Global Cloud Project Portfolio Management Market - Key Trends and Drivers Summarized

What Makes Cloud Project Portfolio Management Essential for Modern Enterprises?

Cloud Project Portfolio Management (PPM) has emerged as a transformative solution for organizations looking to streamline their project management practices in an increasingly complex business landscape. The shift from traditional, on-premise PPM tools to cloud-based platforms is largely fueled by the need for greater flexibility, scalability, and accessibility. Cloud PPM enables organizations to manage multiple projects across various teams and locations with real-time access to critical data, offering unparalleled visibility and control. This shift is particularly appealing for global enterprises, where project teams are often distributed across geographies, requiring a solution that can centralize operations and ensure seamless collaboration. The cloud-based nature of these platforms allows for easy integration with other enterprise systems, such as Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM), which enhances data synchronization and workflow automation. The pay-as-you-go model offered by cloud PPM providers also reduces upfront capital expenditures, making it an attractive option for businesses seeking to optimize their project management without the burden of high infrastructure costs.How Is Cloud PPM Transforming Business Operations?

The impact of Cloud Project Portfolio Management on business operations is profound, as it redefines how organizations approach project planning, execution, and evaluation. By providing a unified platform that aggregates data from all projects, cloud PPM allows businesses to gain a comprehensive view of their entire project portfolio, enabling more informed decision-making. This increased transparency is critical for managing resources effectively, as real-time data helps decision-makers prioritize projects, allocate resources more efficiently, and adjust timelines as necessary. Additionally, cloud PPM solutions often include robust reporting and analytics tools that offer insights into project performance, helping organizations identify potential risks and bottlenecks before they impact overall outcomes. For industries such as IT, healthcare, finance, and manufacturing, where the timely execution of projects is critical to maintaining competitive advantage, cloud PPM is becoming indispensable. The ability to track progress, monitor budgets, and ensure alignment with strategic objectives in real time significantly enhances operational efficiency and helps companies remain agile in responding to changing market demands.What Are the Key Trends Shaping the Cloud PPM Landscape?

The landscape of Cloud Project Portfolio Management is continuously evolving, driven by several key trends that are shaping the future of the technology. One of the most notable trends is the increasing integration of artificial intelligence (AI) and machine learning (ML) into cloud PPM platforms. These technologies offer predictive analytics capabilities that enable businesses to forecast project outcomes more accurately, optimize resource allocation, and identify potential risks before they materialize. AI-driven insights are particularly valuable in large, complex organizations that manage multiple projects simultaneously, as they enhance decision-making and improve the overall efficiency of portfolio management. Another major trend is the rise of hybrid cloud solutions, where businesses combine public and private cloud infrastructures to balance security, compliance, and performance needs. This is especially relevant for industries with stringent regulatory requirements, such as finance and healthcare, where sensitive data must be carefully managed. The ongoing shift toward remote and hybrid work models has also accelerated the adoption of cloud PPM, as organizations require flexible tools that facilitate collaboration across decentralized teams. Additionally, the increasing demand for customizable solutions tailored to industry-specific needs has prompted cloud PPM vendors to offer more specialized features, ensuring that businesses can deploy solutions that align with their unique operational requirements.What Is Fueling the Growth of the Cloud PPM Market?

The growth in the Cloud Project Portfolio Management market is driven by several factors that reflect both technological advancements and evolving business practices. One of the primary drivers is the increasing complexity of project portfolios in modern organizations, especially as businesses scale and diversify their operations. Cloud PPM solutions offer the flexibility and scalability needed to manage this complexity by providing centralized oversight and control over multiple, simultaneous projects. The rise of remote work, fueled by the COVID-19 pandemic and the subsequent shift to more flexible work arrangements, has further underscored the importance of cloud-based solutions that enable real-time collaboration and transparency. As businesses continue to embrace digital transformation, the need for tools that integrate seamlessly with other enterprise systems, such as data analytics platforms and ERP systems, has become a critical factor in driving cloud PPM adoption. Additionally, the integration of AI and ML into cloud PPM solutions is allowing businesses to optimize project planning, resource management, and risk mitigation, further accelerating the adoption of these technologies. Regulatory compliance, particularly in industries with stringent security requirements, is also a key growth driver, as organizations increasingly seek cloud PPM platforms that offer robust security features and the ability to meet industry-specific standards. These factors, combined with the growing demand for agile, data-driven project management solutions, are fueling the expansion of the cloud PPM market, positioning it as a vital tool for modern enterprises.Report Scope

The report analyzes the Cloud Project Portfolio Management market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Deployment (Public Cloud, Private Cloud, Hybrid Cloud); Application (Project Management, Portfolio Management, Financial Management, Resource Management, Demand Management, Other Applications); End-Use (BFSI, Manufacturing, Telecommunications, Healthcare, Government, Retail & Consumer Goods, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

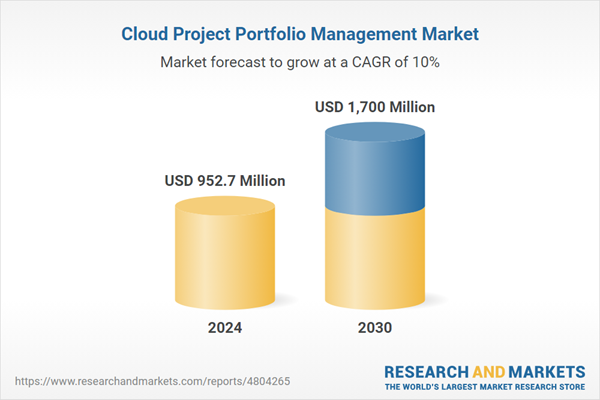

- Market Growth: Understand the significant growth trajectory of the Other Applications segment, which is expected to reach US$1.7 Billion by 2030 with a CAGR of 10%. The Public Cloud segment is also set to grow at 16.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $240.2 Million in 2024, and China, forecasted to grow at an impressive 9% CAGR to reach $269.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cloud Project Portfolio Management Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cloud Project Portfolio Management Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cloud Project Portfolio Management Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as CA Technologies, Inc., Changepoint Corp., Clarizen, Hewlett Packard Enterprise Development LP (HPE), Mavenlink, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 12 companies featured in this Cloud Project Portfolio Management market report include:

- CA Technologies, Inc.

- Changepoint Corp.

- Clarizen

- Hewlett Packard Enterprise Development LP (HPE)

- Mavenlink, Inc.

- Microsoft Corporation

- Oracle Corporation

- Planisware

- Planview, Inc.

- SAP SE

- ServiceNow, Inc.

- Upland Software, Inc.

- Workfront

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- CA Technologies, Inc.

- Changepoint Corp.

- Clarizen

- Hewlett Packard Enterprise Development LP (HPE)

- Mavenlink, Inc.

- Microsoft Corporation

- Oracle Corporation

- Planisware

- Planview, Inc.

- SAP SE

- ServiceNow, Inc.

- Upland Software, Inc.

- Workfront

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 179 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 952.7 Million |

| Forecasted Market Value ( USD | $ 1700 Million |

| Compound Annual Growth Rate | 10.0% |

| Regions Covered | Global |