Global E-Beam Wafer Inspection Systems Market - Key Trends & Drivers Summarized

What Are E-Beam Wafer Inspection Systems?

E-Beam (Electron Beam) wafer inspection systems are advanced tools used in the semiconductor manufacturing industry to detect and analyze defects on wafers at a nanometric scale. These systems utilize electron beams to scan the surface of semiconductor wafers, providing high-resolution images and detailed information about potential defects. E-Beam inspection is crucial for ensuring the quality and reliability of semiconductor devices, as it can identify minute defects that might impact the performance and yield of integrated circuits. The precision and accuracy of E-Beam inspection systems make them indispensable in the production of advanced semiconductor technologies.How Are Industry Demands Shaping This Market?

The demands of the semiconductor industry are significantly shaping the market for E-Beam wafer inspection systems. As semiconductor devices become increasingly complex and miniaturized, the need for more precise and accurate inspection tools is growing. The transition to smaller node sizes and the development of advanced technologies such as 3D NAND, FinFET, and multi-patterning require inspection systems that can detect even the smallest defects. The push for higher yield and reliability in semiconductor manufacturing is driving the adoption of E-Beam inspection systems, which offer the resolution and sensitivity needed to meet these stringent requirements.What Technological Innovations Are Influencing This Field?

Technological innovations are at the forefront of advancements in E-Beam wafer inspection systems. Improvements in electron optics, detector sensitivity, and data processing algorithms are enhancing the performance and efficiency of these systems. The integration of artificial intelligence and machine learning is enabling more sophisticated defect detection and classification, reducing false positives and improving inspection throughput. Additionally, the development of hybrid inspection systems that combine E-Beam with optical inspection technologies is providing a more comprehensive solution for defect analysis. These innovations are essential for addressing the challenges of inspecting advanced semiconductor nodes and ensuring the production of high-quality devices.What Factors Are Driving Market Growth?

The growth in the E-Beam wafer inspection systems market is driven by several factors, including the increasing complexity of semiconductor devices, the need for higher yield and reliability, and technological advancements in inspection tools. The ongoing development of smaller and more complex semiconductor nodes is creating a demand for more precise and accurate inspection systems. The push for higher yield and lower defect rates in semiconductor manufacturing is also driving market growth, as manufacturers seek to optimize production and reduce costs. Technological advancements in electron optics, AI, and data processing are enhancing the capabilities of E-Beam inspection systems, making them more effective and efficient. Additionally, the expansion of the semiconductor industry, driven by the growing demand for electronics and emerging technologies such as 5G, IoT, and AI, is further propelling the market for E-Beam wafer inspection systems.Report Scope

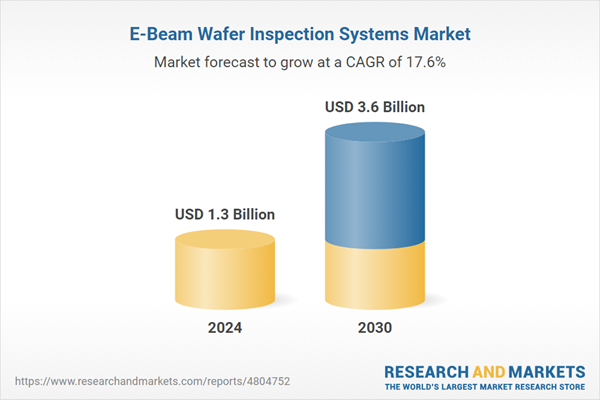

The report analyzes the E-Beam Wafer Inspection Systems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (More Than 10 nm Size, 1 to 10 nm Size, Less Than 1 nm Size); Application (Defect Imaging Application, Lithographic Qualification Application, Bare Wafer OQC / IQC Application, Wafer Dispositioning Application, Reticle Quality Inspection Application, Other Applications).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; South Korea; Taiwan; Rest of Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the More Than 10 Nm Size segment, which is expected to reach US$2.4 Billion by 2030 with a CAGR of 16.9%. The 1 To 10 Nm Size segment is also set to grow at 18% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $164.2 Million in 2024, and China, forecasted to grow at an impressive 21.3% CAGR to reach $931.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global E-Beam Wafer Inspection Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global E-Beam Wafer Inspection Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global E-Beam Wafer Inspection Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aerotech, Inc., Applied Materials, Inc., ASML Holding NV, Hitachi High-Technologies Corporation, Holon Co, Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 18 companies featured in this E-Beam Wafer Inspection Systems market report include:

- Aerotech, Inc.

- Applied Materials, Inc.

- ASML Holding NV

- Hitachi High-Technologies Corporation

- Holon Co, Ltd.

- KLA Corporation

- MKS Instruments, Inc.

- PDF Solutions, Inc.

- Photo electron Soul Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aerotech, Inc.

- Applied Materials, Inc.

- ASML Holding NV

- Hitachi High-Technologies Corporation

- Holon Co, Ltd.

- KLA Corporation

- MKS Instruments, Inc.

- PDF Solutions, Inc.

- Photo electron Soul Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 258 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.3 Billion |

| Forecasted Market Value ( USD | $ 3.6 Billion |

| Compound Annual Growth Rate | 17.6% |

| Regions Covered | Global |