Global Graphic Films Market - Key Trends and Drivers Summarized

Why Are Graphic Films Becoming Essential for Branding, Advertising, and Surface Protection Across Industries?

Graphic films are becoming a crucial tool for branding, advertising, and surface protection in a variety of industries. But why are graphic films so important today? Graphic films are thin, flexible materials that can be printed on, laminated, or otherwise customized to display logos, images, or messages. They are widely used in sectors such as automotive, retail, packaging, and construction for advertising, product labeling, decorative purposes, and even protective applications. Whether it's vibrant vehicle wraps, eye-catching storefront signage, or protective films for surfaces, graphic films provide a versatile and durable solution for both functional and aesthetic needs.For businesses, graphic films serve as a cost-effective and highly customizable medium for promoting brand identity and attracting customers. Vehicle wraps, for example, transform company cars or delivery trucks into mobile billboards, expanding the reach of advertising campaigns. In retail environments, graphic films can be used for window displays or interior decoration, allowing stores to update their promotional messages regularly without committing to permanent signage. Additionally, graphic films serve a dual purpose by offering surface protection in applications like automotive and construction, where they shield surfaces from scratches, UV damage, and environmental wear. As industries demand more creative, cost-effective, and adaptable ways to advertise and protect surfaces, graphic films are becoming essential for both commercial and industrial applications.

How Are Technological Advancements Enhancing the Performance and Versatility of Graphic Films?

Technological advancements are significantly enhancing the performance, versatility, and durability of graphic films, making them more valuable for a broader range of applications. One of the most impactful advancements is the development of high-performance polymer materials, such as polyvinyl chloride (PVC), polyethylene, and polyurethane, which improve the durability, flexibility, and adhesion properties of graphic films. These materials can withstand harsh environmental conditions, including extreme temperatures, moisture, and UV radiation, making them ideal for outdoor use in applications such as vehicle wraps, outdoor signage, and building wraps. With improved resistance to weathering and fading, graphic films now offer longer-lasting solutions for both indoor and outdoor applications.Another key advancement is the development of more sophisticated printing technologies, such as digital printing, which allows for high-resolution graphics and vibrant colors to be printed directly onto graphic films. Digital printing provides greater customization options, enabling businesses to create highly detailed and unique designs tailored to their branding and promotional needs. Moreover, digital printing technology allows for shorter production runs, making it more cost-effective for businesses to update their designs frequently or create limited-edition promotional materials. This flexibility has made graphic films an increasingly popular choice for businesses looking to create dynamic advertising campaigns and quickly adapt to changing market trends.

Improvements in adhesive technologies have also expanded the versatility of graphic films. Today's graphic films feature advanced adhesive systems that enable easy application and removal without leaving residue or damaging the underlying surfaces. This is particularly beneficial for temporary installations, such as seasonal promotions, event branding, or vehicle wraps that need to be updated periodically. Pressure-sensitive adhesives (PSAs) and repositionable adhesives allow for bubble-free application and adjustment during installation, making the process faster and more user-friendly. These advancements are especially important for industries like retail, automotive, and construction, where the ability to change or update graphics frequently without additional costs or surface damage is crucial.

Another area of innovation is the development of eco-friendly graphic films. With the growing emphasis on sustainability and environmental responsibility, manufacturers are creating graphic films made from biodegradable or recyclable materials. These eco-friendly films maintain the performance characteristics of traditional films while reducing their environmental impact. For example, bio-based films made from renewable resources or films with reduced PVC content are gaining traction in industries that are prioritizing green initiatives. Additionally, water-based inks and solvent-free adhesives are being used in conjunction with these films to further reduce the environmental footprint of graphic film production and application.

Advancements in functional coatings and laminations are also enhancing the capabilities of graphic films. Anti-graffiti coatings, for example, allow films to resist defacement and make it easier to clean off paint or markings. Similarly, scratch-resistant coatings improve the durability of films in high-traffic areas, such as commercial interiors or vehicle exteriors, ensuring that graphics remain vibrant and intact despite frequent use. Other specialty coatings, such as antimicrobial or self-cleaning films, add a protective layer to surfaces, making them ideal for environments like hospitals, restaurants, or public spaces where hygiene and cleanliness are critical. These innovations are broadening the use cases for graphic films, extending their utility beyond advertising and into functional applications that enhance surface protection.

Why Are Graphic Films Critical for Enhancing Brand Visibility, Customization, and Surface Protection?

Graphic films are critical for enhancing brand visibility, customization, and surface protection because they offer a versatile and cost-effective solution for both aesthetic and functional applications. In terms of brand visibility, graphic films are an impactful medium for delivering eye-catching and memorable advertising. Vehicle wraps, for instance, allow businesses to turn their fleets into moving advertisements, generating brand awareness wherever they go. Similarly, building wraps and outdoor signage made from graphic films help businesses reach a broader audience, providing high-visibility advertising in urban or high-traffic areas. In retail, graphic films used for window displays or point-of-sale (POS) materials draw customers' attention and reinforce brand identity, helping businesses stand out in competitive markets.Customization is another key advantage of graphic films, as they can be tailored to meet the unique design needs of any brand or campaign. Graphic films can be printed in virtually any color, pattern, or texture, allowing businesses to create personalized graphics that align with their brand image. For example, companies can use graphic films to produce limited-edition product wraps, customize their storefronts for seasonal promotions, or create immersive brand experiences at trade shows and events. The flexibility of graphic films to accommodate different shapes, surfaces, and sizes makes them an ideal solution for brands looking to maintain a consistent visual identity across various platforms and environments.

In addition to enhancing visual appeal, graphic films provide a valuable layer of protection for surfaces in industries such as automotive, construction, and packaging. Vehicle wraps not only serve as a medium for branding but also protect a vehicle's paintwork from UV rays, dirt, and minor abrasions. Similarly, protective graphic films used in construction applications shield surfaces like windows, facades, and countertops from damage during installation or renovation projects. In the packaging industry, graphic films provide both branding opportunities and protection for products, ensuring that packaging remains intact and visually appealing during transportation and on store shelves. The dual functionality of graphic films - offering both protection and promotion - makes them an invaluable asset for businesses across multiple sectors.

Furthermore, the ease of application and removal offered by modern graphic films adds to their utility, allowing businesses to update their branding or promotional messages without significant costs or logistical challenges. Whether it's a temporary promotion, event marketing, or a seasonal design, graphic films can be easily swapped out, providing businesses with the flexibility to stay relevant and respond quickly to market trends. The ability to install and remove films without damaging the underlying surfaces also makes them an ideal solution for leased vehicles or rental properties, where permanent modifications may not be possible.

Surface protection is especially critical in environments where surfaces are prone to wear and tear, graffiti, or exposure to harsh conditions. In these cases, graphic films serve a dual purpose by protecting the surface while simultaneously enhancing its appearance. For example, architectural films used on glass or metal surfaces can protect against scratches and environmental damage while adding a decorative element. Similarly, anti-graffiti films are used in public spaces, transportation hubs, and commercial buildings to deter vandalism and reduce maintenance costs. By combining aesthetics with functionality, graphic films offer a unique value proposition that extends beyond simple signage or branding.

What Factors Are Driving the Growth of the Graphic Film Market?

Several key factors are driving the rapid growth of the graphic film market, including the increasing demand for advertising and branding solutions, advancements in printing and material technologies, the rise of eco-friendly films, and the growing need for surface protection across industries. First, the increasing demand for cost-effective advertising and branding solutions is a major driver of the graphic film market. As businesses seek new ways to promote their products and services, graphic films offer a highly customizable and visually impactful medium for advertising. The versatility of graphic films allows businesses to create dynamic, attention-grabbing displays that can be used across a wide range of surfaces, from vehicles and storefronts to trade show booths and packaging. The ability to easily update graphics also makes graphic films a practical solution for companies looking to adapt their branding and promotions to seasonal changes or market trends.Second, advancements in printing technologies, such as digital printing and large-format printing, are making it easier for businesses to create high-quality, vibrant graphics on graphic films. Digital printing allows for the production of highly detailed and colorful designs with shorter lead times and lower costs, making graphic films more accessible to businesses of all sizes. Large-format printers enable the production of oversized graphics, such as building wraps or vehicle decals, with excellent resolution and durability. These printing advancements are expanding the creative possibilities for graphic film applications, allowing brands to experiment with bold, eye-catching designs that leave a lasting impression on consumers.

The rise of eco-friendly graphic films is another significant factor driving market growth. As businesses and consumers alike become more conscious of environmental sustainability, there is a growing demand for graphic films made from recyclable, biodegradable, or renewable materials. Eco-friendly graphic films reduce the environmental impact of advertising and surface protection while maintaining the performance characteristics of traditional films. Additionally, the use of water-based inks, solvent-free adhesives, and reduced-PVC formulations aligns with green initiatives and helps companies meet sustainability goals. This shift toward more environmentally responsible products is creating new opportunities in the graphic film market, particularly in industries that prioritize sustainable practices, such as retail, packaging, and architecture.

The growing need for surface protection is also fueling demand for graphic films across various industries. In the automotive sector, vehicle wraps serve not only as an advertising medium but also as a protective barrier that shields vehicles from UV damage, scratches, and minor abrasions. In construction, protective films are used to safeguard surfaces such as windows, doors, and facades during building projects, ensuring that they remain clean and undamaged until the work is completed. Similarly, graphic films used in public spaces, transportation hubs, and commercial buildings offer protection against graffiti, wear, and environmental exposure, reducing maintenance costs and extending the lifespan of surfaces. As more industries recognize the dual benefits of graphic films - offering both protection and branding - the demand for these products continues to grow.

The increasing popularity of vehicle wraps and fleet branding is another major driver of the graphic film market. As businesses seek new ways to promote their brands, vehicle wraps offer a mobile advertising solution that reaches a wide audience without the ongoing costs associated with traditional advertising methods. Fleet owners, including delivery services, taxi companies, and logistics providers, are increasingly adopting vehicle wraps to showcase their branding, turning their vehicles into moving billboards. With advancements in adhesive technology making it easier to apply and remove wraps, this trend is expected to continue, further boosting the demand for graphic films in the automotive sector.

In conclusion, the growth of the graphic film market is being driven by the increasing demand for dynamic advertising solutions, advancements in printing technologies, the rise of eco-friendly films, and the growing need for surface protection across industries. As businesses continue to seek creative, flexible, and sustainable ways to enhance their branding and protect their assets, graphic films will remain a vital tool for promoting visibility, customization, and functionality across a wide range of applications.

Report Scope

The report analyzes the Graphic Films market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Polymer (PVC, PE, PP, Other Polymers); Film Type (Opaque, Transparent, Translucent, Reflective); End-Use (Promotional & Advertisement, Automotive, Industrial, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Opaque Films segment, which is expected to reach US$17.3 Billion by 2030 with a CAGR of 5.7%. The Transparent Films segment is also set to grow at 4.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.5 Billion in 2024, and China, forecasted to grow at an impressive 8.5% CAGR to reach $9.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Graphic Films Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Graphic Films Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Graphic Films Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACC Silicones Ltd., Dow Corning Corporation, Elkay Chemicals Pvt. Ltd., Evonik Industries AG, JNC Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 12 companies featured in this Graphic Films market report include:

- ACC Silicones Ltd.

- Dow Corning Corporation

- Elkay Chemicals Pvt. Ltd.

- Evonik Industries AG

- JNC Corporation

- McCoy Performance Silicones Pvt. Ltd.

- Momentive Performance Materials, Inc.

- Shin-Etsu Chemical Co., Ltd.

- Silicone Engineering Ltd.

- Wacker Chemie AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACC Silicones Ltd.

- Dow Corning Corporation

- Elkay Chemicals Pvt. Ltd.

- Evonik Industries AG

- JNC Corporation

- McCoy Performance Silicones Pvt. Ltd.

- Momentive Performance Materials, Inc.

- Shin-Etsu Chemical Co., Ltd.

- Silicone Engineering Ltd.

- Wacker Chemie AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 179 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

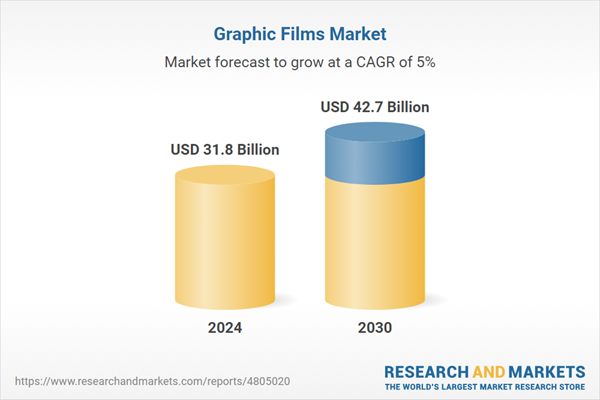

| Estimated Market Value ( USD | $ 31.8 Billion |

| Forecasted Market Value ( USD | $ 42.7 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |