The protein ingredients market is expected to register a CAGR of 8.7% during the forecast period (2022-2027).

The COVID-19 outbreak has impacted people’s consumption patterns and purchasing behavior globally. Due to rising health concerns, people have reduced meat and poultry consumption. This protein consumption gap is being filled by protein substitute products, in which protein ingredients are key. The consumption of immunity strengthening products increased globally during the period, further fueling the demand for protein ingredients.

The protein ingredient industry in most of the established markets, such as the United States, witnessed a considerable increase in the consumption of animal proteins in the recent past. A further increase in the consumption of animal protein is anticipated over the next few years.

On the other hand, in terms of plant protein, new compositional research and modified high-moisture extrusion processes are helping in the market's growth. For instance, plant protein-based chocolates, which are free from animal proteins, observe a good demand from consumers who do not consume dairy. Plant-based milk noticed a significant growth in recent years, with an increasing number of people turning to dairy-free options. This innovative product line of ready-to-eat products, with no compromise in taste and texture, has, in turn, boosted the overall plant protein market.

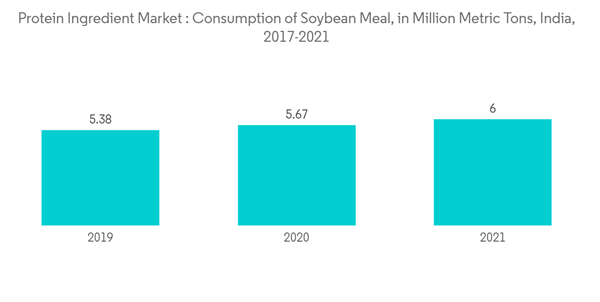

Health management through food has become a trend, and consumers are looking for food and beverage products that will help them treat or prevent specific conditions. In a PDCAAS (protein digestibility-corrected amino acid score) method, which provides protein quality rankings by comparing the amino acid profile of a food protein against a standard amino acid profile, it was found that soy protein has the highest possible score of 1.0. This score implies that, after digestion, soy protein provides 100% or more of the indispensable amino acids per unit of protein, thus making it a suitable nutrient source. Soy protein is a biologically-active non-isoflavone component of soy, with health benefits such as cholesterol-lowering effects, blood-pressure-lowering effects, reduction of cancer risks and diabetes incidence, and favorable effects on kidney functioning and cardiac health. According to the US Department of Agriculture, India consumed around 6 million metric ton of soybean meal in 2021 compared to 4.74 million metric ton in 2018.

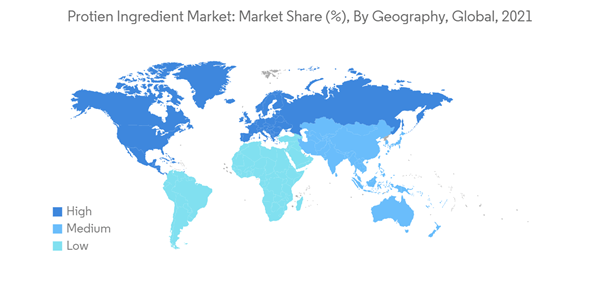

The key factors driving the North American protein ingredient market are changes in consumption patterns, food requirements, and an inclination toward vegetarian products for protein sources. The US Department of Agriculture’s (USDA) confirmation that soy protein reduces heart diseases has strongly boosted the market in the country and increased the demand for other vegan proteins. The market for soy-based drinks and nutrition bars is more stable and saturated in the region. However, the pea protein application in sports nutrition is gaining an advantage due to its high nutritional profile and comparatively good sensory properties compared to other plant proteins. The plant protein market is more saturated in the United States than in other countries. However, the new trend of pea and other vegetable proteins is boosting the market’s growth. By product application type, plant protein has major use in bakery and sports nutrition products. The shift among Americans toward bakery products in breakfast meals has increased the plant protein application in bakery products.

The protein ingredients market is highly competitive, and the players capturing the leading market shares dominate the food ingredients industry. On the other hand, some of the major strategies adopted by the companies operating in the protein ingredients market are geographical expansion, product innovation, and mergers and acquisitions. The major players operating in the market are Cargill Inc., DuPont de Nemours Inc., and Archer Daniel Midland Company.

This product will be delivered within 2 business days.

The COVID-19 outbreak has impacted people’s consumption patterns and purchasing behavior globally. Due to rising health concerns, people have reduced meat and poultry consumption. This protein consumption gap is being filled by protein substitute products, in which protein ingredients are key. The consumption of immunity strengthening products increased globally during the period, further fueling the demand for protein ingredients.

The protein ingredient industry in most of the established markets, such as the United States, witnessed a considerable increase in the consumption of animal proteins in the recent past. A further increase in the consumption of animal protein is anticipated over the next few years.

On the other hand, in terms of plant protein, new compositional research and modified high-moisture extrusion processes are helping in the market's growth. For instance, plant protein-based chocolates, which are free from animal proteins, observe a good demand from consumers who do not consume dairy. Plant-based milk noticed a significant growth in recent years, with an increasing number of people turning to dairy-free options. This innovative product line of ready-to-eat products, with no compromise in taste and texture, has, in turn, boosted the overall plant protein market.

Key Market Trends

Increasing Awareness About the Benefits of Soy Protein

Health management through food has become a trend, and consumers are looking for food and beverage products that will help them treat or prevent specific conditions. In a PDCAAS (protein digestibility-corrected amino acid score) method, which provides protein quality rankings by comparing the amino acid profile of a food protein against a standard amino acid profile, it was found that soy protein has the highest possible score of 1.0. This score implies that, after digestion, soy protein provides 100% or more of the indispensable amino acids per unit of protein, thus making it a suitable nutrient source. Soy protein is a biologically-active non-isoflavone component of soy, with health benefits such as cholesterol-lowering effects, blood-pressure-lowering effects, reduction of cancer risks and diabetes incidence, and favorable effects on kidney functioning and cardiac health. According to the US Department of Agriculture, India consumed around 6 million metric ton of soybean meal in 2021 compared to 4.74 million metric ton in 2018.

North America Holds the Largest Share

The key factors driving the North American protein ingredient market are changes in consumption patterns, food requirements, and an inclination toward vegetarian products for protein sources. The US Department of Agriculture’s (USDA) confirmation that soy protein reduces heart diseases has strongly boosted the market in the country and increased the demand for other vegan proteins. The market for soy-based drinks and nutrition bars is more stable and saturated in the region. However, the pea protein application in sports nutrition is gaining an advantage due to its high nutritional profile and comparatively good sensory properties compared to other plant proteins. The plant protein market is more saturated in the United States than in other countries. However, the new trend of pea and other vegetable proteins is boosting the market’s growth. By product application type, plant protein has major use in bakery and sports nutrition products. The shift among Americans toward bakery products in breakfast meals has increased the plant protein application in bakery products.

Competitive Landscape

The protein ingredients market is highly competitive, and the players capturing the leading market shares dominate the food ingredients industry. On the other hand, some of the major strategies adopted by the companies operating in the protein ingredients market are geographical expansion, product innovation, and mergers and acquisitions. The major players operating in the market are Cargill Inc., DuPont de Nemours Inc., and Archer Daniel Midland Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET DYNAMICS

5 MARKET SEGMENTATION

6 COMPETITIVE LANDSCAPE

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cargill Incorporated

- Roquette Freres

- Glanbia PLC

- DuPont de Nemours Inc.

- Archer Daniels Midland Company

- MGP Ingredients

- Kerry Group PLC

- Bunge Ltd

- Fonterra Co-operative Group

- Burcon Nutrascience