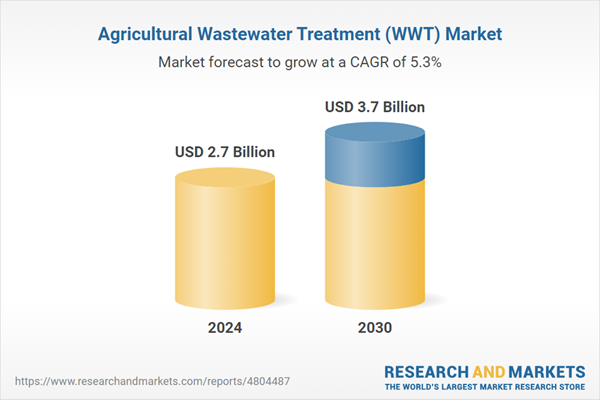

The global market for Agricultural Wastewater Treatment (WWT) was estimated at US$2.7 Billion in 2024 and is projected to reach US$3.7 Billion by 2030, growing at a CAGR of 5.3% from 2024 to 2030. This comprehensive report provides an in-depth analysis of market trends, drivers, and forecasts, helping you make informed business decisions. The report includes the most recent global tariff developments and how they impact the Agricultural Wastewater Treatment (WWT) market.

Global Agricultural Wastewater Treatment Market - Key Trends & Drivers Summarized

What Challenges Are Faced in Managing Agricultural Wastewater?

Agricultural wastewater treatment (WWT) confronts unique challenges due to the composition and variability of the waste. Predominantly originating from irrigation runoff, pesticide and fertilizer application, and animal farming, this wastewater contains high levels of nutrients, organic matter, and often pathogens, making treatment complex and critical. Traditional methods struggle to effectively address these contaminants, posing environmental risks to water bodies and surrounding ecosystems through eutrophication and biodiversity loss. As regulations tighten globally, the pressure mounts on agricultural operations to adopt more sophisticated and efficient treatment solutions that can tackle these diverse pollutants comprehensively.How Are Modern Technologies Revolutionizing WWT in Agriculture?

In response to growing environmental concerns and stringent regulations, innovative technologies have emerged in the agricultural WWT market. Techniques such as membrane bioreactors (MBR), reverse osmosis, and advanced oxidation processes have gained traction, offering higher efficiency and smaller footprint solutions compared to conventional treatments. These technologies are capable of removing a wide range of contaminants, including nitrates, phosphates, and bacteria, thus ensuring compliance with environmental standards. Moreover, the integration of smart sensors and IoT technologies in WWT systems is enhancing the monitoring and control capabilities, leading to more efficient operations and reduced costs.What Are the Economic and Environmental Benefits of Effective WWT in Agriculture?

Effective wastewater treatment systems in agriculture can lead to significant economic and environmental benefits. Economically, these systems reduce the costs associated with environmental compliance and improve the overall efficiency of agricultural operations. Environmentally, they prevent the leaching of pollutants into water bodies, protecting aquatic life and reducing the incidence of waterborne diseases. Furthermore, treated wastewater can be reused for irrigation, promoting water conservation and sustainability in water-scarce regions. This reuse not only helps in managing water resources more effectively but also reduces the dependency on freshwater supplies, which are becoming increasingly stressed due to global climate change and population growth.What Drives the Growth in the Agricultural WWT Market?

The growth in the agricultural WWT market is driven by several factors including technological advancements, regulatory policies, and increasing environmental awareness. Technological innovations, such as the development of energy-efficient and cost-effective treatment systems, are making WWT solutions more accessible and attractive to agricultural businesses. Regulatory frameworks across the globe are tightening, compelling farm owners to adopt advanced WWT systems to comply with discharge standards and avoid hefty fines. Additionally, a growing consumer preference for sustainably grown produce is pushing agricultural producers towards adopting environmentally friendly practices, including efficient wastewater management.SCOPE OF STUDY:

The report analyzes the Agricultural Wastewater Treatment (WWT) market in terms of units by the following Segments, and Geographic Regions/Countries:- Segments: Technology (Chemical Solutions, Physical Solutions, Biological Solutions)

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Chemical Solutions segment, which is expected to reach US$1.7 Billion by 2030 with a CAGR of a 6.0%. The Physical Solutions segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $505.4 Million in 2024, and China, forecasted to grow at an impressive 6.2% CAGR to reach $752.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Agricultural Wastewater Treatment (WWT) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Agricultural Wastewater Treatment (WWT) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Agricultural Wastewater Treatment (WWT) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BASF SE, Calgon Carbon Corporation, Evoqua Water Technologies LLC, AECOM, Black & Veatch Holding Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 70 companies featured in this Agricultural Wastewater Treatment (WWT) market report include:

- BASF SE

- Calgon Carbon Corporation

- Evoqua Water Technologies LLC

- AECOM

- Black & Veatch Holding Company

- Aquatech International LLC

- Atkins

- Chembond Chemicals Ltd.

- Dema Engineering Co.

- Ecosphere Technologies, Inc.

- DAS Environmental Expert GmbH

- ASIO TECH, spol. s r.o.

- BioMicrobics, Inc.

- Blue Foot Membranes

- Apricot Technologies Limited

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

I. METHODOLOGYII. EXECUTIVE SUMMARY2. FOCUS ON SELECT PLAYERSIII. MARKET ANALYSISIV. COMPETITION

1. MARKET OVERVIEW

3. MARKET TRENDS & DRIVERS

4. GLOBAL MARKET PERSPECTIVE

UNITED STATES

CANADA

JAPAN

CHINA

EUROPE

FRANCE

GERMANY

ITALY

UNITED KINGDOM

SPAIN

RUSSIA

REST OF EUROPE

ASIA-PACIFIC

AUSTRALIA

INDIA

SOUTH KOREA

REST OF ASIA-PACIFIC

LATIN AMERICA

ARGENTINA

BRAZIL

MEXICO

REST OF LATIN AMERICA

MIDDLE EAST

AFRICA

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF SE

- Calgon Carbon Corporation

- Evoqua Water Technologies LLC

- AECOM

- Black & Veatch Holding Company

- Aquatech International LLC

- Atkins

- Chembond Chemicals Ltd.

- Dema Engineering Co.

- Ecosphere Technologies, Inc.

- DAS Environmental Expert GmbH

- ASIO TECH, spol. s r.o.

- BioMicrobics, Inc.

- Blue Foot Membranes

- Apricot Technologies Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 337 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.7 Billion |

| Forecasted Market Value ( USD | $ 3.7 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |