Global Embedded Displays Market - Key Trends and Drivers Summarized

Are Embedded Displays Revolutionizing Modern Technology and User Interfaces?

Embedded displays are revolutionizing modern technology and user interfaces by integrating sophisticated visual elements directly into devices and systems, enhancing functionality, user experience, and connectivity across a wide range of industries. Unlike traditional external displays, embedded displays are seamlessly integrated into devices, providing real-time information, control, and interactivity. They are increasingly found in automotive dashboards, industrial machinery, medical devices, consumer electronics, and smart home appliances, where they offer intuitive and user-friendly interfaces. The integration of these displays allows for more compact and efficient designs, enabling devices to perform complex functions while remaining easy to use. As the demand for smarter, more connected devices grows, embedded displays are becoming a crucial component in delivering the enhanced visual and interactive experiences that consumers and professionals expect. By providing instant access to critical information and controls, embedded displays are playing a key role in the evolution of technology, making it more accessible, responsive, and integrated into daily life.What Innovations Are Enhancing the Functionality of Embedded Displays?

Innovations in embedded display technology are enhancing functionality through advancements in display quality, touch interfaces, and connectivity. One of the most significant developments is the improvement in display resolution and color accuracy, with technologies like OLED (Organic Light-Emitting Diode) and AMOLED (Active-Matrix Organic Light-Emitting Diode) offering vibrant, high-contrast visuals that are easily readable in various lighting conditions. These advancements are particularly important in industries like automotive and healthcare, where clarity and precision are critical. Another key innovation is the integration of advanced touch interfaces, including multi-touch and haptic feedback, which provide more interactive and intuitive user experiences. These interfaces allow users to interact with devices more naturally, making complex operations simpler and more efficient. Connectivity enhancements, such as the integration of wireless communication protocols like Bluetooth and Wi-Fi, enable embedded displays to connect seamlessly with other devices and systems, facilitating real-time data exchange and remote monitoring. Additionally, the development of energy-efficient displays, including low-power LCDs and e-paper, is extending battery life in portable devices and reducing energy consumption in industrial applications. These innovations are making embedded displays more versatile, responsive, and energy-efficient, expanding their use across a wide range of applications and industries.How Do Embedded Displays Impact Product Design and User Experience?

Embedded displays have a significant impact on product design and user experience by enabling more streamlined, intuitive, and interactive interfaces that enhance the functionality and appeal of devices. From a design perspective, the integration of embedded displays allows manufacturers to create more compact and aesthetically pleasing products, as they eliminate the need for external monitors or control panels. This integration is particularly valuable in consumer electronics, automotive interiors, and medical devices, where space is often at a premium. The presence of an embedded display within a device simplifies the user interface, allowing for more direct interaction and reducing the need for additional buttons or controls. For users, this translates into a more seamless and efficient experience, where information and controls are presented in a clear and accessible manner. In the automotive industry, for example, embedded displays provide drivers with real-time navigation, vehicle diagnostics, and entertainment options, all within easy reach, enhancing both safety and convenience. In industrial settings, embedded displays improve operational efficiency by providing operators with real-time data and control options directly on machinery. By enhancing both product design and user experience, embedded displays are helping to create more functional, user-friendly, and visually appealing devices across various sectors.What Trends Are Driving Growth in the Embedded Displays Market?

Several trends are driving growth in the embedded displays market, including the increasing demand for smart and connected devices, the rise of the Internet of Things (IoT), and the push for more advanced human-machine interfaces (HMIs). As consumers and industries alike seek smarter, more connected devices, the need for embedded displays that can provide real-time data, control, and interaction is growing. The proliferation of IoT devices, which rely on embedded displays for monitoring and control, is a significant driver of this trend, particularly in smart homes, industrial automation, and healthcare. The automotive industry is another key area of growth, as vehicles become increasingly equipped with advanced infotainment systems, digital dashboards, and driver assistance features that rely on embedded displays. Additionally, the push for more sophisticated HMIs is leading to the development of displays with enhanced interactivity, such as touchscreens with haptic feedback and gesture recognition, which offer more intuitive and responsive user experiences. The demand for energy-efficient and durable displays, particularly in portable and industrial applications, is also contributing to market growth. These trends underscore the expanding role of embedded displays in modern technology, as they become integral to the development of next-generation devices and systems that are smarter, more connected, and more user-friendly.Report Scope

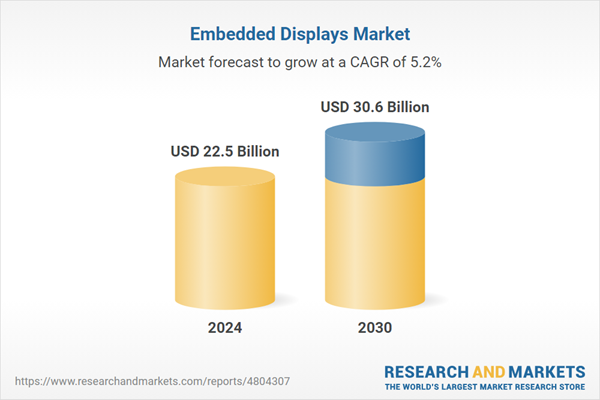

The report analyzes the Embedded Displays market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (LCD, LED, OLED, Other Technologies); Application (Automotive, Construction Equipment, Home Automation & HVAC Systems, Medical, Fitness Devices & Wearables, Home Appliances, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the LCD Displays segment, which is expected to reach US$9.1 Billion by 2030 with a CAGR of 3.2%. The LED Displays segment is also set to grow at 6.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6 Billion in 2024, and China, forecasted to grow at an impressive 5% CAGR to reach $4.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Embedded Displays Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Embedded Displays Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Embedded Displays Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amulet Technologies, Anders Electronics plc, Apption, ARM Holdings PLC, Avnet, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Embedded Displays market report include:

- Amulet Technologies

- Anders Electronics plc

- Apption

- ARM Holdings PLC

- Avnet, Inc.

- Data Modul AG

- DFI America LLC

- Flairmicro

- Glimm Screens BV

- Himax Display Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amulet Technologies

- Anders Electronics plc

- Apption

- ARM Holdings PLC

- Avnet, Inc.

- Data Modul AG

- DFI America LLC

- Flairmicro

- Glimm Screens BV

- Himax Display Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 22.5 Billion |

| Forecasted Market Value ( USD | $ 30.6 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |