Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Demand for Reliable Power Supply in Rural Areas

The DC power systems market in India is being driven by the increasing demand for reliable power supply in rural areas. India's predominantly agrarian economy and significant rural population highlights the need for improved electricity access. However, many of these areas face inadequate or unreliable electricity supply from the traditional AC grid. This lack of consistent power hampers economic development, education, and healthcare services.To address this issue, DC power systems have emerged as a viable alternative. Unlike AC power, DC power can be derived from diverse sources such as solar panels, wind turbines, and batteries. This versatility in power generation and distribution makes DC systems well-suited for remote and off-grid areas. Consequently, there is a growing interest in deploying DC microgrids and standalone systems to provide uninterrupted power to rural communities. Government initiatives like the "Saubhagya Scheme" and "Deen Dayal Upadhyaya Gram Jyoti Yojana" are further driving the adoption of DC power systems in rural India.

Furthermore, DC power systems offer improved energy efficiency compared to their AC counterparts, which is particularly crucial in resource-scarce areas. These systems minimize energy losses during transmission and distribution, making them a cost-effective and sustainable solution for enhancing electricity access in rural India.

Growing Renewable Energy Integration

One of the key drivers of the India DC power systems market is the increasing integration of renewable energy sources into the country's energy mix. India has established ambitious targets for renewable energy to reduce its carbon footprint and combat climate change. Solar and wind power are two prominent sources of renewable energy, both of which generate DC electricity. DC power systems play a crucial role in efficiently utilizing this DC power and seamlessly integrating it into the existing grid.DC-DC converters and inverters are utilized to convert the DC power generated by solar panels and wind turbines into AC power or other forms that can be stored in batteries. These components are essential for efficient energy harvesting and distribution. Additionally, the popularity of DC microgrids is growing for localized energy distribution in areas with high renewable energy generation.

The Indian government has implemented policies and incentives to promote renewable energy projects, which, in turn, drives the demand for DC power systems. As the country continues to invest in renewable energy infrastructure, the DC power systems market is poised for significant growth.

Data Centers and Telecom Sector Expansion

India's rapid digital transformation and the expansion of the data center and telecom sectors are fueling the demand for DC power systems. The increasing usage of smartphones, internet services, and cloud computing has led to a tremendous surge in the demand for data centers and telecom infrastructure. These facilities require a reliable and uninterrupted power supply to ensure continuous operation.DC power systems offer numerous advantages to data centers and telecom networks. They provide a stable and efficient power supply, minimizing the risk of downtime and data loss. Moreover, DC power systems are inherently more efficient in powering sensitive electronic equipment, as most of these devices internally operate on DC power. This reduces the need for energy-wasting AC-DC conversions.

To meet the growing demand for data center and telecom infrastructure, there has been a significant deployment of DC power systems across the country. This trend is expected to persist as India's digital economy expands, making the DC power systems market a critical component of the nation's technological growth.

In conclusion, the India DC power systems market is driven by factors such as the need for reliable power in rural areas, the integration of renewable energy sources, and the expansion of data centers and the telecom sector. These drivers not only address critical energy challenges but also contribute to India's economic and technological development while promoting sustainability.

Key Market Challenges

Infrastructure Development and Modernization

One of the key challenges confronting the India DC power systems market is the imperative for substantial infrastructure development and modernization. India possesses a diverse and expansive power infrastructure, primarily centered around the conventional alternating current (AC) grid. The transition to DC power systems, which inherently differ from the existing AC infrastructure, presents a multifaceted endeavor.Primarily, retrofitting the current AC grids to accommodate DC power can prove to be a costly and time-consuming process. This entails the replacement or enhancement of transformers, substations, and distribution lines to accommodate DC voltage levels. Furthermore, the integration of renewable energy sources, which often generate DC power, into the grid mandates significant modifications.

Moreover, ensuring the interoperability of DC power systems with existing AC systems poses a technical challenge. The resolution of standardization and compatibility issues is crucial for seamless integration and operation. This necessitates substantial research, investment, and coordination among government agencies, utilities, and private sector stakeholders.

Cost and Affordability

The implementation of DC power systems poses a significant challenge in the Indian market, primarily due to cost considerations. Although DC systems offer notable advantages such as higher efficiency and compatibility with renewable energy sources, the upfront investment required can be relatively high. Consequently, widespread adoption, especially in rural and economically disadvantaged areas, faces obstacles.The cost challenges can be categorized into two aspects:

Capital Costs: The establishment of infrastructure for DC power generation, distribution, and storage, including solar panels, batteries, and DC-DC converters, entails considerable expenses. Rural communities and small-scale businesses may encounter difficulties in affording these initial investments.

Operational Costs: While DC systems are generally more energy-efficient, their maintenance and repair costs can be substantial due to the specialized equipment and expertise involved. This factor may discourage potential users from embracing DC power solutions.

To address these cost challenges effectively, innovative financing models, subsidies, and incentives from government bodies are necessary. These measures would make DC power systems more accessible and affordable to a broader range of consumers.

Key Market Trends

Rapid Adoption of DC Microgrids in Urban Areas

One notable trend in the India DC Power Systems Market is the rapid adoption of DC microgrids in urban areas. As the urban population of India continues to grow and cities become more densely populated, there is an increasing demand for reliable and sustainable power solutions. DC microgrids have emerged as a promising solution to address these energy challenges in urban environments.DC microgrids offer several advantages, including higher efficiency and better integration with renewable energy sources such as solar panels and wind turbines, which generate DC power. In urban areas, where space is limited, rooftop solar installations can be seamlessly integrated with DC microgrids to provide clean energy to buildings, industries, and critical infrastructure.

The reliability of DC microgrids is particularly beneficial in urban settings, where power outages can disrupt daily life and economic activities. These microgrids can operate independently or in conjunction with the main AC grid, providing backup power during grid failures or emergencies. Such resilience is essential for critical facilities such as hospitals, data centers, and telecommunications networks.

The adoption of DC microgrids is further accelerated by government initiatives and policies that promote renewable energy and decentralized power generation. Programs like the Smart Cities Mission and various state-level policies incentivize the deployment of microgrids and encourage urban planners to incorporate DC power infrastructure into city development projects.

As India continues to urbanize and strive for sustainable energy solutions, the trend of embracing DC microgrids is expected to gain momentum, creating opportunities for companies specializing in DC power systems and microgrid technology.

Growth of DC-Powered Electric Mobility Infrastructure

Another notable trend in the India DC Power Systems Market is the growth of DC-powered electric mobility infrastructure. With a growing awareness of environmental issues and a push for cleaner transportation options, electric vehicles (EVs) are gaining popularity in India. DC power systems play a crucial role in supporting the charging infrastructure needed to facilitate the widespread adoption of EVs.DC fast-charging stations are becoming increasingly prevalent across major Indian cities and highways, enabling quick and convenient charging for electric vehicle owners. Unlike traditional slow-charging methods that use alternating current (AC), DC fast-charging stations provide direct current (DC) power to EV batteries, significantly reducing charging times.

This trend is driven by several factors:

Government Initiatives: The Indian government has launched initiatives like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme to promote EV adoption. These programs include funding for the installation of DC fast-charging infrastructure.

Automaker Investments: Leading automakers are introducing electric vehicle models in India, increasing the demand for charging infrastructure. Many of these EVs are compatible with DC fast-charging, making it a preferred option for consumers.

Urban Planning: City authorities are incorporating EV charging infrastructure into urban development plans, encouraging the installation of DC fast-charging stations in public spaces, parking lots, and commercial areas.

Green Mobility Trends: The shift towards sustainable transportation and the desire to reduce carbon emissions motivate individuals and businesses to invest in electric vehicles, further fueling the demand for DC-powered charging infrastructure.

As the electric mobility ecosystem matures in India, the DC power systems market is poised for significant growth. Companies specializing in DC fast-charging solutions and related technologies have a substantial opportunity to contribute to the country's sustainable transportation future. This trend aligns with India's commitment to reducing carbon emissions and promoting clean energy solutions in the transportation sector.

Regulatory Framework and Policy Ambiguity

The regulatory framework and policy ambiguity in India present a significant challenge to the DC power systems market. The power sector in India is subject to various regulations and policies at the central and state levels, primarily designed for AC systems. However, the transition to DC power necessitates a comprehensive review and adaptation of these regulations to accommodate the distinctive characteristics of DC systems.A key regulatory challenge lies in the absence of clear guidelines for integrating DC systems, particularly in the context of renewable energy. Existing policies often favor AC-based solutions, resulting in limited support and incentives for DC technology. Consequently, this can impede investments in DC infrastructure and discourage market entry by companies.

Furthermore, the absence of standardized codes and protocols for DC power systems can lead to implementation confusion and inefficiencies, impacting interoperability and safety. To overcome this challenge, policymakers should collaborate closely with industry experts to develop comprehensive and precise regulations and standards that foster the growth of the DC power systems market. This entails defining technical specifications, safety guidelines, and incentive structures aligned with India's energy goals and priorities.

Segmental Insights

Type Insights

The 4.1-32 kW segment emerged as the dominant player in the global market in 2023. The telecommunications industry heavily relies on DC power systems ranging from 4.1 to 32 kW to ensure uninterrupted network connectivity. The increasing usage of mobile phones and data services in India has resulted in a growing demand for reliable power backup solutions, including DC systems. As the deployment of 5G networks continues, the demand for DC power systems in this segment is expected to further increase. Various industrial applications, such as small-scale manufacturing, automation, and machinery, require DC power systems within this power range.Industries are progressively adopting DC solutions to improve energy efficiency and reduce operational costs. Moreover, DC systems are preferred for powering sensitive equipment, making them integral to industrial processes. In summary, the 4.1-32 kW segment in the India DC Power Systems Market caters to a wide range of applications and is driven by factors such as telecommunications growth, industrial needs, residential adoption, renewable energy integration, and government support.

In residential areas and small businesses, DC power systems are gaining popularity for backup power and energy management. Solar installations with capacities in this range are commonly used, enabling homeowners and businesses to generate and store their own DC power. As grid reliability remains a concern in certain regions, these systems provide a reliable source of electricity.

Application Insights

The Telecom segment is projected to experience rapid growth during the forecast period. The continuous expansion and modernization of telecom networks in India drive the demand for DC power systems. With the proliferation of smartphones, data usage, and the imminent rollout of 5G technology, telecom companies are investing in infrastructure upgrades, including the deployment of more cell towers and data centers. These facilities require reliable DC power systems to ensure network uptime. Telecom services must operate without interruptions to meet customer expectations. DC power systems provide a dependable source of power, particularly in areas with unreliable grid electricity. Given the frequent power outages and voltage fluctuations in many regions of India, DC power systems serve as a critical backup, enabling telecom networks to remain operational during blackouts.The impending rollout of 5G technology in India presents a significant opportunity for providers of DC power systems. The increased data speeds and capacity demands of 5G networks will necessitate robust and efficient power solutions.

In conclusion, the telecom segment within the India DC Power Systems Market is crucial for the country's telecommunications infrastructure. With the growth of mobile networks, data centers, and the upcoming 5G rollout, the demand for reliable and efficient DC power systems is expected to remain strong. However, telecom companies must address cost considerations and invest in technical expertise to fully capitalize on the opportunities in this segment.

Regional Insights

South India emerged as the dominant region in the India DC Power Systems market in 2023. South India is a prominent hub for renewable energy projects, particularly in solar and wind energy. The region's abundant sunlight and wind resources make it highly conducive for efficient renewable energy generation. DC power systems play a pivotal role in seamlessly integrating this renewable energy into the grid and supporting off-grid applications, thereby contributing significantly to the market's growth.South India boasts a thriving industrial and commercial sector, encompassing automotive manufacturing, electronics, and IT services. These industries demand robust power solutions, and DC power systems offer distinct advantages such as energy efficiency and superior power quality, making them highly appealing options.

South Indian cities are witnessing rapid urbanization, with many being part of the government's Smart Cities Mission. These initiatives frequently involve the deployment of state-of-the-art infrastructure, including DC microgrids and energy-efficient solutions, to elevate urban living standards and minimize environmental impact.

State-level policies and incentives, such as net metering for rooftop solar installations and renewable energy purchase obligations, actively promote the adoption of DC power systems for efficient renewable energy integration. These initiatives aim to mitigate the carbon footprint and enhance energy security.

With the region's growing emphasis on renewable energy, substantial opportunities exist for companies specializing in DC power systems to provide cutting-edge solutions for effective renewable energy integration.

Report Scope:

In this report, the India DC Power Systems Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India DC Power Systems Market, By Type:

- Below 4 kW

- 4.1-32 kW

- Above 32 kW

India DC Power Systems Market, By Application:

- Telecom

- Industrial

- Commercial

- Others

India DC Power Systems Market, By Region:

- North India

- South India

- East India

- West India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India DC Power Systems Market.Available Customizations:

India DC Power Systems Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Delta Electronics India

- Emerson Network Power

- Eltek India

- Schneider Electric India

- Luminous Power Technologies

- Microtek International

- Socomec India

- Aplab Limited

- Amara Raja Power Systems

- Su-Kam Power Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 84 |

| Published | October 2023 |

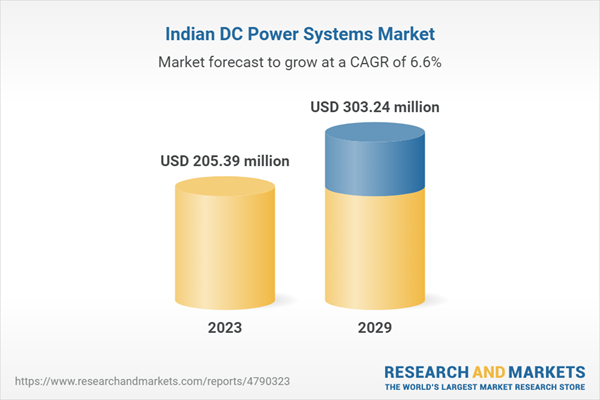

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 205.39 million |

| Forecasted Market Value ( USD | $ 303.24 Million |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |