Global Drone Identification Systems Market - Key Trends & Drivers Summarized

Drone identification systems are essential technologies designed to track, identify, and manage unmanned aerial vehicles (UAVs) in the airspace. These systems are increasingly important as the number of drones in both civilian and commercial use continues to rise, presenting challenges for airspace safety and security. Drone identification systems work by employing various technologies, such as radio frequency (RF) sensors, radar, acoustic sensors, and visual recognition, to detect and identify drones. These systems can determine a drone's position, altitude, speed, and often its operator's location, providing crucial data to air traffic controllers, security personnel, and law enforcement agencies. By integrating these identification systems with existing air traffic management infrastructure, authorities can ensure that drones are operating safely and in compliance with regulations, thereby minimizing the risk of accidents and unauthorized activities.Technological advancements have significantly enhanced the capabilities and accuracy of drone identification systems. Modern systems are equipped with advanced algorithms and machine learning techniques that improve the detection and classification of different types of drones, even in complex environments with high levels of background noise and clutter. Innovations in RF technology allow for the precise triangulation of drone signals, providing accurate location data. Additionally, the integration of networked sensors and cloud-based platforms enables real-time data sharing and analysis, facilitating rapid response to potential threats. Some systems also incorporate geofencing technology, which creates virtual boundaries that drones cannot cross, automatically alerting operators and authorities if these boundaries are breached. These advancements not only improve the effectiveness of drone identification systems but also enhance their scalability and adaptability to various operational scenarios.

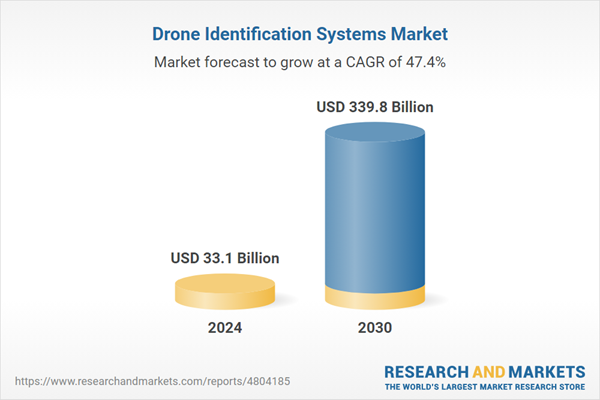

The growth in the drone identification systems market is driven by several factors, including increasing drone usage, stringent regulatory requirements, and the rising need for airspace security. As drones become more prevalent in applications such as delivery services, agriculture, infrastructure inspection, and entertainment, the need for robust identification and tracking systems has become more pressing. Regulatory bodies worldwide, including the Federal Aviation Administration (FAA) in the United States and the European Union Aviation Safety Agency (EASA), have implemented or are in the process of implementing mandatory drone identification requirements to ensure safe and controlled drone operations. These regulations are a significant driver of market growth, as compliance necessitates the adoption of advanced identification systems. Additionally, concerns over privacy, security, and the potential for malicious use of drones, such as in espionage or terrorism, have heightened the demand for effective drone identification solutions. The increasing investments in smart city projects and the development of urban air mobility also contribute to the market's expansion, as these initiatives require sophisticated systems to manage the integration of drones into urban airspaces. Together, these factors ensure a robust growth trajectory for the drone identification systems market, reflecting the critical need for secure and efficient drone management in the evolving aerial landscape.

Report Scope

The report analyzes the Drone Identification Systems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Drone Mounting, Ground Station); End-Use (Military, Commercial, Homeland Security); Technology (Identification & Detection, Countermeasures).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Drone Mounting Application segment, which is expected to reach US$76.6 Billion by 2030 with a CAGR of 38%. The Ground Station Application segment is also set to grow at 51.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $13.1 Billion in 2024, and China, forecasted to grow at an impressive 63.3% CAGR to reach $64.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Drone Identification Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Drone Identification Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Drone Identification Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Elbit Systems Ltd., Aselsan A.S., Accipiter Radar Technologies, Inc., Allen-Vanguard Corp., Aveillant Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 82 companies featured in this Drone Identification Systems market report include:

- Elbit Systems Ltd.

- Aselsan A.S.

- Accipiter Radar Technologies, Inc.

- Allen-Vanguard Corp.

- Aveillant Ltd.

- Blighter Surveillance Systems Ltd.

- CONTROP Precision Technologies Ltd.

- Advanced Radar Technologies SA

- Chess Dynamics Ltd.

- DeTect, Inc.

- DMT Radar & Security Systems

- Dedrone, Inc.

- HENSOLDT AG

- IDS Ingegneria Dei Sistemi S.p.A.

- IGP bv

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Elbit Systems Ltd.

- Aselsan A.S.

- Accipiter Radar Technologies, Inc.

- Allen-Vanguard Corp.

- Aveillant Ltd.

- Blighter Surveillance Systems Ltd.

- CONTROP Precision Technologies Ltd.

- Advanced Radar Technologies SA

- Chess Dynamics Ltd.

- DeTect, Inc.

- DMT Radar & Security Systems

- Dedrone, Inc.

- HENSOLDT AG

- IDS Ingegneria Dei Sistemi S.p.A.

- IGP bv

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 490 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 33.1 Billion |

| Forecasted Market Value ( USD | $ 339.8 Billion |

| Compound Annual Growth Rate | 47.4% |

| Regions Covered | Global |