Global Automotive Fabrics Market - Key Trends and Drivers Summarized

How Are Automotive Fabrics Shaping Vehicle Interiors?

Automotive fabrics play a crucial role in defining the comfort, aesthetics, and functionality of a vehicle's interior. These fabrics are used extensively in seating, headliners, door panels, and carpets, contributing significantly to the overall sensory experience of the vehicle. Modern automotive fabrics are not just about looks; they are engineered for performance, offering attributes such as durability, stain resistance, and thermal management. The choice of fabric can influence the perception of luxury and quality in a vehicle, with premium cars often featuring high-end textiles like Alcantara, leather, or specially engineered synthetics. Additionally, the need for ergonomic support and comfort has led to innovations in fabric designs that enhance seating comfort for long drives, integrating features like breathability and moisture-wicking properties. As consumer expectations for interior quality rise, the demand for high-performance automotive fabrics continues to grow, making them a key area of focus for automakers aiming to enhance the driving experience.Why Are Sustainability and Innovation Central to Automotive Fabrics?

The automotive industry is undergoing a significant transformation, with sustainability and innovation at its core, and automotive fabrics are no exception. With increasing regulatory pressures and consumer demand for environmentally friendly products, automakers are shifting towards eco-friendly textiles made from recycled materials or those that have a reduced environmental impact. For instance, fabrics made from recycled PET bottles are becoming more common, offering both environmental benefits and high performance. Innovation is also evident in the development of smart fabrics that incorporate electronic capabilities, such as embedded sensors for monitoring occupant health or controlling interior climate. Moreover, the trend towards electric vehicles (EVs) has driven the need for lightweight fabrics that help reduce overall vehicle weight, thus improving energy efficiency. These advancements in material science are not only meeting the functional requirements of modern vehicles but are also helping manufacturers meet the growing expectations for sustainability without compromising on quality or performance.What Are the Emerging Challenges and Opportunities in Automotive Fabrics?

The automotive fabrics market is facing both challenges and opportunities as it navigates the complexities of modern vehicle design and consumer preferences. One of the significant challenges is the need to balance cost with performance, particularly in the mass-market segment, where affordability remains crucial. Additionally, the rise of autonomous vehicles introduces new demands for interior fabrics that are more durable and easier to clean, as shared vehicle ownership models become more common. On the other hand, there are significant opportunities in the development of multifunctional fabrics that offer features such as noise reduction, enhanced thermal insulation, and even self-cleaning capabilities. The integration of nanotechnology into fabric production is creating possibilities for textiles with superior properties, such as increased resistance to wear and tear or enhanced tactile sensations. Furthermore, the shift towards minimalistic and sustainable interior designs is driving the demand for natural and biodegradable materials, opening new avenues for innovation in the automotive fabrics sector.What Is Fueling the Growth in the Automotive Fabrics Market?

The growth in the automotive fabrics market is driven by several factors, each playing a pivotal role in shaping the future of vehicle interiors. Technological advancements in material science, particularly in the development of smart and lightweight fabrics, are expanding the market's potential as they address the evolving needs of electric and autonomous vehicles. The increasing consumer demand for premium and customizable interiors is also driving the adoption of high-quality, aesthetically appealing textiles. Environmental concerns are pushing both automakers and consumers towards sustainable fabric options, further accelerating the market's growth. Additionally, regulatory pressures aimed at reducing vehicle emissions and improving fuel efficiency are propelling the adoption of innovative fabrics that contribute to lighter vehicle weights. The growing focus on occupant comfort and health is generating demand for fabrics with anti-microbial properties and enhanced thermal regulation, further broadening the scope of automotive fabric applications. These factors collectively underscore the dynamic nature of the automotive fabrics market, which is poised for continued expansion as it adapts to the challenges and opportunities of a rapidly evolving automotive landscape.Report Scope

The report analyzes the Automotive Fabrics market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Floor Covering, Upholstery, Pre-Assembled Interior Components, Tires, Safety Belts, Airbags, Other Applications); End-Use (Passenger Cars, Commercial Vehicles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Floor Covering Application segment, which is expected to reach US$10.8 Billion by 2030 with a CAGR of 3.1%. The Upholstery Application segment is also set to grow at 3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $9.6 Billion in 2024, and China, forecasted to grow at an impressive 5% CAGR to reach $8.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Fabrics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Fabrics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Fabrics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Acme Mills, Adient PLC, BMD Private Limited, Borgers SE & Co. KGaA, Chori Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Automotive Fabrics market report include:

- Acme Mills

- Adient PLC

- BMD Private Limited

- Borgers SE & Co. KGaA

- Chori Co., Ltd.

- Cmi Enterprises Inc.

- Grupo Antolin-Irausa SA

- Heathcoat Fabrics Limited

- Lear Corporation

- Martur Automotive Seating Systems

- Moriden America Inc.

- Sage Automotive Interiors, Inc.

- Seiren Co., Ltd.

- SRF Ltd.

- Suminoe Textile Co., Ltd.

- Takata Corporation

- Tb Kawashima Co., Ltd.

- Tenowo GmbH

- Toyota Boshoku Corporation

- Trevira GmbH

- Uniroyal Engineered Products LLC.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acme Mills

- Adient PLC

- BMD Private Limited

- Borgers SE & Co. KGaA

- Chori Co., Ltd.

- Cmi Enterprises Inc.

- Grupo Antolin-Irausa SA

- Heathcoat Fabrics Limited

- Lear Corporation

- Martur Automotive Seating Systems

- Moriden America Inc.

- Sage Automotive Interiors, Inc.

- Seiren Co., Ltd.

- SRF Ltd.

- Suminoe Textile Co., Ltd.

- Takata Corporation

- Tb Kawashima Co., Ltd.

- Tenowo GmbH

- Toyota Boshoku Corporation

- Trevira GmbH

- Uniroyal Engineered Products LLC.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

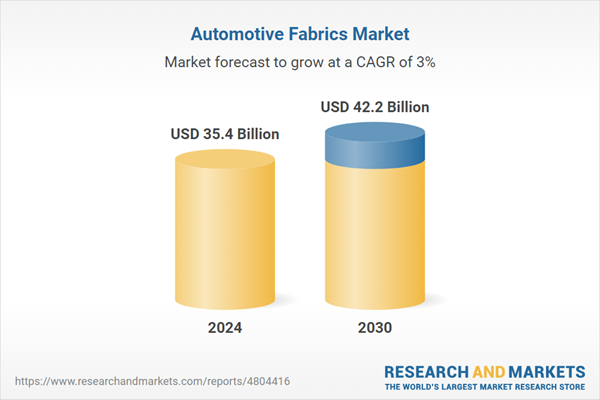

| Estimated Market Value ( USD | $ 35.4 Billion |

| Forecasted Market Value ( USD | $ 42.2 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |