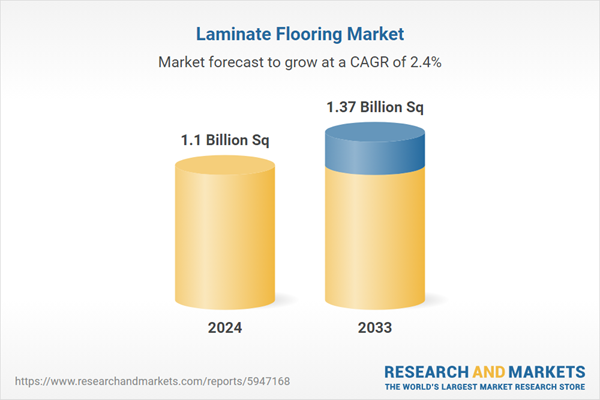

Laminate flooring refers to a synthetic flooring material comprised of multiple layers fused together using a lamination process. It is manufactured using foam, cork, aluminum oxide, rubber, thermosetting resins, and fiberboards. Laminate flooring is widely used in households, commercial spaces, educational institutions, rental properties, retail stores, exhibition and event spaces, hotels, resorts, and government buildings. It is a cost-effective, versatile, and highly durable product that requires low maintenance, offers long service life, and exhibits resistance against moisture and stains. Laminate flooring helps to reduce the risk of allergies due to its smooth and sealed surface that does not trap dust, pet danders, and allergens.The global laminate flooring market is expected to expand at a larger CAGR during the forecast period. The increasing number of home renovation activities across the globe is one of the key factors driving the market growth. Laminate flooring is widely used in home renovation and improvement activities due to its user-friendliness and simplified installation process. Moreover, the increasing emphasis on flooring designs, colors, and aesthetics is facilitating product demand. Laminate flooring provides a wide range of customization options enabling users to align their flooring choices with contemporary and trendy designs. Apart from this, the increasing consumer awareness regarding various product benefits, such as high impact resistance, easy installation, and extended service life, is supporting the market growth. Other factors, including rapid urbanization activities, growing expenditure capacities of consumers, the emerging do-it-yourself (DIY) trend and easy product availability across various online retail platforms, are anticipated to drive the market growth.

Laminate Flooring Market Trends/Drivers

The significant growth in the construction industry

Laminate flooring finds extensive applications in the construction of residential and commercial spaces. It is widely used in living rooms, bathrooms, hallways, retail stores, offices, restaurants, and hotels due to its cost-effectiveness, low maintenance, high durability, and excellent resistance against scratches and stains. Laminate flooring also enhances the aesthetic appeal of the space and complements interior décor by replicating the appearance of various materials, such as wood, stone, and tiles. Moreover, it is readily available in a wide range of colors, sizes, and designs, which allows users to create a cohesive and personalized look that harmonizes with the overall design scheme of the house. Apart from this, the widespread product utilization in educational institutions and healthcare facilities due to its ability to withstand high foot traffic and maintain a cleaner environment is acting as another growth-inducing factor.The rising demand for eco-friendly flooring options

The rising demand for eco-friendly flooring options due to increasing environmental concerns is providing an impetus to the market growth. Laminate flooring can mimic the appearance of natural wood and stones, which aids in minimizing deforestation activities and overutilization of resources. Furthermore, it can be manufactured using recycled materials which assist in reducing waste generation and promoting sustainability. In addition to this, several manufacturers are producing laminate flooring with low volatile organic compound (VOC) emission levels that can be used in hospitals, schools, universities, gyms, and sports facilities to create a cleaner and healthier indoor environment.Extensive research and development (R&D) activities

The laminate flooring market has witnessed extensive R&D activities aimed at enhancing the performance, aesthetics, and sustainability of the products. In line with this, the utilization of high-definition (HD) printing to produce laminate flooring with highly detailed, intricate patterns, and vibrant colors at affordable prices is contributing to the market growth. Moreover, the recent development of embossed-in-register (EIR) technology that allows manufacturers to create realistic textures that closely mimic the feel and look of natural materials, thus, improving the visual and tactile experience of laminate flooring, is supporting the market growth. Apart from this, the introduction of innovative installation systems, such as click-lock and snap-together systems, which facilitate easy and precision installation without the requirement of adhesives or nails, is positively influencing the market growth.Laminate Flooring Industry Segmentation

This report provides an analysis of the key trends in each segment of the global laminate flooring market report, along with forecasts at the global, regional, and country levels from 2025-2033. The report has categorized the market based on type and sector.Breakup by Type

- HDF Laminates

- MDF Laminates

The report has provided a detailed breakup and analysis of the laminate flooring market based on the type. This includes HDF and MDF laminates. According to the report, MDF laminates represented the largest market segment.

Medium-density fiberboard (MDF) laminates hold a majority share in the market owing to their cost-effectiveness and smooth and uniform surface, which allows for consistent adhesion of laminate sheets, thus enabling a seamless finish and enhancing the visual appearance of the product. Furthermore, MDF laminates offer excellent versatility in design as they can mimic the appearance of different materials, such as wood grains and solid colors. Moreover, they provide good dimensional stability, which is less prone to warping or swelling due to changes in humidity or temperature. Apart from this, the ease of installation, machinability, and printability of MDF laminates allows greater design flexibility and customization options, which, in turn, is facilitating their demand across the globe.

Breakup by Sector

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the laminate flooring market based on the sector. This includes residential and commercial. According to the report, residential represented the largest market segment.

The residential sector is dominating the laminate flooring market owing to the increasing construction of houses, apartments, and residential complexes. Furthermore, the widespread product adoption in home renovation and improvement activities to enhance the appearance, aesthetics, and functionality of living spaces is acting as another growth-inducing factor. Moreover, the easy availability of a diverse range of design options, including colors, patterns, and texture, which allow homeowners to choose flooring styles that best suit their personal preferences and complement their interior décor, is contributing to the market growth. Additionally, the rising disposable incomes and increasing urbanization activities are favoring the market growth. Apart from this, the emerging do-it-yourself (DIY) trends in residential settings are facilitating product demand due to its cost-effectiveness, ease of installation, and lower maintenance.

Breakup by Region

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which includes Asia Pacific, North America, Europe, Latina America, and the Middle East and Africa. According to the report, Asia Pacific represented the largest market segment.

Asia Pacific represents a leading market for laminate flooring due to the increasing construction activities. In line with this, laminate flooring is widely selected as a cost-effective, durable, and user-friendly flooring material in residential, commercial, and industrial projects. Furthermore, the presence of a large customer base, owing to the growing expenditure capacities of consumers and rapid urbanization activities in the region, is acting as another growth-inducing factor. Moreover, the increasing investments by regional governments in infrastructural development projects, such as railway stations, airports, supermarkets, shopping malls, educational institutions, and healthcare facilities, are providing an impetus to the market growth. Along with this, regional governments are providing favorable policies to encourage product manufacturers to expand their operations and develop strong export capabilities.

Competitive Landscape

The global laminate flooring market is experiencing steady growth due to increasing construction activities across the globe. Several key market players are focusing on product innovations to create new patterns, textures, and finishes that imitate various natural materials, such as wood and stone. Furthermore, the growing emphasis by leading producers on product quality, durability, and performance to increase customer satisfaction and gain competitive advantage is acting as another growth-inducing factor. Moreover, top companies are actively engaged in forming new partnerships and collaborating with retailers, contractors, and other industry stakeholders to expand their global footprint, increase sales, and attract new customers. Apart from this, aggressive promotional and branding activities by manufacturers through social media campaigns, paid advertisements, and trade shows are positively influencing the market growth.The report has provided a comprehensive analysis of the competitive landscape in the global laminate flooring market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Mohawk Industries, Inc.

- Tarkett SA

- Armstrong World Industries, Inc.

- Shaw Industries, Inc.

- Mannington Mills, Inc.

- Beaulieu International Group

Key Questions Answered in This Report

1. How big is the global laminate flooring market?2. What is the expected growth rate of the global laminate flooring market during 2025-2033?

3. What are the key factors driving the global laminate flooring market?

4. What has been the impact of COVID-19 on the global laminate flooring market?

5. What is the breakup of the global laminate flooring market based on the type?

6. What is the breakup of the global laminate flooring market based on the sector?

7. What are the key regions in the global laminate flooring market?

8. Who are the key players/companies in the global laminate flooring market?

Table of Contents

Companies Mentioned

- Mohawk Industries Inc.

- Tarkett SA

- Armstrong World Industries Inc.

- Shaw Industries Inc.

- Mannington Mills Inc.

- Beaulieu International Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 141 |

| Published | February 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value in 2024 | 1.1 Billion Sq |

| Forecasted Market Value by 2033 | 1.37 Billion Sq |

| Compound Annual Growth Rate | 2.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 6 |