Global Digital Imaging Market - Key Trends and Drivers Summarized

What Is Digital Imaging and How Has It Revolutionized Visual Media?

Digital imaging encompasses the processes of capturing, processing, and producing images using digital technology. Over the past few decades, this technology has profoundly transformed the fields of photography, cinematography, and medical imaging, among others. Unlike traditional analog imaging that uses chemical processes to develop film, digital imaging utilizes electronic sensors to capture an image as a set of pixels, which are then processed by computers to produce a digital output. This shift has democratized photography, making it more accessible and versatile. Digital images can be edited, shared, and stored with far greater ease than film-based images, allowing for instant viewing and manipulation. This has not only changed the professional landscape for photographers and filmmakers but has also become integral to everyday communications in the form of digital cameras, smartphones, and web broadcasting.How Are Advancements in Technology Enhancing Digital Imaging?

Technological advancements continue to push the boundaries of what digital imaging can achieve. High-resolution sensors now offer unparalleled detail and sensitivity, making them indispensable in fields like astronomy and environmental science, where precision is crucial. Innovations in computational photography, where image processing uses algorithms to enhance images beyond traditional capabilities, are opening new possibilities in consumer electronics and professional gear alike. For example, features such as high dynamic range (HDR) imaging and low-light performance improvements are becoming standard in smartphones, enhancing the casual photography experience. Additionally, the integration of AI has made significant strides in scene recognition, image correction, and even generating high-quality images from low-resolution inputs, further expanding the creative and practical applications of digital imaging.What Role Does Digital Imaging Play in Industry and Medicine?

Beyond the realms of media and entertainment, digital imaging plays a critical role in various industries and medical fields. In healthcare, digital imaging technologies such as X-rays, CT scans, and MRI all rely on digital sensors to provide detailed internal images that are crucial for diagnosis and treatment planning. These tools allow for non-invasive examinations and faster diagnosis, significantly improving patient care. In the industrial sector, digital imaging is used extensively for quality control, particularly in manufacturing and assembly processes where precision is necessary. Advanced imaging systems can detect defects that are invisible to the naked eye, ensuring products meet quality standards. The versatility and scalability of digital imaging make it a valuable tool across numerous fields, contributing to its widespread adoption and continual development.What Drives the Growth in the Digital Imaging Market?

The growth in the digital imaging market is driven by several factors, including the surge in demand for superior image quality in consumer electronics, the widespread use of digital imaging in medical diagnostics, and the increasing automation in industrial processes. As smartphones and digital cameras continue to incorporate more advanced imaging technologies, consumers are increasingly seeking devices that offer professional-grade photography capabilities. In medicine, the push towards more accurate and timely diagnostics is propelling the adoption of sophisticated imaging technologies, which are also being integrated into telemedicine applications. Additionally, industries are leveraging digital imaging to enhance visual inspection processes, driven by trends towards precision manufacturing and quality assurance. The convergence of these factors ensures that digital imaging remains a dynamic and growing field, adapting to meet the needs of a visually-driven society.Report Scope

The report analyzes the Digital Imaging market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Machine Vision, Radiography, LiDAR, Metrology); Application (Inspection, Surveying, Reverse Engineering); End-Use (Automotive, Aerospace, Oil & Gas, Pharmaceuticals, Power Generation, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Machine Vision Technology segment, which is expected to reach US$19.4 Billion by 2030 with a CAGR of 8.8%. The Radiography Technology segment is also set to grow at 8.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6.4 Billion in 2024, and China, forecasted to grow at an impressive 7.8% CAGR to reach $5.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Digital Imaging Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Digital Imaging Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Digital Imaging Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AMETEK, Inc., Cognex Corporation, General Electric Company, Hexagon AB, Keyence Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Digital Imaging market report include:

- AMETEK, Inc.

- Cognex Corporation

- General Electric Company

- Hexagon AB

- Keyence Corporation

- Matrox Electronic Systems Ltd.

- National Instruments Corporation

- Nikon Corporation

- Olympus Corporation

- Omron Corporation

- Teledyne Technologies Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AMETEK, Inc.

- Cognex Corporation

- General Electric Company

- Hexagon AB

- Keyence Corporation

- Matrox Electronic Systems Ltd.

- National Instruments Corporation

- Nikon Corporation

- Olympus Corporation

- Omron Corporation

- Teledyne Technologies Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

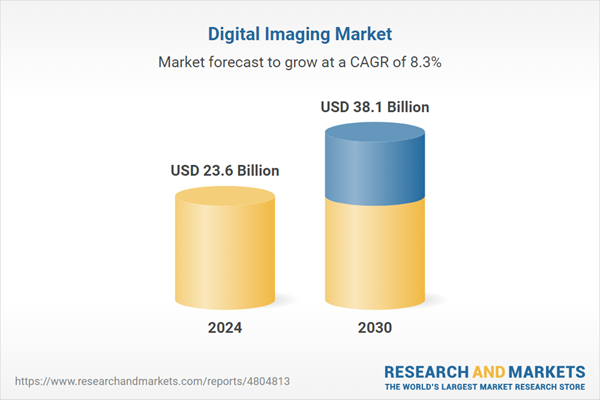

| Estimated Market Value ( USD | $ 23.6 Billion |

| Forecasted Market Value ( USD | $ 38.1 Billion |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | Global |