missions. Moreover, its application in medical imaging technologies highlights its growing importance in non-invasive surgical procedures and diagnostics, thereby fueling its demand. Additionally, the semiconductor industry experienced significant growth, with global sales reaching approximately USD 600 Billion in 2023, marking a 10% year-on-year increase, an industrial report stated. This surge in sales drives demand for xenon in semiconductor manufacturing, particularly in plasma etching processes, which are vital for creating microelectronic devices.Market Expansion in Emerging Economies

The global shift towards high-tech manufacturing and increased industrialization in emerging economies is a substantial factor propelling the xenon gas market demand. According to an industrial report, in 2023, China was the largest producer of electronics, accounting for over 30% of global production, significantly impacting the demand for xenon gas in industries such as electronics, aerospace, and automotive. Countries like India and Brazil are witnessing rapid industrial growth, thereby experiencing heightened demand for electronics, aerospace, and automotive industries, which are significant consumers of this gas. This increases the applications in these sectors, including high-intensity lighting, insulation, and as a propellant in satellite propulsion systems. The economic development in these regions is fostering investments in infrastructure, healthcare, and research, further amplifying the usage of xenon. Consequently, the expanding industrial base, coupled with supportive government initiatives promoting technological advancements, is expected to drive the market's growth.Supply Chain and Raw Material Price Fluctuations

According to the xenon gas price trends, trade policies and economic conditions can impact the raw material prices and availability, influencing the market's overall stability. Xenon is obtained as a byproduct of the air separation process used to produce oxygen and nitrogen. According to an industrial report, in 2023, the global supply of xenon gas from air separation units was 10-15% lower than in previous years due to fluctuations in the demand for oxygen and nitrogen in various industries. Therefore, its availability is closely tied to the operational rates of air separation units, which are influenced by the demand for oxygen and nitrogen in various industries. Fluctuations in the production of these primary gases can lead to variability in xenon supply, subsequently affecting its price. Additionally, the geopolitical scenario, trade policies, and economic conditions can impact raw material prices and availability, influencing the market's overall stability. Supply chain robustness, coupled with strategic stockpiling and diversified sourcing, becomes crucial for manufacturers to mitigate the risks associated with supply disruptions and price volatility.Xenon Gas Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on distribution channel and end-user.Analysis by Distribution Channel:

- Packaged

- Merchant

- On-Site

Analysis by End-User:

- Imaging and Lighting

- Automotive and Transportation

- Aviation and Aerospace

- Healthcare

- Others

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

Key Regional Takeaways:

United States Xenon Gas Market Analysis

The United States holds a substantial share of the North American xenon gas market with 87.80% in 2024. The U.S. market for xenon gas is growing due to its uses in different industries, such as aerospace, medical imaging, and lighting. An industrial report states that the demand for xenon gas in the United States grew by 5% in 2023, with the aerospace and semiconductor industries being the biggest users. The country's well-established semiconductor manufacturing sector, with key players such as Intel and Texas Instruments, drives demand for xenon in excimer lasers used in lithography. Another contributing factor is the aerospace sector, especially in satellite propulsion systems, as ion thrusters, which are xenon-based, tend to offer higher efficiency compared to chemical propulsion, which has a direct impact on the demand for xenon. Also, the country's focus on and investment in medical imaging technologies such as x-ray-enhanced MRI contributes to the growth of the market. Some of the dominant market leaders in the region, such as Air Products and Praxair, are investing in new manufacturing technologies to secure supply lines and decrease dependence on imports. The market growth in the United States us further augmented by expanding applications in luxury lighting and automotive sectors.Europe Xenon Gas Market Analysis

The European market for xenon gas is expanding, spurred by technological and medical application breakthroughs. In a report by the European Space Agency, the EU spent EUR 3.8 Billion (USD 4.2 Billion) in 2023 on space missions, propelling demand for xenon employed in ion engines. Germany, France, and the United Kingdom are key contributors due to their advanced semiconductor industries, where xenon is essential for deep ultraviolet (DUV) lithography processes. The medical imaging industry is also a heavy user, with nations spending money on new MRI machines. Demand from high-end lighting applications is also a driving force behind the need for xenon, with the European automotive market prioritizing LED technology. Dominant players like Linde and Air Liquide control the European market. They are increasingly moving toward environmentally friendly production techniques, and the European Commission's green deal incentivizes the production of eco-friendly processes. Moreover, Europe's dedication to promoting energy-efficient technology guarantees a solid demand for xenon gas and makes it one of the primary players in the international market.Asia Pacific Xenon Gas Market Analysis

The Asia Pacific xenon gas market is growing rapidly, fueled by the high-flying semiconductor and aerospace industries in the region. Japan's space program, as reported by the Japan Aerospace Exploration Agency, spent JPY 154.8 Billion (about USD 1.05 Billion) in fiscal year 2024, with a large amount going towards space missions that use xenon for ion propulsion systems. In China, the medical imaging market is growing fast, with huge investments in MRI systems, such as the large-scale production of locally developed MRI equipment in 2023. The semiconductor manufacturing industry in the region, especially in South Korea and Taiwan, also depends heavily on xenon for etching purposes. The increase in disposable incomes in developing countries such as India and China further increase the need for xenon in premium lighting applications, particularly in high-end automotive markets. Top players in the region, such as Taiyo Nippon Sanso and Messer, are investing significantly in expanding xenon production capacity to cater to the increasing demand.Latin America Xenon Gas Market Analysis

Latin America's market for xenon gas is on the rise as a result of space technology and defense upgrade investments. In 2023, Brazil's defense spending accounted for USD 21.8 Billion, much of which was allocated to boosting its space capabilities, such as satellite initiatives that use xenon for propulsion, as per reports. The other factor furthering the need for xenon for space exploration comes from the increase in investment being made towards space agencies operating within the region, including the Brazil National Institute for Space Research (INPE). According to reports, more than 20,822 firearm permits have been licensed within Brazil, providing a driving need for xenon within lighting that is at an upscale level. Argentina and Chile are also raising their investments in space programs, emphasizing satellite technology, further fueling the demand for xenon in the region. The increasing middle class and rising penetration of smartphones in the region make it easier to establish digital platforms for space-based services, further driving overall market growth.Middle East and Africa Xenon Gas Market Analysis

The market in the Middle East and Africa is driven by increased healthcare applications such as xenon-enhanced MRI and anesthesia gaining traction. In the Middle East and Africa, the demand for xenon closely follows the increasing space exploration activities as well as defense expenditures. According to an industrial report, the Middle East's space industry is anticipated to rise to USD 75 Billion by 2032. This surge comes from investments in satellite technology, space exploration, and advanced propulsion systems, which all depend on xenon. According to an industry report, Saudi Arabia, whose defence budget for 2022 was USD 75.01 Billion, continues to place a focus on military modernization, including the acquisition of space-based technologies. In Africa, nations such as South Africa are developing their space programs and supporting industries, thus driving the demand for xenon in propulsion systems and satellite construction. Also, the UAE and other Gulf states are promoting cooperation with international space agencies, establishing themselves as major players in the regional and international space markets.Competitive Landscape:

The key players in the xenon gas market are actively engaged in expanding their production capacities, enhancing their technological capabilities, and forming strategic partnerships to meet the growing global demand. They are investing in advanced purification and recycling technologies to improve yield and reduce costs, ensuring a stable supply of high-purity xenon gas for various high-tech applications. These companies are also focusing on expanding their global footprint through collaborations, mergers, and acquisitions to strengthen their market presence and to capitalize on emerging opportunities in sectors like aerospace, electronics, and healthcare. Their efforts are geared towards innovation, sustainability, and meeting the stringent quality standards required in diverse end-use industries.The report provides a comprehensive analysis of the competitive landscape in the xenon gas market with detailed profiles of all major companies, including:

- Airgas

- Air Liquide

- Linde

- Messer

- Praxair

- Air Water

- American Gas

- BASF

- Core Gas

- Matheson Tri-Gas

- Proton Gas

Key Questions Answered in This Report

1. How big is the xenon gas market?2. What is the future outlook of the xenon gas market?

3. What are the key factors driving the xenon gas market?

4. Which region accounts for the largest xenon gas market share?

5. Which are the leading companies in the global xenon gas market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Properties

4.3 Key Industry Trends

5 Global Xenon Gas Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Breakup by Distribution Channel

5.5 Market Breakup by End-User

5.6 Market Breakup by Region

5.7 Market Forecast

5.8 SWOT Analysis

5.8.1 Overview

5.8.2 Strengths

5.8.3 Weaknesses

5.8.4 Opportunities

5.8.5 Threats

5.9 Value Chain Analysis

5.10 Porters Five Forces Analysis

5.10.1 Overview

5.10.2 Bargaining Power of Buyers

5.10.3 Bargaining Power of Suppliers

5.10.4 Degree of Competition

5.10.5 Threat of New Entrants

5.10.6 Threat of Substitutes

5.11 Price Analysis

5.11.1 Key Price Indicators

5.11.2 Price Trends

5.11.3 Margin Analysis

6 Market Breakup by Distribution Channel

6.1 Packaged

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Merchant

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 On-Site

6.3.1 Market Trends

6.3.2 Market Forecast

7 Market Breakup by End-User

7.1 Imaging and Lighting

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Automotive and Transportation

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Aviation and Aerospace

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Healthcare

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 Others

7.5.1 Market Trends

7.5.2 Market Forecast

8 Market Breakup by Region

8.1 Asia Pacific

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 North America

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Europe

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Middle East and Africa

8.4.1 Market Trends

8.4.2 Market Forecast

8.5 Latin America

8.5.1 Market Trends

8.5.2 Market Forecast

9 Xenon Gas Production

9.1 Product Overview

9.2 Raw Material Requirements

9.3 Production

9.4 Key Success and Risk Factors

10 Competitive Landscape

10.1 Market Structure

10.2 Key Players

10.3 Profiles of Key Players

10.3.1 Airgas

10.3.2 Air Liquide

10.3.3 Linde

10.3.4 Messer

10.3.5 Praxair

10.3.6 Air Water

10.3.7 American Gas

10.3.8 BASF

10.3.9 Core Gas

10.3.10 Matheson Tri-Gas

10.3.11 Proton Gas

List of Figures

Figure 1: Global: Xenon Gas Market: Major Drivers and Challenges

Figure 2: Global: Xenon Gas Market: Volume Trends (in Million Liters), 2019-2024

Figure 3: Global: Xenon Gas Market: Value Trends (in Million USD), 2019-2024

Figure 4: Global: Xenon Gas Market: Breakup by Distribution Channel (in %), 2024

Figure 5: Global: Xenon Gas Market: Breakup by End-User (in %), 2024

Figure 6: Global: Xenon Gas Market: Breakup by Region (in %), 2024

Figure 7: Global: Xenon Gas Market Forecast: Volume Trends (in Million Liters), 2025-2033

Figure 8: Global: Xenon Gas Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 9: Global: Xenon Gas Industry: SWOT Analysis

Figure 10: Global: Xenon Gas Industry: Value Chain Analysis

Figure 11: Global: Xenon Gas Industry: Porter’s Five Forces Analysis

Figure 12: Global: Xenon Gas Market: Packaged (in Million Liters), 2019 & 2024

Figure 13: Global: Xenon Gas Market Forecast: Packaged (in Million Liters), 2025-2033

Figure 14: Global: Xenon Gas Market: Merchant Sales (in Million Liters), 2019 & 2024

Figure 15: Global: Xenon Gas Market Forecast: Merchant Sales (in Million Liters), 2025-2033

Figure 16: Global: Xenon Gas Market: On-Site Sales (in Million Liters), 2019 & 2024

Figure 17: Global: Xenon Gas Market Forecast: On-Site Sales (in Million Liters), 2025-2033

Figure 18: Global: Xenon Gas (Imaging and Lighting Sector) Market: Volume Trends (in Million Liters), 2019 & 2024

Figure 19: Global: Xenon Gas (Imaging and Lighting Sector) Market Forecast: Volume Trends (in Million Liters), 2025-2033

Figure 20: Global: Xenon Gas (Automotive and Transportation Sector) Market: Volume Trends (in Million Liters), 2019 & 2024

Figure 21: Global: Xenon Gas (Automotive and Transportation Sector) Market Forecast: Volume Trends (in Million Liters), 2025-2033

Figure 22: Global: Xenon Gas (Aviation and Aerospace Sector) Market: Volume Trends (in Million Liters), 2019 & 2024

Figure 23: Global: Xenon Gas (Aviation and Aerospace Sector) Market Forecast: Volume Trends (in Million Liters), 2025-2033

Figure 24: Global: Xenon Gas (Healthcare Sector) Market: Volume Trends (in Million Liters), 2019 & 2024

Figure 25: Global: Xenon Gas (Healthcare Sector) Market Forecast: Volume Trends (in Million Liters), 2025-2033

Figure 26: Global: Xenon Gas (Other End-Users) Market: Volume Trends (in Million Liters), 2019 & 2024

Figure 27: Global: Xenon Gas (Other End-Users) Market Forecast: Volume Trends (in Million Liters), 2025-2033

Figure 28: Asia Pacific: Xenon Gas Market: Volume Trends (in Million Liters), 2019 & 2024

Figure 29: Asia Pacific: Xenon Gas Market Forecast: Volume Trends (in Million Liters), 2025-2033

Figure 30: North America: Xenon Gas Market: Volume Trends (in Million Liters), 2019 & 2024

Figure 31: North America: Xenon Gas Market Forecast: Volume Trends (in Million Liters), 2025-2033

Figure 32: Europe: Xenon Gas Market: Volume Trends (in Million Liters), 2019 & 2024

Figure 33: Europe: Xenon Gas Market Forecast: Volume Trends (in Million Liters), 2025-2033

Figure 34: Middle East and Africa: Xenon Gas Market: Volume Trends (in Million Liters), 2019 & 2024

Figure 35: Middle East and Africa: Xenon Gas Market Forecast: Volume Trends (in Million Liters), 2025-2033

Figure 36: Latin America: Xenon Gas Market: Volume Trends (in Million Liters), 2019 & 2024

Figure 37: Latin America: Xenon Gas Market Forecast: Volume Trends (in Million Liters), 2025-2033

Figure 38: Xenon Gas Production: Detailed Process Flow

List of Tables

Table 1: Xenon Gas: General Properties

Table 2: Global: Xenon Gas Market: Key Industry Highlights, 2024 and 2033

Table 3: Global: Xenon Gas Market Forecast: Breakup by Distribution Channel (in Million Liters), 2025-2033

Table 4: Global: Xenon Gas Market Forecast: Breakup by End-User (in Million Liters), 2025-2033

Table 5: Global: Xenon Gas Market Forecast: Breakup by Region (in Million Liters), 2025-2033

Table 6: Xenon Gas: Raw Material Requirements

Table 7: Global: Xenon Gas Market: Competitive Structure

Table 8: Global: Xenon Gas Market: Key Players

Companies Mentioned

- Airgas

- Air Liquide

- Linde

- Messer

- Praxair

- Air Water

- American Gas

- BASF

- Core Gas

- Matheson Tri-Gas

- Proton Gas

Table Information

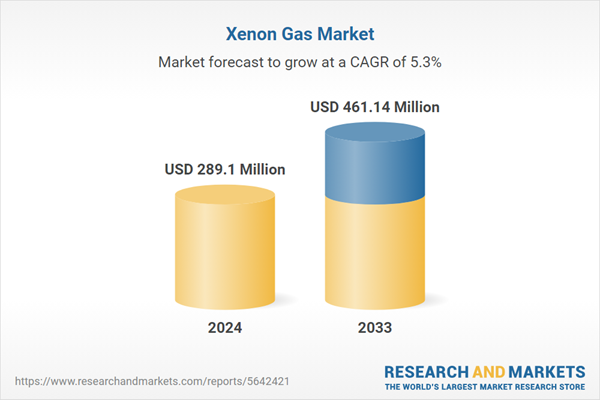

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 289.1 Million |

| Forecasted Market Value ( USD | $ 461.14 Million |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |