Global Acoustic Wave Sensor Market - Key Trends & Drivers Summarized

Acoustic wave sensors are specialized devices that utilize the propagation of acoustic waves to detect changes in environmental conditions. These sensors operate on the principle of converting a mechanical wave into an electrical signal, which can be analyzed to determine various physical, chemical, and biological properties. They are particularly notable for their high sensitivity, reliability, and operational stability, making them suitable for a wide range of applications across different sectors. Common types of acoustic wave sensors include surface acoustic wave (SAW) sensors and bulk acoustic wave (BAW) sensors. SAW sensors are used in applications ranging from electronic communications and signal processing to chemical sensing and mechanical sensing. BAW sensors, on the other hand, are often employed in applications requiring high-frequency operation such as in telecommunications and resonator filters. These sensors are widely used in industries such as automotive, aerospace, healthcare, consumer electronics, and environmental monitoring, where precise and reliable sensing is crucial.The capabilities of acoustic wave sensors are enhanced by recent advancements in microelectronic technologies and material science. Innovations such as miniaturization, better signal processing algorithms, and improvements in sensor design and fabrication techniques have significantly expanded their application range and improved their performance metrics. For instance, in the healthcare sector, these sensors are increasingly used for patient monitoring systems, diagnostic assays, and wearable devices that require non-invasive monitoring of health parameters like heart rate, blood pressure, and bodily fluids. In the environmental monitoring field, acoustic wave sensors are crucial for detecting toxic gases and air quality indices, providing real-time data essential for environmental protection and compliance with safety regulations. The integration of these sensors with wireless technology and the Internet of Things (IoT) has further broadened their applicability, allowing for the development of smart sensor networks that can communicate seamlessly and provide actionable insights in various industrial, commercial, and residential settings.

The growth in the acoustic wave sensor market is driven by several factors, including the increasing demand for precision sensing in industrial processes, advancements in wireless technology, and the integration of IoT capabilities. Industrial automation trends, where precision, efficiency, and safety are paramount, heavily rely on the accurate and reliable data provided by acoustic wave sensors to optimize manufacturing processes and improve productivity. Additionally, the surge in IoT applications, where sensors play a fundamental role in enabling devices to interact and autonomously perform a wide range of functions, creates substantial demand for these sensors. Consumer behavior has also influenced the market, as there is a growing preference for smart devices and systems that enhance lifestyle and efficiency, from smart homes and cities to health and fitness tracking devices. Moreover, regulatory requirements across various industries for safety, environmental protection, and quality control further compel the adoption of advanced sensing technologies like acoustic wave sensors. Collectively, these drivers ensure a dynamic expansion of the acoustic wave sensor market, underpinning its importance in the current technological landscape.

Report Scope

The report analyzes the Acoustic Wave Sensors market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Device (Resonators, Delay Lines); End-Use Application (Military, Automotive, Industrial, Food & Beverages, Other End-Use Applications); Sensing Parameter (Temperature, Pressure, Humidity, Mass, Torque, Other Sensing Parameters); Type (Surface Acoustic Wave (SAW) Sensor, Bulk Acoustic Wave (BAW) Sensor).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Surface Acoustic Wave (SAW) Sensor segment, which is expected to reach US$626.1 Million by 2030 with a CAGR of 8.3%. The Bulk Acoustic Wave (BAW) Sensor segment is also set to grow at 9.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $221.3 Million in 2024, and China, forecasted to grow at an impressive 13% CAGR to reach $222.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Acoustic Wave Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Acoustic Wave Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Acoustic Wave Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

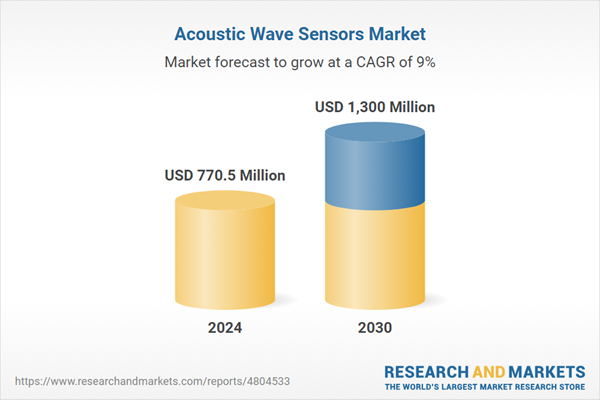

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Broadcom Inc., Emerson Electric Company, CTS Corporation, Christian Burkert GmbH & Co. KG, Campbell Scientific, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 35 companies featured in this Acoustic Wave Sensors market report include:

- Broadcom Inc.

- Emerson Electric Company

- CTS Corporation

- Christian Burkert GmbH & Co. KG

- Campbell Scientific, Inc.

- Burkert USA Corporation

- ALTHEN GmbH Mess- und Sensortechnik

- Ceramtec GmbH

- Dytran Instruments, Inc.

- Abracon LLC

- Biosensor Applications Sweden AB

- H. Heinz Messwiderstande GmbH

- Aanderaa Data Instruments AS

- Electronic Sensor Technology, Inc.

- Boston Piezo-Optics Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Broadcom Inc.

- Emerson Electric Company

- CTS Corporation

- Christian Burkert GmbH & Co. KG

- Campbell Scientific, Inc.

- Burkert USA Corporation

- ALTHEN GmbH Mess- und Sensortechnik

- Ceramtec GmbH

- Dytran Instruments, Inc.

- Abracon LLC

- Biosensor Applications Sweden AB

- H. Heinz Messwiderstande GmbH

- Aanderaa Data Instruments AS

- Electronic Sensor Technology, Inc.

- Boston Piezo-Optics Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 590 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 770.5 Million |

| Forecasted Market Value ( USD | $ 1300 Million |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | Global |