COVID-19 highly impacted industry growth owing to the temporary halt on production facilities. However, the growing pulp and paper industry in developing countries has propelled the demand for alkylamines post-pandemic.

Key Highlights

- The growing demand for alkylamines as solvents in the paints and coatings industry globally is expected to drive demand for the market during the forecast period.

- Regional governments and organizations that put limits on emissions in the transportation sector are likely to slow the growth of the market.

- In the future, the market should benefit from the fact that there are more and more new ideas in the pharmaceutical industry.

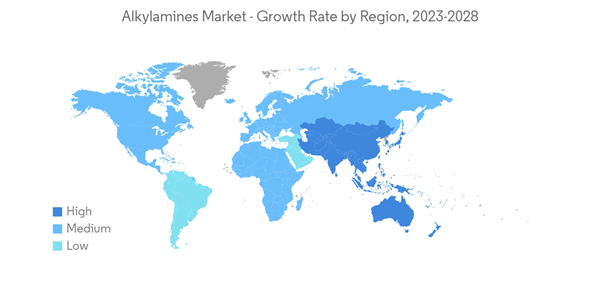

- Asia Pacific dominated the global alkylamines market owing to their surging application in the paint and coatings industry.

Alkylamines Market Trends

Growing Demand of Solvent in the Paints and Coatings Industry

- Alkylamines are primarily employed in the formulation of paints and coatings as solvents.

- Due to the growth of industries like automotive, machinery, and construction, there is a growing need for paints and coatings right now.

- Big companies in the paint and coatings business are growing and putting most of their attention on developing economies around the world.This is mostly because the demand for new buildings and other industrial uses is growing in developing countries.

- Solvents are being used in more and more paints and coatings because paints are getting better, the market is getting more and more competitive, and customer tastes are changing.

- The global paint and coatings industry will be worth approximately USD 160 billion in 2021. It is forecast to reach around USD 235 billion by 2029. The market is mainly driven by increasing demand in the construction industry, with the wood, general industrial, automotive, coil, aerospace, railing, and packaging coatings markets also driving demand growth.

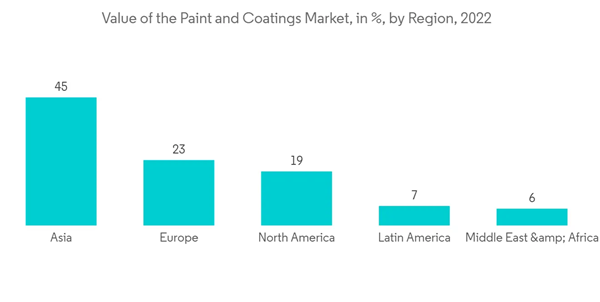

- In 2022, Asia was the world's largest paint and coatings market, with a market share of approximately 45 percent. Europe and North America came next, each with a 23 and 19 percent share of the market.

- The building and construction industry is the largest end-user industry for paints and coatings. The Chinese government has projected the capital expenditure in construction to be over 7% higher than the previous years.

- According to Nippon Paint Group, China’s overall paints and coatings market was valued at USD 46.7 billion in 2021. In 2021, Chinese manufacturers of architectural coatings will have made 7.14 million metric tons of architectural coatings, which is more than 13% more than when COVID-19 hit in 2020.

- The Indian paint industry is worth over INR 62,000 crores (USD 8 billion) and is the fastest-growing major paint economy in the world, with consistent double-digit growth over the last two decades.

- All of these things should make more people want to use paints and coatings (solvents) in the coming years. This, in turn, is expected to drive demand for the alkylamines during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominated the global market share. With the growing demand for paints and coatings and the growing pharmaceutical industries in countries such as China, India, Japan, and South Korea, the usage of alkylamines is increasing in the region.

- China is the largest producer and consumer of alkylamines and accounts for a large chunk of the global capacity.

- China's pharmaceutical market is the second largest in the world. It is expected to reach USD 145 billion by 2024, which is a CAGR of 3.4% over the period of the forecast.

- During the period of the forecast, the Indian rubber industry is expected to grow at a CAGR of 2.5%, from 1.11 million metric tons of rubber now to 1.26 million metric tons in 2023. This will increase the demand for alkylamines in India.

- Also, the growing paper and pulp industries in China and India are a big driver of the alkylamines business.The market size of China's paper and paperboard manufacturing industry grew by five percent in 2022 to USD 217.5 billion.

- Asia-Pacific consumes more than three-fourths of the world's total alkylamine consumption. Hence, the developing countries of Asia-Pacific are expected to be the prime drivers of growth for the alkylamines market through the forecast period.

Alkylamines Industry Overview

The alkylamines market is partially fragmented. The key players in the allkylamines market include BASF SE, Alkyl Amines Chemicals Ltd, Dow, Eastman Chemical Company, and Hutsman Internetional LLC, among others (not in any particular order).Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Deliverables

1.2 Study Assumptions

1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Drivers

4.1.1 Growing Demand as Solvent in the Paints and Coatings Industry

4.1.2 Growing Pulp and Paper Industry in Developing Countries

4.2 Restraints

4.2.1 Emission Restrictions in the Transportation Sector by Various Governments

4.3 Industry Value-Chain Analysis

4.4 Porter's Five Forces Analysis

4.4.1 Threat of New Entrants

4.4.2 Bargaining Power of Consumers

4.4.3 Bargaining Power of Suppliers

4.4.4 Threat of Substitute Products/Services

4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value)

5.1 Product Type

5.1.1 Methylamines

5.1.2 Ethylamines

5.1.3 Propylamines

5.1.4 Butylamines

5.1.5 Cyclohexylamines

5.2 Application

5.2.1 Solvent

5.2.2 Rubber

5.2.3 Agrochemical

5.2.4 Paper Chemicals

5.2.5 Fuel Additives

5.2.6 Pharmaceuticals

5.2.7 Other Applications

5.3 Geography

5.3.1 Asia-Pacific

5.3.1.1 China

5.3.1.2 India

5.3.1.3 Japan

5.3.1.4 South Korea

5.3.1.5 Rest of Asia-Pacific

5.3.2 North America

5.3.2.1 United States

5.3.2.2 Mexico

5.3.2.3 Canada

5.3.3 Europe

5.3.3.1 Germany

5.3.3.2 United Kingdom

5.3.3.3 France

5.3.3.4 Italy

5.3.3.5 Rest of Europe

5.3.4 South America

5.3.4.1 Brazil

5.3.4.2 Argentina

5.3.4.3 Rest of South America

5.3.5 Middle East & Africa

5.3.5.1 United Arab Emirates

5.3.5.2 Saudi Arabia

5.3.5.3 Rest of Middle East & Africa

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share (%)**/Ranking Analysis

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 Akzo Nobel NV

6.4.2 Alkyl Amines Chemicals Ltd.

6.4.3 Arkema Group

6.4.4 BASF SE

6.4.5 Eastman Chemical Company

6.4.6 Hutsman International LLC

6.4.7 Kao Corporation

6.4.8 Mitsubishi Chemical Corporation

6.4.9 Procter & Gamble

6.4.10 Solvay

6.4.11 Dow

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Innovations in the Pharmaceutical Sector

7.2 Other Opportunities

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Akzo Nobel NV

- Alkyl Amines Chemicals Ltd.

- Arkema Group

- BASF SE

- Eastman Chemical Company

- Hutsman International LLC

- Kao Corporation

- Mitsubishi Chemical Corporation

- Procter & Gamble

- Solvay

- Dow