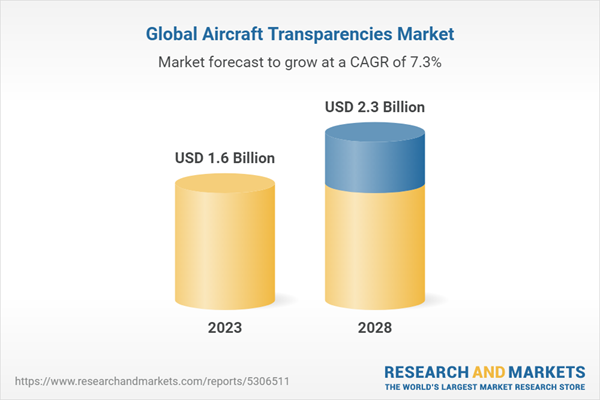

The global market for aircraft transparencies market is estimated to be USD 1.6 billion in 2023 and expected to reach USD 2.3 billion by 2028 at a CAGR of 7.3% from 2023 to 2028. The growth of this market can be attributed to the airlines striving to modernize their fleets to improve fuel efficiency, reduce maintenance costs, and enhance passenger comfort. This trend involves retiring older aircraft and replacing them with newer, more technologically advanced models. As new aircraft are introduced, the demand for aircraft transparencies increases.

The aftermarket segment is projected to witness the highest CAGR during the forecast period.

Based on end-use, the aftermarket segment of the aircraft transparencies market is projected to hold the highest growth rate during the forecast period. Aftermarket segment in the aircraft transparencies market is expected to experience significant growth due to the aging aircraft fleet, retrofitting activities, regulatory compliance, cost-effectiveness, technological advancements, and the competitive market landscape.

The commercial aviation segment is projected to dominate the aircraft transparencies market by frequency

Based on aircraft type, the commercial aviation segment is projected to dominate the market share during the forecast period. This is primarily due to the increasing air passenger traffic, fleet modernization and expansion efforts by airlines, and the demand for enhanced passenger experience. The commercial aviation segment includes major airlines operating both domestic and international flights, and their need for new aircraft and transparency replacements drives the market. Additionally, the commercial aviation segment's focus on fuel efficiency, regulatory compliance, and technological advancements further contributes to its significant market share in the aircraft transparencies market.

North America is expected to account for the largest market share in 2023

The aircraft transparencies market industry has been studied in North America, Europe, Asia Pacific, Middle East and Africa and Latin America. North America accounted for the largest market share in 2023. The largest market for aircraft transparencies in North America is typically the United States. The United States has a significant presence in the aviation industry, with numerous major aircraft manufacturers, suppliers, and operators based in the country. This robust aviation sector drives the demand for aircraft transparencies in the North American market. The United States has a strong aerospace industry, with leading companies like Boeing and Lockheed Martin based in the country. These companies manufacture a large number of commercial and military aircraft, which require aircraft transparencies for windshields, windows, and canopies. The demand from these manufacturers drives the market for aircraft transparencies in the United States

The break-up of the profile of primary participants in the Aircraft Transparencies market:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C Level - 30%, Director Level - 20%, Others-50%

- By Region: North America -35%, Europe - 20%, Asia Pacific - 30%, Middle East & Africa - 10%, and Latin America - 5%

Prominent companies include PPG Industries, Inc. (US), GKN Aerospace (UK), Saint-Gobain (France), General Electric Company (US), and Gentex Corporation (US) among others.

Research Coverage:

This research report categorizes the aircraft transparencies market by application (windows, windshields, canopies, landing lights & wingtip lenses, chin bubbles, cabin interiors, and skylights), by aircraft type, (military aviation, commercial aviation, business & general aviation, and advanced air mobility), by end-use(oem, and aftermarket), by material (glass , acrylic, and polycarbonate), and region (North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the aircraft transparencies market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. new product & service launches, mergers and acquisitions, and recent developments associated with the aircraft transparencies market. Competitive analysis of upcoming startups in the aircraft transparencies market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall aircraft transparencies market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on aircraft transparencies offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the aircraft transparencies market

- Market Development: Comprehensive information about lucrative markets - the report analyses the aircraft transparencies market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the aircraft transparencies market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players in the aircraft transparencies market

Table of Contents

Companies Mentioned

- Aeropair Ltd.

- Aviationglass & Technology B.V.

- Bell Textron Inc.

- Cee Bailey's Aircraft Plastics

- Control Logistics Inc.

- Dart Aerospace

- Desser Aerospace

- General Electric Company

- Gentex Corporation

- Gkn Aerospace

- Lee Aerospace

- Llamas Plastics Inc.

- Lp Aero Plastics Inc.

- Magnetic Mro As

- Mecaplex Ltd.

- Pacific Aero Tech, LLC

- Plexiweiss GmbH

- Ppg Industries, Inc.

- Saint-Gobain

- Soundair Aviation

- Spartech

- Tech-Tool Plastics, Inc.

- The Nordam Group LLC

- The Wag Aero Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 216 |

| Published | May 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 1.6 Billion |

| Forecasted Market Value ( USD | $ 2.3 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |