Global Data Center Accelerators Market - Key Trends & Drivers Summarized

Data center accelerators are specialized hardware components designed to enhance the performance and efficiency of data centers by offloading and accelerating specific computational tasks. These accelerators include Graphics Processing Units (GPUs), Field Programmable Gate Arrays (FPGAs), and Application-Specific Integrated Circuits (ASICs). Each type of accelerator excels in different applications: GPUs are widely used for parallel processing tasks such as machine learning and artificial intelligence (AI) workloads; FPGAs offer flexibility and reconfigurability for custom processing tasks; and ASICs provide highly optimized performance for specific applications, such as cryptocurrency mining or specific AI inference tasks. By integrating these accelerators, data centers can achieve higher throughput, lower latency, and improved energy efficiency, thereby supporting the growing demand for processing power in modern applications.The adoption of data center accelerators has been driven by the exponential growth in data generation and the increasing complexity of computational tasks. Traditional Central Processing Units (CPUs) are often insufficient for handling the massive data sets and intensive computations required by applications such as big data analytics, deep learning, and high-performance computing (HPC). Accelerators address these challenges by providing specialized processing capabilities that significantly boost performance. For example, GPUs have become essential in training complex neural networks for AI, enabling faster and more accurate results. Similarly, FPGAs are used in networking and storage applications to accelerate data processing tasks and improve throughput. The integration of these accelerators into data centers not only enhances computational efficiency but also optimizes the overall performance and scalability of data center operations.

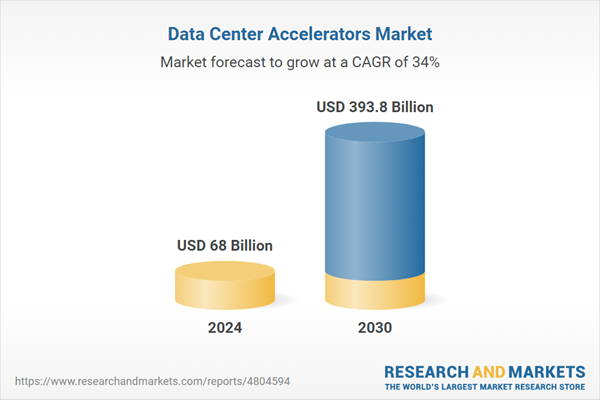

The growth in the data center accelerators market is driven by several factors, including advancements in AI and machine learning, the increasing demand for cloud services, and the rise of edge computing. Technological advancements in AI and machine learning are pushing the boundaries of computational requirements, necessitating the use of specialized accelerators to meet performance demands. The rapid expansion of cloud services has led to a surge in data center deployments, with providers seeking to differentiate their offerings through enhanced performance and efficiency enabled by accelerators. Additionally, the proliferation of edge computing, which requires real-time processing of data close to the source, is driving the adoption of accelerators to handle localized data processing tasks. Moreover, strategic collaborations between technology providers and data center operators are fostering the development and deployment of advanced accelerator solutions. As these factors converge, the data center accelerators market is poised for significant growth, driven by the need for enhanced computational capabilities, the evolution of AI and cloud technologies, and the expansion of edge computing infrastructure.

Report Scope

The report analyzes the Data Center Accelerators market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Processor Type (GPU, CPU, FPGA, ASIC); Application (Deep Learning Training, Public Cloud Interface, Enterprise Interface).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Deep Learning Training segment, which is expected to reach US$238.6 Billion by 2030 with a CAGR of 33.9%. The Public Cloud Interface segment is also set to grow at 31.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $20.5 Billion in 2024, and China, forecasted to grow at an impressive 32.6% CAGR to reach $57.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Data Center Accelerators Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Data Center Accelerators Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Data Center Accelerators Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as IBM Corporation, Microsoft Corporation, Intel Corporation, Microchip Technology, Inc., NVIDIA Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 49 companies featured in this Data Center Accelerators market report include:

- IBM Corporation

- Microsoft Corporation

- Intel Corporation

- Microchip Technology, Inc.

- NVIDIA Corporation

- Microsemi Corporation

- Aldec, Inc.

- CyrusOne LLC

- Netronome

- Achronix Semiconductor Corporation

- CoreSite Realty Corporation

- Dell Technologies, Inc.

- One Stop Systems, Inc.

- algolux

- AT TOKYO Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- IBM Corporation

- Microsoft Corporation

- Intel Corporation

- Microchip Technology, Inc.

- NVIDIA Corporation

- Microsemi Corporation

- Aldec, Inc.

- CyrusOne LLC

- Netronome

- Achronix Semiconductor Corporation

- CoreSite Realty Corporation

- Dell Technologies, Inc.

- One Stop Systems, Inc.

- algolux

- AT TOKYO Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 303 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 68 Billion |

| Forecasted Market Value ( USD | $ 393.8 Billion |

| Compound Annual Growth Rate | 34.0% |

| Regions Covered | Global |