Due to the COVID-19 pandemic, the number of visits to hospitals and clinics for dental purposes has decreased, leading to a dampening of the demand for dental consumables. Dental companies across the world showed a significant dip in income, contrary to growth rates delivered in the past decade. Dental procedures were reduced during the pandemic as it was considered one of the most potent sources of viral transmission. According to a study published in PubMed Central in June 2021, a study showed that over 92.3% of dental specialists were reluctant to treat a patient suspected or confirmed with COVID-19 infection. This shows that the COVID-19 pandemic disrupted dental services in its initial phase. Thus, owing to the ongoing COVID-19 pandemic and the high risk of viral transmission through dental procedures, the dental cement market was significantly impacted during the initial pandemic phase. However, as the pandemic has subsided currently, dental visits have increased, so the studied market is expected to have stable growth during the forecast period of the study.

The dental cement market is expected to witness steady growth due to an increase in the number of patients with teeth discoloration, gaps between teeth, misalignment of teeth, etc. The number of dental cavities cases is increasing across the world. The primary cause for these is poor oral hygiene status and the aging of the population. Thus, the increase in the number of public health awareness programs will likely promote the importance of proper oral hygiene and educate consumers on dental caries, which will drive the demand for dental cement as it is used to fill the gaps between restorations and natural teeth. For instance, according to the WHO update in March 2022, 3.5 billion people are estimated to have oral diseases across the globe.

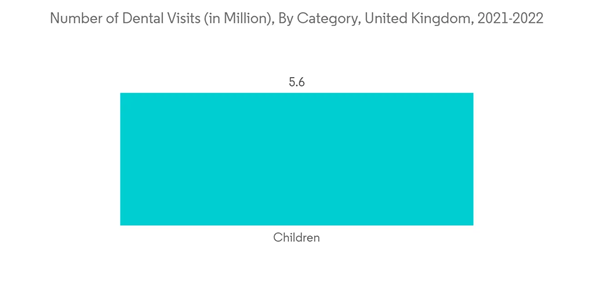

Additionally, the increasing dental caries in children is a major factor driving the growth of the market. For instance, according to an article published by the Journal of Dental Problems and Solutions in January 2022, a study was conducted in Macedonia which showed that the prevalence of dental caries within 12-year old children was 63.92%. Furthermore, the rising geriatric population and an increasing number of dental clinics and practitioners providing large-level dental care services are the other factors driving the growth of the dental cement market. According to the data by UN in 2022, the share of the global population aged 65 years or above is projected to rise from 10% in 2022 to 16% in 2050. It is also estimated that by 2050, the number of persons aged 65 years or over worldwide is projected to be more than twice the number of children under age 5 and about the same as the number of children under age 12. Oral health is directly linked to aging, hence as the geriatric population is expected to witness an increasing trend in the coming years, globally, the demand for dental procedures is also expected to surge, which, in turn, leads to the healthy growth of the dental cement market over the forecast period.

Furthemore, product launches by key market players are also enahancing the market growth. For instance, in May 2022, KPower Bhd’s 70%-owned subsidiary Granulab (M) Sdn Bhd launched Prosteomax, a halal-certified synthetic bone cement. Prosteomax has been certified halal by the Malaysian Islamic Development Department and registered with the Malaysian Medical Device Authority for use in orthopedics, cranio, dental, and maxillofacial applications.

Therefore, owing to the aforementioned factors such as increase in the number of patients with teeth discoloration, gaps between teeth, misalignment of teeth, increasing dental caries in children, the rising geriatric population, increasing number of dental clinics and practitioners providing large-level dental care services, and product launches by key market players, the studied market is anticipated to witness growth over the analysis period. However, the high operational costs for dental procedures and implant failures caused by cement are likely to impede the market's growth.

Key Market Trends

Zinc Phosphate Segment Anticipated to Register A Significant Growth Over the Forecast Period

Zinc phosphate cement is a widely used cement for luting permanent metal restorations. The segment is expected to witness good growth due to benefits associated with it, such as a high-strength cement base when mixed with zinc oxide powder and phosphoric acid liquid. There are many other uses of this cement, including the cementation of inlays, crowns, bridges, and orthodontic appliances and occasionally as a temporary restoration. Zinc phosphate has a significant amount of clinical success associated with its long-term usage.According to an article published by the Journal of Pharmacy & Bioallied Sciences in July 2022, a broad spectrum of luting agents are used to bond and seal restorations to teeth, and the most popular among them is zinc phosphate cement. Additionally, according to the data published by Inside Dentistry in August 2022, zinc phosphate is considered a standard with which other dental cement are compared and it is a very useful luting agent for many indirect dental restorations.

Furthermore, the increasing prevalence of dental caries among children and adults, and the increasing need for dental restorations are expected to boost the adoption of zinc phosphate cement. For instance, according to an article published by the Nigerian Journal of Basic and Clinical Sciences in May 2021, a study was conducted in Nigeria which showed that the prevalence of dental caries among adults in Nigeria was high, with many untreated new and recurrent caries.

Hence, due to aforementioned factors such as the advantages of zinc phosphate cement, the rising dental visits, and the increasing prevalence of dental caries among children and adults, the segment is expected to experience growth during the forecast period of the study.

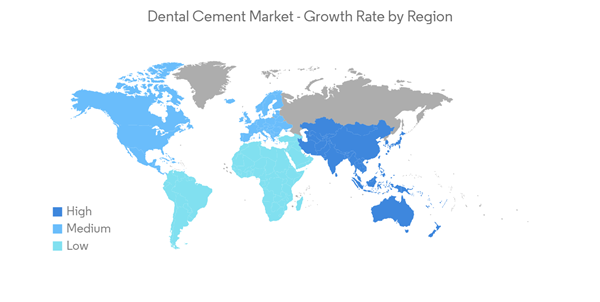

North American Region is Expected to Hold a Significant Share in the Dental Cement Market Over the Forecast Period

The increasing number of tooth cavities and tooth decay problems are considered to be the most common health problems witnessed by the North American population.According to the data from the National Institute of Dental and Craniofacial Research in August 2021, an estimated 42.2% of adults 30 years or older in the United States had total periodontitis, consisting of 7.8% with severe periodontitis and 34.4% with nonsevere periodontitis. The prevalence of nonsevere (mild or moderate) periodontitis increased with age. Moreover, there has been a steady increase in the geriatric population in the region that requires regular dental check-ups and health assistance. The well-developed healthcare infrastructure and technological advancements are the factors driving the growth of the market.

The increasing number of dentists and dental offices in Canada is also expected to enhance market growth. For instance, according to the data published by the Canadian Dental Association in September 2022, there are approximately 25,500 licensed dentists in Canada in 2022 which stands for 65 dentists for every 100,000 Canadians. They are operating in roughly 16,000 dental offices in Canada.

Furthermore, key product launches by major players in the region are enhancing the market growth. For instance, in June 2022, Parkell, a United States-based company, launched the Predicta Bioactive Cement, which is formulated to fill and seal micro gaps with robust hydroxyapatite formation at the margin, thereby alleviating or preventing microleakage. It combines the properties and performance of premium universal resin cement with bioactivity and this cement gives crown margins unprecedented protection against secondary caries.

Hence, due to aforementioned factors such as the increasing prevalence of oral diseases, increasing number of dentists and dental offices, and key product launches by major players, the North America region of the market is expected to experience growth.

Competitive Landscape

The Dental Cement market is moderately fragmented in nature. The market players are focusing on expanding their dental cement product portfolio, primarily by improving their existing product portfolios, along with continuous innovations in the dental restorative material. The key market players are Dentsply Sirona, Ivoclar Vivadent AG, BISCO Inc., Shofu Dental Corporation, and 3M.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M

- Dentsply Sirona

- Ivoclar Vivadent AG

- Shofu Dental Corporation

- BISCO Inc.

- SDI Limited

- DMG Chemisch-Pharmazeutische Fabrik GmbH

- FGM Produtos Odontolgicos

- Envista Holdings Corporation

- Medental International Inc.

- Bombay Burmah Trading Corporation (Dental Products of India)

- Prime Dental Products Pvt. Ltd

- DETAX Ettlingen