Global Diagnostic Imaging Market - Key Trends & Drivers Summarized

Diagnostic imaging is a critical tool in modern medicine, enabling the visualization of the internal structures of the body non-invasively to diagnose, monitor, and treat medical conditions effectively. This field includes a variety of techniques such as X-ray radiography, computed tomography (CT), magnetic resonance imaging (MRI), ultrasound, and nuclear medicine including positron emission tomography (PET) and single-photon emission computed tomography (SPECT). Each of these modalities serves distinct purposes and is chosen based on the specific medical conditions and the part of the body being examined. For instance, X-rays are often used for viewing bones and detecting fractures, while soft tissues are better visualized by MRI. Ultrasound is frequently used in obstetrics and cardiology to examine the fetus during pregnancy and assess cardiac functions. Nuclear medicine provides functional information about a person's body, detecting molecular activity and can pinpoint disease in its earliest stages before they are apparent with other imaging tests.Technological advancements have vastly improved the capabilities of diagnostic imaging. Innovations such as digital imaging and 3D reconstruction have enhanced image quality and reduced exposure to radiation. The integration of artificial intelligence (AI) with imaging technologies is transforming the field, enabling faster and more accurate analyses of images. AI algorithms help in detecting patterns that may be missed by the human eye, assisting radiologists in diagnosing diseases such as cancer more effectively. Furthermore, the development of portable imaging devices has expanded the reach of diagnostic services, allowing for point-of-care services that are particularly valuable in emergency settings and in rural or under-resourced areas. This accessibility improvement is vital for timely diagnosis and treatment, significantly impacting patient outcomes. Additionally, advances in hybrid imaging techniques, such as PET/CT and PET/MRI, allow for simultaneous imaging of anatomical and biochemical functions, providing a more comprehensive assessment and aiding in precise disease localization and management.

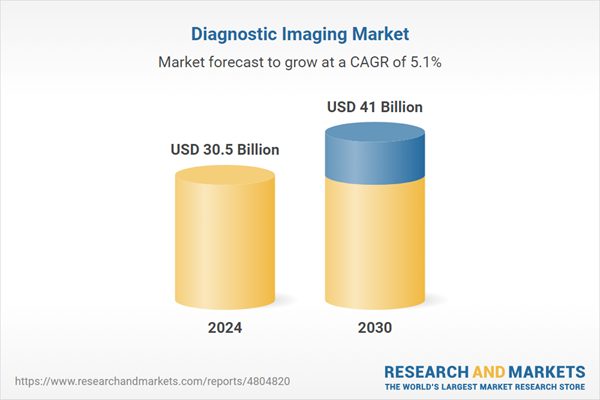

The growth in the diagnostic imaging market is driven by several factors, including the aging global population, the rising prevalence of chronic diseases, technological advancements in imaging modalities, and increasing healthcare expenditure. As the population ages, there is a higher incidence of conditions such as cardiovascular diseases, cancers, and neurological disorders, all of which require diagnostic imaging for effective management. Chronic diseases are also becoming more common across all age groups, necessitating frequent monitoring and evaluation, which supports the demand for imaging services. Technological advancements not only enhance the quality and efficiency of diagnostic imaging but also expand its applications, leading to broader clinical adoption. Additionally, healthcare systems worldwide are focusing more on preventive care and early diagnosis, which further drives the demand for advanced imaging solutions. The increasing investment in healthcare infrastructure, especially in emerging economies, and the growing acceptance of hybrid and advanced imaging modalities contribute to the robust growth of this market. Thus, diagnostic imaging continues to be an indispensable part of modern medical practice, with ongoing innovations ensuring its expanding role in healthcare delivery.

Report Scope

The report analyzes the Diagnostic Imaging market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Hospitals, Diagnostic Imaging Centers, Other End-Uses); Product (X-ray Imaging, MRI, Ultrasound, CT, Nuclear Imaging).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the X-ray Imaging segment, which is expected to reach US$9.4 Billion by 2030 with a CAGR of 4.5%. The MRI segment is also set to grow at 5.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $9.2 Billion in 2024, and China, forecasted to grow at an impressive 7.2% CAGR to reach $5.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Diagnostic Imaging Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Diagnostic Imaging Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Diagnostic Imaging Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Barco NV, Agfa-Gevaert NV, Analogic Corporation, Brainlab AG, Adelaide Health Care and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 66 companies featured in this Diagnostic Imaging market report include:

- Barco NV

- Agfa-Gevaert NV

- Analogic Corporation

- Brainlab AG

- Adelaide Health Care

- Bracco Diagnostics, Inc.

- Accuray, Inc.

- Bracco SpA

- Biodex Medical Systems, Inc.

- Brain Scientific Inc.

- Alliance Medical Limited

- Asahi Roentgen Ind. Co., Ltd.

- A. Menarini Asia-Pacific Holdings Pte., Ltd.

- Beijing Wandong Medical Technology Co., Ltd.

- Bonraybio Company Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Barco NV

- Agfa-Gevaert NV

- Analogic Corporation

- Brainlab AG

- Adelaide Health Care

- Bracco Diagnostics, Inc.

- Accuray, Inc.

- Bracco SpA

- Biodex Medical Systems, Inc.

- Brain Scientific Inc.

- Alliance Medical Limited

- Asahi Roentgen Ind. Co., Ltd.

- A. Menarini Asia-Pacific Holdings Pte., Ltd.

- Beijing Wandong Medical Technology Co., Ltd.

- Bonraybio Company Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 537 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 30.5 Billion |

| Forecasted Market Value ( USD | $ 41 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |