Global Forming Fluids Market - Key Trends and Drivers Summarized

Why Are Forming Fluids Revolutionizing Metalworking and Industrial Processes?

Forming fluids are transforming metalworking and industrial manufacturing, but why have they become so essential in today's production processes? Forming fluids, also known as metal forming lubricants or oils, are specialized fluids used during metal shaping operations such as bending, drawing, stamping, and forging. These fluids play a critical role in reducing friction, cooling, and protecting both the workpiece and the tooling from damage. Forming fluids are widely used in industries like automotive, aerospace, heavy machinery, and metal fabrication to enhance the quality of finished products and extend the life of tools and machinery.One of the primary reasons forming fluids are revolutionizing manufacturing is their ability to optimize metal forming processes by reducing friction between the tool and workpiece. By providing a lubricating barrier, forming fluids ensure smoother metal flow during shaping, preventing defects like tearing, wrinkling, or galling. This leads to higher-quality finished products and reduces the need for secondary finishing processes. Additionally, forming fluids help dissipate heat generated during metalworking, which protects tools and machinery from excessive wear and damage. As a result, forming fluids are indispensable in achieving both efficiency and quality in high-precision metalworking applications.

How Do Forming Fluids Work, and What Makes Them So Effective?

Forming fluids play a crucial role in metal shaping, but how do they work, and what makes them so effective in enhancing performance and longevity? Forming fluids work by creating a lubricating layer between the tool and the workpiece, minimizing friction and wear. This is especially important in processes like deep drawing, where metal is pulled or stretched into complex shapes. The fluid ensures that the metal can flow smoothly across the tool surface without sticking or tearing. Forming fluids also act as coolants, absorbing and dissipating the heat generated during metal deformation, which helps maintain the stability of both the workpiece and the tooling.What makes forming fluids so effective is their ability to meet the specific requirements of different metalworking processes and materials. These fluids are available in various formulations, including oil-based, water-based, synthetic, and semi-synthetic types, each tailored to specific metals and forming operations. For example, water-based fluids are often used in high-temperature processes like hot forging, where cooling is critical, while oil-based fluids provide superior lubrication in cold forming and stamping. Specialized additives are also included to enhance the fluid's performance, such as anti-corrosion agents, extreme pressure (EP) additives, and anti-wear compounds that further protect the tool and workpiece.

Additionally, forming fluids are designed to optimize tool life and product quality. By reducing friction, they prevent excessive wear on tooling, extending the life of expensive dies, molds, and presses. The protective coating left behind by some forming fluids can also prevent corrosion, ensuring that both tools and workpieces remain in optimal condition during storage or transport. The ability to maintain high-quality surface finishes is another major advantage, as forming fluids minimize defects, such as scratches or galling, that can occur when metal sticks to the tooling. This combination of lubrication, cooling, and protection makes forming fluids essential in industries where precision and durability are paramount.

How Are Forming Fluids Shaping the Future of Sustainability, Efficiency, and Advanced Manufacturing?

Forming fluids are not only improving current metalworking processes - they are also shaping the future of sustainability, efficiency, and advanced manufacturing. One of the most significant trends in forming fluids is the development of eco-friendly and biodegradable formulations. As industries prioritize sustainability and reduce environmental impact, manufacturers are turning to water-based and bio-based forming fluids that minimize harmful emissions and waste. These fluids offer the same lubrication and cooling benefits as traditional oil-based fluids but with a reduced environmental footprint. Additionally, advancements in synthetic fluids have led to formulations that are free from hazardous chemicals, such as chlorine and sulfur, making them safer for workers and the environment.In addition to supporting sustainability efforts, forming fluids are driving innovation in high-performance manufacturing processes. With the rise of advanced manufacturing technologies, such as additive manufacturing (3D printing) and precision metal forming, forming fluids are evolving to meet the demands of these cutting-edge processes. Fluids with enhanced thermal stability, anti-wear properties, and extreme pressure resistance are being developed to ensure that tools and equipment can handle the increased stress and temperatures of modern metalworking. These fluids also contribute to faster production speeds by reducing downtime due to tool wear or metal defects, improving overall efficiency and productivity.

Forming fluids are also advancing customization and specialization in manufacturing. As industries shift toward more complex and high-precision components, especially in aerospace and automotive sectors, forming fluids are being designed to work with specific metals, alloys, and processes. For example, fluids used in forming high-strength steel or aluminum alloys must be formulated to handle the unique challenges posed by these materials, such as their higher hardness and reactivity. Custom fluids are also being developed to optimize forming in cleanroom environments, where contamination must be minimized. This level of customization is helping manufacturers achieve higher quality standards and meet the increasingly stringent requirements of modern industrial production.

Moreover, forming fluids are playing a key role in reducing production costs and improving tool longevity. By enhancing lubrication and cooling, these fluids reduce the friction and wear that can cause premature tool failure, minimizing the need for frequent tool replacements and maintenance. This not only lowers operational costs but also increases the lifespan of expensive machinery and equipment. Additionally, forming fluids contribute to energy efficiency, as smoother metalworking operations require less power to achieve the desired results. As manufacturing becomes more focused on cost-efficiency and sustainability, forming fluids are essential in helping companies optimize their processes while reducing environmental impact.

What Factors Are Driving the Growth of the Forming Fluids Market?

Several key factors are driving the rapid growth of the forming fluids market, reflecting broader trends in sustainable manufacturing, technological advancements, and demand for precision metalworking. One of the primary drivers is the increasing demand for lightweight and durable components in industries such as automotive, aerospace, and defense. As manufacturers seek to reduce vehicle weight for improved fuel efficiency and performance, the use of high-strength metals and alloys like aluminum and titanium is growing. These materials require specialized forming fluids that can handle their unique properties, ensuring smooth forming processes while maintaining material integrity. The rise of electric vehicles (EVs) is also contributing to this demand, as automakers focus on producing lighter, more efficient components.Another significant factor contributing to the growth of the forming fluids market is the adoption of advanced manufacturing technologies. As industries adopt automated systems, robotics, and precision metalworking, the need for high-performance forming fluids that can support these technologies is increasing. Modern forming fluids must not only provide lubrication and cooling but also withstand the high pressures and temperatures associated with advanced metal forming techniques like high-speed stamping, hot forging, and superplastic forming. As manufacturers push the boundaries of metalworking, the development of fluids with enhanced properties, such as higher thermal stability and extreme pressure resistance, is driving innovation in the market.

The focus on sustainability and environmental responsibility is also fueling demand for forming fluids. Governments and regulatory bodies are increasingly implementing stricter environmental regulations, particularly regarding the use and disposal of industrial fluids. This is driving manufacturers to seek eco-friendly alternatives to traditional oil-based forming fluids, such as water-based, biodegradable, and synthetic fluids. These greener solutions help companies reduce their environmental footprint, lower waste disposal costs, and meet compliance standards without sacrificing performance. The shift toward more sustainable production practices is expected to continue driving growth in the forming fluids market as industries strive to balance efficiency with environmental stewardship.

Finally, technological advancements in forming fluid formulations and application methods are contributing to the market's expansion. New additives and synthetic compounds are being developed to enhance the performance of forming fluids, improving their lubricity, corrosion resistance, and cooling capacity. Innovations such as micro-lubrication systems, which apply minimal quantities of lubricant directly to the tool-workpiece interface, are helping reduce fluid consumption and waste. These advancements are making forming processes more efficient, cost-effective, and environmentally friendly, driving further adoption of high-performance fluids across various industries.

As the demand for durable, high-quality metal components grows and industries continue to embrace sustainable practices, forming fluids will remain a critical component in the evolution of modern manufacturing, driving improvements in performance, efficiency, and environmental responsibility.

Report Scope

The report analyzes the Forming Fluids market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Primary Metals, Machinery, Transportation Equipment, Fabricated Metal Products, Metal Cans, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Primary Metals End-Use segment, which is expected to reach US$1.4 Billion by 2030 with a CAGR of 3%. The Machinery End-Use segment is also set to grow at 2.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $919.2 Million in 2024, and China, forecasted to grow at an impressive 4.2% CAGR to reach $793.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Forming Fluids Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Forming Fluids Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Forming Fluids Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Afton Chemical Corporation, Apar Industries Ltd., BASF SE, Chevron Corporation, Chevron Oronite Company LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Forming Fluids market report include:

- Afton Chemical Corporation

- Apar Industries Ltd.

- BASF SE

- Chevron Corporation

- Chevron Oronite Company LLC

- Columbia Petro Chem Pvt. Ltd.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Gazprom Neft PJSC

- Indian Oil Corporation Ltd.

- Lonza Group AG

- Sinopec Corporation

- The Lubrizol Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Afton Chemical Corporation

- Apar Industries Ltd.

- BASF SE

- Chevron Corporation

- Chevron Oronite Company LLC

- Columbia Petro Chem Pvt. Ltd.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Gazprom Neft PJSC

- Indian Oil Corporation Ltd.

- Lonza Group AG

- Sinopec Corporation

- The Lubrizol Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

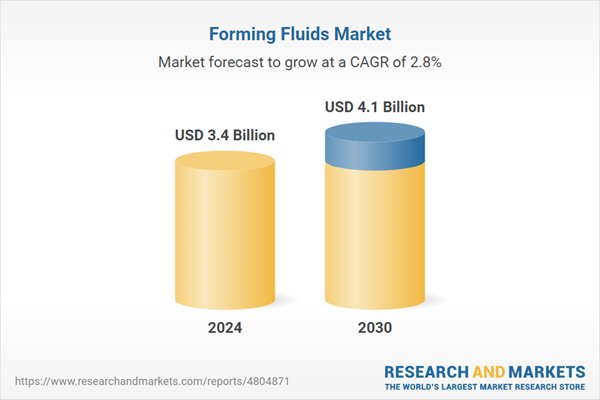

| Estimated Market Value ( USD | $ 3.4 Billion |

| Forecasted Market Value ( USD | $ 4.1 Billion |

| Compound Annual Growth Rate | 2.8% |

| Regions Covered | Global |