Global Cold Insulation Market - Key Trends & Drivers Summarized

What Is Cold Insulation, and Why Is It a Critical Component in Modern Industries?

Cold insulation is a technology used to minimize heat transfer between materials within systems operating below ambient temperature. It is primarily used in industries where processes require the maintenance of low temperatures, such as in chemical processing, HVAC, refrigeration, oil and gas, and particularly in liquefied natural gas (LNG) storage and transport. Cold insulation materials are designed to prevent condensation, control surface temperatures for safety and efficiency, and maintain the integrity of cold-chain logistics. The effectiveness of cold insulation materials not only supports operational efficiencies but also plays a significant role in energy conservation, as it significantly reduces energy costs by maintaining the desired temperature levels without excessive cooling efforts.How Does Cold Insulation Technology Work and What Materials Are Involved?

How are various materials employed in cold insulation applications adapted to meet diverse industrial needs? Cold insulation materials include fiberglass, polyurethane foam, polystyrene, and phenolic foam, each selected based on their thermal conductivity, moisture resistance, and structural integrity at low temperatures. For instance, polyurethane foam is extensively used in the refrigeration sector due to its excellent insulation properties and strength. These materials are often installed in the form of blankets, boards, or foams, encapsulating equipment such as pipes, vessels, and ducts to restrict energy loss and prevent the formation of ice or frost which could impair the system's function or integrity. Innovations in material science continually enhance these materials' effectiveness, ensuring they meet the stringent requirements of various environmental and operational conditions.What Challenges and Trends Influence the Cold Insulation Market?

What are the main challenges in implementing cold insulation, and what current trends are shaping the future of this sector? One of the primary challenges is the high initial installation cost and the complexity of integrating cold insulation into existing systems. Additionally, stringent environmental regulations drive the need for materials that are not only effective but also environmentally friendly. This has prompted a shift towards greener materials and technologies that reduce the carbon footprint. A significant trend in the industry is the increasing use of advanced composites and eco-friendly materials that offer superior performance without environmental compromise. There is also a growing demand for new installation techniques that can accommodate more complex system geometries and applications, driving innovation in how cold insulation is applied and maintained.What's Driving Growth in the Cold Insulation Market?

The growth in the cold insulation market is driven by several factors, reflecting the dynamic changes in technology, environmental policies, and industry standards. The expansion of industries that rely heavily on refrigeration technologies, such as biopharmaceuticals, food processing, and energy, particularly with the increase in LNG projects, directly impacts the demand for advanced cold insulation solutions. Technological advancements that lead to more efficient and sustainable insulation materials also contribute to market growth. Furthermore, growing global concerns about energy efficiency and greenhouse gas emissions have prompted tighter regulatory standards worldwide, enhancing the adoption of effective insulation practices. Consumer behavior, especially increased demand for processed foods and pharmaceuticals requiring controlled temperatures, further accelerates the growth of the cold insulation market. These factors collectively fuel the continued development and implementation of cold insulation technologies across various sectors.Report Scope

The report analyzes the Cold Insulation market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Material (Fiber Glass, Phenolic Foams, Polystyrene Foams, Polyurethane Foams, Other Materials); End-Use (Chemicals, HVAC, Oil & Gas, Refrigeration, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Fiber Glass Material segment, which is expected to reach US$1.7 Billion by 2030 with a CAGR of 6.5%. The Phenolic Foams Material segment is also set to grow at 6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $812.6 Million in 2024, and China, forecasted to grow at an impressive 9.2% CAGR to reach $1.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cold Insulation Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cold Insulation Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cold Insulation Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BASF SE, Dow Inc., Evonik Industries AG, Certain Teed Corporation, Johns Manville and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 80 companies featured in this Cold Insulation market report include:

- BASF SE

- Dow Inc.

- Evonik Industries AG

- Certain Teed Corporation

- Johns Manville

- Covestro AG

- Aspen Aerogels, Inc.

- Armacell

- Kingspan Group PLC

- Fletcher Insulation Pty., Ltd.

- Arabian Fiberglass Insulation Co., Ltd.

- CSR Bradford Insulation

- Kaefer Isoliertechnik GmbH & Co. KG

- DAFA A/S

- DUNA-Corradini SpA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF SE

- Dow Inc.

- Evonik Industries AG

- Certain Teed Corporation

- Johns Manville

- Covestro AG

- Aspen Aerogels, Inc.

- Armacell

- Kingspan Group PLC

- Fletcher Insulation Pty., Ltd.

- Arabian Fiberglass Insulation Co., Ltd.

- CSR Bradford Insulation

- Kaefer Isoliertechnik GmbH & Co. KG

- DAFA A/S

- DUNA-Corradini SpA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 442 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

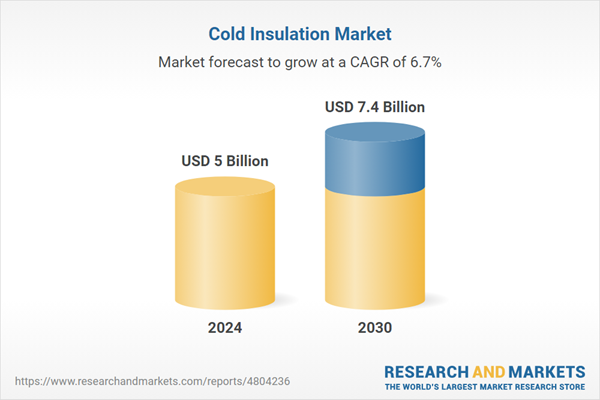

| Estimated Market Value ( USD | $ 5 Billion |

| Forecasted Market Value ( USD | $ 7.4 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |