Global Electronic Stability Control (ESC) Market - Key Trends and Drivers Summarized

How Is Electronic Stability Control (ESC) Enhancing Vehicle Safety?

Electronic Stability Control (ESC) is a critical automotive safety technology that improves vehicle stability by detecting and reducing loss of traction during sharp turns or sudden maneuvers. When ESC senses that a vehicle is beginning to skid or lose control, it automatically applies the brakes to individual wheels and, if necessary, reduces engine power. This intervention helps the driver maintain control and prevent the vehicle from veering off the road or rolling over. The implementation of ESC is particularly important in adverse weather conditions such as rain or snow, where the risk of accidents increases significantly. By preventing potential skids or loss of control, ESC plays a vital role in reducing the number of road accidents, thereby saving lives and reducing injuries.What Innovations Are Enhancing the Functionality of Electronic Stability Control?

Recent innovations in Electronic Stability Control systems are focused on integrating ESC with other advanced driver-assistance systems (ADAS) to enhance overall vehicle safety and performance. For example, modern ESC systems are often combined with anti-lock braking systems (ABS) and traction control systems (TCS) to provide a comprehensive safety solution that addresses multiple aspects of vehicle dynamics. Additionally, the integration of ESC with adaptive cruise control and lane keeping assist technologies allows for more nuanced and situation-specific interventions, further improving vehicle stability and driver control. Developments in sensor technology, such as more accurate gyroscopes and accelerometers, are also enhancing the responsiveness and precision of ESC systems, making them more effective in preventing accidents.How Does Electronic Stability Control Impact Environmental Sustainability?

Electronic Stability Control contributes to environmental sustainability indirectly by promoting safer and more efficient driving. ESC helps maintain optimal control and stability, which can lead to smoother driving patterns and reduced sudden accelerations or decelerations. This efficient driving behavior can help improve fuel economy and reduce vehicle emissions over time. Additionally, by helping to prevent accidents and the associated vehicle damage, ESC systems reduce the need for energy-intensive auto repairs and the production of replacement parts, which often involve significant material and energy consumption. Thus, while the primary focus of ESC is on safety, its benefits extend to environmental considerations by promoting more sustainable driving behaviors and vehicle longevity.What Trends Are Driving Growth in the Electronic Stability Control Market?

The growth of the Electronic Stability Control market is primarily driven by increasing global safety regulations, consumer demand for safer vehicles, and advancements in automotive technology. Many countries have implemented regulations that require ESC systems in all new vehicles, recognizing their effectiveness in preventing accidents. This regulatory push is a major driver for the widespread adoption of ESC technology. Additionally, consumer awareness of vehicle safety features has increased, with more buyers prioritizing advanced safety systems when purchasing new vehicles. The automotive industry's shift towards more intelligent and connected vehicles also supports the integration of advanced control systems like ESC. As part of broader efforts to develop fully autonomous vehicles, ESC serves as a foundational technology for ensuring vehicle stability and safety. These trends ensure continued investments and innovations in the ESC market, making it an integral part of modern automotive safety engineering.Report Scope

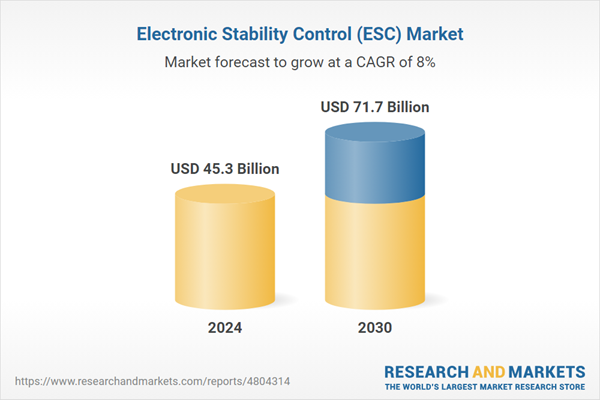

The report analyzes the Electronic Stability Control (ESC) market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Passenger Cars End-Use segment, which is expected to reach US$48.5 Billion by 2030 with a CAGR of 8.8%. The Light Commercial Vehicles End-Use segment is also set to grow at 7.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $12.3 Billion in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $11.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electronic Stability Control (ESC) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electronic Stability Control (ESC) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electronic Stability Control (ESC) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Continental AG, Delphi Automotive PLC, Denso Corporation, Hitachi Ltd., Hyundai Mobis Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Electronic Stability Control (ESC) market report include:

- Continental AG

- Delphi Automotive PLC

- Denso Corporation

- Hitachi Ltd.

- Hyundai Mobis Co., Ltd.

- Knorr-Bremse AG

- Mando Corporation

- Robert Bosch GmbH

- ZF Friedrichshafen AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Continental AG

- Delphi Automotive PLC

- Denso Corporation

- Hitachi Ltd.

- Hyundai Mobis Co., Ltd.

- Knorr-Bremse AG

- Mando Corporation

- Robert Bosch GmbH

- ZF Friedrichshafen AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 242 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 45.3 Billion |

| Forecasted Market Value ( USD | $ 71.7 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |