With COVID-19, many regulatory bodies like the United States Food and Drug Administration (FDA) have deemed it necessary to maintain adequate sterilization that can facilitate the rapid turnaround of sterilized or disinfected medical devices, raw materials, and packaging to help reduce the contamination and ensure the safety of the novel diagnostic tests and drugs developed for the treatment and management of COVID-19. As per the study published in November 2021, titled "Infection prevention and surgery in the pandemic era" this article has reviewed the measures that have been implemented and have helped infection control in surgery, such as testing, patient isolation, personal protective equipment, and ventilation. Additionally, during COVID-19 pandemic, the Eurofins Medical Device Testing network of laboratories has worked to give expert assistance in examining the safety and efficacy of COVID-19-fighting technologies. Thus, during the COVID-19 pandemic, researchers and healthcare practitioners were more focused on bioburden testing, and this tendency is predicted to continue over the projected period.

The major factors boosting the market growth are the high frequency of product recall due to microbial contamination and increasing research and development investments in life sciences. The high potential of microbial contamination and bioburden during pharmaceutical and biologics manufacturing is seen as a major motivator for governments and corporate companies to implement diverse biological safety practices due to consequences like product recall. For instance, in June 2022, Green Pharmaceuticals Inc voluntarily recalled to the consumer level lot 2373/21222 of SnoreStop NasoSpray, packed in 0.3 FL OZ (9ml) bottles. The product recall happened due to microbiological contamination with Providencia rettgeri. Additionally, in March 2022, Plastikon Healthcare, LLC voluntarily recalled three lots of Milk of Magnesia 2400 mg/30 mL Oral Suspension, one lot of Acetaminophen 650mg/ 20.3mL, and six lots of Magnesium Hydroxide 1200mg/Aluminum Hydroxide 1200mg/Simethicone 120mg per 30 mL. The products are being recalled as a result of microbial contamination and a failure to adequately examine failed microbiological testing. Thus, with the increase in the product recall due to microbial contamination the demand for microbial testing is expected to increase over the forecast period.

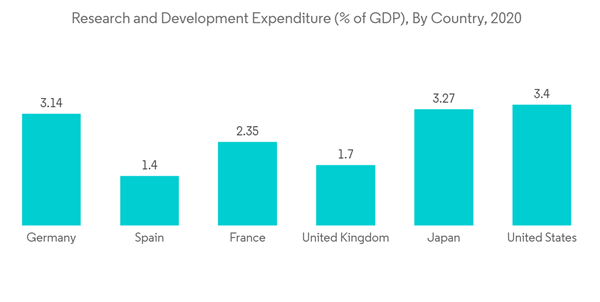

Furthermore, increase in the pharmaceutical research and development is another factor which is contributing to the market growth. For instance, according to the September 2021 data from Pharmaceutical Research and Manufacturers of America (PhRMA), since 2000, PhRMA member companies have invested more than USD 1.1 trillion in the search for new treatments and cures, including USD 102.3 billion in 2021 alone. Furthermore, this R&D expenditure is further expected to increase in coming years, which is likely to contribute to the market growth. Additionally, increasing research and development in the field of life sciences, coupled with huge public and private funding in the sector boost the market growth. The Indian Ministry of Science and Technology allocated a budget of INR 35 billion for the Department of Biotechnology (DBT) of India in the Union Budget for the year 2021-2022, a 25% increase from the 2020-2021 budget, primarily for biotechnology research and development as well as industrial and entrepreneurship development in the country, which will boost the studied market. Hence, all the above-mentioned factors are contributing to the market growth.

However, the high cost of microbial enumeration instruments may restrain the market growth over the forecast period.

Bioburden Testing Market Trends

Polymerase Chain Reaction (PCR) Systems are Expected to Hold the Large Share of the Market

The molecular methods of identifying pathogens are becoming progressively popular, as they offer precise detection at a fraction of the time and effort invested in traditional, culture-based methods. Both the real-time and end-point PCR provide the rapid, sensitive, and highly specific detection of nucleic acids from bacteria, viruses, fungi, and other microbial organisms. There is a positive impact on the segment due to the increasing demand for bioburden testing as the research and development activity for COVID-19 vaccines has increased.Polymerase chain reaction testing is therefore found to be one of the well-established methods for the detection, and quantification of different types of microbial agents in the areas of clinical diagnostics and food safety. PCR-based pathogen detection requires the use of appropriate controls, which aid in result interpretation by identifying adverse factors such as contamination, and inhibition of the amplification reaction.

Moreover, the market players are also adopting various growth strategies, such as frequent product launches, partnerships, and merger and acquisition activities, to gain a competitive edge in the market. For instance, in March 2021 the UgenTecand Hamann Lab entered into a partnership venture for the PCR middleware landscape. Such partnerships by the market players to develop PCR System and strengthen their position in the market is boosting the growth of the market. Hence, all these factors have majorly impacted the overall market growth.

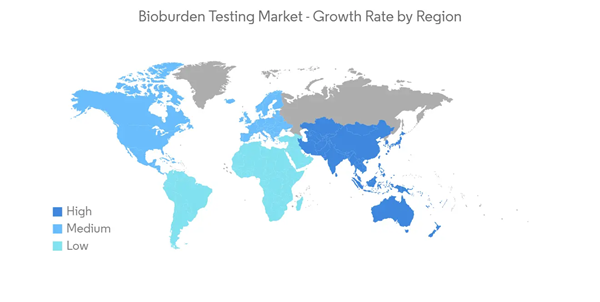

The North American Region Dominates Bioburden Testing Market Over the Forecast Period

North America is the largest market in terms of revenue due to the increasing research and development expenditures, increased number of product recalls, and government initiatives related to the accuracy of the safety process of drugs and devices. The recent outbreak of COVID -19 has also created a huge demand for drug discovery and medical devices, increasing the demand for bioburden testing.Due to the increasing number of drugs and devices recalled, the emerging need for validation of the manufacturing process for drugs and devices is expected to boost the demand for the market studied. For instance, in June 2022, Buzzagogo voluntarily recalled one lot of Allergy Bee Gone for Kids Nasal Swab Remedy due to microbial contamination identified by the FDA as Bacillus cereus, a gram-positive bacterium, as well as high levels of yeast and mold.

According to the data published by the National Center for Biotechnology Information (NCBI), biotechnology funding by the National Institute of Health (NIH), and increasing R&D investments by prominent companies are expected to encourage companies to adopt highly efficient biological testing tools to counter the possible losses caused by contamination. According to the data published in May 2022 by the National Center for Biotechnology Information (NCBI), the National Institutes of Health (NIH) invested around USD 7.77 billion in biotechnology, during the fiscal year 2020. Furthermore, according to figures supplied by the Federation of American Scientists, federal funding for research and development increased 5.9% in 2020 compared to 2019, totaling to USD 138.9 billion. Thus, with growing research and development spending it is expected that the research and development activity is going to increase over the forecast period, thereby boosting the market growth in the region.

Thus, all the above-mentioned factors are expected to boost the market growth in the North American region.

Bioburden Testing Industry Overview

The bioburden testing market consists of several major players such as Becton, Dickinson and Company, Charles River Laboratories Inc., Merck KGaA, Pacific BioLabs Inc., SGS SA, and others. The companies are implementing certain strategic initiatives, such as mergers, new product launches, acquisitions, and partnerships that help them strengthen their market position. For instance, Charles River Laboratories is adopting an innovative technology platform for helping streamline bioburden testing. Additionally, Merck KGaA developed the product for testing bioburden and others, called EZ Fluo Rapid Detection, Ready-to-Use Culture Media.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Becton, Dickinson and Company

- Charles River Laboratories Inc.

- Merck KGaA

- Sotera Health (Nelson Laboratories Inc.)

- Pacific BioLabs Inc.

- SGS SA

- Thermo Fisher Scientific Inc.

- WuXi AppTec Co. Ltd

- North American Science Associates Inc.

- Biomérieux SA

- STERIS Laboratories

- Sartorius AG