Global Cloud Encryption Market - Key Trends and Drivers Summarized

Why Is Cloud Encryption Essential for Securing Cloud Data?

Cloud encryption has become a cornerstone of modern cloud security strategies as businesses increasingly shift critical data and operations to cloud environments. With the adoption of cloud services, the potential risks associated with data breaches, unauthorized access, and cyberattacks have grown, making data protection a top priority for organizations. Cloud encryption ensures that sensitive data is converted into unreadable code, preventing unauthorized access during storage, processing, and transmission across cloud platforms. This protection is particularly crucial for organizations handling sensitive information, such as financial data, intellectual property, and personal identifiers. Industries like healthcare, finance, and government are bound by strict regulations, such as GDPR, HIPAA, and PCI-DSS, which mandate the encryption of certain data to maintain privacy and security. By encrypting data both at rest and in transit, businesses can mitigate the risks of data breaches and ensure that even if data is intercepted by malicious actors, it remains unusable without the proper decryption keys. As cyber threats continue to evolve, cloud encryption stands as a critical defense mechanism, allowing organizations to leverage the benefits of cloud computing while ensuring that their data remains secure and compliant with industry standards.How Are Technological Advancements Shaping Cloud Encryption Solutions?

Technological advancements are revolutionizing cloud encryption, making it more sophisticated, efficient, and adaptable to the evolving needs of modern cloud environments. One of the most groundbreaking innovations is homomorphic encryption, which allows organizations to perform computations on encrypted data without needing to decrypt it first. This capability is transformative for industries such as finance and healthcare, where sensitive data needs to be processed while maintaining privacy and security. Additionally, the development of quantum-resistant encryption algorithms is helping future-proof cloud encryption solutions against the potential risks posed by quantum computing, which has the theoretical capability to break traditional encryption methods. Advanced key management systems have also become a focal point, providing businesses with automated and secure methods for generating, distributing, and storing encryption keys across multi-cloud and hybrid cloud environments. These systems ensure that encryption keys are protected and easily accessible by authorized users, while minimizing the risks of human error or key mismanagement. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) into encryption solutions is enhancing real-time threat detection and response, enabling businesses to identify vulnerabilities or malicious activities more quickly and accurately. These innovations are driving the evolution of cloud encryption, making it a more robust and dynamic solution for securing cloud-based data.Where Is Cloud Encryption Making the Greatest Impact?

Cloud encryption is playing a pivotal role in industries where the protection of sensitive and regulated data is of paramount importance. In healthcare, cloud encryption is critical for securing electronic health records (EHRs), medical histories, and other patient data. Healthcare providers are increasingly using cloud-based platforms to manage patient care, conduct telemedicine, and store medical records, making encryption essential for ensuring compliance with HIPAA regulations that protect personal health information. In the financial services sector, encryption is indispensable for safeguarding sensitive financial data, customer account information, and transactional details. Financial institutions face stringent regulatory requirements such as PCI-DSS and GDPR, which mandate encryption of payment card information and other sensitive data to prevent fraud, data breaches, and unauthorized access. Government and defense agencies also rely heavily on encryption to protect classified information, secure communications, and maintain the integrity of mission-critical operations. The public sector uses cloud encryption to protect sensitive government data and comply with national security regulations. In the retail and e-commerce industries, encryption ensures that customer payment details, purchase histories, and personal information remain secure, preventing data breaches that could lead to significant financial losses and damage to consumer trust. Across these industries, cloud encryption is ensuring data privacy, regulatory compliance, and security, which are essential to maintaining operational integrity and customer confidence in cloud-based operations.What Factors Are Fueling Expansion of the Cloud Encryption Market?

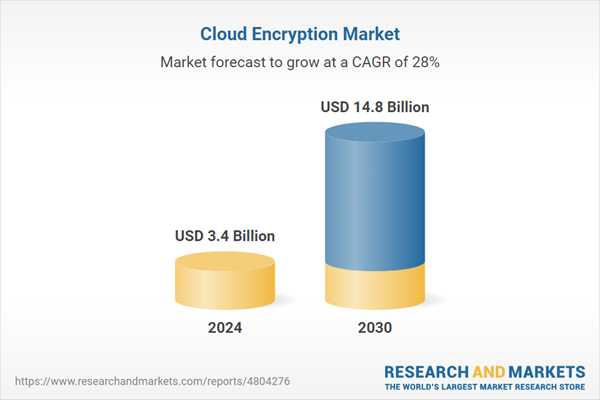

The growth in the cloud encryption market is driven by several key factors, most notably the increasing adoption of cloud services across industries. As more organizations migrate their data, applications, and critical operations to the cloud, concerns around data security have intensified, driving demand for robust encryption solutions. Cloud encryption is becoming a vital tool in protecting sensitive information from data breaches, unauthorized access, and cyberattacks, particularly as businesses operate in complex multi-cloud and hybrid cloud environments. Regulatory pressures are also a significant driver, with data privacy laws like GDPR, HIPAA, and CCPA requiring organizations to encrypt personal and sensitive data to maintain compliance. The failure to adhere to these regulations can result in substantial fines and reputational damage, further incentivizing businesses to adopt cloud encryption. Another important factor propelling the growth of the market is the rising sophistication of cyberattacks, including ransomware, phishing schemes, and advanced persistent threats. These evolving threats are pushing organizations to invest in stronger encryption technologies to protect their cloud environments and safeguard critical data. The growing adoption of remote and hybrid work models has also contributed to the need for cloud encryption, as employees access corporate data from multiple locations and devices, increasing the potential for data breaches. Advancements in encryption technology, including the development of quantum-resistant algorithms and AI-driven key management systems, are making encryption more adaptable and secure, ensuring businesses are prepared for both current and future threats. These factors, along with the increasing need for secure cloud operations and compliance, are driving the rapid growth of the cloud encryption market, positioning it as a fundamental component of cloud security strategies.Report Scope

The report analyzes the Cloud Encryption market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Service Model (Infrastructure-as-a-Service, Platform-as-a-Service, Software-as-a-Service); End-Use (IT & Telecom, Healthcare, BFSI, Retail, Aerospace & Defense, Government, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Infrastructure-as-a-Service Model segment, which is expected to reach US$7.9 Billion by 2030 with a CAGR of 30.7%. The Platform-as-a-Service Model segment is also set to grow at 24.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $934 Million in 2024, and China, forecasted to grow at an impressive 26.4% CAGR to reach $2.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cloud Encryption Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cloud Encryption Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cloud Encryption Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ciphercloud, Inc., Gemalto, HyTrust, Inc., IBM Corporation, Netskope, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 19 companies featured in this Cloud Encryption market report include:

- Ciphercloud, Inc.

- Gemalto

- HyTrust, Inc.

- IBM Corporation

- Netskope, Inc.

- Parablu Inc.

- Secomba GmbH

- Sophos Ltd.

- Symantec Corporation

- Thales E-Security, Inc.

- Trend Micro, Inc.

- Twd Industries AG

- Vaultive Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ciphercloud, Inc.

- Gemalto

- HyTrust, Inc.

- IBM Corporation

- Netskope, Inc.

- Parablu Inc.

- Secomba GmbH

- Sophos Ltd.

- Symantec Corporation

- Thales E-Security, Inc.

- Trend Micro, Inc.

- Twd Industries AG

- Vaultive Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.4 Billion |

| Forecasted Market Value ( USD | $ 14.8 Billion |

| Compound Annual Growth Rate | 28.0% |

| Regions Covered | Global |