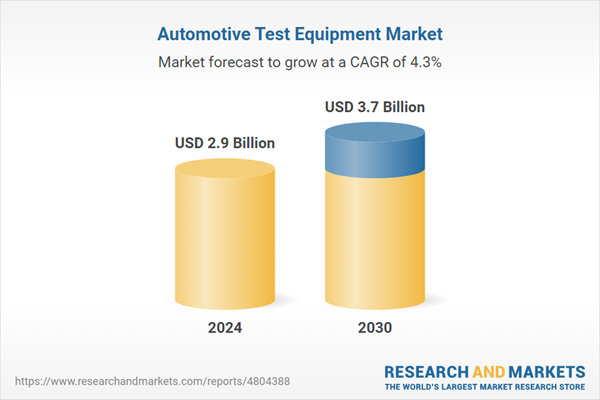

The global market for Automotive Test Equipment was estimated at US$2.9 Billion in 2024 and is projected to reach US$3.7 Billion by 2030, growing at a CAGR of 4.3% from 2024 to 2030. This comprehensive report provides an in-depth analysis of market trends, drivers, and forecasts, helping you make informed business decisions. The report includes the most recent global tariff developments and how they impact the Automotive Test Equipment market.

Global Automotive Test Equipment Market - Key Trends and Drivers Summarized

How Is Automotive Test Equipment Shaping the Future of Vehicle Safety and Performance?

Automotive test equipment plays a pivotal role in the development and manufacturing of vehicles, ensuring that every component meets the highest standards of safety and performance. As the automotive industry evolves, the complexity of vehicles has increased, requiring more sophisticated testing solutions. From traditional combustion engines to modern electric vehicles (EVs), each type of vehicle demands specific testing procedures that ensure reliability, efficiency, and compliance with stringent global regulations. This equipment covers a broad spectrum, including engine dynamometers, emission testing systems, and brake testers, all of which are essential for verifying the performance and safety of vehicles before they reach the market. The push towards electrification and autonomous driving technologies has further intensified the need for advanced testing equipment, which must now accommodate not only mechanical components but also complex electronic systems and software. As vehicles become more integrated with technology, the role of automotive test equipment in preventing failures and ensuring safety is more critical than ever.Why Is Precision Testing Crucial in the Era of Electrification and Autonomy?

In the era of vehicle electrification and autonomy, the demands on automotive test equipment have reached new heights. Electric vehicles (EVs) and hybrid vehicles, with their unique powertrains, require specialized testing equipment to evaluate battery performance, energy efficiency, and electrical systems. Additionally, the rise of autonomous vehicles necessitates the testing of advanced driver-assistance systems (ADAS), sensors, and algorithms that control vehicle navigation and decision-making processes. Precision is paramount in these scenarios, as even the smallest error in testing can lead to significant safety risks. Automotive test equipment must be capable of simulating real-world driving conditions, testing vehicles under various environmental stresses, and ensuring that both hardware and software components work seamlessly together. The ongoing advancements in vehicle technology are driving the development of more sophisticated and integrated testing solutions, which are becoming a cornerstone of vehicle development in the modern automotive industry.What Role Does Regulation Play in Advancing Automotive Test Equipment?

Regulatory compliance is a major driver in the evolution of automotive test equipment, as governments and international bodies impose increasingly stringent standards on vehicle safety, emissions, and performance. To meet these regulations, manufacturers must invest in advanced testing solutions that can accurately measure emissions, ensure compliance with safety standards, and verify the durability of new vehicle technologies. For instance, the shift towards lower emissions and the adoption of Euro 6 standards in Europe or Corporate Average Fuel Economy (CAFE) standards in the United States has significantly increased the demand for sophisticated emission testing equipment. Similarly, the push for autonomous vehicles has led to the development of testing systems that can assess the reliability and safety of autonomous driving features under various conditions. As regulations continue to evolve, the automotive test equipment industry must innovate to keep pace, providing manufacturers with the tools they need to meet these ever-changing requirements.What Are the Key Factors Driving the Growth of the Automotive Test Equipment Market?

The growth in the automotive test equipment market is driven by several factors, all of which are intricately linked to the ongoing transformation within the automotive industry. Firstly, the rapid adoption of electric and hybrid vehicles has created a significant demand for testing equipment that can handle the unique requirements of these powertrains, including battery testing and electrical system diagnostics. Secondly, the push towards autonomous driving technology is spurring the need for advanced test equipment that can validate the performance of sensors, cameras, and other critical components in autonomous vehicles. Additionally, the increasing complexity of in-vehicle electronics and software, driven by consumer demand for connected and intelligent vehicles, requires more comprehensive testing solutions to ensure reliability and safety. Finally, stringent global regulations on emissions and safety are compelling manufacturers to invest in cutting-edge test equipment to meet compliance standards, driving market growth. The convergence of these factors is shaping the future of the automotive test equipment market, making it a critical area of focus for manufacturers worldwide.SCOPE OF STUDY:

The report analyzes the Automotive Test Equipment market in terms of units by the following Segments, and Geographic Regions/Countries:- Segments: Application (PC / Laptop Based Equipment, Mobile / Tablet Based Equipment); End-Use (Passenger Cars, Commercial Vehicles)

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the PC / Laptop Based Equipment segment, which is expected to reach US$2.6 Billion by 2030 with a CAGR of a 4.3%. The Mobile / Tablet Based Equipment segment is also set to grow at 4.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $758.2 Million in 2024, and China, forecasted to grow at an impressive 6.7% CAGR to reach $802.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Test Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Test Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Test Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AB Dynamics (Anthony Best Dynamics Limited), Applied Technical Services, Inc., AVL List GmbH, Bosch Automotive Aftermarket, Cambridge Mechatronics Limited and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 28 companies featured in this Automotive Test Equipment market report include:

- AB Dynamics (Anthony Best Dynamics Limited)

- Applied Technical Services, Inc.

- AVL List GmbH

- Bosch Automotive Aftermarket

- Cambridge Mechatronics Limited

- DK Photonics Technology Limited

- Hitachi High-Tech Corporation

- Honeywell International, Inc.

- Imasen Electric Industrial Co., Ltd.

- Intertek Group Plc

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

I. METHODOLOGYII. EXECUTIVE SUMMARY2. FOCUS ON SELECT PLAYERSIII. MARKET ANALYSISSOUTH KOREAREST OF ASIA-PACIFICARGENTINABRAZILMEXICOREST OF LATIN AMERICAIRANISRAELSAUDI ARABIAUNITED ARAB EMIRATESREST OF MIDDLE EASTIV. COMPETITION

1. MARKET OVERVIEW

3. MARKET TRENDS & DRIVERS

4. GLOBAL MARKET PERSPECTIVE

UNITED STATES

CANADA

JAPAN

CHINA

EUROPE

FRANCE

GERMANY

ITALY

UNITED KINGDOM

SPAIN

RUSSIA

REST OF EUROPE

ASIA-PACIFIC

AUSTRALIA

INDIA

LATIN AMERICA

MIDDLE EAST

AFRICA

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AB Dynamics (Anthony Best Dynamics Limited)

- Applied Technical Services, Inc.

- AVL List GmbH

- Bosch Automotive Aftermarket

- Cambridge Mechatronics Limited

- DK Photonics Technology Limited

- Hitachi High-Tech Corporation

- Honeywell International, Inc.

- Imasen Electric Industrial Co., Ltd.

- Intertek Group Plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 237 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.9 Billion |

| Forecasted Market Value ( USD | $ 3.7 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |