Global Coiled Tubing Market - Key Trends and Drivers Summarized

What Is Coiled Tubing and Why Is It Vital to the Oil and Gas Industry?

Coiled tubing refers to a long, continuous length of metal pipe that is spooled onto a large reel, used primarily in the oil and gas industry for various well intervention, drilling, and completion operations. Unlike traditional drill pipe, coiled tubing can be inserted into wells while under pressure, eliminating the need to stop production during interventions and enhancing operational efficiency. This tubing is highly flexible, making it ideal for use in complex well structures where traditional straight pipe systems would be less effective. Coiled tubing can perform a wide range of functions, including cleaning wellbores, delivering chemical treatments, logging, and even light drilling. Its ability to perform multiple tasks without interrupting well operations makes it a critical tool for enhancing the productivity and longevity of oil and gas wells, especially in challenging environments like deepwater and shale formations.How Is Coiled Tubing Revolutionizing Well Intervention and Drilling Operations?

Coiled tubing has revolutionized the oil and gas industry by enabling continuous, cost-effective operations that minimize downtime and maximize well performance. In well intervention operations, coiled tubing is often used to clear blockages, remove debris, and clean wellbores, ensuring that the well remains productive and reducing the risk of damage or failure. In complex drilling environments, particularly in horizontal or deviated wells, coiled tubing's flexibility allows operators to reach deeper and more intricate parts of the wellbore where traditional drill pipe would struggle. This capability is particularly valuable in unconventional shale plays, where wells often have complex geometries and require more precise interventions. In addition to traditional well services, coiled tubing is increasingly being used for milling, fracturing, and deploying bottomhole assemblies in underbalanced drilling. Its ability to deploy in a continuous fashion without the need for connecting individual pipe segments makes operations faster and safer, as it reduces the risks associated with handling multiple connections in high-pressure environments. Furthermore, coiled tubing is widely employed in offshore operations, where the ability to conduct well interventions without halting production is especially valuable. By reducing the time and cost associated with stopping and restarting production, coiled tubing has become an essential tool in enhancing the efficiency and profitability of oil and gas extraction.What Technologies and Innovations Are Driving Advancements in Coiled Tubing?

The coiled tubing industry is seeing significant advancements, driven by innovations in materials, monitoring technologies, and operational efficiency. One of the key developments in the field is the use of higher-strength materials, such as advanced steel alloys, that allow coiled tubing to withstand greater stress, pressure, and fatigue, particularly in deepwater and high-temperature environments. These enhanced materials extend the life of coiled tubing, allowing it to perform more rigorous operations without frequent replacements or failures. In addition, coatings and corrosion-resistant materials are being developed to extend the durability of coiled tubing in harsh environments, such as wells with high hydrogen sulfide (H2S) content or abrasive sand formations. Technological advancements in real-time data monitoring are also transforming how coiled tubing operations are managed. Operators can now use downhole sensors to monitor tubing performance, well conditions, and pressures in real time, enabling them to make instant adjustments and optimize operations. This data-driven approach enhances the safety and efficiency of interventions, as potential issues can be identified and addressed before they lead to operational delays or equipment failures. Furthermore, innovations in automation and robotics are being applied to coiled tubing units, reducing manual handling and improving the precision of operations.What Are the Factors Driving the Expansion of the Coiled Tubing Market?

The growth in the coiled tubing market is driven by several factors, including increasing well intervention activity, the rise of shale drilling, and the demand for more efficient and cost-effective well operations. One of the primary drivers is the growing need for well maintenance and stimulation in aging oilfields, where coiled tubing provides an efficient solution for enhancing production without halting operations. As oil wells mature, they require more frequent interventions to maintain optimal production levels, and coiled tubing offers a versatile and flexible tool for performing these tasks quickly and safely. The rise of shale gas and tight oil production, particularly in North America, is another significant growth driver. Shale formations often have complex well geometries that require the use of coiled tubing for horizontal drilling and hydraulic fracturing operations. The ability to drill further and perform multi-stage fracking operations with precision is critical to maximizing the output of these unconventional wells, making coiled tubing an indispensable part of the process. Additionally, increasing offshore exploration and deepwater drilling activities are expanding the use of coiled tubing in these challenging environments. The ability to perform interventions without stopping production is particularly valuable in offshore operations, where downtime can lead to significant financial losses. Technological advancements are also accelerating the adoption of coiled tubing, with innovations such as real-time data monitoring, automated operations, and enhanced tubing materials making it a more reliable and efficient option for operators. Furthermore, the growing focus on cost reduction and operational efficiency in the oil and gas sector is driving the demand for solutions like coiled tubing that can streamline processes and minimize operational risks. As the global demand for oil and gas continues, and as fields become more complex and challenging to operate, the versatility and efficiency of coiled tubing will continue to drive its growth in both onshore and offshore markets.Report Scope

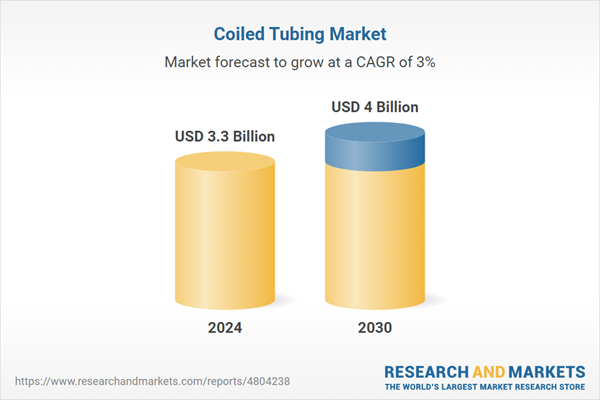

The report analyzes the Coiled Tubing market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Services (Well Intervention & Production, Drilling, Other Services); Application (On-Shore, Off-Shore).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the On-Shore Application segment, which is expected to reach US$2.5 Billion by 2030 with a CAGR of 3.7%. The Off-Shore Application segment is also set to grow at 1.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $891 Million in 2024, and China, forecasted to grow at an impressive 5.5% CAGR to reach $817.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Coiled Tubing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Coiled Tubing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Coiled Tubing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Baker Hughes, a GE company, C&J Energy Services, Inc., Calfrac Well Services, Ltd., Halliburton, Rpc, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 58 companies featured in this Coiled Tubing market report include:

- Baker Hughes, a GE company

- C&J Energy Services, Inc.

- Calfrac Well Services, Ltd.

- Halliburton

- Rpc, Inc.

- Schlumberger Ltd.

- Superior Energy Services

- Trican Well Services Ltd.

- Weatherford International Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Baker Hughes, a GE company

- C&J Energy Services, Inc.

- Calfrac Well Services, Ltd.

- Halliburton

- Rpc, Inc.

- Schlumberger Ltd.

- Superior Energy Services

- Trican Well Services Ltd.

- Weatherford International Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 252 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.3 Billion |

| Forecasted Market Value ( USD | $ 4 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |